You’re looking at a screen, seeing a ticker move, and wondering exactly how much is a oil barrel right now. It's a fair question. But here’s the thing: there isn't just one price. If you check CNBC, you might see $75. If you look at a specialized energy feed, it might say $72 or $78. This isn't a glitch in the system. It’s because "oil" isn't one single thing you buy at a store like a gallon of milk.

Oil is messy. It’s global. It’s incredibly political.

When people ask about the price, they’re usually looking at "benchmarks." The two big ones are West Texas Intermediate (WTI) and Brent Crude. WTI is the US standard. Brent is the international yardstick. Most of the time, they trade within a few dollars of each other, but they are distinct products coming from different holes in the ground.

The actual cost of a barrel today

Price fluctuates. Constantly. As of early 2026, we’ve seen a lot of volatility. To give you a real-world ballpark, prices have recently hovered between $70 and $85 per barrel. Why such a wide range? Because a drone strike in the Middle East or a surprise production cut from OPEC+ can swing the needle by $3 in ten minutes.

It’s wild.

Think back to April 2020. That was the most insane moment in the history of the energy market. For a brief, terrifying window, the price of a WTI oil barrel went negative. It hit -$37. Producers were literally paying people to take the oil away because there was nowhere left to store it. That tells you everything you need to know about the "value" of oil—it’s only worth what someone can actually do with it at that exact moment.

What is a barrel anyway?

Let's clear up a huge misconception. When you buy a barrel of oil, you aren't getting a literal blue drum delivered to your porch. The "barrel" is a unit of measurement. It’s exactly 42 US gallons.

Why 42? It’s a weirdly specific number that dates back to the 1860s in Pennsylvania. Early oil pioneers used old whiskey barrels to transport the stuff. They settled on 42 gallons because it was the most weight a couple of guys could reasonably handle without breaking their backs, while still fitting enough product to make the trip worthwhile. We’ve stuck with it ever since.

Why how much is a oil barrel matters to your wallet

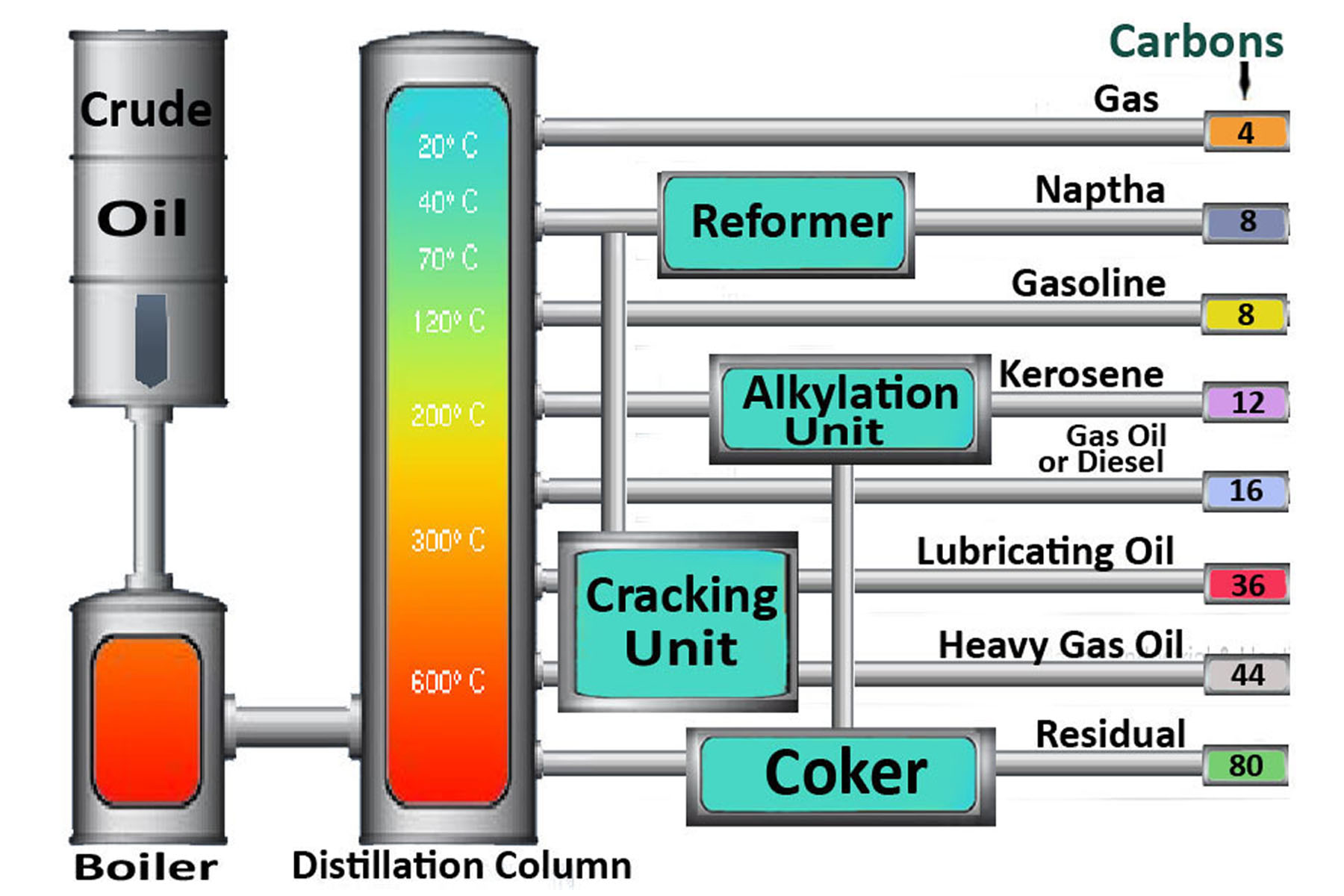

Most people don't care about the spot price of WTI because they want to buy crude. They care because of the "crack spread." That’s the industry term for the difference between the price of raw crude and the price of the finished products refined from it—like gasoline, diesel, and jet fuel.

