You’re staring at a sea of red on your screen. It feels like every time you check your portfolio, another few thousand dollars have evaporated into the digital ether. It’s sickening. You start doing the "napkin math"—if it drops another 10%, I can handle it; if it drops 30%, I’m working until I’m 90.

Everyone wants to know where the bottom is. But honestly? The "bottom" isn't a fixed number. It's a moving target dictated by math, human panic, and how much "froth" needs to be bleached out of the system.

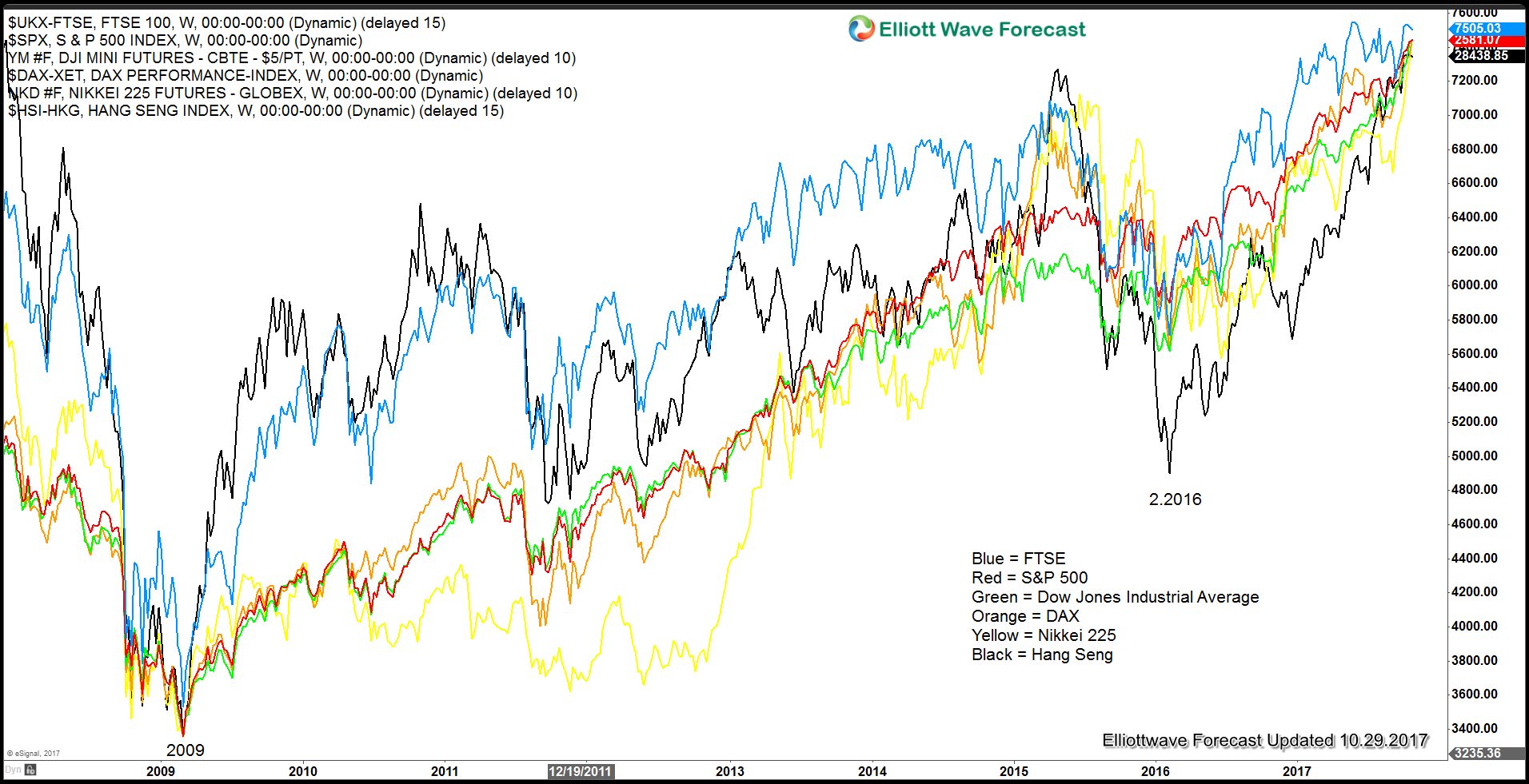

If you're asking how low can the stock market go, you have to look past the scary headlines and look at the actual structural floors that have caught the market during every major crash in history.

The Math of the Abyss: P/E Ratios and the "Fair Value" Floor

When things get ugly, Wall Street stops talking about "growth stories" and starts talking about "multiples."

Basically, the price of a stock is just a multiple of its earnings. In a raging bull market, people are happy to pay $25 or $30 for every $1 of profit a company makes. They’re optimistic! They think the future is all sunshine and AI-driven rainbows.

But when the vibe shifts, that multiple shrinks. Hard.

Historically, the S&P 500 has a "mean" P/E ratio of about 16. During the dark days of 2008 or the stagflation of the 70s, it has dipped as low as 10 or 12.

If we look at where we are in early 2026, the S&P 500 has been trading at a forward P/E of roughly 23 to 24. If earnings stay flat but the "mood" of the market reverts to its historical average of 16, you’re looking at a 30% haircut just to get back to "normal."

