Oil is messy. Not just the sticky, black liquid itself, but the way we talk about it. When people ask about how much barrel of crude oil costs or what it actually contains, they usually get hit with a wall of Wall Street jargon or complex chemistry. It’s confusing.

Basically, a "barrel" isn't even a physical thing you'll see rolling around a ship most of the time. It’s a unit of measurement—42 U.S. gallons, to be exact. Why 42? Because back in the 1860s, Pennsylvania oil men decided that was the right size to account for some spilling during transport on bumpy wagons. We’ve stuck with it ever since.

The Price Tag: It’s Never Just One Number

If you look at the news, you’ll see two big names: Brent Crude and West Texas Intermediate (WTI). They aren't the same. WTI is the U.S. benchmark, usually pulled from Texas and the Permian Basin. Brent comes from the North Sea.

Price fluctuates wildly. In 2020, we saw the insanity of "negative" prices where people were literally being paid to take oil because there was nowhere to store it. Today, in 2026, the market is a different beast entirely. We’re looking at geopolitical shifts in the Middle East and the massive influence of Guyana's offshore production. Honestly, trying to pin down a single price for a barrel is like trying to hit a moving target while riding a rollercoaster.

The physical reality of how much barrel of crude oil is worth depends on its "API gravity" and sulfur content. "Sweet" oil is low in sulfur and easier to process. "Sour" oil is high in sulfur and smells like rotten eggs. Refineries hate the sour stuff because it eats their equipment, so it sells for less.

💡 You might also like: AOL CEO Tim Armstrong: What Most People Get Wrong About the Comeback King

What’s Actually Inside That 42-Gallon Drum?

