Ever looked at your DMV renewal notice and felt your stomach drop? You aren’t alone. California is notorious for having some of the most expensive—and frankly, confusing—vehicle fees in the country. If you're wondering exactly how much for car registration in california in 2026, the answer is rarely a single number. It’s a stack of smaller fees that pile up like a game of financial Tetris.

Most people think it’s just one flat rate. Nope.

🔗 Read more: Black Hair to Dark Brown: What Most People Get Wrong About This Transition

Your neighbor might pay $180 for their old truck while you’re staring down a $700 bill for a new SUV. It feels personal, but there’s a method to the madness. Usually.

The "Base" Fee is Only the Beginning

Don't let the "registration fee" line fool you. As of 2026, the base registration fee is sitting around $76. That sounds reasonable, right? But that’s just the cover charge to get into the club. Once you’re in, the DMV starts adding the "drinks."

First, there’s the California Highway Patrol (CHP) fee. That’s $34 right now. Then you’ve got a smattering of smaller $1 to $3 charges for things like "Fingerprint ID" or "Abandoned Vehicle Trust." They seem tiny, but they’re mandatory. If you live in a specific county, you might also see an Air Quality Management fee or a Transportation Improvement Fee (TIF).

The TIF is a big one. It’s tiered based on what your car is worth. If your car is a "beater" worth less than $5,000, you only pay about **$33**. But if you’re driving a luxury ride worth over $60,000, that single fee jumps to **$231**. It’s basically a wealth tax on your driveway.

💡 You might also like: Killer or Be Killed: Why This Brutal Philosophy Still Dominates High-Stakes Culture

The VLF: Where the Big Money Lives

If you want to know the real reason your bill is high, look for the Vehicle License Fee (VLF). This is the heavy hitter. It’s calculated as 0.65% of your vehicle’s value.

Think about that for a second. If you just bought a $50,000 car, your VLF alone is **$325**.

The "silver lining" is that the VLF is technically a property tax. That means if you itemize your taxes, you can actually deduct this specific portion of your registration. Most people miss this. Honestly, keep your DMV receipt; it’s one of the few ways to get a tiny bit of that money back from the IRS.

Here’s how the math usually shakes out for a mid-range car:

- Base Registration: $76

- CHP Fee: $34

- VLF (on a $30,000 car): $195

- TIF (on a $30,000 car): $132

- County/Local Fees: ~$25

- Total: $462

The Electric Vehicle "Surprise"

You’d think going green would save you money at the DMV. Kinda. You skip the $20 smog abatement fee, which is nice. But California realized that EV owners don’t pay gas taxes, which fund the roads. To make up for it, they added the Road Improvement Fee (RIF).

If you own a zero-emission vehicle (ZEV) from the 2020 model year or newer, expect an extra $118 (inflation-adjusted for 2026) tacked onto your renewal. It’s a bit of a sting for Tesla and Rivian owners who thought they were outsmarting the system.

🔗 Read more: Cross Section of Leaf: What Your Biology Teacher Kinda Skipped

Smog Checks and Transfer Traps

If your car is more than eight years old, you’re likely stuck in the smog check cycle every two years. The DMV doesn't charge the actual inspection fee—you pay a private shop for that, usually $50 to $90—but the DMV does charge a $20 smog abatement fee if you're exempt, or a $8 smog certificate fee if you aren't.

Buying a used car? That’s a whole different headache. You’ll pay a $15 transfer fee, but the real killer is the Use Tax. Unless you bought the car from a family member, you owe sales tax based on the city where you live. In places like Los Angeles or the Bay Area, that can be 10% of the purchase price. Buy a $20,000 car from a friend? You owe the DMV **$2,000** just for the privilege of putting your name on the title.

The Cost of Procrastination

California is brutal with late fees. There is no "grace period." If you’re one day late, you’re hit with a penalty.

The penalties are a percentage of your VLF plus flat fees. If you’re more than a year late, the penalty can be 80% of the VLF plus $100 in other fines. A $500 registration can easily turn into $900 if you let it sit on your kitchen counter for too long.

Actionable Steps to Handle Your Registration

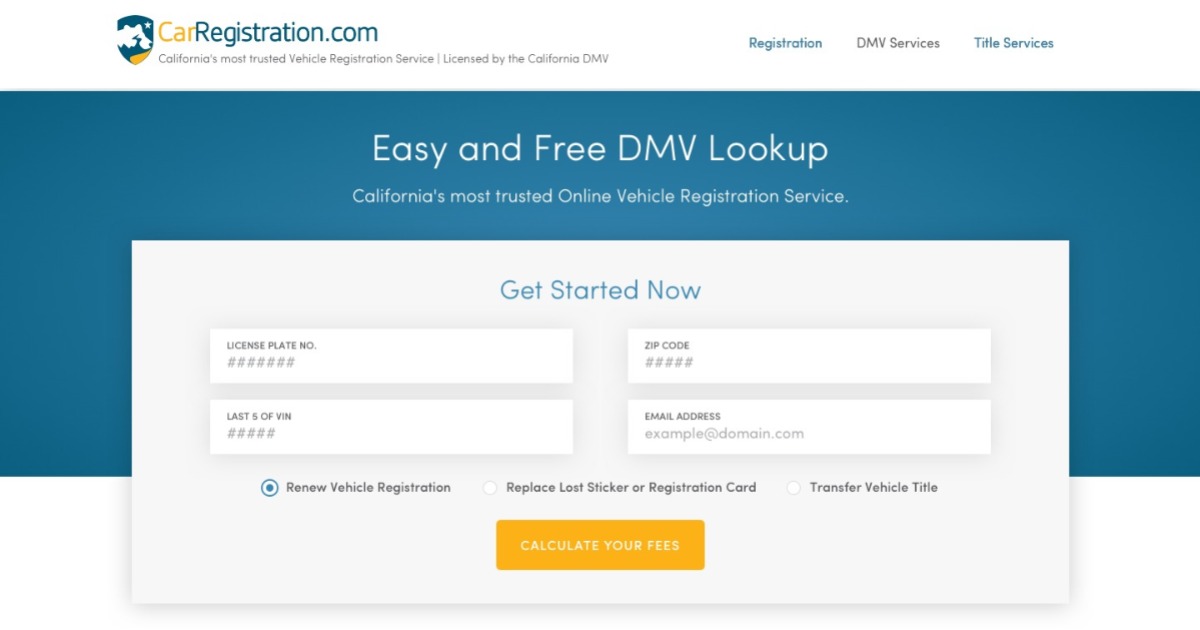

- Use the Calculator: Don't guess. The California DMV website has a "Vehicle Registration Fee Calculator." It’s actually pretty accurate. You'll need your VIN and license plate number.

- Check for PNO: If your car is sitting in a garage and you aren't driving it, file for Planned Non-Operation (PNO). It costs about $23, and it saves you from paying the full registration while the car is off the road. But do it before your tags expire.

- Deduct the VLF: When tax season hits, look at your registration card. Line 2A is usually your VLF. That’s the number you give your accountant.

- Pay Online: If you use a third-party "BPA" partner (those kiosks in grocery stores or private tag offices), they just increased their electronic filing fees by $2 as of January 1, 2026. Stick to the official DMV portal or mail to save the convenience fee.

Registering a car here is a chore, and it isn't getting any cheaper. But knowing why that number is so high at least takes the mystery out of the misery. Keep your address updated with the DMV so you actually get your renewal notice; "I didn't get the mail" is an excuse the DMV has heard a million times, and they never care.