Money in media is weird. If you asked what CNN was worth back in the 90s, the answer was basically "the world." Today? It’s complicated. If you're looking for a single, clean number to pin on a wall, you're going to be disappointed because the "value" of a news giant like CNN depends entirely on who you ask and how they’re feeling about the future of cable TV on any given Tuesday.

Honestly, the numbers are kind of a roller coaster. In early 2025, during a high-profile defamation trial, forensic economists dropped a bombshell: they pegged CNN’s net worth at roughly $2.3 billion. That sounds like a lot until you realize that just two years prior, that same valuation was sitting at $4.4 billion.

It basically got cut in half in the blink of an eye.

But wait. If you look at the moves being made by parent company Warner Bros. Discovery (WBD) in 2026, the narrative shifts again. Wall Street analysts and rival CEOs like David Ellison have been arguing over the "Discovery Global" segment—which includes CNN. Some say the cable business is worth next to nothing because cord-cutting is a slow-motion car crash. Others, including the WBD board, think the segment is still worth billions, specifically placing a value of $3 to $5 per share on those assets.

The Math Behind the $2 Billion Question

So, how do you actually value a news network? It’s not just about the cameras and the fancy desks in Atlanta and New York.

Most of the value comes from two buckets:

- Carriage Fees: This is the "hidden" money. Every time someone pays a cable bill, a few cents (or dollars) goes straight to CNN just for the right to carry the channel. Even if you never watch it, they get paid.

- Advertising: This is the stuff we see. Brands pay to be next to Anderson Cooper or Jake Tapper.

The problem is that both buckets have leaks. In 2025, reports showed that CNN’s TV ad revenues had taken some serious hits—sometimes dipping as much as 39% in a single year during "quiet" news cycles. You've also got the "Trump Bump" factor. Whenever there’s a massive political firestorm, ratings go up, and the "worth" of the network spikes. When things settle down? The value sags.

Why the $2.3 Billion Number is Decieving

That $2.3 billion figure from the 2025 court filings was a "liquidation" or "market" value based on specific accounting rules. But if Warner Bros. Discovery actually put CNN up for sale tomorrow, would it go for $2 billion?

🔗 Read more: Is Today a Holiday for the Stock Market? What You Need to Know Before the Opening Bell

Probably not. It would likely go for more.

Why? Because of brand equity. CNN is one of the most recognized brands on the planet. You can't just go out and build another CNN. For a billionaire looking for political influence or a tech giant wanting to plug a global news feed into their AI, the "prestige" value might push a sale price closer to $6 billion or $7 billion.

It’s the difference between what a car is worth on Kelley Blue Book and what a collector will pay for it because it’s a vintage Ferrari.

The Mark Thompson "Pivot" and 2026 Projections

Right now, CNN is in the middle of a massive identity crisis, and that's affecting the bottom line. Mark Thompson, the guy who famously saved The New York Times by making everyone pay for digital subscriptions, is now the boss at CNN.

His plan? Stop obsessing over the "linear" TV channel and turn CNN into a digital powerhouse.

In late 2025 and into early 2026, Thompson started rolling out "lifestyle" verticals. Think of it like this: CNN doesn't just want to tell you about a war; they want to sell you a weather app, a travel guide, and maybe a health subscription. They even launched a new streaming subscription service in late 2025 that saw a massive spike in sign-ups during the 2026 winter storms and political shifts.

The Current Financial Snapshot:

💡 You might also like: Olin Corporation Stock Price: What Most People Get Wrong

- Annual Revenue: Hovering around $1.8 billion to $2 billion.

- Profit (EBITDA): Estimated between $800 million and $900 million, though this has been shrinking from the $1 billion+ highs of the 2020 election cycle.