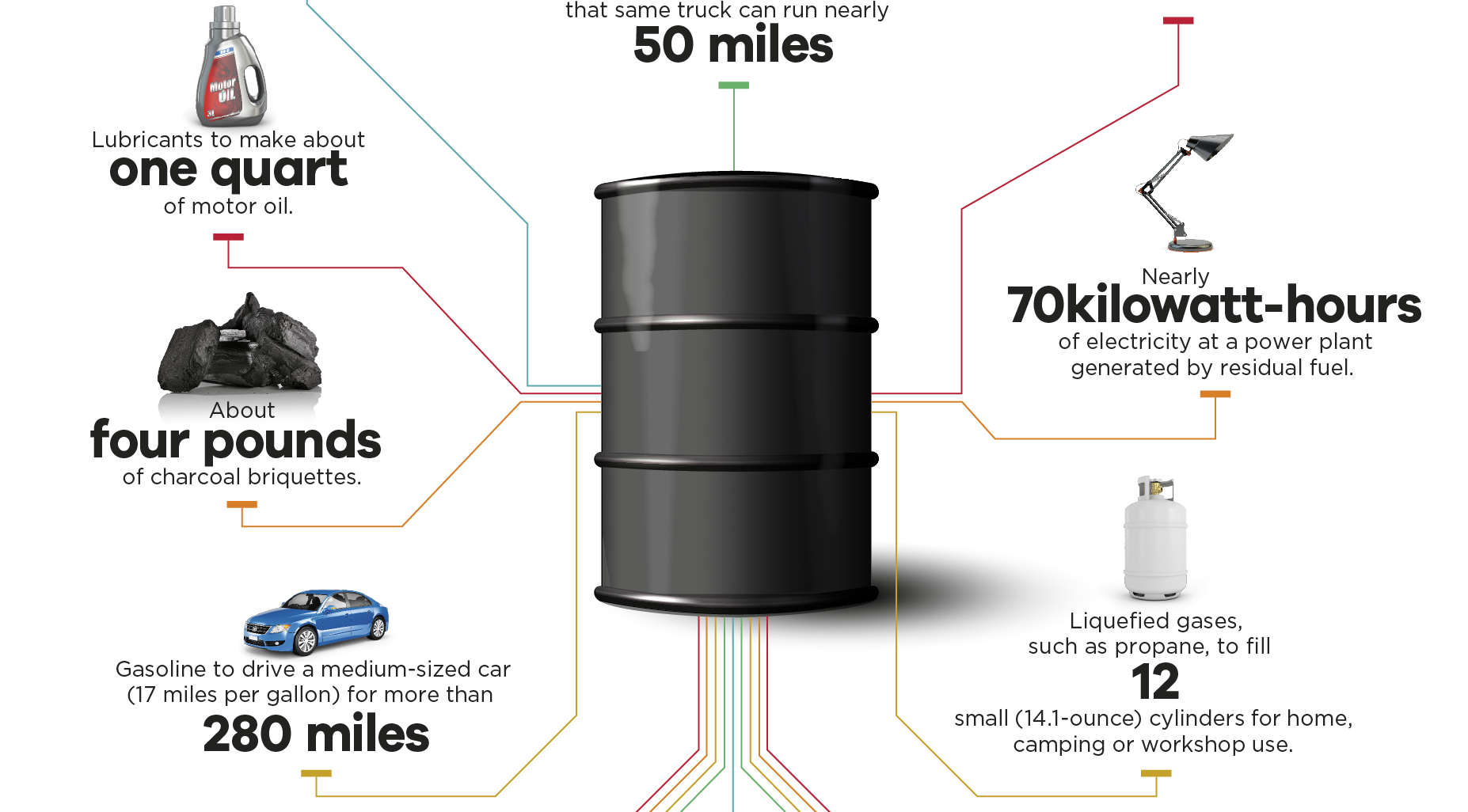

Here is the weird part: you get more than 42 gallons of products out of a 42-gallon barrel. It’s called "refinery gain." Think of it like popcorn; when you heat it up and process it, the volume expands. Usually, you end up with about 45 gallons of finished products.

Most of it goes to transportation. You're looking at roughly 19 to 20 gallons of gasoline. Then about 11 or 12 gallons of diesel. The rest is a mix of jet fuel, heating oil, and heavy fuel oils used for massive cargo ships. But that’s only the fuel side.

The "leftovers" are arguably more important for your daily life. We’re talking about petrochemicals.

Your toothbrush? Oil. Your sneakers? Oil. The aspirin you took this morning? Yep, petroleum derivatives. Even the fertilizers used to grow the organic kale in your fridge rely on the natural gas and oil industry. We are physically surrounded by the ghost of ancient plankton.

📖 Related: Wall Street Lays an Egg: The Truth About the Most Famous Headline in History

Why the Math Doesn't Always Add Up

You've probably noticed that when the price of crude oil drops 10%, your gas station price doesn't drop 10% the next day. It’s frustrating.

Refineries are the middleman. They have fixed costs. Then you’ve got federal and state taxes, which stay the same regardless of whether oil is $40 or $140. Also, summer and winter blends change the price. In the summer, the EPA requires fuels that don't evaporate as easily in the heat, which are more expensive to cook up.

Understanding how much barrel of crude oil weighs on the global economy requires looking at the "crack spread." This is the difference between the price of crude and the price of the finished products. If the spread is thin, refineries slow down. If it's fat, they run at 100% capacity.

The Geopolitical Mess

OPEC+ still holds the steering wheel, sort of. Saudi Arabia can flip a switch and change global supply, but the U.S. shale revolution changed the math. The U.S. is now a massive producer, but shale wells "decline" fast. You have to keep drilling just to stay in the same place.

👉 See also: 121 GBP to USD: Why Your Bank Is Probably Ripping You Off

Then there’s the transition. Everyone talks about EVs. But even if every car on the road tomorrow was electric, we’d still need millions of barrels of oil for planes, ships, and plastic. We haven't figured out how to fly a Boeing 787 across the Atlantic on a AAA battery yet.

Practical Insights for Navigating the Oil Market

If you are trying to make sense of the energy sector for your own finances or business, stop looking at the daily price spikes. They are mostly noise.

Look at inventory reports instead. The Energy Information Administration (EIA) releases data every Wednesday. If inventories are dropping but prices are staying flat, something is weird. It usually means a price jump is coming.

Also, pay attention to "spare capacity." That’s the amount of oil the world can bring online in 30 days. Right now, that margin is thinner than most people realize. When spare capacity is low, any small war or pipeline leak sends prices to the moon.

Next Steps for Tracking Energy Trends:

- Monitor the EIA Weekly Status Report: This is the "gold standard" for knowing if there is actually a shortage or just a lot of hype in the news.

- Check the "Crack Spread" indices: If you see refining margins blowing up, expect gas prices to stay high even if crude falls.

- Watch the US Dollar (DXY): Oil is priced in dollars globally. When the dollar gets stronger, oil technically becomes more expensive for everyone else, which often kills demand.

- Diversify your exposure: If you’re worried about high prices, look into energy sector ETFs (like XLE) which can act as a natural hedge against your own rising fuel costs.

Understanding the barrel is about understanding the plumbing of the world. It’s not just a commodity; it’s the literal energy density that allows modern civilization to function. Until we find a way to make plastic out of thin air and fly cargo jets on sunlight, that 42-gallon measurement is the most important number in the world.