You’re staring at a stack of medical bills and wondering how the math is supposed to work. It’s a stressful spot. When you can’t work because of a chronic illness or a sudden injury, the first question is always: how much is a disability check actually going to be?

People expect a simple number. They want to hear "it's $2,000 a month." But the Social Security Administration (SSA) doesn't work like a standard paycheck. It's a bureaucratic puzzle. Your neighbor might be getting $900 while a former tech executive down the street pulls in over $3,500. It feels random. It isn't.

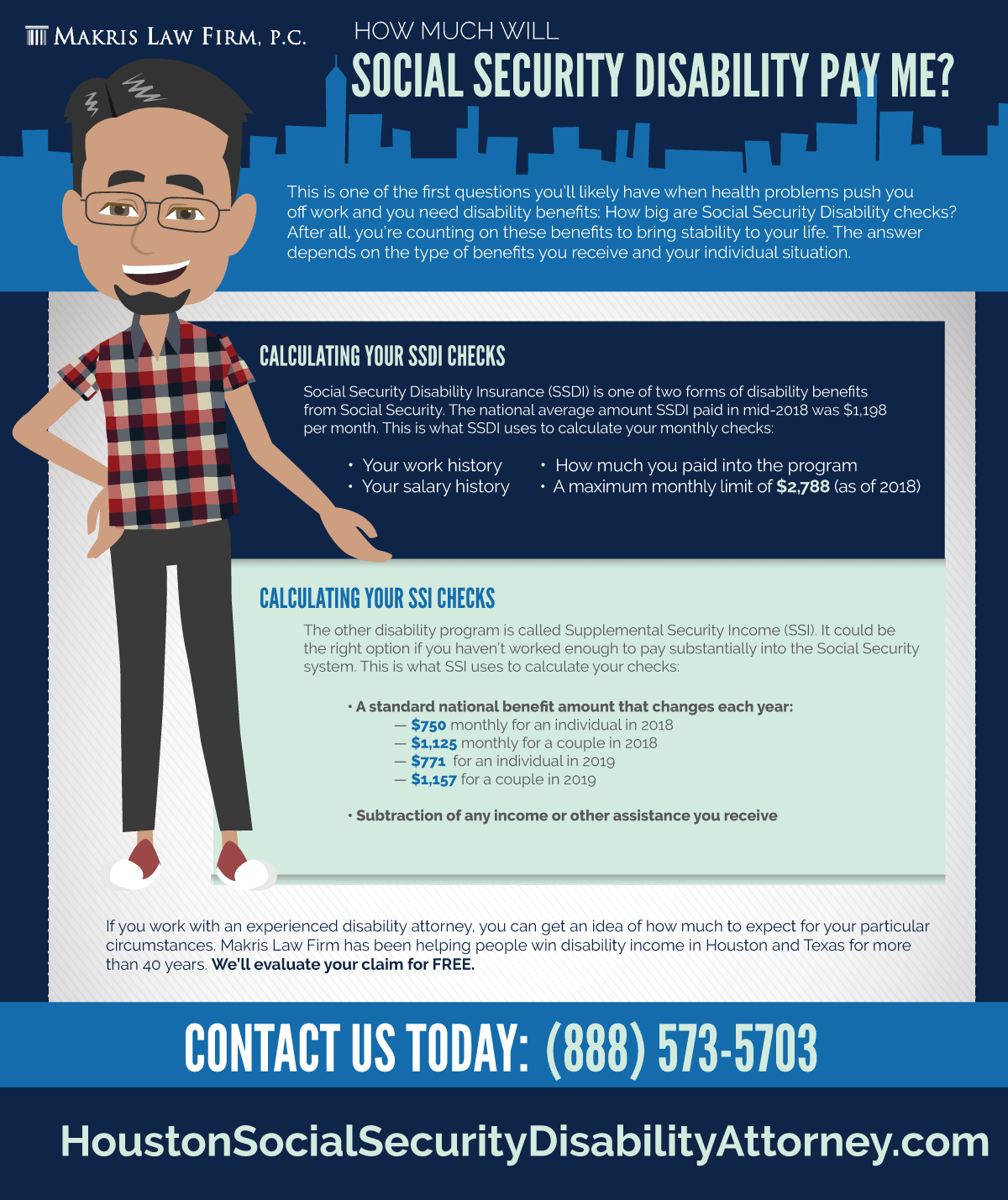

Basically, your payment depends on which door you walk through: Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI). One is based on your work history. The other is a safety net for those with very little.

The SSDI Math: It’s All About Your Past Life

If you’ve spent years paying into the system through FICA taxes, you’re looking at SSDI. Think of this as an insurance policy you’ve already paid for. The SSA uses a formula called the Primary Insurance Amount (PIA).

They don't just look at last year. They look at your "average indexed monthly earnings" over your working life.

For 2026, the maximum possible SSDI check is roughly $3,900 to $4,000 per month, but almost nobody actually gets that. To hit that ceiling, you’d need to have earned the maximum taxable income for decades. Most people? They land somewhere between $1,300 and $1,800.

