You see the number flashing on the bottom of the news screen every single morning. $75. $82. $94. It looks simple. It looks like a price tag on a gallon of milk, but oil is weird. It isn't just one thing. When you ask how much is a barrel of oil, you’re actually asking about a massive, global tug-of-war between Middle Eastern royalty, Texas frackers, and Chinese factory owners.

It’s about 42 gallons. That’s the standard. But you can't just go to a gas station and buy a wooden cask of the stuff.

Why the price changes before you even finish your coffee

Oil prices move because the world is nervous. Honestly, the physical oil—the thick, black goo—often stays sitting in a tanker or a salt cavern while the "price" jumps five dollars in a day. Traders are betting on what might happen three months from now. If there is a hint of a storm in the Gulf of Mexico or a drone spotted near a refinery in Saudi Arabia, the price spikes. It’s pure adrenaline.

Supply and demand are the old guard, sure. If OPEC+ (that’s the Organization of the Petroleum Exporting Countries plus Russia and a few others) decides to turn off the taps, the price goes up because there’s less to go around. But lately, it’s more about the "macro." If the Federal Reserve raises interest rates, the dollar gets stronger. Since oil is priced in U.S. dollars globally, a strong dollar actually makes oil more expensive for a buyer in Europe or India, even if the "number" on the screen stays the same.

Brent vs. WTI: Which one are you actually looking at?

You’ve probably heard these names. They aren't brothers; they're benchmarks.

West Texas Intermediate (WTI) is the U.S. standard. It’s "sweet" and "light," which basically means it has low sulfur and is easy to turn into gasoline. If you live in North America, this is usually the price you see. Then there’s Brent Crude. This comes from the North Sea and sets the price for about two-thirds of the world’s oil. Usually, Brent is a few dollars more expensive than WTI because it's easier to ship across oceans.

✨ Don't miss: 40 Quid to Dollars: Why You Always Get Less Than the Google Rate

There are dozens of others. Dubai Crudes. Western Canadian Select (which is usually way cheaper because it's "heavy" and hard to move). When someone tells you how much is a barrel of oil, they are usually giving you the WTI price, but that doesn't tell the whole story for a refinery in Singapore.

The 42-gallon myth and the refinery reality

History is funny. Back in the 1860s, in the early Pennsylvania oil fields, they used old whiskey barrels to transport the stuff. They settled on 42 gallons because it was the right weight for a man to handle but big enough to be worth the trip. That stuck.

