You’re staring at a spreadsheet or maybe just a bank balance on your phone, and that one nagging question keeps looping: how long will my money last? It’s a heavy thought. It’s the kind of thing that keeps you up at 2:00 AM while you’re trying to calculate the price of milk in fifteen years. Most people think there’s a magic number—a million bucks, maybe two—that guarantees safety.

Honestly, it doesn’t work like that.

Money isn’t a static pile of gold. It’s more like a leaky bucket that you’re trying to refill while the holes keep getting bigger. Between inflation, the "sequence of returns" risk, and the fact that we’re all living much longer than our grandparents did, the math gets messy fast. Bill Bengen, the guy who actually came up with the famous 4% rule back in the 90s, has even revisited his own math because the world changed.

Why the 4% rule is kinda broken (but still useful)

If you’ve spent five minutes on a finance blog, you’ve heard of the 4% rule. The idea is simple: if you withdraw 4% of your portfolio in the first year of retirement and adjust for inflation every year after, you shouldn’t run out of money for at least 30 years. It was based on historical market data from the Trinity Study.

But here’s the problem. That study looked at a very specific window of American history. If you retire right before a massive market crash—like 2008 or the 2000 tech bubble—withdrawing 4% can cannibalize your principal so fast that the "how long will my money last" question gets answered with a terrifyingly short number.

Current financial planners, like Wade Pfau, often argue that 4% might be too aggressive in a world where interest rates are weird and stock valuations are sky-high. Some suggest 3.3% or even lower if you want to be "bulletproof." Others say you can go higher if you're willing to be flexible.

It’s about your "burn rate."

If your expenses are fixed and you can’t cut back when the market dips, you’re in trouble. If you can live on ramen and Netflix for a year when the S&P 500 is down 20%, your money is going to last a lot longer. Flexibility is the ultimate insurance policy.

The silent killer of your savings

Inflation is a jerk. There’s no other way to put it. We all felt it over the last few years at the grocery store. When you’re wondering how long will my money last, you have to account for the fact that a dollar in 2026 won't buy the same amount of bread in 2046.

💡 You might also like: Why Every Mom and Daughter Photo You Take Actually Matters

If inflation averages 3%, the purchasing power of your money halves every 24 years. Think about that. If you need $5,000 a month to live comfortably now, you might need $10,000 just to maintain the exact same lifestyle in two decades. If you aren't investing in things that outpace inflation—like equities or certain types of real estate—your "runway" is effectively shortening every single day.

The Sequence of Returns: A fancy way of saying "bad luck"

This is the part most people ignore.

Imagine two people, Sarah and Mike. Both have $1 million. Both withdraw $50,000 a year. Sarah retires during a bull market. Her portfolio grows 10% in the first few years. Even after her withdrawals, her balance is higher than when she started.

Mike retires into a recession. His portfolio drops 15% in year one. He still takes out his $50,000 because he has bills to pay. Now he’s selling stocks at the bottom. His portfolio is wounded, and it might never recover enough to catch the next upswing.

- Sequence risk is the danger that the market tanks right when you start spending.

- It matters way more than the "average" return over 30 years.

- The first five years of your retirement basically dictate the rest of your life.

If you hit a bad sequence, you have to pivot. You have to work a part-time job, or sell the house, or just stop spending on anything that isn't a necessity. It’s not fair, but the math doesn’t care about fairness.

Taxes are the part we forget to calculate

You look at your 401(k) and see $800,000. You think, "Great, I have $800,000."

You don't.

You have $800,000 minus whatever the IRS decides to take. If that money is in a traditional IRA or 401(k), every penny you pull out is taxed as ordinary income. If you're in a 22% or 24% tax bracket, a huge chunk of your "safety net" belongs to the government. This is why people talk so much about Roth conversions. Paying the tax now might feel like a punch in the gut, but it makes the "how long will my money last" calculation a lot cleaner because you actually own the whole number you see on the screen.

