You’re probably thinking about a bunch of guys in powdered wigs shouting in a coffee house. Or maybe you're picturing the frantic floor of the New York Stock Exchange in the 1980s. People ask how long has the stock market been around expecting a single date, like a birthday. It doesn't really work that way. It’s more like asking when "cooking" was invented. There’s a long, messy evolution from trading spices on a boat to clicking a button on an app.

Honestly, the "stock market" as we know it—a centralized place where you buy tiny pieces of a company—is about 400 years old. But the idea of it? That goes back much further. You can trace the DNA of the S&P 500 back to ancient Rome, where "societates publicanorum" allowed people to invest in government contracts. It wasn't a stock market, but it was the spark.

If you want the hard truth, the real, formal beginning happened in 1602.

The Dutch East India Company and the 1602 milestone

Forget Wall Street. The birthplace of modern investing was Amsterdam. The Dutch East India Company, or the Vereenigde Oost-Indische Compagnie (VOC), was facing a massive problem. Sending ships to the Spice Islands was incredibly expensive and risky. Half the time, the ships sank or were raided. No single person wanted to cough up the cash to fund a whole voyage.

So, they did something radical.

They invited the general public to fund the voyages in exchange for a share of the profits. This was the first time a company issued bonds and shares of stock to the general public. Suddenly, a baker or a blacksmith could own a "piece" of a global shipping empire. This is the definitive answer to how long has the stock market been around in a formal sense. The Amsterdam Stock Exchange was established shortly after to facilitate the trading of these shares. It wasn't just a club for the elite; it was surprisingly inclusive for the 17th century.

It changed everything.

Before this, if you wanted to invest, you basically had to be a partner in a business. You were liable for its debts. If the business failed, you went to debtor's prison. The VOC introduced "limited liability." If the ship sank, you only lost the money you put in. You weren't on the hook for the whole company's debt. That single shift in risk management is why your 4001(k) exists today.

Why the London "Coffee House" scene matters

Fast forward a bit to the late 1600s and early 1700s in London. Things got weird. People didn't have fancy glass buildings. They had coffee. Lots of it.

👉 See also: E-commerce Meaning: It Is Way More Than Just Buying Stuff on Amazon

The London Stock Exchange didn't start in a boardroom. It started in Jonathan’s Coffee House in 1698. A guy named John Castaing started posting a list of stock and commodity prices on the wall. It was basically the first "ticker symbol" list. Traders would sit around, caffeinated and loud, buying and selling shares in companies that often didn't even exist.

This led to the South Sea Bubble of 1720. It’s one of the most famous market crashes in history. People lost their shirts. Even Sir Isaac Newton—literally one of the smartest humans to ever live—lost a fortune. He famously said, "I can calculate the motions of the heavenly bodies, but not the madness of people."

The British government got so spooked by the crash that they passed the Bubble Act, which basically made it illegal to form joint-stock companies without a royal charter for over a century. This actually slowed down the development of the British stock market, giving other markets a chance to catch up.

The Buttonwood Agreement: America enters the chat

While Europe was dealing with bubbles and crashes, the United States was just getting started. In the late 1700s, the U.S. government needed to pay off debts from the Revolutionary War. They issued $80 million in bonds.

In March 1792, 24 brokers met under a buttonwood tree at 68 Wall Street in New York City. They were tired of the "auctioneers" taking a massive cut of their trades. They signed a simple two-sentence document called the Buttonwood Agreement.

"We the Subscribers, Brokers for the Purchase and Sale of the Public Stock, do hereby solemnly promise and pledge ourselves to each other, that we will not buy or sell from this day for any person whatsoever, any kind of Public Stock, at a less rate than one quarter percent Commission on the Specie value and that we will give a preference to each other in our Negotiations."

That was it. That's the birth of the New York Stock Exchange. It wasn't some grand economic theory. It was 24 guys under a tree trying to protect their commissions.

The evolution of "The Market" through the centuries

When you look at how long has the stock market been around, you have to see the technological leaps that changed its nature. It's not just about the dates. It's about the speed.