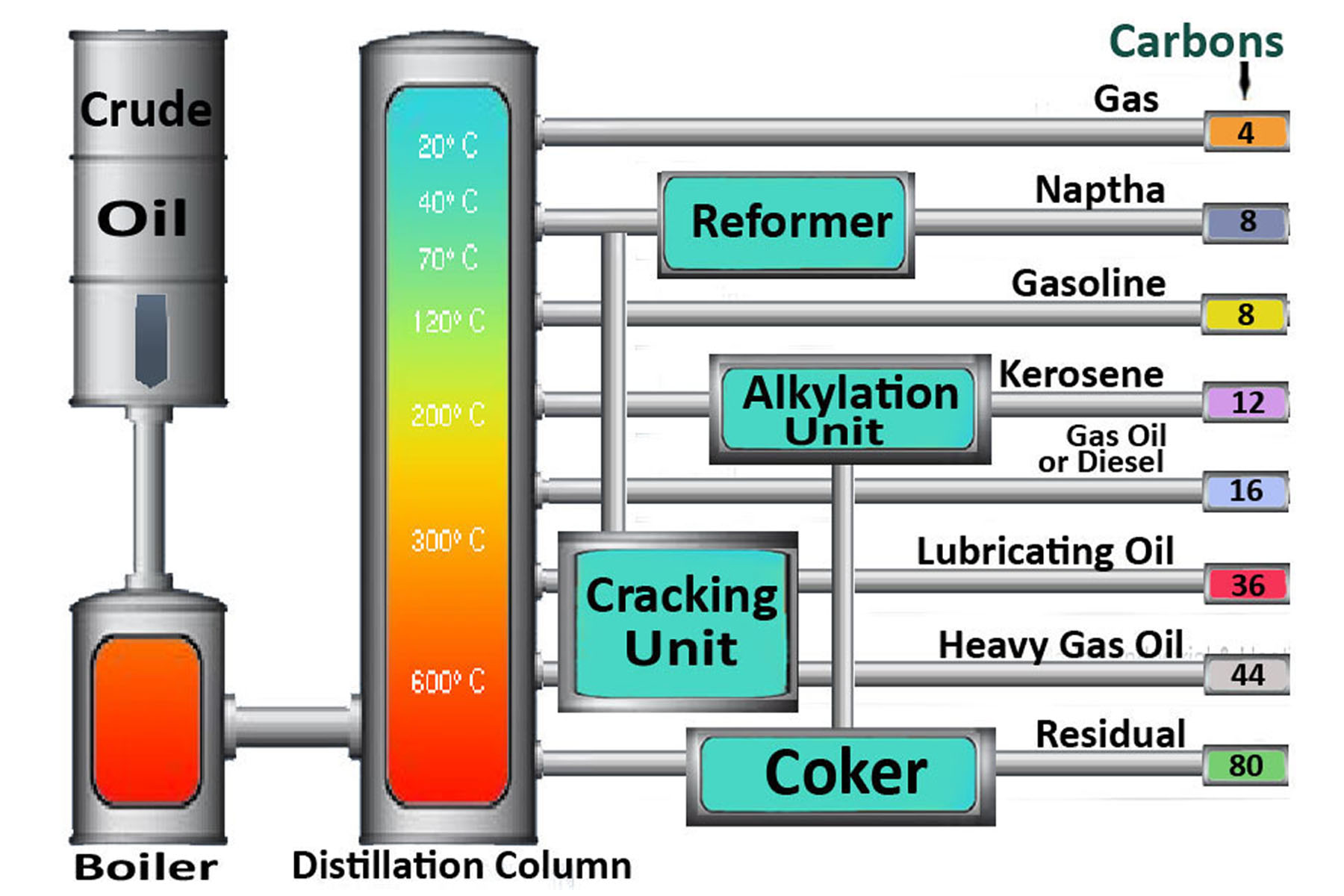

But here is the catch: a 42-gallon barrel of crude oil doesn't just make 42 gallons of gas. It’s actually better than that. Due to something called "refinery gain," you actually get about 45 gallons of products out of a single barrel.

- About 19 to 20 gallons become finished motor gasoline.

- Roughly 11 to 12 gallons turn into distillate fuel oil (diesel and heating oil).

- Around 4 gallons become jet fuel.

- The rest? It’s everything from asphalt for your roads to the plastic in your phone and the synthetic fibers in your yoga pants.

The invisible hand of OPEC+ and the shale revolution

For decades, the answer to how much is a barrel of oil was basically whatever the Saudi oil minister said it was. They held the "spare capacity." If prices got too low, they cut production. If prices got too high and threatened to kill the global economy, they pumped more.

Then came the frackers.

🔗 Read more: 25 Pounds in USD: What You’re Actually Paying After the Hidden Fees

Around 2010, the U.S. shale boom changed the math. Suddenly, places like the Permian Basin in Texas and the Bakken in North Dakota were pumping millions of barrels. This created a "ceiling" on prices. If oil gets too expensive—say, over $80 a barrel—it becomes very profitable for American companies to drill more. They flood the market, and the price drops. It’s a constant cycle of "boom and bust" that keeps the global price in a weird sort of equilibrium, though it feels anything but stable.

The 2020 anomaly: When oil was worth less than nothing

We have to talk about April 2020. It was the most insane day in the history of the energy market. Because of the pandemic, nobody was driving. Nobody was flying. The world was literally out of places to put the oil.

On April 20, 2020, the price of WTI went negative. -$37.63.

Think about that. Sellers were literally paying people to take the oil off their hands because they had nowhere to store it and couldn't just stop the wells from flowing without damaging them. It was a "black swan" event, but it proves that the price of oil isn't just about value; it's about logistics. If you can't move it or store it, it's a liability, not an asset.

Geopolitics is the real price driver

Oil is the only commodity that can be held hostage by a single tweet or a border skirmish. When Russia invaded Ukraine in 2022, Brent Crude shot up toward $130. Why? Because Russia is one of the top three producers in the world. People panicked that Russian oil would vanish from the market.

💡 You might also like: 156 Canadian to US Dollars: Why the Rate is Shifting Right Now

It didn't. It just shifted.

Now, India and China buy a huge portion of that Russian crude, often at a discount. This has created a "shadow fleet" of tankers moving oil outside of Western eyes. This makes answering how much is a barrel of oil even harder, because there is the "official" price and then there is the "gray market" price that countries pay behind closed doors.

Looking at the future: Is $100 the new normal?

Some analysts, like those at Goldman Sachs, often argue that we are in a "supercycle." They think that because we aren't investing enough in new oil wells (since everyone is focused on green energy), we will eventually run out of supply, senting prices into the triple digits.

Others say the opposite. They look at the rise of Electric Vehicles (EVs) and think we’ve already hit "peak demand." If the world starts using less oil every year, the price will eventually have to slide down.

But for now, the price stays volatile. It’s stuck between the reality of today—where we still need 100 million barrels every single day to keep the lights on—and the promise of tomorrow.

Actionable steps for the average person

Unless you are a day trader, you don't need to check the price of Brent every hour. But you should know how it hits your wallet.

- Watch the "Rule of 10": Generally, every $10 increase in the price of a barrel of oil leads to about a 25-cent increase in the price of a gallon of gas at the pump. If you see oil jump from $70 to $90, prepare to pay an extra 50 cents for gas in about two weeks.

- Check the "Crack Spread": This is the difference between the price of crude oil and the price of the products made from it. Sometimes oil is cheap, but gas is expensive because refineries are offline. If oil is down but your local gas station is up, look for news about refinery maintenance in your region.

- Inflation hedge: If you're worried about rising prices, some people invest in energy ETFs (Exchange Traded Funds) like XLE. When oil goes up, these stocks often follow, helping to offset the extra money you’re spending at the pump.

- Heating oil timing: If you live in a place that uses heating oil, buy in the summer. It sounds obvious, but the "seasonal spread" is real. Prices almost always dip when the sun is out, regardless of what's happening in the Middle East.

The price of a barrel of oil is never just a number. It's a snapshot of global fear, greed, and logistics. Next time you see that ticker, remember you're looking at the heartbeat of the global economy, and it’s a heart that beats pretty fast.