If you’ve looked at the news lately, you probably feel like the U.S. economy is a giant game of Jenga where someone just pulled the bottom block. It’s messy. The big question on everyone’s mind—especially with the 2026 budget season looming—is just how much has the national debt increased in 2025?

Honestly, the numbers are kind of terrifying. We aren't just talking about a few billion dollars anymore. We’re talking about trillions. By the time Fiscal Year 2025 wrapped up on September 30, the total outstanding national debt had climbed to a staggering $37.64 trillion.

To put that in perspective, the debt grew by roughly $2.17 trillion in just twelve months. That’s about $5.95 billion every single day. If you’re sitting there eating breakfast, the government just spent about $4 million in the minute it took you to finish your toast.

Why the $38 Trillion Milestone Matters Right Now

Wait, didn't you just say 37.64? Yeah, but that was the end of the fiscal year. By October 21, 2025, the U.S. Treasury officially crossed the $38 trillion threshold. It’s a psychological barrier as much as a financial one. When we talk about how much has the national debt increased in 2025, we have to look at the momentum. We are now in a "debt spiral" where we are borrowing money just to pay the interest on the money we already borrowed.

It’s basically like using a credit card to pay off the interest on another credit card. Not exactly a recipe for success.

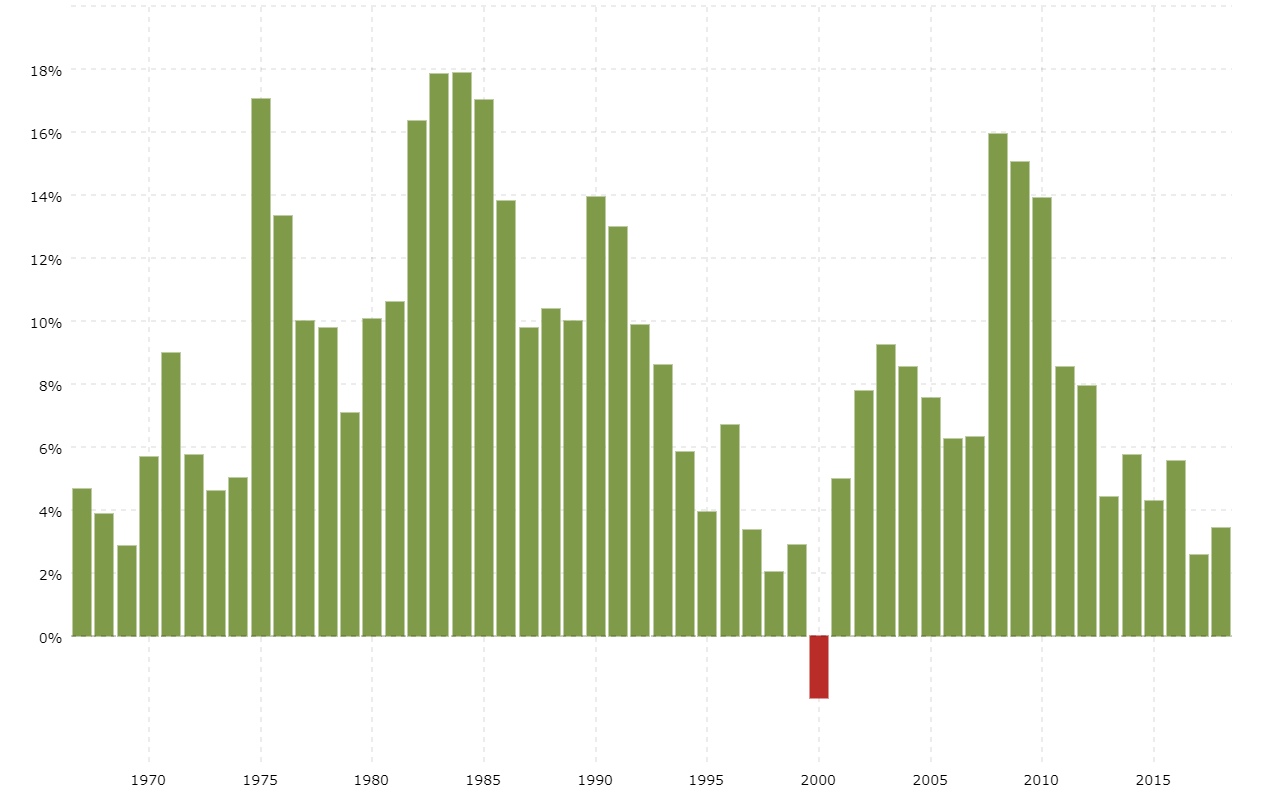

The debt held by the public—the part that actually affects the markets and interest rates—is now sitting at over $30 trillion. That’s roughly 100% of our Gross Domestic Product (GDP). For the first time since the aftermath of World War II, our "mortgage" on the country is as big as the entire country's annual income.

