You’ve probably seen the commercials. Some silver-haired actor leans into the camera, promising that you can turn your home into a tax-free goldmine without ever having to move. It sounds like magic. Honestly, it's not magic; it’s just math. But the math is weirder than most people realize. When you start asking how much can you get on a reverse mortgage, you aren't going to get a single, solid number like you would with a car loan.

It’s a sliding scale.

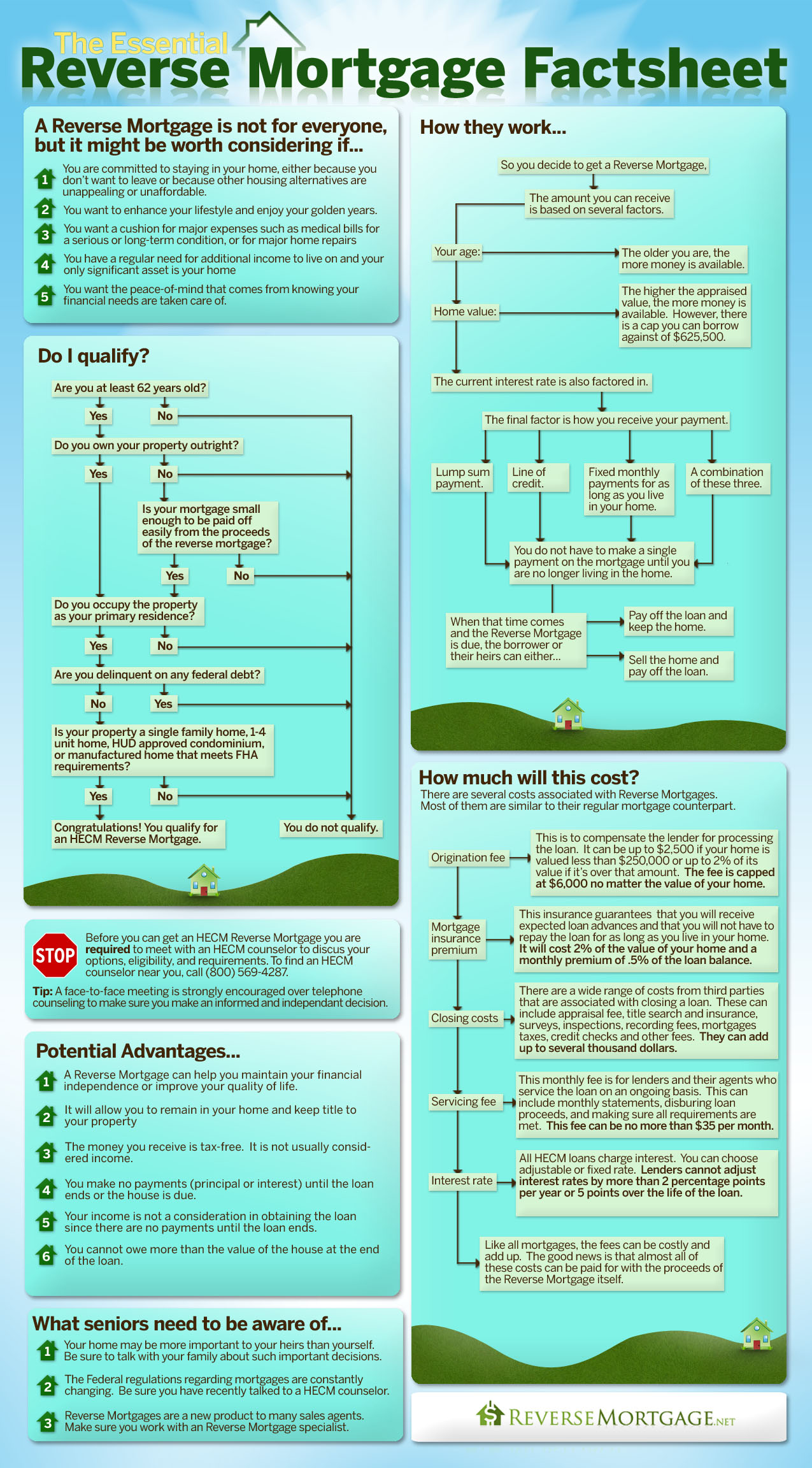

The amount of cash you can actually touch depends on a cocktail of variables: your age, current interest rates, and the value of your home. You’re essentially borrowing against your future self. If you're 62, you're going to get significantly less than if you're 82. Why? Because the bank assumes the 62-year-old is going to live longer, meaning the interest has more time to snowball.

The Math Behind the Money

Banks don't just hand over a check for the full value of your house. That would be a disaster for them. Instead, they use something called the Principal Limit. Think of this as the maximum "bucket" of money available to you before fees and costs are stripped away.

The U.S. Department of Housing and Urban Development (HUD) sets these limits for the most common type of reverse mortgage, the Home Equity Conversion Mortgage (HECM). As of 2026, the maximum claim amount—basically the ceiling for the home value used in the calculation—has been adjusted to reflect the cooling but still elevated housing market. If your home is worth $2 million, the bank isn't going to look at that $2 million. They’re going to cap their calculation at the HUD limit, which currently sits north of $1.1 million.

