Money feels solid. You hold a twenty-dollar bill, and it’s there—paper, ink, that weird plastic strip. But if you start digging into how many usd in circulation actually exist right now, things get blurry fast. Most people think about the stacks of cash in bank vaults or the crumpled singles in their pockets. That’s barely the tip of the iceberg.

Honestly, the "real" number depends entirely on who you ask and how they define "money." If we’re just talking about the physical greenbacks—the stuff you can drop on a counter to buy a soda—we’re looking at roughly $2.3 trillion.

That sounds like a lot. It is. But it’s also a tiny slice of the total US dollar supply.

Most of the money we use isn't physical. It’s digital. It’s a series of ones and zeros on a server at JPMorgan Chase or Wells Fargo. When you swipe your debit card, no physical dollar moves anywhere. A computer just updates a ledger. Because of this, the Federal Reserve tracks money in different buckets, or "aggregates," known as M0, M1, and M2. Understanding these is the only way to get a grip on what's actually happening in the economy.

The Different Layers of How Many USD in Circulation

The Federal Reserve doesn’t just count coins. They look at the "liquidity" of money—how fast you can spend it.

The most restrictive count is the Monetary Base. This is the physical currency in your pocket plus the reserves that banks hold at the Fed. As of late 2025 and heading into 2026, the Fed’s H.6 release shows that the physical currency component remains relatively stable compared to the explosive growth we saw a few years back.

Then you have M1. This used to be just cash and checking accounts. In 2020, the Fed changed the rules. They started including savings accounts in M1 because, let’s be real, you can move money from savings to checking on your phone in three seconds. That makes it "liquid."

Because of that rule change, the M1 supply look like it teleported from $4 trillion to over $18 trillion almost overnight. It didn't actually grow that fast in real terms; we just changed how we labeled it.

M2 is the big one. This includes everything in M1 plus "near money"—things like money market funds, certificates of deposit (CDs), and other time deposits. This is the number economists freak out about. Why? Because M2 is a massive indicator of future inflation. If there’s too much M2 chasing too few goods, prices go up. It's basic supply and demand. Currently, the M2 money supply hovers around $21 trillion.

Think about that. $2.3 trillion in paper. $21 trillion in total spendable "money."

📖 Related: Olin Corporation Stock Price: What Most People Get Wrong

Most of our wealth is an illusion of credit.

Why is the physical cash count so high?

If everyone uses Apple Pay and credit cards, why are there trillions in physical bills? You’d think we’d need less cash, right?

The reality is that the US dollar is the world's "reserve currency." A huge chunk of those $100 bills aren't in the US. They are in suitcases in South America, under mattresses in Eastern Europe, and in bank vaults in Southeast Asia. People in unstable economies trust the "greenback" more than their own local currency. Ben Bernanke once noted that over half of all US currency circulates abroad. It’s a global safety net.

The Post-2020 Explosion and the "Great Contraction"

We have to talk about the elephant in the room. The stimulus.

During the pandemic, the Fed and the Treasury went into overdrive. They printed money. Well, technically, the Fed bought government bonds with money they created out of thin air. This is called "Quantitative Easing." It’s a fancy term for "making the money supply go brrr."

