Ever looked at a rusty blue drum and wondered why on earth we use that specific size to dictate the entire global economy? It's weird. Most people assume a barrel is just a barrel. But if you're asking how much in a barrel of oil, the answer is exactly 42 U.S. gallons. Not 40. Not 50. 42.

It’s a specific number with a gritty, Pennsylvania history that still dictates how billions of dollars move across the ocean every single day.

Standardization is the bedrock of the energy sector. Without it, the New York Mercantile Exchange (NYMEX) would be a chaotic mess of different volumes and confused traders. When you see the price of Brent or West Texas Intermediate (WTI) flashing on a ticker tape, you’re looking at the price for that specific 42-gallon unit.

But here’s the kicker: that barrel doesn't actually exist as a physical object most of the time. You won't see 42-gallon drums being rolled onto tankers. It's a "unit of account." We move oil through massive pipelines and into VLCCs (Very Large Crude Carriers) that hold two million barrels at a time. The 42-gallon drum is basically a ghost that haunts the spreadsheets of every oil major from ExxonMobil to Saudi Aramco.

The Weird History of the 42-Gallon Standard

Why 42? It sounds like a random choice. In the early 1860s, during the Pennsylvania oil boom, there was no standard. People used whatever they had. Beer barrels. Fish barrels. Molasses tubs. It was a disaster for trade because nobody knew exactly how much they were buying.

In 1866, a group of producers met in Titusville, Pennsylvania. They agreed that a 42-gallon barrel was the fairest measure. Why? Because a "tierce" (an old English wine measure) was 42 gallons. It was a size a couple of strong men could actually manhandle. Plus, they added a couple of gallons as a "buffer" for evaporation and leaking during transport on bumpy wagon trails. Basically, they wanted to make sure the customer actually got at least 40 gallons by the time the barrel reached its destination.

The Commonwealth of Pennsylvania officially adopted the 42-gallon standard in 1872. Eventually, the rest of the world just fell in line. It’s a classic case of "if it ain't broke, don't fix it," even though we don't use the physical barrels anymore.

What Actually Comes Out of the Barrel?