📖 Related: Sport watch water resist explained: why 50 meters doesn't mean you can dive

Healthcare is the ultimate wild card

Fidelity does a study every year, and the most recent numbers are staggering. An average couple aged 65 retiring today might need around $315,000 just to cover healthcare costs in retirement. And that doesn't even include long-term care, like a nursing home.

Medicare isn't free.

There are premiums, deductibles, and things it just straight-up doesn't cover (like most dental or long-term stays). If you get hit with a chronic illness or need specialized care, your retirement runway can vanish in a heartbeat. This is why an HSA (Health Savings Account) is basically a cheat code for retirement—it’s triple tax-advantaged and specifically for these costs.

Real-world math: A quick sanity check

Let's look at a realistic example. Let’s say you have $500,000.

If you take out $2,500 a month ($30,000 a year), and your money earns a 5% return while inflation sits at 3%, you’re looking at about 22 to 25 years of life for that money.

But what if the market returns 7%? Now you’re looking at 35 years.

What if inflation spikes to 5% and the market only returns 4%? You might be out of cash in 15 years.

This is why "one and done" planning is a disaster. You have to check in. You have to adjust. You sort of have to be your own CFO.

👉 See also: Pink White Nail Studio Secrets and Why Your Manicure Isn't Lasting

Steps to make sure you don't run out of cash

First, you’ve got to build a "cash bucket." This is usually one to three years of living expenses kept in a high-yield savings account or short-term CDs. When the market is down, you spend from the bucket. You don't sell your stocks. This gives your portfolio time to breathe and recover. It’s the best way to fight that sequence of returns risk I mentioned earlier.

Second, consider the "Guaranteed Income Floor." This is your Social Security, maybe a pension if you’re lucky, or an annuity if you’re into that. If these "forever checks" cover your basic needs—rent, food, utilities—then your investment portfolio is just for the "fun stuff." If the market crashes, you just stop traveling for a bit. Your survival isn't tied to the S&P 500.

Third, watch the fees. If you’re paying a financial advisor 1% and your mutual funds cost another 0.5%, you’re losing 1.5% of your total wealth every single year. Over 30 years, that can literally shave a decade off how long your money lasts. Low-cost index funds are boring, but they are efficient.

The psychology of spending

Most people who are good at saving actually find it really hard to spend. They’ve spent 40 years watching the number go up. Seeing it go down feels like failure.

But the goal isn't to die with the biggest pile of money. The goal is to use the money to live.

There’s a concept called "Die With Zero" by Bill Perkins. He argues that you should aim to spend your wealth on experiences while you’re still healthy enough to enjoy them. It’s a radical idea, but it puts the focus back on "utility" rather than just "accumulation."

