You’re staring at that renewal notice and wondering if your insurance company accidentally added an extra zero. It feels personal. Like they know you’ve been buying the "good" coffee lately and want a cut of the action. But honestly, you aren't alone in that sticker shock.

The national average for car insurance has hit a point that makes most of us want to trade our SUVs for a sturdy pair of walking shoes. As of early 2026, the typical American driver is shelling out roughly $2,256 a year for coverage. That’s about $188 every single month.

Wait. Let’s pause.

That number is just a "middle of the road" figure. It’s like saying the average temperature in the U.S. is 52 degrees—it doesn't tell you if you're shivering in Maine or sweating in Florida. In reality, what you pay is a messy cocktail of where you live, what you drive, and how many times you’ve accidentally clipped a mailbox.

Why the average car insurance cost is a moving target

If you want the raw data from the heavy hitters like Insurify and The Zebra, the landscape is shifting. For a full-coverage policy—the kind that actually fixes your car if you hit a deer or a light pole—the average is actually closer to $2,513 per year in 2026. If you're just doing the bare minimum to stay legal (liability only), you might get away with $629 to $1,000 annually.

But "minimum" is risky.

Basically, if you have assets like a house or a savings account, minimum coverage is like wearing a paper rain poncho in a hurricane. One bad left turn and you’re personally on the hook for someone’s $80,000 Tesla and their $150,000 surgery.

Geography is your biggest bill-driver

Where you park your car at night matters more than almost anything else. It's kinda wild how much the state line changes things.

- The Expensive Zone: If you live in Florida, Louisiana, or Maryland, I’m sorry. You’re likely looking at averages over $3,500 for full coverage. In Florida, it’s a perfect storm of high litigation costs, frequent hurricanes, and... well, Florida drivers.

- The Bargain States: If you’re in Vermont, New Hampshire, or Idaho, you’re winning. Drivers in Vermont often pay less than $1,100 a year for the same protection that costs a New Yorker three times as much.

The Factors Nobody Tells You About

We all know speeding tickets suck. A single ticket can hike your rate by 15% to 20% almost instantly. But there are weirder things at play in 2026.

Your Credit Score is an Insurance Score

In most states (except places like California, Hawaii, and Massachusetts), your credit score is a massive factor. If your credit is "poor," you could pay double what someone with "excellent" credit pays. Even with a perfectly clean driving record. It feels unfair, but insurers claim people with lower credit scores statistically file more claims.

The "Tech" Tax

Cars are basically rolling computers now. A fender bender in 2010 meant a new plastic bumper. Today? That same tap destroys three cameras, two radar sensors, and a parking sonar system. This is a huge reason why how much is average car insurance keeps climbing even as cars get "safer." We’re paying for the calibration of those sensors, not just the metal.