💡 You might also like: Dealing With the IRS San Diego CA Office Without Losing Your Mind

What Actually Drove the 2025 Debt Spike?

You might be wondering where all this cash is going. It’s not just one thing. It’s a perfect storm of demographics, interest rates, and policy choices.

The Interest Rate Trap

For decades, the government got away with massive borrowing because interest rates were basically zero. Those days are gone. In 2025, the "Net Interest" on the public debt—the check we write to bondholders just to keep the lights on—surpassed $1 trillion for the first time in history.

Think about that. We spent more on interest than we did on the entire National Defense budget. It's now the second-largest expense the government has, right behind Social Security.

The Big Spenders: Social Security and Medicare

It’s the "silver tsunami." As more Baby Boomers retire, the cost of Social Security and Medicare is ballooning. Social Security costs grew by $121 billion this year alone. Medicare jumped by another $117 billion. These aren't programs that politicians can just "cut" without a massive public outcry, so the borrowing continues.

The "One Big Beautiful Bill" Act (OBBBA)

In mid-2025, Congress passed the budget reconciliation law that raised the debt limit by $5 trillion. While the bill included some student loan accounting shifts that technically "lowered" the deficit on paper, the Committee for a Responsible Federal Budget (CRFB) pointed out that policymakers actually added about $1.5 trillion in net new ten-year debt through various new provisions and farm aid packages.

📖 Related: Sands Casino Long Island: What Actually Happens Next at the Old Coliseum Site

The Reality of the $1.8 Trillion Deficit

While the total debt is the "big number," the deficit is the annual gap. For 2025, the deficit was $1.8 trillion.

Wait, that’s actually a decrease of $41 billion from 2024. Success, right?

Well, not really.

If you strip away the accounting quirks—like the way the Department of Education records student loans—the underlying "primary deficit" is actually getting worse. Revenue collections (taxes) actually rose by 6% to $5.2 trillion, largely due to higher customs duties from new tariffs. But spending (outlays) rose even faster, hitting **$7.0 trillion**.

Basically, even when the government makes more money, it finds a way to spend even more. The Bipartisan Policy Center noted that while individual income taxes were up, corporate tax receipts actually declined because of new investment deductions allowed under recent tax laws (like H.R. 1).

👉 See also: Is The Housing Market About To Crash? What Most People Get Wrong

Why You Should Care (Beyond the Scary Numbers)

It’s easy to tune out when people start talking about "trillions." It feels fake. But the 2025 debt increase has real-world consequences for your wallet:

- Mortgage Rates: When the government borrows trillions, it competes with you for loans. This pushes interest rates up. That’s why your 30-year fixed mortgage is still hovering at levels that make 2020 look like a dream.

- Inflation Risk: Financial legends like Ray Dalio have spent much of 2025 warning that the U.S. is at a crossroads. If we can’t pay the debt through taxes, the government might resort to "printing" money, which devalues the dollar and makes your groceries more expensive.

- Crowding Out: Every dollar spent on interest is a dollar NOT spent on fixing bridges, funding schools, or researching new technology.

Is There a Way Out?

Most experts, including those at the CBO and GAO, aren't exactly optimistic. The current trajectory is "unsustainable." That's a word you'll hear a lot in Washington, yet no one seems to want to be the person to turn off the tap.

Some economists, like Joseph Stiglitz, argue that the solution isn't just "austerity" (cutting spending) because that could tank the economy. Instead, they suggest we need massive investment to grow the GDP faster than the debt. But with the debt-to-GDP ratio at 124%, growing our way out is getting harder every day.

Actionable Steps for Your Own Finances

Since we can't control the Treasury, the best move is to insulate yourself from the fallout of the national debt increase.

- Lock in Fixed Rates: If you're carrying debt, move it to fixed rates. Variable rates are a gamble when the government is essentially a "subprime borrower" on a national scale.

- Hedge Against Inflation: Consider assets that hold value if the dollar dips. This could be real estate, certain stocks, or even a small allocation of gold or Bitcoin (if that’s your vibe).

- Stay Informed but Not Panicked: The $38 trillion mark is a milestone, not a cliff. The U.S. still has the world's reserve currency, which gives us a massive "get out of jail free" card—for now.

- Watch the 2026 Budget: Keep an eye on the upcoming "debt ceiling" debates. They usually lead to market volatility, which can be an opportunity if you're prepared.

The national debt in 2025 didn't just grow; it accelerated into a new era of trillion-dollar interest payments. Understanding these numbers is the first step in making sure your own "personal treasury" doesn't follow the same path.

Sources and Further Reading

- U.S. Treasury Fiscal Data: National Debt Tracker

- Congressional Budget Office (CBO) 2025 Budget Review

- Committee for a Responsible Federal Budget (CRFB) Analysis

- Joint Economic Committee: FY2025 Debt Update

Next Step: Review your investment portfolio to ensure you aren't over-exposed to interest-rate-sensitive assets as the 2026 fiscal cycle begins.