You've probably heard the pitch by now. A jeweler leans over the glass, points to a massive, sparkling three-carat rock, and tells you it's chemically identical to a mined diamond but costs less than a used Honda Civic. It sounds like a glitch in the Matrix.

But then you start wondering. If I buy this, what is it actually worth?

Honestly, the answer depends on whether you’re talking about the price tag at the counter or what happens when you try to sell it back two years later. In 2026, the market for these stones has shifted so fast it’s giving veteran gemologists whiplash. We aren't in 2018 anymore. Back then, a lab diamond was a "disruptor." Now? It’s basically a tech commodity.

The Cold, Hard Numbers on What Lab Grown Diamonds Are Worth Right Now

If you walk into a store today, you’re going to see some wild price gaps. Most people asking how much are lab grown diamonds worth are shocked to find that the "value" has basically entered a freefall compared to natural stones.

As of early 2026, a high-quality 1-carat lab-grown diamond typically retails for somewhere between $700 and $1,000. Compare that to a natural diamond of the same specs, which still commands roughly $3,800 to $4,500.

The gap is even more aggressive as you go up in size. A 2-carat lab stone might cost you $1,600 to $1,800, while a mined equivalent is easily a $15,000+ conversation. Basically, you’re paying about 80% to 90% less for the lab version.

Why the Price Tag is Tanking

It’s simple math, really. Factories in India and China have gotten scary good at this. They’ve scaled up production so much that the "scarcity" factor is dead.

Think of it like a flat-screen TV.

Twenty years ago, a plasma TV cost $10,000.

Today, you can grab a better one at a big-box store for $400.

Lab diamonds are on that same trajectory. Technology makes them cheaper to grow every single year. Because we can just "make more," there is no supply cap to keep the prices high.

🔗 Read more: Marie Kondo The Life Changing Magic of Tidying Up: What Most People Get Wrong

The Resale Trap: Can You Actually Sell It?

Here is the part most jewelers won't mention unless you ask.

If you buy a lab-grown diamond for $2,000 today and try to sell it tomorrow, you are going to get punched in the gut by the "resale value."

Most traditional jewelers won’t even buy them back. They don't have a "buy-back" price for lab stones because they can just buy a brand-new one from a wholesaler for pennies on the dollar.

- Natural Diamond Resale: You might get 25% to 50% of what you paid.

- Lab-Grown Diamond Resale: You’re lucky to get 10% to 30%. Honestly? Many people end up getting "pennies on the dollar" on sites like eBay or specialized secondary platforms.

Paul Zimnisky, a leading diamond industry analyst, has been vocal about this. He’s noted that because production costs are dropping so fast, a "used" lab diamond is competing with new ones that are cheaper and potentially better quality. It’s a tough sell.

The "Sunk Cost" Perspective

Wait, don't get discouraged yet. There is a different way to look at the "worth" of these stones.

Let's say you have a $10,000 budget.

Option A: Buy a modest 1-carat natural diamond. You spend the full $10,000. If you sell it later, you get $4,000 back. You lost $6,000.

Option B: Buy a massive 3-carat lab diamond for $2,500. You put the other $7,500 into a high-yield savings account or an index fund. Even if the lab diamond’s resale value drops to zero, you still have $7,500 in the bank plus interest.

In this scenario, the lab diamond is "worth" more to your lifestyle because it freed up your cash. You aren't "investing" in the rock; you're investing in your life.

What Factors Actually Drive the Price?

Even though they're grown in a lab, they aren't all created equal. You can’t just say "a lab diamond costs X." It’s more nuanced.

💡 You might also like: Why Transparent Plus Size Models Are Changing How We Actually Shop

1. The Growth Method (CVD vs. HPHT)

Most diamonds you see now are grown via Chemical Vapor Deposition (CVD). It’s cheaper and allows for massive batches. High-Pressure High-Temperature (HPHT) is the older school way—it mimics the earth's pressure more closely. HPHT stones often have a slightly different "bloom" or "tint," and while they're becoming more common, the tech used can slightly bump the price.