Roughly 45% of every barrel of crude oil becomes gasoline.

When the barrel price goes up, the pump price follows. Usually, there’s a lag. If oil spikes on Monday, you’ll feel it at the Shell station by Friday. But when oil prices drop? Funny enough, the prices at the pump tend to "drift" down much slower. Economists call this "rockets and feathers." Prices go up like a rocket and fall like a feather. It’s frustrating, but it’s the reality of how gas station owners manage their inventory costs.

The invisible factors pushing the price

You can't talk about the cost of oil without talking about the "risk premium." This is the extra few dollars added to the price because traders are scared of what might happen.

✨ Don't miss: TD Bank MA Routing Number: What Most People Get Wrong About Your Transfers

If there is tension in the Strait of Hormuz—a narrow waterway where about a fifth of the world's oil passes—prices jump. Not because the oil stopped flowing, but because traders are terrified it could stop. It's a market built on anxiety.

Then you have the "Petrodollar." Since oil is priced in US dollars globally, the strength of the dollar changes how much a barrel costs for someone in London or Tokyo. If the dollar gets stronger, oil actually becomes more expensive for other countries, even if the "price" on the screen stays the same. It’s a double whammy for emerging economies.

How much is a oil barrel to actually produce?

This is where it gets interesting. The "price" on the news is the market price, but the "cost" to get it out of the ground varies wildly by geography.

- Saudi Arabia: These guys have it easy. Their oil is close to the surface and easy to pump. They can break even at maybe $10 to $20 a barrel.

- US Shale: This is much tougher. It involves fracking—drilling down and then turning the drill bit sideways. Most US shale producers need the price to stay above $40 or $50 just to keep the lights on.

- Deepwater Drilling: Think rigs in the middle of the Gulf of Mexico. These are billion-dollar projects. They might need $60+ oil to justify the massive investment.

When you see oil drop to $30, the Saudis are still making money, but the guys in North Dakota are starting to sweat. This is why OPEC+ (the coalition led by Saudi Arabia and Russia) has so much power. They can flood the market to kill off competition or starve the market to drive prices up.

The future of the $100 barrel

There is a constant debate among analysts like those at Goldman Sachs or JP Morgan about whether we will ever see a permanent return to $100 oil. Some say the "Green Transition" is killing demand. Others argue that because we aren't investing in new oil wells as much as we used to, we’re going to hit a massive supply shortage that sends prices into the triple digits.

Honestly, both could be true.

We are in a weird "in-between" era. We have more electric cars than ever, yet global oil demand hit record highs recently. It turns out that while we might be driving more EVs, we are also flying more, buying more plastic (made from oil), and shipping more packages across the ocean.

✨ Don't miss: Is 5200 Buffington Rd Atlanta GA 30349 Actually Worth the Hype?

Misconceptions about "Big Oil" profits

A lot of people think that when how much is a oil barrel hits $100, the oil companies are just throwing parties. They are making bank, sure. But these companies are also terrified of high prices. Why? Because high prices destroy demand. If gas hits $6 a gallon, people stop taking road trips. They buy Teslas. They take the bus. The "sweet spot" for most oil companies is actually around $70 to $80. It’s high enough to make a great profit, but low enough that consumers don't change their lifestyle.

Checking the price like a pro

If you want to track this yourself, don't just Google "oil price." You need to look for specific tickers.

- CL=F: This is the ticker for WTI Crude Futures. It represents the American market.

- BZ=F: This is Brent Crude. It’s the global benchmark.

- The Spread: Keep an eye on the difference between the two. If Brent is much higher than WTI, it usually means there’s a supply issue in Europe or the Middle East that hasn't hit the US yet.

You also have to understand "Contango" and "Backwardation." These sound like dance moves, but they’re vital. Contango is when the price for delivery in the future is higher than the price today. Backwardation is the opposite. If the market is in backwardation, it means people are desperate for oil right now, which is usually a sign of a very tight, expensive market.

Actionable Insights for Navigating Oil Prices:

To get a real handle on how these numbers affect your life or your investments, stop looking at the daily fluctuations and focus on these three indicators:

- The EIA Weekly Petroleum Status Report: Released every Wednesday at 10:30 AM Eastern. This is the "gold standard" of data. It tells you exactly how much oil is sitting in US tanks (inventories). If inventories drop more than expected, expect the price to jump.

- The US Dollar Index (DXY): If you see the dollar surging, oil prices often face "downward pressure." Understanding this inverse relationship helps you predict moves before they happen.

- Refinery Utilization Rates: If oil is cheap but gas is expensive, check the refineries. If refineries are undergoing "turnaround" (maintenance) or have been hit by a hurricane, the price of a barrel doesn't matter—the price of gas will go up anyway because the "bottleneck" is at the factory, not the well.

Monitor the WTI/Brent spread to see if an energy crisis is localized or global. If you're an investor, look for companies with a "low break-even" point—those who can survive even if the price of a barrel temporarily craters.