Oil prices are weird. Honestly, if you look at a ticker on CNBC and see a number like $78.42, you might think that’s the universal cost for a big drum of black sludge. It isn't. Not even close. When people ask how much for barrel of oil, they’re usually looking for a single, easy answer, but the energy market is a chaotic web of grades, locations, and "delivery months" that can make your head spin.

Prices change. Fast.

One minute, a supply disruption in the Red Sea sends traders into a frenzy. The next, a lackluster manufacturing report from China makes everyone think the world is ending. It’s a constant tug-of-war between the physical reality of pumping liquids out of the ground and the psychological games played by speculators in Chicago and London.

The Benchmark Battle: WTI vs. Brent

You can't talk about the cost of a barrel without knowing which "flavor" of oil you’re buying. There are hundreds of types, but the world mostly stares at two: West Texas Intermediate (WTI) and Brent Crude.

WTI is the US standard. It’s "sweet" and "light," which basically means it has low sulfur and is easy to turn into gasoline. If you're wondering how much for barrel of oil in the United States, WTI is your go-to number. It's usually priced out of Cushing, Oklahoma—a massive hub of tanks that people call the "Pipeline Crossroads of the World."

Brent is the international big brother. It comes from the North Sea and sets the price for about two-thirds of the world's oil traded globally. Because it's produced at sea, it's easier to ship than WTI, which has to deal with landlocked pipelines. Usually, Brent trades at a premium of a few dollars over WTI. Why? Because shipping logistics are expensive. If the gap—traders call this the "spread"—gets too wide, it signals a massive imbalance in global supply.

✨ Don't miss: Is US Stock Market Open Tomorrow? What to Know for the MLK Holiday Weekend

Why the Price Fluctuates Like Crazy

Greed and fear. That’s the short version.

The long version involves OPEC+. This group, led by Saudi Arabia and Russia, acts like a global thermostat. When they think the price is too low, they "turn down the heat" by cutting production. This artificially limits supply to prop up prices. It’s a delicate dance. If they cut too much, they lose market share to US shale producers who are more than happy to fill the void.

Then there’s the "Paper Oil" market.

Most oil traded isn't actually oil. It's a contract. A promise to deliver oil in the future. Wall Street hedge funds buy and sell these contracts without ever intending to touch a drop of crude. This speculation adds a layer of volatility that has nothing to do with how much oil is actually in the tanks.

Remember April 2020? The price of a barrel of WTI actually went negative. It hit minus $37. People were literally being paid to take oil away because there was nowhere left to store it during the lockdowns. It was a mathematical glitch in the system that showed just how fragile these pricing models really are.

🔗 Read more: Big Lots in Potsdam NY: What Really Happened to Our Store

The Hidden Costs: Beyond the Ticker

When you see a price on the news, that's for a 42-gallon barrel. But that isn't the price a refinery pays.

- Quality Differentials: If the oil is "sour" (high sulfur), it costs less because it's harder to process.

- Transportation: Moving oil from a well in North Dakota to a refinery in Louisiana can cost $5 to $12 per barrel.

- Risk Premiums: If a tanker has to sail through a war zone, insurance rates skyrocket.

Basically, the "spot price" is just the starting point of a much longer negotiation.

The Role of the US Dollar

Oil is priced in dollars. Always. This is a huge deal.

When the US dollar is strong, oil usually gets cheaper for Americans but more expensive for everyone else. If you're in Brazil or India and your currency is weak against the dollar, a "stable" oil price can still feel like an economic crisis. It’s one of the reasons countries like China are trying to push for oil trades in other currencies, though the "Petrodollar" still reigns supreme for now.

What Determines the Future Price?

Right now, the big question mark is the energy transition.

💡 You might also like: Why 425 Market Street San Francisco California 94105 Stays Relevant in a Remote World

For decades, the answer to how much for barrel of oil was driven by the fear that we’d run out (Peak Oil). Now, the conversation has shifted. People are worried about "Peak Demand." As electric vehicles gain ground and renewables scale up, the long-term floor for oil prices is getting shaky.

However, don't expect it to crash to zero.

Underinvestment is a real problem. Because many banks are hesitant to fund new oil projects due to ESG (Environmental, Social, and Governance) pressures, we aren't finding enough new oil to replace what we use. This creates a "supply crunch" that could keep prices high for years, even as demand starts to level off. It’s a paradox: we want less oil, but because we’re looking for less of it, the oil we do have becomes more valuable.

Actionable Steps for Tracking Oil Prices

If you actually want to understand the market rather than just reading a headline, you need to look at the right data points. Don't just look at the price; look at the context.

- Check the EIA Weekly Petroleum Status Report. Every Wednesday, the US Energy Information Administration drops a massive data set. Look at "Inventories." If the amount of oil in storage is dropping, prices are likely going up, regardless of what's happening in the news.

