You’ve probably heard the rumors that California is basically the piggy bank of the United States. It's a common talking point in political debates, usually followed by someone grumbling about "donor states" or "subsidizing" the rest of the country. But what’s the actual math? If you look at the raw numbers, the scale is honestly a bit dizzying.

In the 2024 fiscal year, Californians sent a staggering $5.1 trillion total to the IRS—not just from California, mind you, but that’s the national bucket. Out of that massive federal pie, California alone accounted for about 15.9% of all federal revenue.

Basically, for every dollar the federal government collects, nearly 16 cents comes from the Golden State.

The Big Number: Breaking Down the $275 Billion Gap

When people ask how much federal tax does california pay, they aren’t usually looking for a single tax return number. They want to know the "balance of payments."

According to the latest 2025 data from USAFacts and the Rockefeller Institute, California paid about $275.6 billion more to the federal government in 2024 than it received back in federal spending. That is the largest "net contribution" gap of any state in the union. To put that in perspective, the next closest state is New York, which has a gap of around $76 billion.

California's gap is nearly four times larger.

🔗 Read more: Where Did Dow Close Today: Why the Market is Stalling Near 50,000

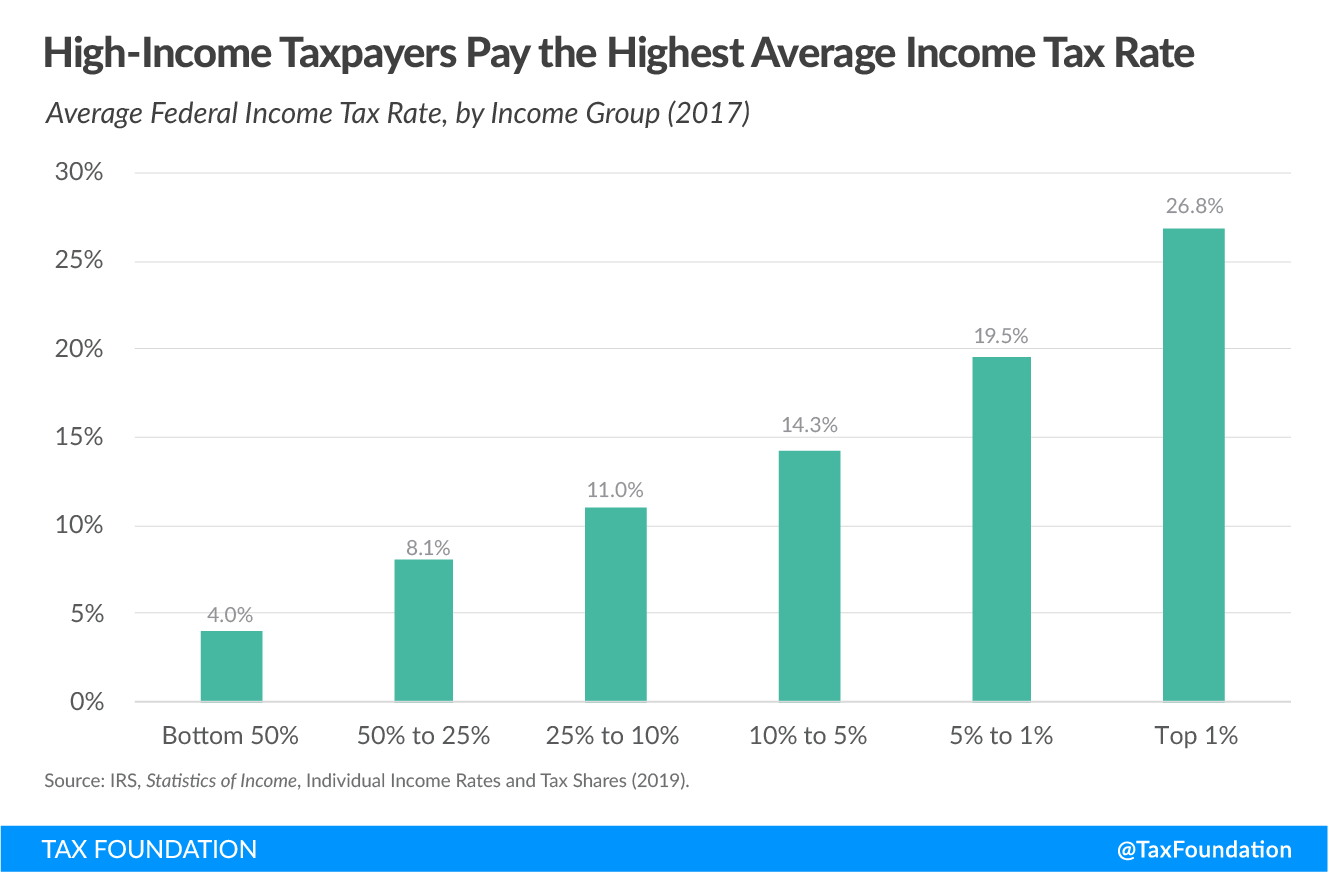

Why is this gap so huge? It’s not just because the state has nearly 40 million people. It's the "progressive" nature of our federal tax system. California is home to a massive concentration of high-income earners in tech, entertainment, and venture capital. Since federal income tax rates climb as you earn more, these individuals shoulder a disproportionate share of the national tax burden.

