You've seen the movies. The heist crew slides a heavy, glittering brick across a table. It looks easy. But if you actually walk into a dealer today and ask how much for a bar of gold, you aren't going to get a single, simple number. Gold is weird. It’s a commodity, a currency, and a piece of history all wrapped into one.

Prices move. Fast.

If you check the spot price right now, you might see something like $2,700 per ounce. But try buying a bar for that price. You can't. There’s always a premium. There's shipping. There's the "spread." Most people looking to buy their first bar get sticker shock not because the gold is expensive—though it is—but because they didn't account for the friction of the physical market.

The Reality of the Spot Price vs. The Physical Bar

The "spot price" is basically a paper hallucination. It represents the price of gold for immediate delivery in the professional markets, like the COMEX in New York or the London Bullion Market Association (LBMA). It's based on massive 400-ounce bars that most humans will never touch.

When you ask how much for a bar of gold, you’re usually asking about the retail price. Retailers take that ticker symbol you see on CNBC and add a "premium." This covers their lights, their vault security, and their profit. For a standard 1-ounce bar, expect to pay 2% to 5% over spot. If you’re buying smaller grams? That premium can skyrocket to 15% or more. It’s the "Costco effect" in reverse; buying in tiny increments is a great way to lose money instantly.

Why Size Changes Everything

Size matters immensely here. A 1-gram bar is tiny. It’s about the size of a thumb tack. Because it costs almost as much to mint and assay a tiny bar as it does a 10-ounce bar, the markup is brutal. Honestly, unless you just want a cool gift, 1-gram bars are a bad investment.

🔗 Read more: ROST Stock Price History: What Most People Get Wrong

On the flip side, the "Good Delivery" bars held by central banks weigh roughly 400 troy ounces (about 27 pounds). At today's prices, one of those costs over $1 million. You aren't sticking that in a sock drawer. Most serious individual investors aim for the 1-ounce or 10-ounce bars. They offer the best balance between a lower premium and "divisibility"—the ability to sell off a piece of your hoard without offloading the whole thing.

Decoding the Hidden Costs of Buying Gold

It isn't just the price on the screen.

You have to think about the "spread." This is the difference between what a dealer sells a bar to you for and what they’ll pay to buy it back. If you buy a bar for $2,800 and the dealer’s buy-back price is $2,700, you’re down $100 the second you walk out the door. You’re "underwater." Gold has to go up just for you to break even.

Then there’s shipping and insurance. Gold is heavy. It requires registered mail and high-level insurance. If you’re buying online from a place like APMEX or JM Bullion, they often bake this into the price or offer "free" shipping on large orders. But if you're buying from a local coin shop, you might be paying for the convenience of taking it home that day.

