You’re staring at a positive pregnancy test and suddenly the room feels a little smaller. Or maybe you're just staring at your bank account, wondering if a nursery and a college fund can coexist in the same reality. It’s the ultimate "adulting" question. How much does it cost to have a child?

Honestly, the answer is a moving target. If you search for it, you’ll see scary numbers like $300,000 or $400,000 flashed around by the USDA and think-tanks like the Brookings Institution. Those figures are real, but they’re also aggregate. They don’t tell you about the $20 you’ll spend on a Sophie la Girafe toy that your kid will promptly lose, or the $15,000 you might drop on daycare before they even learn to tie their shoes.

The truth is, having a kid is a series of "financial micro-bosses" you have to defeat. First, there’s the birth. Then the "stuff." Then the childcare. By the time you get to the teenage years, you're basically a walking ATM.

The Hospital Bill: Birth is a Business

Let’s get the immediate shock out of the way. Giving birth in the United States isn't exactly cheap. According to the Peterson-KFF Health System Tracker, the average cost for pregnancy, delivery, and postpartum care is about $18,865.

If you have "good" insurance—the kind people talk about in hushed, respectful tones—you might only pay around $2,854 out of pocket. But that’s a big "if." If you’re uninsured or have a high-deductible plan, that vaginal delivery could run you $13,000 to $15,000. Need a C-section? Buckle up. The total bill often climbs past $26,000, with out-of-pocket costs for the insured hitting over $3,200.

Then there’s the "newborn" tax. People forget that once the baby is born, they become their own person on your insurance plan. Suddenly, you aren't just meeting one deductible; you’re meeting two. It’s a fun little quirk of the American healthcare system that can leave you with a surprise four-figure bill just as you’re trying to figure out how a diaper genie works.