Age is the biggest lever here.

The older you are, the higher your "Principal Limit Factor" becomes. A 75-year-old with a $500,000 home might qualify for 50% of their equity, while a 62-year-old might only see 35% or 40%. It feels a bit morbid, but the actuarial tables drive the entire industry. They are betting on how long that loan will sit unpaid.

👉 See also: Why 1221 S Hayford Rd Spokane WA 99224 is the Logistics Powerhouse You Didn't Notice

Interest Rates: The Invisible Hand

Interest rates are the silent killer of loan proceeds.

When rates are low, you get more money. When rates are high—like the volatile environment we’ve seen recently—the amount you can borrow shrinks. This is because the lender has to account for the interest that will accrue over the life of the loan. If the interest rate is 7%, that "debt snowball" grows much faster than at 3%. To make sure the loan balance doesn't eventually exceed the value of the home, the lender simply gives you less cash upfront.

It’s a bit of a gut punch for seniors who waited to see if rates would drop. If you’re looking at how much can you get on a reverse mortgage today versus three years ago, the difference could be tens of thousands of dollars in "lost" borrowing power solely due to the Fed's movements.

Upfront Costs and the "Net" Reality

Nobody talks about the "net" enough. You might qualify for $200,000, but you aren't walking away with $200,000.

First, there’s the Initial Mortgage Insurance Premium (IMIP). That’s 2% of the home’s appraised value right off the top. On a $500,000 home, that’s $10,000 gone before you even sign the paperwork. Then you have origination fees, which are capped at $6,000 but still sting. Throw in appraisal fees, title insurance, and closing costs, and you’ve suddenly shaved $15,000 to $20,000 off your total.

And if you still have a traditional mortgage? That has to go first.

This is the part that trips people up. You cannot have a regular mortgage and a reverse mortgage at the same time. The reverse mortgage must pay off your existing balance. If your house is worth $400,000 and you qualify for $200,000 in reverse mortgage funds, but you still owe $150,000 on your 30-year fixed loan, you only get $50,000 in actual pocketable cash.

Sometimes, the math doesn't even work. If you owe $250,000 and only qualify for $200,000, the lender will tell you to bring $50,000 to the table to close the gap. Most people in that situation just walk away.

👉 See also: Who Founded Nike Company: The Odd Couple Behind the Swoosh

Proprietary Loans: The Jumbo Alternative

If you have a home worth $3 million, a standard HECM is a bad deal because of those HUD limits. This is where "Jumbo" or proprietary reverse mortgages come in.

Private lenders like Finance of America or Longbridge Financial offer these products. They don't follow the FHA limits. They can go up to $4 million or more in some cases. The trade-off is that they aren't federally insured. You might not get the same "non-recourse" protections that a HECM provides, though many private lenders now mirror those features to stay competitive.

The percentage of equity you can access in a jumbo loan is often lower than a HECM, but because the home value isn't capped at $1.1 million, the actual dollar amount is much higher. It's a niche market, but for wealthy retirees in California or New York, it’s often the only way the numbers make sense.

Disbursement Options Matter

How you take the money changes the feel of the loan.

- Lump Sum: You take it all at once. This is usually only available with fixed-rate loans. It’s risky because once it’s gone, it’s gone, and interest starts accruing on the whole amount immediately.

- Line of Credit: This is arguably the smartest play. You only pay interest on what you use. Plus, the unused portion of the line of credit actually grows over time. It’s one of the few financial products where your borrowing power increases as you get older.

- Term or Tenure Payments: This is basically a "reverse" paycheck. The bank sends you a set amount every month for a fixed period (term) or for as long as you live in the home (tenure).

The Crucial Role of Counseling

You can’t just go buy a reverse mortgage like you buy a toaster. The government requires you to attend a counseling session with a third-party, HUD-approved agency.

They aren't there to sell you anything. They are there to make sure you aren't being scammed and that you actually understand that if you stop paying your property taxes or homeowners insurance, you can still lose the house. This is a common myth: "The bank owns the house." No, you still own the house. But you have to keep up your end of the bargain regarding maintenance and taxes. If you don't, the loan becomes "due and payable."

Practical Steps to Determine Your Amount

If you're serious about figuring out your specific numbers, don't rely on a generic online calculator that doesn't ask for your zip code.

- Check your current equity: Use a recent appraisal or a conservative estimate from sites like Zillow, then subtract every penny you still owe on the home.

- Verify your age: If there are two of you on the deed, the lender uses the age of the younger spouse to calculate the limit.

- Get a "Quote Suite": Ask a broker to run scenarios for a line of credit versus a monthly payment. The differences can be startling.

- Factor in the "LESA": If your credit history is spotty or you’ve missed tax payments, the lender might require a Life Expectancy Set-Aside. This is a chunk of your loan money held back in an escrow-style account to pay your future taxes and insurance. It drastically reduces the cash you get today.

The reality of how much can you get on a reverse mortgage is that it’s rarely enough to fund a lavish lifestyle, but it’s often exactly enough to keep someone in their home comfortably. It is a tool for liquidity, not a lottery win. Understand the costs, acknowledge the impact of interest, and never assume the headline number is what you’ll actually see at the closing table.