✨ Don't miss: Shangri-La Asia Interim Report 2024 PDF: What Most People Get Wrong

- The Ticker Tape (1867): Before this, news of stock prices traveled by foot or horse. Edward Calahan invented the ticker, which used telegraph lines to beam prices across the city. Suddenly, you didn't have to be on Wall Street to know what was happening.

- The Dow Jones Industrial Average (1896): Charles Dow wanted a way to tell if the market was "healthy" or not. He took 12 companies, added up their stock prices, and divided by 12. It gave the public a temperature check for the economy.

- Electronic Trading (1971): NASDAQ launched as the world's first electronic stock market. No more shouting on floors (at least, eventually). This paved the way for the high-frequency trading we see today.

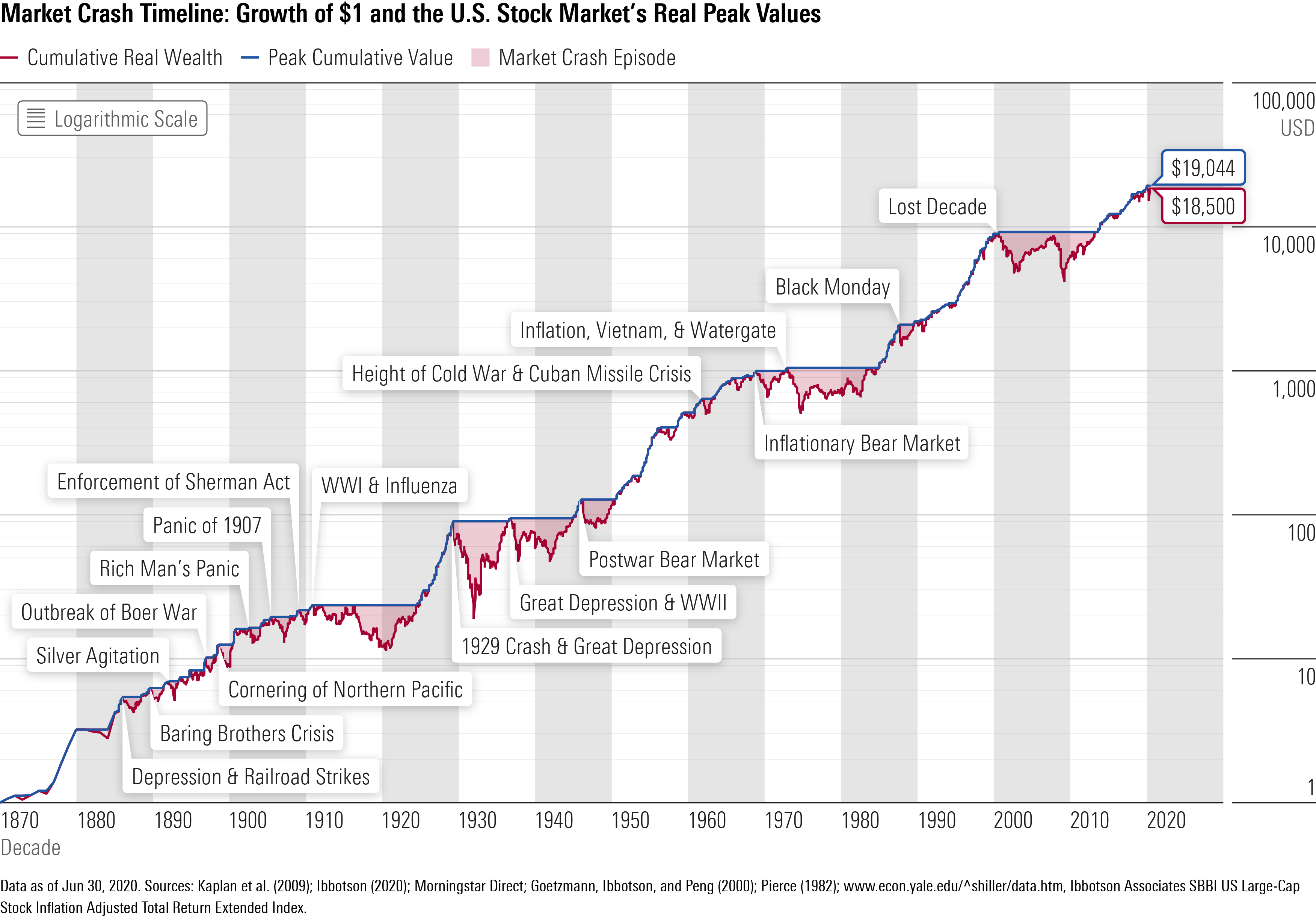

There's a common misconception that the stock market has always been this "stable" thing that just goes up. It's not. It’s been a series of experiments, many of which failed spectacularly. From the Panic of 1907 to the Great Depression in 1929, the market has spent just as much time being a source of terror as it has a source of wealth.

Is the market "too old" to be relevant?

Some people argue that the traditional stock market is a dinosaur. With the rise of decentralized finance (DeFi) and crypto, there’s a feeling that the 400-year-old model is breaking.

But here’s the thing. The stock market has survived because it adapts. It moved from coffee houses to trees to telegraphs to fiber-optic cables. The core human desire remains: we want to own a piece of the future. Whether that’s a Dutch spice ship in 1602 or a tech startup in 2026, the mechanism is fundamentally the same.

The market is also more regulated now than it has ever been. After the 1929 crash, the Securities and Exchange Commission (SEC) was formed in 1934 to stop the "Wild West" antics that characterized the 19th century. You might complain about red tape, but it’s better than the era when "bucket shops" would literally just steal your money and run.

Real-world impact: Why this history matters to you

If you’re wondering how long has the stock market been around because you’re nervous about investing, look at the timeline. It’s a 400-year track record of human ingenuity and resilience.

Markets have survived world wars, pandemics (including the Spanish Flu and COVID-19), the collapse of empires, and the transition from steam power to AI. Historically, despite the crashes, the trajectory has been upward.

