Ever stared at a slip of paper from your grandma or a new employer and wondered why it looks like a coded relic from the 1950s? Honestly, it kind of is. Even in 2026, with instant transfers and crypto wallets, the physical check remains a cornerstone of the American financial system. It’s a legal contract, a security document, and a set of instructions all rolled into one. If you’ve ever fumbled while trying to figure out where the routing number ends and the account number begins, you aren’t alone.

Most people just see a rectangle. But if you look closer, there is a very specific anatomy designed to prevent fraud and ensure the Federal Reserve’s massive sorting machines don't lose your rent money.

The Visual Anatomy: How Does a Check Look to the Naked Eye?

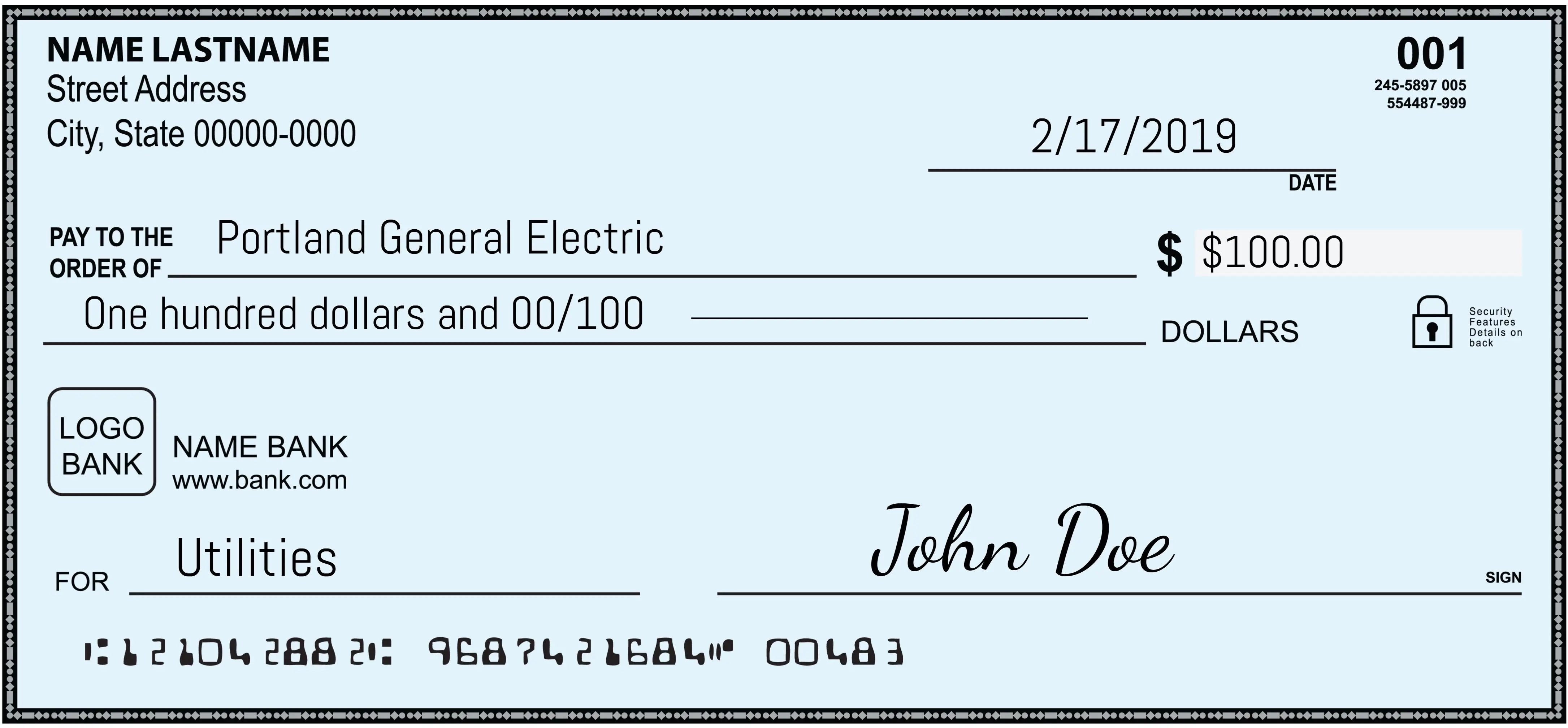

Basically, every personal check follows a standardized layout established by the American National Standards Institute (ANSI). This isn't just for aesthetics. It’s so banks can process them using Optical Character Recognition (OCR). At the top left, you’ll find the personal information. This is usually your name and address. Professional tip: you don't actually need your phone number or Social Security number printed here, and for privacy reasons, you probably shouldn't have them.

Opposite that, in the top right corner, is the check number. It’s there for your tracking. If you’re writing a series of checks, these numbers help you reconcile your bank statement later. Beneath the check number is the date line. Interestingly, banks aren't strictly required to honor the date—post-dating a check (writing a future date) doesn't legally stop a bank from cashing it early, though many will try to honor your request as a courtesy.