- Monitor the Rig Count. Baker Hughes releases a "Rig Count" every Friday. It tells you how many active drills are in the ground. If the count is falling, it means future supply is shrinking.

- Watch the DXY (Dollar Index). If the dollar starts a major rally, expect oil to face downward pressure. It’s a reliable inverse correlation.

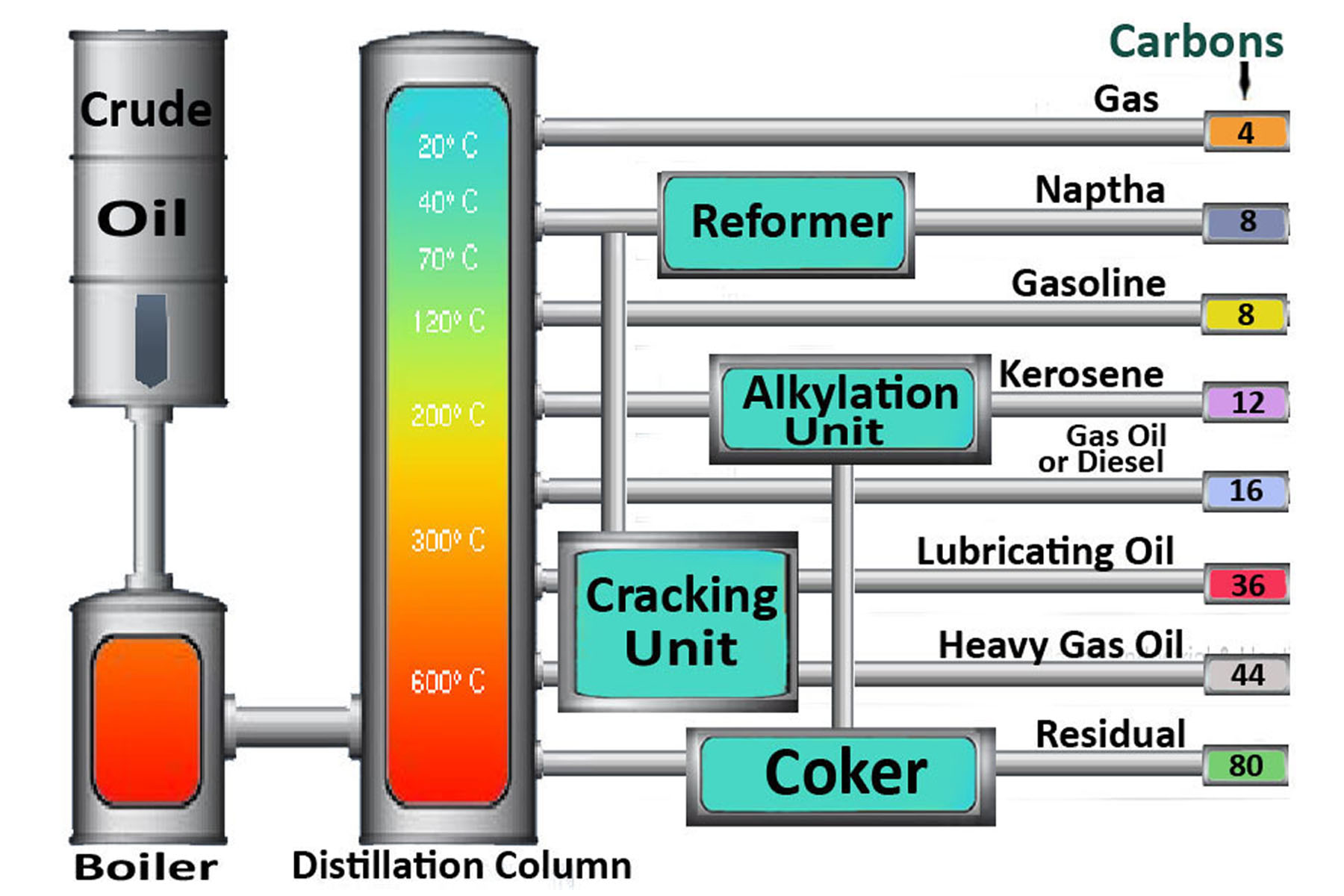

- Follow the "Cracking Spread." This is the difference between the price of crude oil and the products made from it (like gasoline and diesel). If refineries are making huge profits (high spreads), they will buy more crude, which eventually pushes the price of a barrel higher.

- Ignore the "Price Targets" from big banks. Goldman Sachs or Morgan Stanley will often predict $100 or $60 oil. These are often based on specific models that don't account for geopolitical "Black Swan" events. Take them with a grain of salt.

The reality of the oil market is that nobody truly knows the "right" price. It is a messy, real-time reflection of global politics, weather patterns, and the collective anxiety of millions of traders. If you're trying to figure out how much for barrel of oil, look at the Cushing inventory levels first—that’s where the physical truth usually hides.