Wait. Let me rephrase. The diversified trajectory has been upward. Individual companies fail all the time. The Dutch East India Company, the biggest company in history at one point, eventually went bankrupt in 1799. This is why "picking stocks" is risky, but "the market" as a whole tends to endure.

Actionable insights for the modern investor

Knowing the history is great, but what do you do with it? Here is the reality of the market in its current 400-year-old state:

🔗 Read more: Private Credit News Today: Why the Golden Age is Getting a Reality Check

1. Don't fight the timeline.

If the market has been around for centuries, don't try to master it in a week. Success in the stock market is almost entirely dependent on "time in the market" rather than "timing the market." Most people who try to time it end up like the folks in the South Sea Bubble.

2. Look for "Moats," a concept pioneered by Warren Buffett.

The Dutch East India Company succeeded because it had a literal monopoly. While monopolies are mostly illegal now, you want to invest in companies that have a "moat"—something that makes it hard for competitors to crush them.

3. Embrace the boring.

The most successful part of the stock market's history isn't the flashy IPOs. It's compound interest. It’s the slow, steady growth of the world's largest companies.

4. Diversification isn't just a buzzword.

It’s a survival strategy. If you had put all your money in the Dutch East India Company in 1790, you’d have lost everything. If you owned the whole Amsterdam exchange, you’d have fared much better.

5. Understand that volatility is a feature, not a bug.

The market has been crashing and recovering since 1602. A 10% drop isn't a sign of the end times; it's a routine part of a system that has been running for four centuries.

To truly understand how long the stock market has been around, you have to stop looking at it as a "place" and start looking at it as a "process." It is the process of people trading risk for potential reward. That process isn't going anywhere.

Next Steps for Your Portfolio:

- Check your expense ratios: If you're in mutual funds, ensure you aren't paying 17th-century style commissions. Anything over 0.50% is likely too high for a standard index fund.

- Verify your timeline: Ensure any money you have in the stock market isn't needed for at least five years. History shows the market is a terrible savings account but a great long-term wealth builder.

- Research the "Lindy Effect": This is the idea that the longer something has survived, the longer it is likely to survive in the future. The stock market is a prime example of the Lindy Effect in action.