If we hit a true recession and those multiples drop to 12? Well, do the math. That’s a 50% wipeout from the peaks. It’s happened before, and it’s the cold, hard floor that value investors like Warren Buffett watch while everyone else is panicking.

The Shiller CAPE Ratio Warning

We can't talk about floors without mentioning Robert Shiller. His CAPE ratio (Cyclically Adjusted Price-to-Earnings) looks at a 10-year average of earnings to smooth out the noise.

In January 2026, the CAPE ratio is hovering near 39. To put that in perspective:

- 1929 Peak: About 30

- 2000 Dot-Com Peak: About 44

- Historical Average: Around 17

We are in the nosebleed seats. When the CAPE is this high, the "floor" is often a long, long way down.

What Actually Stops the Bleeding?

Markets don't just stop falling because they've "dropped enough." They stop because of three specific triggers.

1. The "Fed Put" (Liquidity to the Rescue)

The Federal Reserve is the fire department. When the "house" (the economy) is actually melting down—not just a small grease fire, but a structural collapse—they start cutting rates. History shows the S&P 500 typically bottoms about four to five months before a recession ends, usually right after the Fed has made its third or fourth aggressive rate cut.

💡 You might also like: How Much Is 100 Euros Actually Worth Right Now?

2. Forced Liquidation Ends

Sometimes the market falls because people want to sell. Other times, it falls because they have to sell. Margin calls, hedge fund blow-ups, and forced liquidations create a "waterfall" effect. The floor is reached when there is nobody left who is forced to sell. It’s the "capitulation" phase. You’ll know it when the news is 100% bad and even the "diamond hands" on Reddit are deleting their apps.

3. Dividend Yield Support

This is a classic "old school" floor. When stock prices drop low enough, their dividend yields start looking incredibly juicy compared to bonds. If a boring blue-chip stock usually pays 2% but its price drops so much that it now pays 6%, big institutional "income" seekers will step in and buy. This creates a natural price floor.

Historical "Worst Case" Scenarios

To understand how low the stock market can go, you have to look at the ghosts of crashes past.

- The Great Depression (1929-1932): The Dow lost 89%. This is the "black swan" of all black swans. It took 25 years just to get back to even.

- The Dot-Com Bust (2000-2002): The S&P 500 fell 49%. The Nasdaq, being tech-heavy, got absolutely vaporized, losing 78%.

- The Global Financial Crisis (2007-2009): A 57% drop for the S&P 500.

Could we see a 50% drop in 2026? It’s unlikely without a major systemic banking failure or a total geopolitical breakdown. Most analysts, like those at JP Morgan and Morgan Stanley, are currently eyeing a "correction" floor around the 20-25% mark if a mild recession hits.

The "Buffett Indicator" Reality Check

Warren Buffett’s favorite metric is the total market cap divided by the US GDP. Basically, it asks: Is the stock market's value growing faster than the actual economy?

Right now, that ratio is over 200%. In a "fairly valued" world, it should be closer to 100%.

Buffett has been sitting on nearly $400 billion in cash at Berkshire Hathaway. He isn't doing that because he hates making money; he's doing it because the "floor" is currently built on a foundation of expensive AI hype and high-interest-rate debt.

When the guy who says "our favorite holding period is forever" is sitting on record cash, it tells you he thinks the market could go a lot lower before it hits a price he likes.

How to Protect Yourself When the Floor is Missing

You don't need to time the bottom perfectly to survive. In fact, trying to do so is usually how people lose their shirts.

Check Your "Sleep at Night" Factor

If a 20% drop makes you want to throw up, you have too much in stocks. Period. Rebalancing into "defensive" sectors like healthcare, utilities, or consumer staples (think toothpaste and toilet paper) can soften the blow. These sectors don't drop nearly as hard because people still need surgery and soap even in a depression.

The Power of the "Dry Powder"

The only people who love a market crash are the ones with cash. If you have a pile of "dry powder" (cash in a high-yield savings account), a 30% market drop isn't a tragedy—it's a 30% off sale.

Stop Following the "Daily Candle"

If you’re a long-term investor, the "how low can it go" question is mostly academic. Over every 20-year period in US history, the stock market has been up. The "floor" for a 20-year investor is almost always higher than their starting point.

Actionable Next Steps

Instead of panic-refreshing your brokerage account, take these three steps today:

- Stress Test Your Portfolio: Look at your total balance and subtract 40%. If that number makes it impossible for you to pay your mortgage or retire on your timeline, you need to sell some equities now and move into fixed income (bonds or CDs) while the market is still relatively high.

- Set "Buy Limits": Decide now at what price you would love to own more of your favorite companies. If the S&P 500 hits 4,800, maybe you buy a little. If it hits 4,200, you buy more. Having a plan stops you from freezing when the blood is in the streets.

- Evaluate Your Debt: In a falling market, cash is king and debt is a noose. If you’re carrying high-interest credit card debt, pay that off before you even think about "buying the dip." A guaranteed 20% "return" by erasing credit card interest is better than any gamble in the stock market.

The market can always go lower than you think it can. It can stay "irrational" longer than you can stay solvent. But by understanding the P/E floors and the macro triggers that stop the bleeding, you can stop being a victim of the volatility and start being a student of it.