2. The "4 Cs" (Yes, They Still Matter)

Even in a factory, things go wrong. You can still get a "VVS1" (very, very slightly included) or a "SI2" (slightly included) lab stone.

- Cut: This is the big one. A poorly cut lab diamond looks like a piece of glass. A "Hearts and Arrows" or "Ideal" cut stone will always be worth more at the counter.

- Color: Most labs aim for "D, E, F" (colorless). If a stone comes out with a weird brown or blue "nuance" (a common byproduct of the CVD process), the price plummets.

3. Certification (GIA vs. IGI)

For a long time, the Gemological Institute of America (GIA) was hesitant to grade lab stones. Now they do, but the International Gemological Institute (IGI) is still the king of the lab-grown world. A stone with a GIA report might carry a small premium just because of the brand name of the lab, but honestly, in the lab-grown world, an IGI cert is the industry standard.

Is It "Real"? (The Emotional Worth)

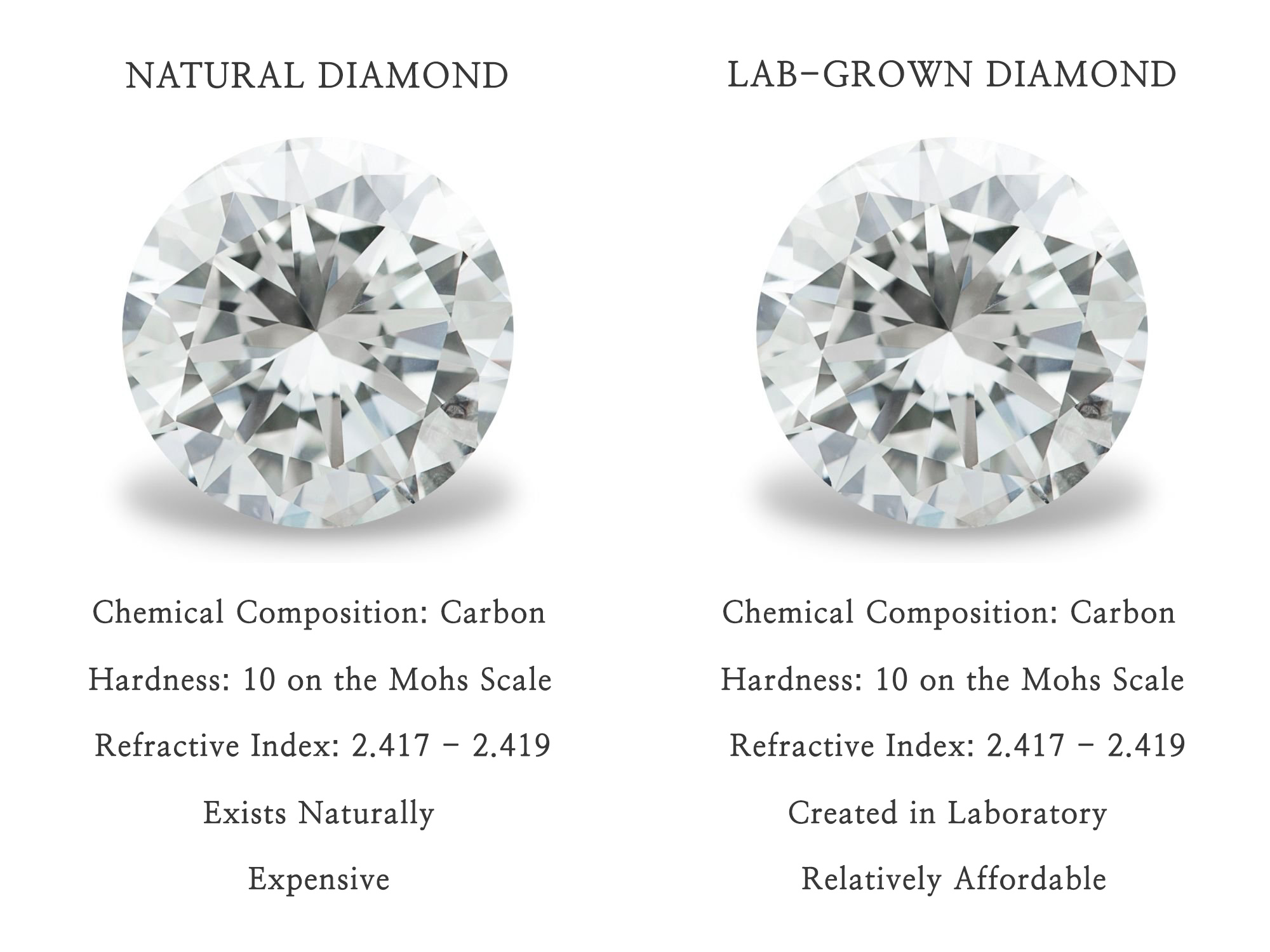

If you take a lab diamond to a jeweler and they use a basic "thermal" tester, it will beep. It will say "DIAMOND."

Because it is.

It’s not cubic zirconia. It’s not moissanite. It’s carbon atoms arranged in a crystal lattice.

For a lot of couples in 2026, the "worth" is tied to ethics and environment. Mined diamonds have a heavy history. Even with the Kimberley Process, people are skeptical. Lab diamonds offer a "clean" story. You know exactly where it came from (a lab in Oregon or a facility in Surat), and no mountains were moved to get it.

To a Gen Z or Millennial buyer, that "peace of mind" adds a layer of value that isn't reflected in a resale price chart.

Misconceptions That Could Cost You

Don't fall for the "investment" trap.

If a jeweler tells you a lab-grown diamond is a "great investment that will hold its value," they are lying to you. Period.

They are a luxury purchase. Like a nice suit or a high-end smartphone. You buy it to enjoy it, not to fund your retirement.

📖 Related: Weather Forecast Calumet MI: What Most People Get Wrong About Keweenaw Winters