It’s a "weighted" formula. This means the SSA replaces a higher percentage of lower earnings than higher earnings. It’s designed to keep people from falling into total poverty, but it rarely replaces a full middle-class salary. If you were making $80,000 a year, a disability check is going to feel like a massive pay cut. You’ve got to prepare for that.

Why your "Work Credits" matter more than you think

You can't just apply because you're sick. You need "credits." Usually, that's 40 credits, 20 of which must have been earned in the last 10 years ending with the year you become disabled. If you’ve been out of the workforce for a long time raising kids or traveling, your "check" might be zero because your insurance coverage expired.

✨ Don't miss: Funny Team Work Images: Why Your Office Slack Channel Is Obsessed With Them

The SSI Reality: A Hard Ceiling

Then there’s SSI. This is for people who haven't worked enough or have been disabled since childhood. It is strictly needs-based.

The federal benefit rate for SSI in 2026 is approximately $960 to $990 for an individual and around $1,450 for a couple. That’s it. That is the most you can get from the federal government.

Some states—like New York or California—add a small "state supplement" to that. Other states, like West Virginia or Mississippi, don't add a dime.

Wait. There’s a catch.

SSI is incredibly sensitive to your other income. If you’re getting $300 a month from a small pension, the SSA will likely reduce your SSI check by almost that same amount. They even count "in-kind" support. If you live with your parents and don’t pay rent, the SSA might slash your check by one-third because they consider that free rent as "income." It’s harsh. It's frustrating. It’s the law.

The COLA Factor: Why the Number Changes Every January

Every October, the government looks at the Consumer Price Index. If eggs and gas got more expensive, they trigger a Cost-of-Living Adjustment (COLA).

In 2023, we saw a massive 8.7% jump because inflation was wild. For 2026, the estimates are much more modest, likely hovering around 2.5% to 3%.

🔗 Read more: Mississippi Taxpayer Access Point: How to Use TAP Without the Headache

When people ask "how much is a disability check," they often forget to factor in Medicare premiums. Most SSDI recipients are automatically enrolled in Medicare Part B after two years. The premium for Part B—which is usually around $175 to $185—is deducted directly from the disability check.

So, your "gross" pay might go up by $40 due to inflation, but if the Medicare premium goes up by $15, you only see a $25 raise in your pocket. It's a shell game.

Backpay: The Lump Sum No One Explains Well

The application process is slow. It takes years sometimes. If you apply today and get approved three years from now, the SSA owes you for that waiting time. This is called backpay.

- SSDI Backpay: Can go back to the date you became disabled (your "onset date"), but there is a five-month mandatory waiting period for which you get nothing.

- SSI Backpay: Only goes back to the month after you applied. No onset date magic here.

Attorneys usually take 25% of this lump sum (capped at a specific dollar amount, currently around $7,200 or $9,200 depending on recent 2024/2025 limit increases). Don't be surprised when that first big check is smaller than you calculated.

Can You Work and Still Get a Check?

Yes, but it's like walking a tightrope.

The SSA uses a metric called Substantial Gainful Activity (SGA). In 2026, if you earn more than roughly $1,600 a month (more if you are blind), the SSA considers you "not disabled." You’re working. They stop the check.

There is a Trial Work Period (TWP). For nine months, you can earn as much as you want while keeping your full SSDI check. It’s a "test drive" for re-entering the workforce. But once those nine months are up—even if they weren't consecutive—the rules get very strict.

💡 You might also like: 60 Pounds to USD: Why the Rate You See Isn't Always the Rate You Get

Family Benefits: The "Extra" Money

If you have children under 18 (or up to 19 if still in high school), they might be eligible for "auxiliary benefits."

Usually, a child can get up to 50% of your monthly SSDI amount. However, there is a "Family Maximum." Total payments to a family generally can't exceed 150% to 180% of your individual benefit. If you have five kids, they don't each get 50%. They split the remaining "pot" until the family max is hit.

SSI does not offer these family benefits. It’s strictly for the individual.

Common Misconceptions That Mess People Up

People think their doctor decides the check amount. Wrong. Your doctor only decides if you are "medically vocational." The money is decided by your tax records.

Another big one: "I paid in for 30 years, I should get the max."

Not necessarily. If you had a lot of "zero" years or years where you worked part-time, those zeros are averaged into your 35 highest-earning years. It drags the average down.

What You Should Do Right Now

Stop guessing. You can actually see your future check amount before you even apply.

- Create a "my Social Security" account on the official SSA.gov website.

- Download your Social Security Statement. It will show you exactly what your SSDI check would be if you were found disabled today.

- Check for "Gaps." Look at your earnings history. If a year is missing or wrong, fix it now. That data determines your check for the rest of your life.

- Audit your assets. If you think you'll need SSI, remember you cannot have more than $2,000 in countable assets ($3,000 for couples). This includes secondary cars and savings accounts.

- Talk to a vocational expert. If you're on the edge of the SGA limit, understand that even $1 over the limit can trigger a full cessation of benefits.

The system is designed to be difficult. Knowing your "PIA" and "SGA" numbers won't make the medical part easier, but it will stop the financial surprises from ruining your planning. Use the SSA’s online calculators for the most accurate "what-if" scenarios based on your specific birth year and earnings.