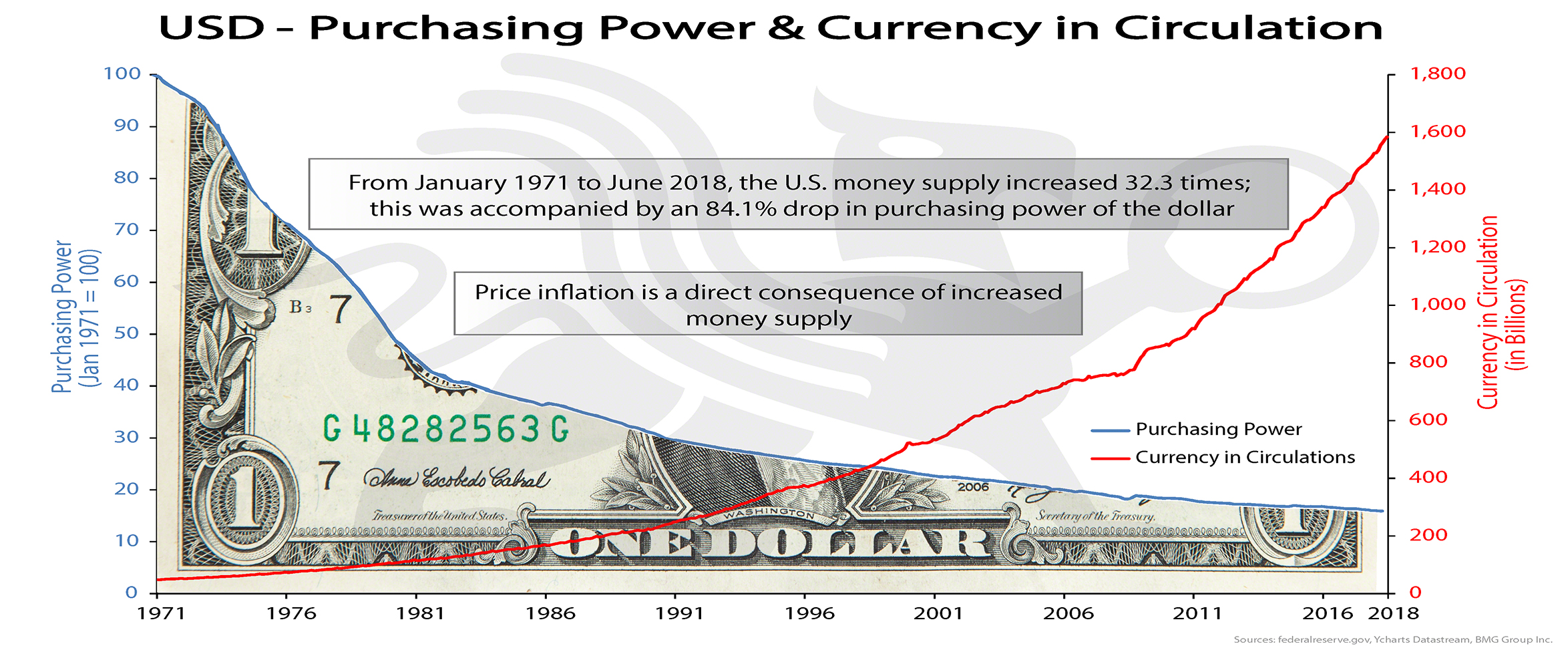

In 2020 alone, the M2 money supply grew by about 25%. That is unprecedented. In the history of the United States, we’ve never seen a spike like that. It’s the reason your groceries cost 30% more now than they did four years ago. You can’t increase how many usd in circulation by that much without devaluing the individual dollars already in the system.

But then something weird happened.

In 2023 and 2024, for the first time in decades, the money supply actually started to shrink. The Fed started "Quantitative Tightening." They stopped buying bonds and let them roll off their balance sheet. They hiked interest rates. They basically tried to suck the excess cash back out of the system like a giant vacuum cleaner.

Does the Fed actually print money?

Not literally. The Bureau of Engraving and Printing (BEP) does the printing. They are part of the Treasury. They have facilities in DC and Fort Worth. They print billions of notes every year, but most of those are just replacing old, torn-up bills that are being shredded.

👉 See also: Funny Team Work Images: Why Your Office Slack Channel Is Obsessed With Them

The "printing" people complain about is digital. When the Fed wants to increase the money supply, they click a button and buy assets from private banks. They credit those banks with "reserves." The banks then take those reserves and lend them to you for a mortgage or a car loan. That is how money is "created." It’s born out of debt.

If nobody took out loans, the money supply would collapse.

The Mystery of the Missing $100 Bills

Here’s a fun fact that feels like a conspiracy but is just boring math: there are more $100 bills in circulation than $1 bills.

According to Fed data, the $100 bill overtook the $1 bill in volume around 2017. This is weird because you rarely see $100 bills in daily life. Most vending machines won’t take them. Target cashiers look at them like they might be fake.

So where are they?

- Tax Evasion: Cash is untraceable. If you’re running a business off the books, you want big bills.

- Criminal Activity: Cartels don’t use Zelle.

- Foreign Hoarding: If you live in a country with 100% inflation, you buy Benjamins and hide them.

This creates a massive discrepancy in how many usd in circulation appear to be active versus how many are actually moving through the US economy. A huge portion of our "circulating" currency is actually stationary. It’s just sitting there, acting as a store of value.

Why the Number Matters to Your Savings

You might think, "Who cares if it's $2 trillion or $20 trillion?"

You should care. The velocity of money—how fast these dollars change hands—combined with the total supply, dictates your purchasing power.

When the Fed increases the supply, your savings account loses value. Even if the number in your bank app stays the same, what that number buys shrinks. This is the "hidden tax" of inflation.

✨ Don't miss: Mississippi Taxpayer Access Point: How to Use TAP Without the Headache

In 2026, we are seeing a stabilization. The wild swings of the early 2020s have calmed down, but the floor has shifted. We aren't going back to 2019 prices. The money supply is too high for that. To get 2019 prices back, you’d have to destroy trillions of dollars, which would cause a depression. Instead, the goal is just to stop the supply from growing too fast.

The Rise of Digital Dollars (CBDCs)

There is a lot of talk about a Central Bank Digital Currency. Some people think this will replace physical cash.

The Fed has been "researching" this for years. While we don't have a "FedCoin" yet, the infrastructure is basically there. Most of our money is already digital. The difference with a CBDC is that the Fed could track every single transaction in real-time.

If a CBDC ever fully launches, the question of how many usd in circulation will become much easier to answer, but much harder to hide. There would be no "under the mattress" for a digital token. This is why many economists and privacy advocates are terrified of the shift. Cash offers a level of anonymity that the digital system can't replicate.

Actionable Insights: What to Do With This Info

Knowing the scale of the money supply isn't just trivia. It’s a signal for how you should manage your own wealth.

Watch the M2 reports. The Federal Reserve releases this data monthly. If you see M2 starting to spike again, expect inflation to follow in 12-18 months. It’s like a warning siren.

Don't hoard cash long-term. Physical cash is great for emergencies. It’s terrible for wealth preservation. Since the supply of USD almost always trends upward, the value of each dollar almost always trends downward. Hold enough for a 6-month safety net, but remember that the "circulation" is working against your purchasing power.

Diversify into "hard" assets. When the money supply is uncertain, people flock to things that can’t be printed. Real estate, gold, and even Bitcoin are popular because their supply is fixed or at least grows much slower than the US dollar.

Understand the "Global Dollar." If you travel, remember that your dollars have different "weights" elsewhere. In times of global crisis, the demand for USD spikes because everyone wants the world's reserve currency. This makes the dollar "stronger" even if inflation is happening at home.

The US dollar is a complicated beast. It’s part paper, part digital promise, and part global geopolitical tool. Whether there are $2 trillion or $21 trillion in circulation, the most important thing is how much of it you can keep—and what it will actually buy when you’re ready to spend it.

Keep an eye on the Fed's balance sheet. It tells a much more honest story than any politician's speech. When the balance sheet expands, the dollar in your pocket gets a little bit lighter. When it shrinks, things get tight. We are currently in the "tight" phase, which means cash is actually harder to come by than it was three years ago. Plan your debts and your investments accordingly.