Ever tried to count the grains of sand on a beach? Okay, maybe checking how many Amazon shares are there isn't quite that impossible, but honestly, the number shifts more than you’d think. If you’re looking at a finance app one day and a SEC filing the next, you might notice the numbers don't perfectly align. It's confusing.

As of early 2026, the "official" answer usually hovers around 10.69 billion shares outstanding.

But wait. That’s just the headline. If you're trying to figure out the actual "weight" of your investment or why the stock price moved the way it did after the last earnings call, you need to look under the hood. There’s a big difference between what's "outstanding," what's "floating," and what's sitting in Jeff Bezos' personal vault.

The Big Number: How Many Amazon Shares Are There Right Now?

To be precise, Amazon’s most recent filings (think late 2025 and moving into the 2026 fiscal cycle) show roughly 10.69 billion common shares.

Now, if you go back a few years, this number would have looked radically different. Why? Because Amazon pulled the trigger on a massive 20-for-1 stock split back in June 2022. Before that, the share count was a relatively tiny 500 million. Suddenly, every single share turned into 20. It didn't make the company more valuable—it just sliced the pie into much smaller, more affordable pieces.

You’ve got to keep an eye on "dilution" too. Amazon loves to pay its engineers and execs in stock. It’s a smart move to keep talent, but it means the company is constantly minting new shares. In 2024, the count was around 10.72 billion; by early 2026, it settled slightly lower due to some strategic buybacks, but the "diluted" share count—which includes all those future employee bonuses—is actually closer to 10.85 billion.

Floating vs. Locked Up: Who Actually Owns the Pie?

Total shares are one thing. But "the float" is what actually matters for daily trading.

The float represents the shares available for the public to trade on the open market. It excludes "insider" holdings. Think Jeff Bezos, Andy Jassy, and various directors.

📖 Related: Harbor Freight Dickson Tennessee: What Most People Get Wrong

- Public Float: Currently sits around 9.71 billion shares.

- Insider Holdings: These are the shares held by the big fish who can’t just dump them on a whim without filing paperwork with the SEC.

Jeff Bezos is obviously the elephant in the room here. Even though he’s been stepping back and selling billions of dollars worth of stock to fund Blue Origin (his rocket company), he still holds a massive chunk. When he sells, it makes headlines, but because there are over 10 billion shares in existence, even a $5 billion sale is sorta just a drop in the bucket these days.

Why the Share Count Keeps Changing

You might wonder why the number isn't static. It’s not like a pizza where you cut eight slices and call it a day. Amazon is a living organism.

Stock-Based Compensation (SBC)

This is the big one. Amazon isn't shy about using equity to attract the best minds in AI and cloud computing. Every time a developer’s restricted stock units (RSUs) vest, new shares enter the ecosystem. This is why the "diluted" share count is the one professional analysts actually care about. If you ignore it, you're basically pretending those future shares don't exist, which can make the company look cheaper than it really is.

Share Buybacks

On the flip side, Amazon occasionally decides to buy its own shares back from the market. They did a $10 billion authorization a couple of years ago. When they buy shares back, they "retire" them. This reduces the total count and makes each remaining share a tiny bit more valuable. It’s basically the opposite of dilution.