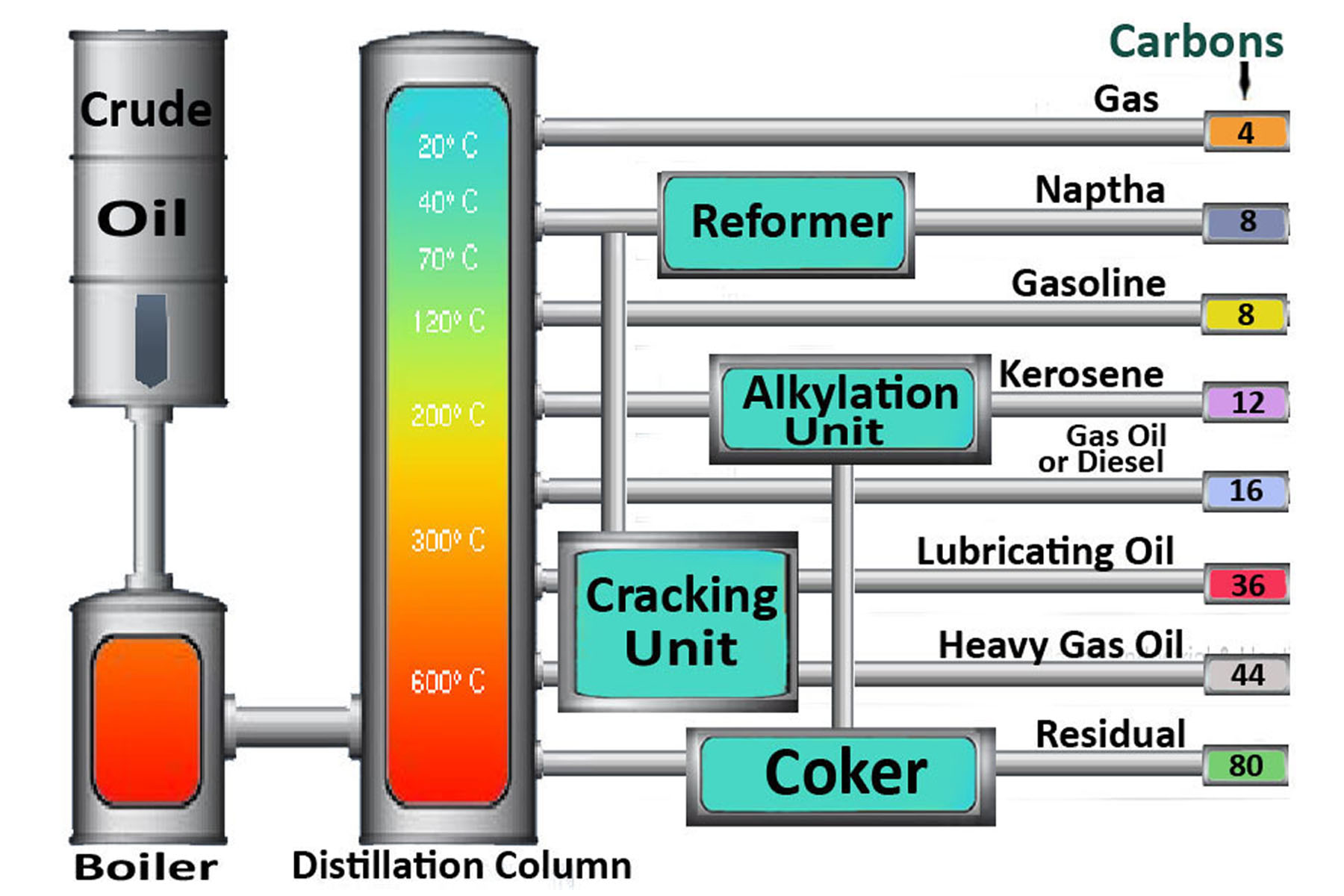

This is where it gets interesting. When you refine a barrel of crude, you don't just get 42 gallons of gasoline. Chemistry doesn't work that way. Through a process called "refinery gain," you actually end up with more than 42 gallons of finished products.

📖 Related: Reading a Crude Oil Barrel Price Chart Without Losing Your Mind

Processing adds volume.

Typically, a single 42-gallon barrel of crude yields about 44 to 45 gallons of petroleum products. This happens because the refining process lowers the density of the liquids, which increases their volume. It's like popcorn kernels expanding when they heat up.

The Typical Yield Breakdown

If you crack open a standard barrel of WTI, you're generally going to get:

- Gasoline: About 19 to 20 gallons. This is the big one. It's the primary driver of refinery margins.

- Distillate Fuel Oil: Roughly 11 to 12 gallons. This includes your diesel and the heating oil used in those old basements in New England.

- Jet Fuel: About 3 to 4 gallons. Kerosene-type fuel that keeps the Boeings and Airbuses in the sky.

- Other Stuff: The "leftovers" include liquefied petroleum gases (LPG), asphalt for our roads, and feedstocks for making plastics.

Think about that next time you buy a plastic water bottle or a pair of polyester leggings. You're holding a tiny fraction of that 42-gallon history.

Why "Heavy" vs. "Light" Oil Changes the Math

Not all oil is created equal. You've probably heard experts talk about "Sweet Crude" or "Heavy Sour." These aren't just fancy names; they drastically change how much in a barrel of oil actually turns into profit.

Light, sweet crude (like WTI) is the gold standard. It's thin, flows easily, and has low sulfur content. It’s easy to turn into gasoline. Heavy crude, like the stuff coming out of the Canadian oil sands or Venezuela, is thick like molasses. It requires way more energy and complex refining to turn into something useful.

Refineries are specifically tuned for certain "diets." A refinery on the Gulf Coast might be optimized for heavy Mexican Maya crude, while one in the Midwest wants that light shale oil from North Dakota. If the "diet" changes, the yield of those 42 gallons shifts.