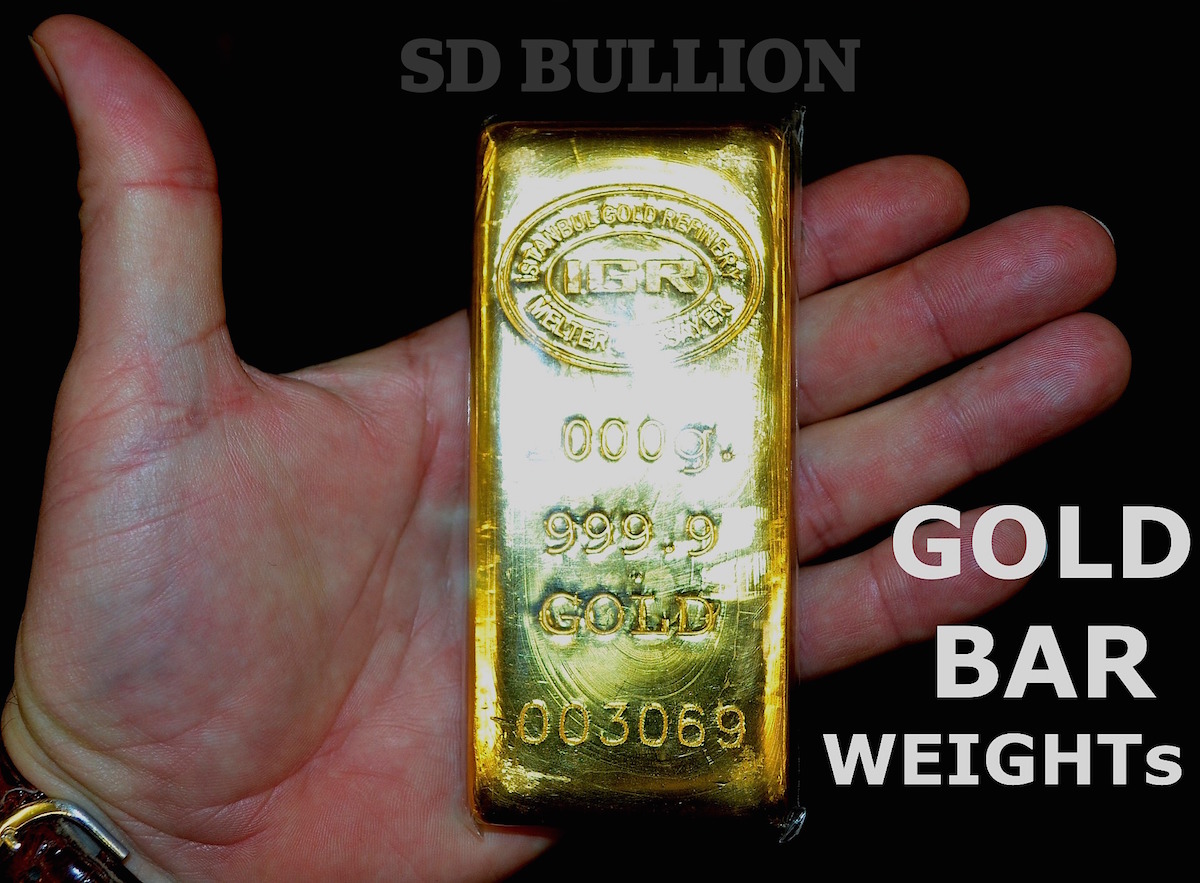

Purity and the Assay Card

When you buy a bar, you’re looking for ".9999 fine gold." This is 24-karat. Anything less, like the 22-karat gold found in some coins (Krugerrands, for instance), is still valuable, but bars are almost always pure. Most reputable bars from mints like PAMP Suisse, Perth Mint, or Royal Canadian Mint come in a sealed plastic "assay card."

💡 You might also like: 53 Scott Ave Brooklyn NY: What It Actually Costs to Build a Creative Empire in East Williamsburg

Don't open it.

The second you crack that plastic to feel the gold, you’ve potentially lowered the resale value. The card is a certificate of authenticity. It lists the weight, the purity, and a serial number. Collectors and dealers trust the card. If you break it, the next buyer might insist on an expensive acid test or an XRF scan to prove it's real, and they'll charge you for that hassle.

Where the Market is Heading in 2026

The world feels a bit shaky lately, doesn't it? That's usually when gold shines. Central banks, especially in China, India, and Turkey, have been vacuuming up gold at record rates. They’re trying to diversify away from the US dollar. When governments buy, the price for a bar of gold generally goes one way: up.

But gold doesn't pay a dividend. It just sits there. If interest rates are high, some investors prefer high-yield bonds or savings accounts. Why hold a heavy yellow bar that does nothing when a bank will pay you 5%? This is the eternal tug-of-war for gold's price. Right now, with geopolitical tensions and debt levels hitting the ceiling, the "fear trade" is keeping gold demand high.

Spotting a Scam

If a price looks too good to be true, it is. Period. There is no such thing as "discount gold." No one is selling a gold bar for 20% under spot because they "need the cash." They’d just go to a local pawn shop or dealer and get 95-98% of spot instantly.

📖 Related: The Big Buydown Bet: Why Homebuyers Are Gambling on Temporary Rates

If you see ads on social media for "Gold bars at wholesale prices," run. These are often "tribute" bars—lead or tungsten cores plated in a thin layer of real gold. They look real. They even weight almost the same because tungsten’s density is nearly identical to gold. Only a professional ultrasonic test or a specific gravity test can tell the difference without cutting the bar in half.

Practical Steps for Your First Purchase

If you’ve decided you want to own a piece of the ultimate "chaos insurance," don't just jump at the first Google result.

First, decide on your budget. If you have $3,000, buy a single 1-ounce bar rather than thirty 1-gram bars. You’ll save hundreds in premiums.

Second, choose your dealer. Look for members of the Professional Numismatists Guild (PNG) or dealers with high ratings on the Better Business Bureau. Check their "buy-back" policy. A good dealer will tell you exactly what they’ll pay to buy the bar back from you before you even give them a dime.

Third, have a storage plan. A $2,700 bar is easy to lose and even easier to steal. If you’re keeping it at home, get a bolted-down, fireproof safe. Don't tell your neighbors. If you’re buying a lot, look into "allocated storage" at a professional vault like Brink's or a specialized bullion depository. It costs a yearly fee, but they’re responsible if it disappears, not you.

Finally, keep your receipts. In many jurisdictions, you’ll owe capital gains tax when you sell your gold for a profit. You need to prove what you paid (your "basis") so you don't get taxed on the entire sale price. Gold is a long game. It’s not for day trading. It’s for the person who wants to know that, even if the banking system has a very bad day, they have something of substance tucked away.

Compare the "all-in" price across three major dealers before hitting the buy button. Look at the total including shipping and credit card fees—many dealers give a 3-4% discount if you pay by wire transfer or personal check. That small step alone can save you the equivalent of a nice dinner out. Gold is about patience; start practicing it before you even own the metal.