Also, watch out for "overpricing." Some high-end boutiques still try to sell lab diamonds for only 30% or 40% less than natural stones. In the current 2026 market, that’s a rip-off. You should be looking for at least a 70% to 80% discount compared to mined.

The Reality Check

So, how much are lab grown diamonds worth?

They are worth exactly what you are willing to pay for the "look." If you want the sparkle of a celebrity-sized ring without the $50,000 price tag, a lab diamond is worth every penny. You get the same physical properties, the same durability (it’s still a 10 on the Mohs scale), and the same "forever" sparkle.

But if you are someone who feels comfort in knowing your jewelry has "intrinsic" or "rarity" value—if you want to know that your stone is a finite piece of Earth's history—then a lab stone might feel "worthless" to you.

Actionable Steps for Buyers

If you’ve decided to go the lab route, here is how you make sure you aren't overpaying:

- Check the Wholesale Vibe: Before buying, look at sites like Loose Grown Diamond or James Allen. If they are selling a 2-carat stone for $1,200 and your local jeweler wants $4,000, walk away.

- Prioritize the Cut: Since the material is cheap, don't settle for anything less than an "Excellent" or "Ideal" cut. The "worth" of a diamond is in its sparkle.

- Ask About the "Nuance": Specifically ask if the CVD stone has a brown, grey, or blue tint. These are common in mass-produced lab stones and can make the diamond look "flat."

- Ignore the Resale Talk: Buy it assuming you will never sell it. If you’re worried about resale, you shouldn’t be buying a lab diamond—or honestly, any diamond, as most of them lose value the second you leave the shop.

The market in 2026 is all about transparency. Lab diamonds have democratized luxury. You can own a masterpiece of science for the price of a nice weekend getaway. Just don't expect it to act like a gold bar in your safe. It's jewelry. Wear it, love it, and forget about the "market value."