The center of the check is where the "instruction" happens. You have the payee line, which starts with the words "Pay to the order of." This is legally significant. It turns the piece of paper into a negotiable instrument. Then there's the amount box (where you write numbers) and the amount line (where you write the words).

🔗 Read more: Where Did Dow Close Today: Why the Market is Stalling Near 50,000

Here’s a weird quirk: if the numbers in the box and the words on the line don't match, the words legally prevail. If you write $100 in the box but "One Thousand Dollars" on the line, the bank is technically supposed to process it for a thousand.

The Bottom Line: Magnetic Ink and MICR Lines

If you’ve ever wondered how does a check look to a computer, look at the very bottom. That weird, blocky font is printed in Magnetic Ink Character Recognition (MICR) ink. This ink contains iron oxide. Back in the day, machines would literally "read" the magnetic signal of each letter to sort checks at high speeds.

The first string of numbers is the routing number. This is a nine-digit code that identifies your specific bank. The first two digits usually indicate which Federal Reserve district the bank belongs to. For example, a "02" refers to New York. The next set of numbers is your account number. These vary in length depending on the bank. Finally, you’ll see the check number repeated.

There’s a reason this area is so sparse. It’s called the "Clear Band." If you scribble your signature over these numbers, the bank’s scanner might reject it, forcing a manual entry which can delay your payment. Just don't do it.

💡 You might also like: Reading a Crude Oil Barrel Price Chart Without Losing Your Mind

Security Features You Probably Missed

Banks are terrified of color copiers. To fight back, they’ve loaded checks with "hidden" features.

Have you noticed a tiny "MP" logo near the signature line? That stands for Microprinting. To the naked eye, the signature line looks like a solid black line. If you put it under a magnifying glass, you’ll see it’s actually the words "Authorized Signature" or the bank's name repeated thousands of times. A photocopier can't replicate that level of detail; it just blurs it into a messy gray line.

Then there’s the padlock icon on the back. This isn't just a cute graphic. It lists the security features present on the document. Many checks also use "chemically reactive paper." If someone tries to use bleach or acetone to "wash" the check (erasing the payee to write their own name), the paper will literally change color, usually turning a bright, ugly stained blue or brown to alert the teller.

The Back of the Check: The Endorsement Area

Flip it over. It’s mostly blank, right? Not quite. The top section is the endorsement area. This is where the recipient signs.

📖 Related: Is US Stock Market Open Tomorrow? What to Know for the MLK Holiday Weekend

You’ve probably seen the phrase "For Deposit Only." This is a "restrictive endorsement." It’s a massive safety net. If you sign your name and drop the check on the street, anyone who finds it can technically cash it. But if you write "For Deposit Only" and your account number, it can only go into your account. It’s a simple habit that prevents a lot of heartbreak.

Common Misconceptions About Check Design

People often think you need fancy "safety paper" for a check to be valid. Honestly, you don't. Legally, you could write a check on a napkin if it had all the necessary components: your name, the bank’s name, the routing/account numbers, the date, the amount, and your signature. However, good luck getting a modern teller to accept a napkin. They want the standard 6-inch by 2.75-inch slip because it fits in their scanners.

Another myth is that checks "expire" after six months. While many banks have a policy of not honoring "stale-dated" checks (checks older than 180 days), it’s at their discretion. The debt itself doesn't disappear just because the paper is old.

Why The "Memos" Don't Really Matter

The "Memo" line at the bottom left is basically just for you. The bank doesn't care what you write there. You could write "For being a great friend" or "Rent for January," and it has almost zero legal weight in the clearing process. It’s purely for your own record-keeping or to help the recipient's bookkeeper figure out which invoice you're paying.

Practical Next Steps for Using Checks Safely

Now that you know how a check looks and why it’s built that way, you should use that knowledge to protect your money. Digital fraud is common, but check fraud is seeing a massive resurgence because people are getting careless.

- Use a Gel Pen: Specifically a Uniball 207 or something similar with "pigmented" ink. Standard ballpoint pen ink sits on top of the paper fibers and can be easily "washed" off by criminals using household chemicals. Gel ink seeps into the fibers and stays there.

- Don't Leave Gaps: When writing the amount in words, start at the far left of the line. Draw a line through any remaining blank space to the right. This prevents someone from turning "Eight" into "Eighty."

- Check Your MICR Line: If you're ordering checks from a third-party printer instead of your bank, verify that the routing number is correct. One wrong digit and your money will bounce around the banking system like a pinball.

- Review Your Statements: Because checks take a few days to clear, you have a window to spot fraud. Check your online banking app every few days to ensure the digital image of the cashed check matches what you actually wrote.

Understanding the mechanics of a check makes you a more competent participant in your own finances. It’s not just paper; it’s a highly engineered tool for moving value across the world. Keep your signatures consistent, use the right ink, and always fill out that "For Deposit Only" line on the back.