👉 See also: Is US Stock Market Open Tomorrow? What to Know for the MLK Holiday Weekend

The Discrepancy Between Barrels and Tonnes

If you go to Europe or look at reports from Russia, they don't talk about barrels. They talk about "metric tonnes."

This drives American analysts crazy.

A metric tonne is a measure of weight, not volume. Because different types of oil have different densities, there isn't a single perfect conversion. However, for a rough estimate, people usually use a factor of 7.33. That means there are roughly 7.33 barrels in one metric tonne of oil. If the oil is "heavy," that number might drop to 6.7. If it's "light," it could jump to 8.0.

It’s all about the API Gravity—a scale created by the American Petroleum Institute to measure how heavy or light a petroleum liquid is compared to water.

The Economic Impact of the 42-Gallon Unit

Everything in the global economy is pegged to this 42-gallon unit. When the "price of oil" goes up by a dollar, it means every single 42-gallon increment just got a dollar more expensive.

Consider the scale. The world consumes roughly 100 million barrels of oil every single day. That is 4.2 billion gallons. Daily.

When you consider how much in a barrel of oil contributes to the global GDP, it’s staggering. It’s not just about the gas in your tank. It’s about the cost of shipping a container from Shanghai to Long Beach. It’s about the price of fertilizers used to grow the corn in Iowa. It’s the raw material for the medical-grade plastics in a hospital’s IV bags.

✨ Don't miss: Big Lots in Potsdam NY: What Really Happened to Our Store

Misconceptions That Just Won't Die

People often think that if oil prices drop, the price at the pump should drop instantly. It doesn't.

There's a "lag."

That 42-gallon barrel has to be bought, shipped, refined, and distributed. The gas you’re buying today was likely crude oil weeks or even months ago. Also, taxes and refining costs are fixed. Even if the crude oil itself was free, you'd still be paying for the chemist, the truck driver, and the local government's cut.

Another myth? That we're running out of those barrels. We aren't. We're just getting better at finding them. Technology like hydraulic fracturing (fracking) and horizontal drilling turned the U.S. from a massive importer into a dominant producer. The "barrel" is more abundant now than many experts predicted in the 1970s.

Real-World Actionable Insights for Tracking Oil

If you want to understand the market like a pro, stop looking at just the headline price. You have to look at the "Crack Spread."

The crack spread is the difference between the price of a barrel of crude and the price of the products (gasoline and diesel) refined from it. This tells you if refineries are actually making money. If crude is cheap but the crack spread is high, the guys turning the oil into gas are cleaning up.

Also, keep an eye on the EIA (Energy Information Administration) Weekly Petroleum Status Report. Every Wednesday at 10:30 AM Eastern, they release the "inventory" numbers. They tell the world exactly how many of those 42-gallon barrels are sitting in storage tanks in Cushing, Oklahoma.

If inventories are high, prices usually drop. If they’re low, hold onto your wallet.

Practical Steps for Following the Market:

- Watch the Cushing Inventories: Cushing is the delivery point for WTI. What happens there dictates the U.S. benchmark.

- Understand the Spread: Look at the difference between WTI (U.S. oil) and Brent (International oil). If the gap gets too wide, it changes where tankers sail.

- Check the Rig Count: Baker Hughes releases a "Rig Count" every Friday. It’s a leading indicator. More rigs today means more 42-gallon barrels in the market six months from now.

- Ignore the Noise: Don't get distracted by daily geopolitical tweets. Look at the long-term "draws" (decreases) or "builds" (increases) in actual physical barrels.

The 42-gallon barrel is an archaic, weird, Pennsylvania-born unit of measurement. But it is the heartbeat of global trade. Whether it's being pumped out of the Permian Basin or the Arabian Desert, every drop is measured against that 19th-century standard. Understanding what’s inside that barrel—and why the number 42 stays constant while everything else changes—is the first step to making sense of the modern world.