🔗 Read more: weather forecast victorville ca: What Most People Get Wrong

Childcare: The Second Mortgage

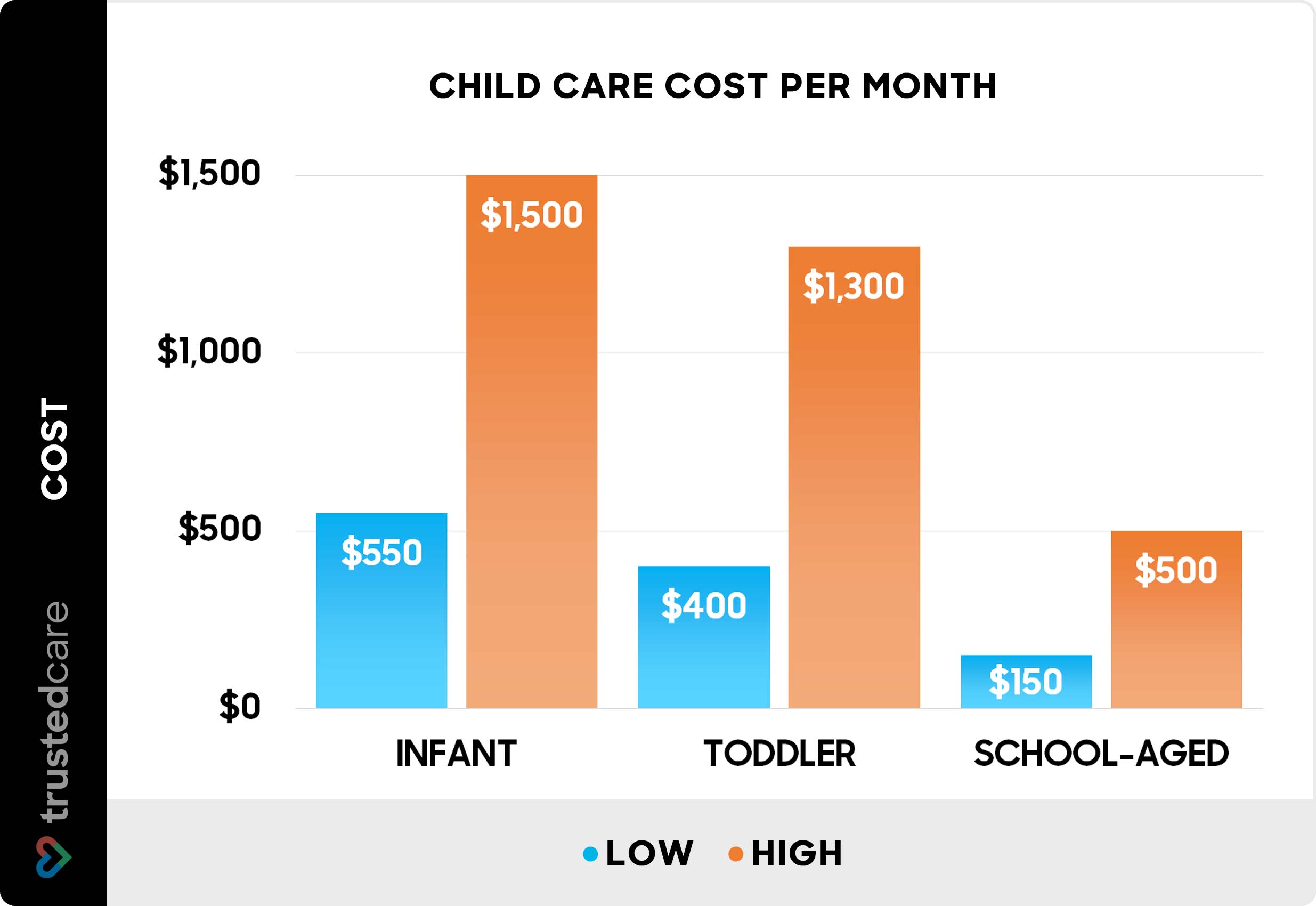

If the birth is the sprint, childcare is the marathon. For many families, this is the single biggest expense. In states like Massachusetts or Hawaii, you’re looking at over $20,000 a year for center-based infant care. Even in "affordable" states like Mississippi, it’s still roughly $8,186 annually.

Basically, in 28 states, infant care costs more than public college tuition. Let that sink in for a second.

You’ve got options, sure.

A nanny is the gold standard for convenience but can cost $3,000 a month or more.

Home-based daycares are usually cheaper, but spots are harder to find than a quiet moment in a house with a toddler.

Some parents do the "tag-team" shift work, where one person works days and the other works nights. It saves money, but it’s a fast track to burnout.

By the time your kid hits age five and enters public school, you feel like you’ve just received a massive raise. But then comes the "lifestyle creep" of soccer fees, dance classes, and the inevitable request for a $1,200 saxophone for the school band.

The Reality of How Much Does It Cost to Have a Child over 18 Years

Recent 2025 and 2026 data shows a sharp incline. LendingTree recently estimated that raising a child to age 18 now costs about $297,674. If you live in a high-cost-of-living area and plan on private school or elite sports, you can easily blow past $450,000.

Here is how that money actually disappears:

Housing takes the biggest bite, roughly 29%. You need the extra bedroom. You want the "good" school district. You pay the premium.

Food is next at 18%. Between the formula phase (which can cost $150 a month) and the teenage "I can eat a whole pizza in one sitting" phase, the grocery bill is relentless.

Transportation (15%) and Healthcare (9%) round out the big spenders.

There’s also the "Motherhood Penalty." Research from the National Bureau of Economic Research and other groups shows that mothers often see a 28% dip in lifetime earnings compared to women without kids. It’s not just the money you spend; it’s the money you don’t make because you took three years off or passed on a promotion to be home for dinner.

The Weird Upside: Why People Still Do It

Surprisingly, some research suggests parents might actually end up with more wealth in the long run. A recent working paper from the NBER suggested that "bequest motives"—the desire to leave something for your kids—actually motivates parents to work harder and save more strategically. Parents might accumulate 23% more lifetime wealth than non-parents simply because they have a reason to stay disciplined.

It’s the ultimate paradox. You’re broke because of the kids, so you work harder to make sure they aren't broke, and you end up with more money than you would have had if you’d just spent your 20s traveling. Sorta.

Actionable Steps to Prep Your Wallet

Don't just panic. Do these things instead:

- Max the HSA/FSA: If you have a High Deductible Health Plan, the Health Savings Account is your best friend. It’s triple-tax advantaged. Use it for the birth and those endless pediatrician co-pays.

- Audit your "Family Plan" insurance: Check the 2026 out-of-pocket maximums. For a family, it can be as high as $10,600. You need that much in a liquid "baby fund" before the third trimester.

- The "Second-Hand" Rule: Never buy a new plastic toy. Go to Facebook Marketplace or "Buy Nothing" groups. Babies grow out of clothes in six weeks. Paying $40 for a designer onesie is a scam.

- Get the Term Life Insurance: Do it now while you're young and relatively healthy. If the unthinkable happens, you want your kid's $300,000 price tag covered.

- Start the 529 Plan early: Even $50 a month starting at birth can take a massive bite out of future tuition. Compounding interest is the only thing that works faster than a toddler's metabolism.

Ultimately, the cost of a child is whatever you have plus 10%. You’ll find a way to make it work, but going in with your eyes open to the $30,000-a-year reality makes the transition a lot less painful.

Next Steps for Financial Readiness

- Request a "Cost of Care" estimate from your OB/GYN and your hospital specifically for your insurance plan.

- Call three local daycares tomorrow to get their current 2026 rates and waitlist times; you might be surprised to find a 12-month lead time is standard.

- Calculate your "Sinking Fund" goal by adding your insurance out-of-pocket max to three months of estimated childcare costs.