Actionable Next Steps

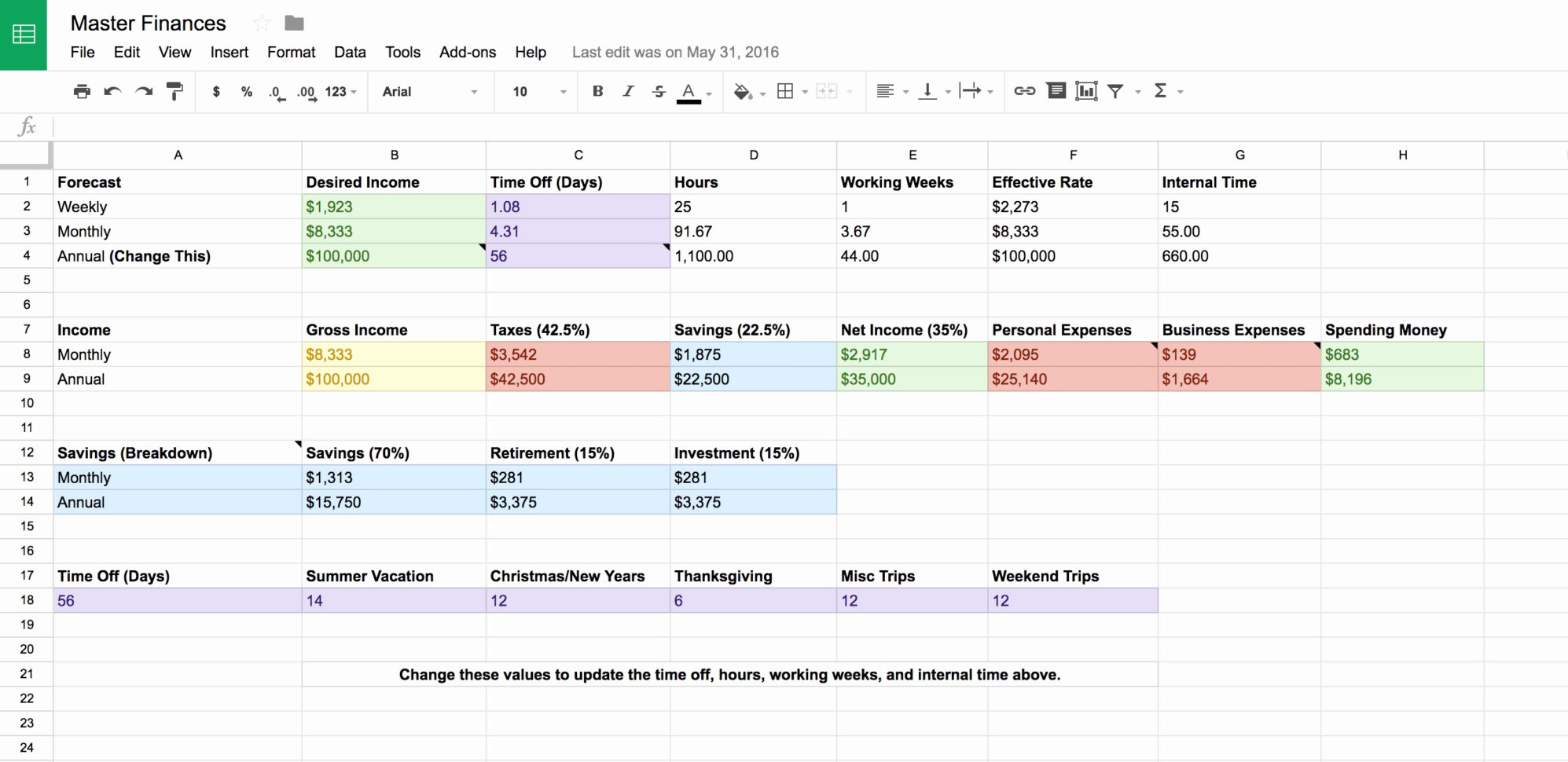

- Track your true spending for 90 days. Don't guess. Use an app or a spreadsheet. You need to know exactly what your life costs before you can calculate a runway.

- Run a "Monte Carlo" simulation. Many free tools online (like Vanguard’s or Fidelity’s) will run your numbers through 10,000 different market scenarios to give you a probability of success. Aim for a 90% success rate.

- Check your asset allocation. If you’re 60 years old and 100% in tech stocks, you’re gambling with your retirement date. You need some "boring" assets like bonds or T-bills to dampen the volatility.

- Model a "What If" scenario for long-term care. Look into the costs of assisted living in your area. Decide now if you’re going to self-insure or look into a long-term care policy.

- Optimize your Social Security strategy. Don't just take it at 62 because it's there. Waiting until 70 increases your monthly check by about 8% for every year you delay. That’s a guaranteed return you can’t find anywhere else.

Knowing how long will my money last isn't about having a crystal ball. It’s about building a system that can take a punch. Life is going to throw curveballs—a roof leak, a medical bill, a market correction. If your plan is too brittle, it breaks. If it’s flexible, you’ll be just fine. Keep your expenses lean, keep your cash bucket full, and don't panic when the headlines get scary. The math usually works out if you're paying attention.