- Gross Collections: In FY 2024, the IRS collected roughly $800 billion to $900 billion from California alone (estimated based on the 15.9% share of the $5.1T national total).

- Net Contribution: After the feds sent money back for highways, schools, and Medi-Cal, the state was still "down" $275.6 billion.

- Per Capita: On average, every Californian is effectively "donating" thousands of dollars to support federal operations in other states.

Why Does California Pay So Much More Than It Gets?

It feels a bit unfair to some, right? You pay into the system, and you'd expect a somewhat equal return. But the federal budget doesn't work like a savings account; it works like an insurance policy and a redistribution system.

The Wealth Concentration Factor

California has one of the highest concentrations of "top 1%" earners. Nationally, the top 1% of earners pay about 45% of all federal income taxes. In California, that top bracket is even more robust. When Silicon Valley has a good year and IPOs are flying, the federal treasury sees a massive spike in capital gains tax revenue.

The "Young" Population Myth

Actually, it’s not a myth—it’s math. A huge chunk of federal spending goes to Social Security and Medicare. California has a relatively younger population compared to "retirement states" like Florida or Arizona. Consequently, fewer federal dollars flow back into the state in the form of retirement benefits.

Infrastructure and Military

While California has massive military bases (like Camp Pendleton or San Diego’s naval hubs), the sheer size of its economy—the 4th or 5th largest in the world if it were a country—dwarfs the federal spending it receives.

💡 You might also like: Reading a Crude Oil Barrel Price Chart Without Losing Your Mind

What Most People Get Wrong About the "Donor State" Label

There’s a lot of nuance here that gets lost in 30-second news clips. For a long time, California was always a donor state. Then, the pandemic happened.

In 2020 and 2021, the federal government pumped billions into every state through COVID-19 relief funds, unemployment boosts, and business loans (PPP). During those specific years, California actually received more than it paid. It briefly lost its "donor" status.

But as of 2024 and heading into 2026, the state is back in the red (or the blue, depending on how you look at the balance sheet). The "mega bill" budget shifts seen in late 2025 have further widened this gap. With federal cuts to certain social programs, California is expected to receive even less per dollar paid over the next three fiscal years.

The Corporate Tax Engine

It’s not just individuals. California leads the nation in Fortune 500 headquarters. When Apple, Google, or Nvidia pay their federal corporate taxes, that counts toward California’s total. Even if their customers are in Ohio or France, the tax "origin" is often tied to their California home base.

The Reality of 2026: What Happens Next?

Looking ahead, the gap is likely to grow. Recent shifts in federal policy have focused on reducing "transfers" to high-income, high-service states.

📖 Related: Is US Stock Market Open Tomorrow? What to Know for the MLK Holiday Weekend

If you are a California resident, your federal tax bill isn't going down just because the state is a "donor." You're still paying the same rates as someone in Texas or Florida. The difference is in the "return on investment" for your community.

- State Budget Pressure: Because the state sends so much away, the California legislature often feels it has to tax more at the state level to fund the services the feds aren't covering. This leads to the "double whammy" of high federal and state taxes.

- Federal Dependency: Interestingly, despite being a donor, about one-third of California's own state budget (around $175 billion for 2025-26) still relies on federal transfers for things like Medi-Cal.

So, it's a weirdly symbiotic, yet lopsided, relationship.

Actionable Insights for Californians

Knowing how much federal tax does california pay might make you want to move to Nevada, but before you pack the U-Haul, consider these tactical steps for managing your piece of that massive $275 billion pie:

- Max Out Tax-Advantaged Accounts: Since you're in a high-contribution state, reducing your Adjusted Gross Income (AGI) is your best defense. Utilize 401(k)s and HSAs to the absolute limit.

- Audit Your Withholding: With the shifts in federal tax laws in 2025, many Californians are finding they are under-withholding. Don't wait until April 2026 to realize you owe the IRS a five-figure check.

- Track SALT Deductions: Keep a close eye on any federal legislative changes regarding the State and Local Tax (SALT) deduction. In a high-tax state like California, this is the single most important lever for your federal return.

- Consider Municipal Bonds: For high-net-worth residents, California "munis" offer a way to keep your investment income triple-tax-free (federal, state, and local), which is a rare win in this landscape.

The Golden State will likely remain the nation's primary financier for the foreseeable future. Whether that’s a point of pride or a point of frustration, the data is clear: California’s taxpayers are doing the heavy lifting for the federal budget.