💡 You might also like: Walt Disney Share Price: What Most People Get Wrong

Age: The 25-Year-Old Myth

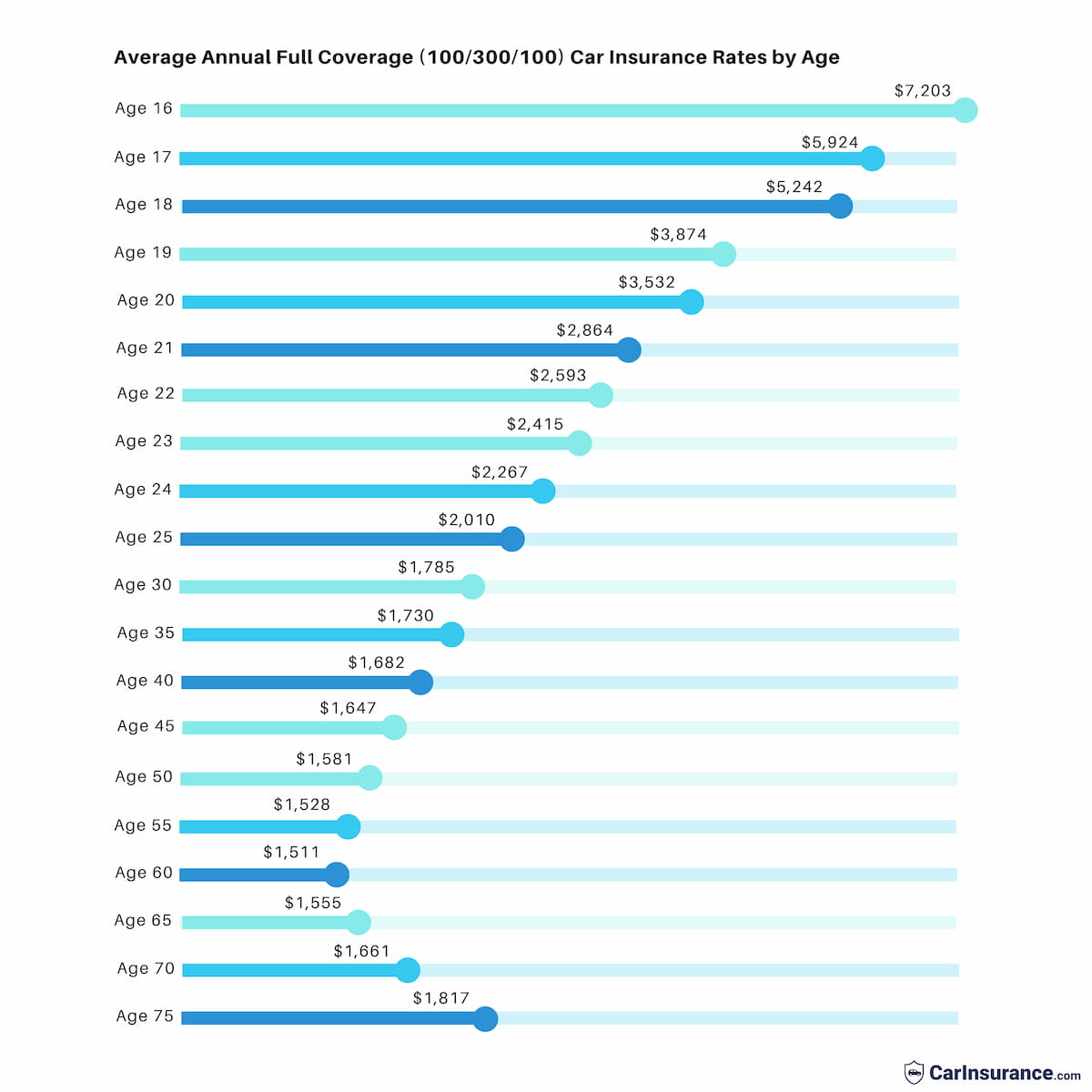

You’ve probably heard that your rates "magically" drop the day you turn 25. Sorta. It’s more of a gradual slope. An 18-year-old is looking at an average of $5,000 to $7,000 a year because, statistically, they are a high-speed disaster waiting to happen. By 30, things level out, but you won't see the "best" rates until your 50s and 60s.

Real Examples of the 2026 Price Gap

Let's look at how two different people might see the "average" differently:

Scenario A: Sarah in Ohio

- Vehicle: 2022 Honda CR-V

- Profile: 42 years old, clean record, good credit.

- Annual Cost: $1,450.

- Why? Ohio is relatively stable, the CR-V is cheap to repair, and she’s in the "sweet spot" for age.

Scenario B: Marcus in Nevada

- Vehicle: 2024 Ford F-150

- Profile: 29 years old, one speeding ticket, fair credit.

- Annual Cost: $3,200.

- Why? Nevada has high theft and accident rates, the truck is expensive to fix, and that one ticket is still haunting his "risk profile."

How to Beat the 2026 Averages

Stop being loyal. Seriously.

Insurance companies have this thing called "price optimization." They know that if you’ve been with them for five years, you’re less likely to leave. So, they slowly nudge your rates up, assuming you won't bother to check elsewhere.

Telematics is the New Standard

Most big carriers like State Farm (Drive Safe & Save) or Progressive (Snapshot) want to track your driving via an app. If you don't mind the "Big Brother" vibes, you can save 20% to 30%. If you’re a hard braker or a midnight driver, though, avoid these. They will catch you.

The "Bundle" Trap

Bundling home and auto is great, but don't assume it's the cheapest. Sometimes the bundle discount is 10%, but a different company’s standalone auto rate is 20% lower anyway. Do the math every two years.

Actionable Steps to Lower Your Bill Today

- Audit your mileage. If you’ve transitioned to a permanent remote job and are still listed as "commuting 20 miles to work," you’re overpaying. Tell them you drive under 7,500 miles a year.

- Raise your deductible. Moving from a $500 deductible to a $1,000 deductible can slash your premium by 15%. Just make sure you actually have $1,000 in a savings account.

- Check for "hidden" discounts. Are you a member of a credit union? An alum of a specific university? A teacher? A nurse? Companies like Liberty Mutual and Farmers have huge affinity discounts that they don't always apply automatically.

- Shop 30 days before renewal. Rates are often higher if you shop the day your policy expires. Carriers see "last-minute" shoppers as higher risk.

The "average" is just a benchmark. Your goal shouldn't be to hit the average—it should be to beat it by proving to the algorithms that you’re the most boring, safe, and predictable driver on the road.