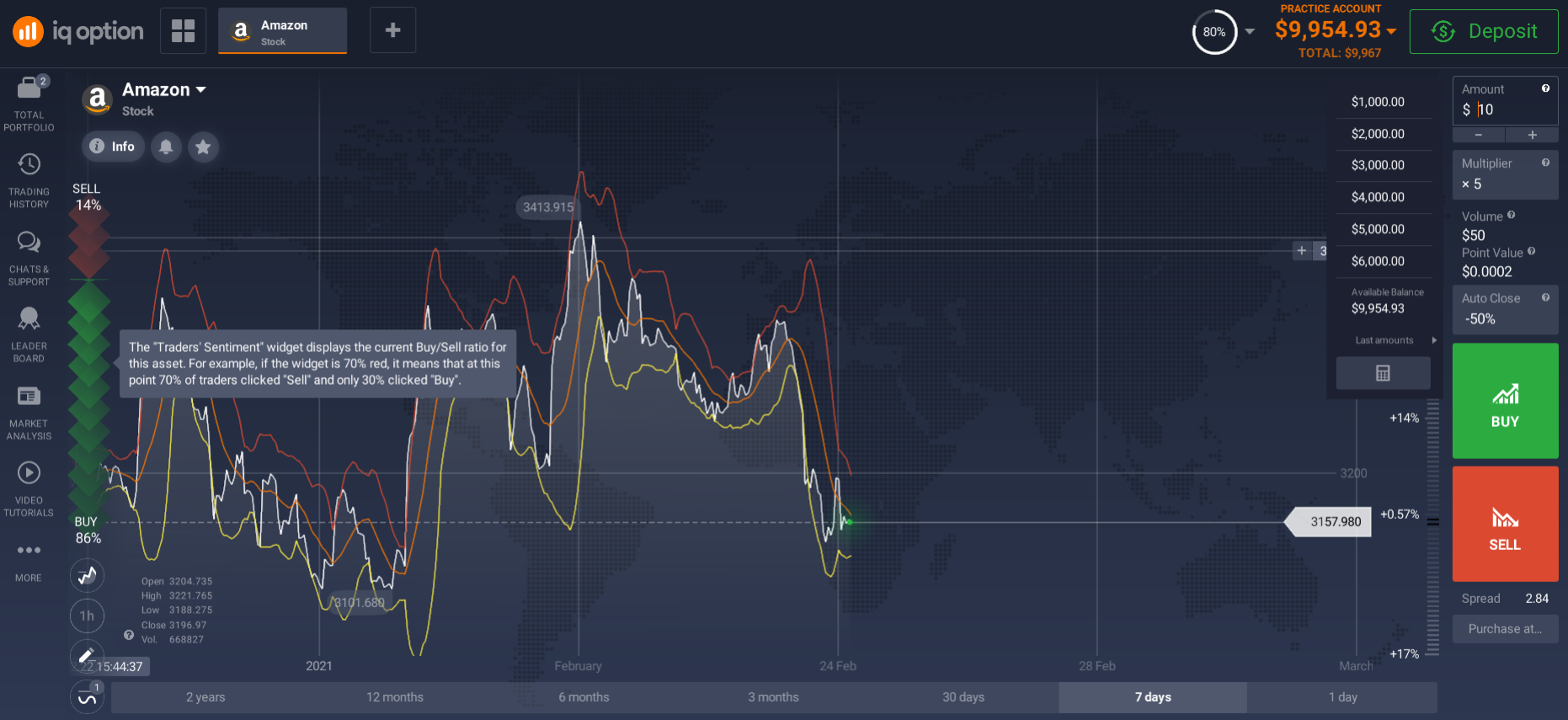

The 2022 Split Hangover

We're still feeling the effects of the 2022 split. Before that, AMZN was trading at over $3,000 a share. Most regular people couldn't afford a single share without using "fractional shares" on apps like Robinhood. By increasing the count to over 10 billion, Amazon brought the price down to a "normal" range (around $120-$150 at the time, though it’s climbed significantly since).

How the Share Count Affects Your Wallet

If you own 100 shares of Amazon today, you own roughly 0.0000009% of the company. Sounds tiny, right? But that tiny percentage is tied to a company that generates hundreds of billions in revenue.

When you're trying to figure out if the stock is "expensive," don't just look at the price. Look at the Market Cap.

$$Market\ Cap = Share\ Price \times Total\ Shares\ Outstanding$$

🔗 Read more: Jerome Powell DC Office Renovation: What Really Happened

In early 2026, with the price hovering around $240-$250 and nearly 10.7 billion shares out there, the market cap is north of $2.6 trillion. That's the real number that tells you how big Amazon is. If the share count was still 500 million, the stock price would be over $5,000 right now. The math stays the same; only the labels change.

What to Watch for in 2026

Honestly, the biggest thing to watch isn't just the raw number of shares, but the rate of dilution.

If Amazon's "Weighted Average Shares Outstanding" starts climbing too fast because of employee pay, it eats into the Earnings Per Share (EPS). Think of it like a group dinner. If more people show up but the amount of food stays the same, everyone leaves hungry.

Investors in 2026 are looking for "margin expansion." They want to see Amazon’s high-profit sectors—like AWS (Cloud) and Advertising—grow fast enough to offset the cost of all those shares they’re handing out to employees.

💡 You might also like: West Africa Ghana Currency: Why the Cedi is Making a Massive Comeback

Your Next Moves for Tracking AMZN

Checking the share count once isn't enough if you're a serious investor. Here is how you should actually track this:

- Check the 10-K and 10-Q Reports: These are the gold standard. Forget what the news says; go to the Amazon Investor Relations page and look at the first page of the latest quarterly report. The exact share count as of a specific date is always listed right there on the cover or in the first few paragraphs.

- Focus on Diluted Shares: When you're calculating P/E ratios or valuation, always use the "Diluted" count (the ~10.8B number). It's the most conservative and realistic way to look at your stake.

- Monitor Insider Filings: Use a tool like OpenInsider to see if the "big guys" are selling. If the total share count is stable but the "float" is increasing because insiders are dumping, that's a signal worth noting.

- Watch the Buyback Clock: If Amazon announces a new multi-billion dollar buyback, expect that 10.69 billion number to start shrinking. That’s usually a "bullish" sign that management thinks the stock is undervalued.

Understanding how many Amazon shares are there is basically about understanding how the pie is sliced. The pie is huge, but knowing exactly how many slices exist—and who’s holding them—is the only way to know what your slice is actually worth.