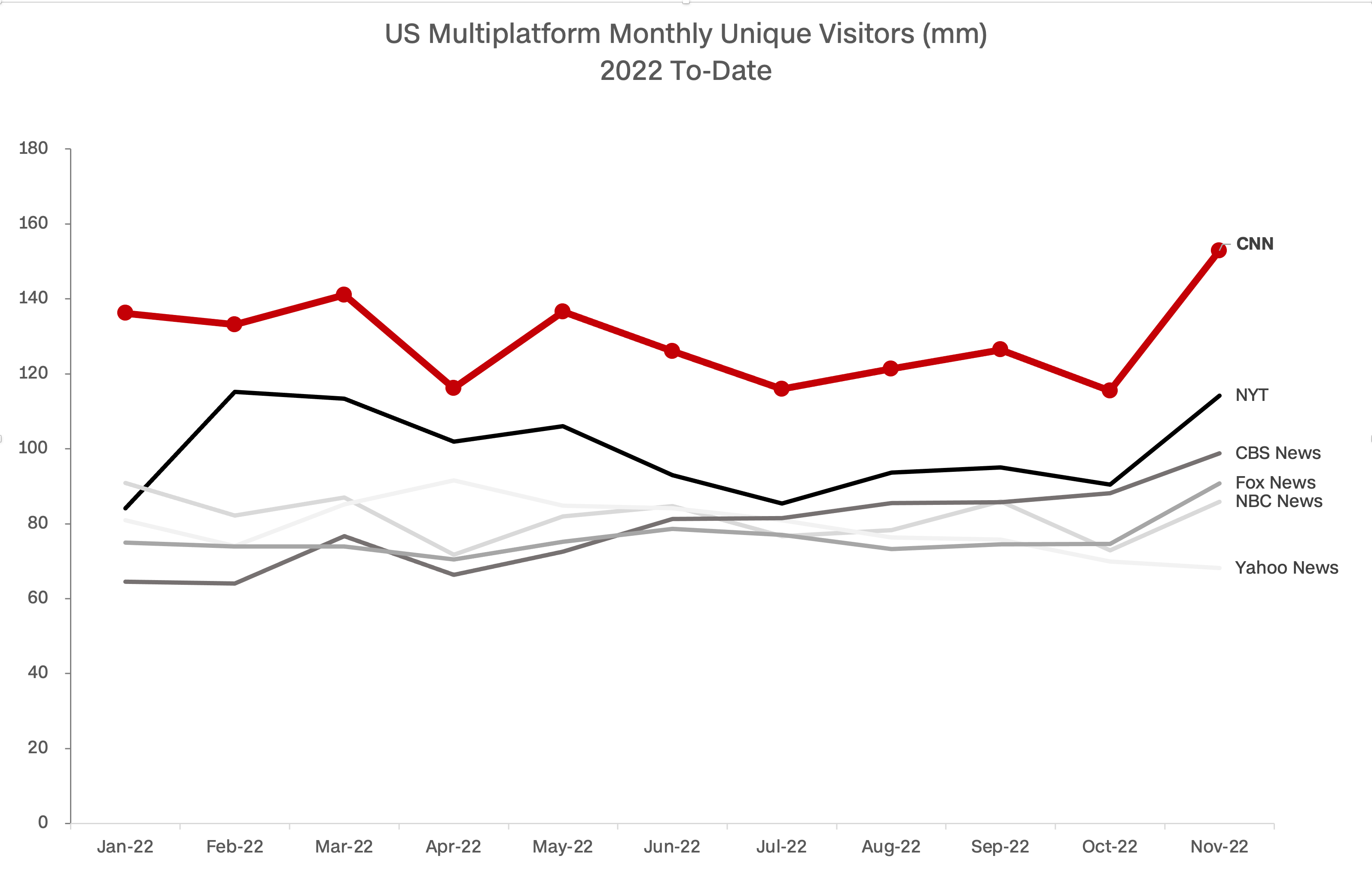

- Digital Reach: Still massive. We're talking 120 million+ monthly unique visitors globally.

If Thompson’s digital plan works, CNN’s worth could skyrocket back toward that $5 billion mark. If it fails, and they can't replace the disappearing cable fees? Well, then the "worthless" talk from some analysts might start to sound less like a negotiation tactic and more like a prophecy.

What People Get Wrong About CNN's Valuation

A lot of people think CNN is "dying" because the TV ratings are lower than Fox News.

That’s a huge misunderstanding of the business.

Fox News is a domestic powerhouse, but CNN International is a different beast entirely. CNN is piped into millions of hotel rooms, airports, and government offices in nearly every country on Earth. That global footprint is a massive moat.

Also, you have to look at the Digital Revenue. CNN.com is consistently one of the most visited news sites in the world. In 2025, while TV revenue was shaky, digital engagement actually grew by about 3%. They are successfully moving the "eyes" from the TV screen to the phone screen, even if the "dollars" haven't quite caught up yet.

The "Breakup" Scenario

There is constant talk about Warner Bros. Discovery spinning off CNN. If that happens, CNN would become its own company again.

As a standalone entity in 2026, CNN would likely be valued based on a "multiple" of its earnings. In the media world, that's usually 6x to 8x EBITDA. If they're making $900 million in profit, you’re looking at a **$5.4 billion to $7.2 billion** valuation.

📖 Related: Funny Team Work Images: Why Your Office Slack Channel Is Obsessed With Them

But there’s a catch: Debt. WBD has a mountain of it. Any spin-off would likely involve saddling CNN with some of that debt, which would immediately lower its actual "net" worth.

Is CNN a Good Investment?

You can't buy "CNN stock." You have to buy Warner Bros. Discovery (WBD).

As of January 2026, WBD is trading around $28 per share. When you buy that, you're buying CNN, but you're also buying Batman, HBO, "90 Day Fiancé," and a whole lot of debt.

Most experts agree that CNN is currently the "steady" part of the business. It generates reliable cash that helps WBD pay down its bills. It's not the high-growth "cool" part of the company—that's Max (the streaming service)—but it’s the engine that keeps the lights on.

Summary of Real-World Value

To wrap this up without the corporate fluff, here is the reality of what CNN is worth right now:

- On Paper (Accounting): Roughly $2.3 billion (based on recent court testimony).

- As a Business (Earnings): Between $5 billion and $7 billion (based on a standard 6x-8x profit multiple).

- To a Buyer (Strategic Value): Potentially $8 billion+ if a tech billionaire wants a global megaphone.

The "worth" is trending slightly downward because the old way of making money (cable) is dying faster than the new way (digital subscriptions) is growing.

What to do with this information:

If you're tracking media valuations for investment or curiosity, keep a close eye on CNN’s digital subscription numbers throughout 2026. If they can hit their goal of 1 million+ paid digital subscribers by year-end, the "worth" of the network will decouple from the failing cable industry. Watch the quarterly earnings reports from Warner Bros. Discovery (WBD); specifically, look for the "Global Linear" segment's profit margins. If those margins stay above 30%, CNN remains a cash cow. Finally, pay attention to any M&A (Mergers and Acquisitions) rumors involving WBD. If the company decides to split its "Studios" from its "Networks," CNN will finally get a public price tag that the market has to respect.