Let’s be real. In an era where you can zap money to a friend via a thumbprint scan or a quick Venmo notification, pulling out a paper check feels like using a typewriter. It’s clunky. It's analog. But then your landlord demands one, or you’re at a wedding and realized you forgot to withdraw cash, and suddenly you’re staring at those blank lines wondering if you still remember how to do this without messing it up. Honestly, knowing how do you write a check for $500 is one of those basic adulting skills that sounds easy until you’re holding the pen and realize a single mistake makes that piece of paper worthless.

Checks are still the backbone of secure, high-value transactions. Banks like Chase or Wells Fargo process millions of them daily because they provide a paper trail that digital apps sometimes lack. If you mess up the decimal point or the wording on a five-hundred-dollar check, you aren't just wasting paper; you're risking a "bounced" payment or a frustrated recipient.

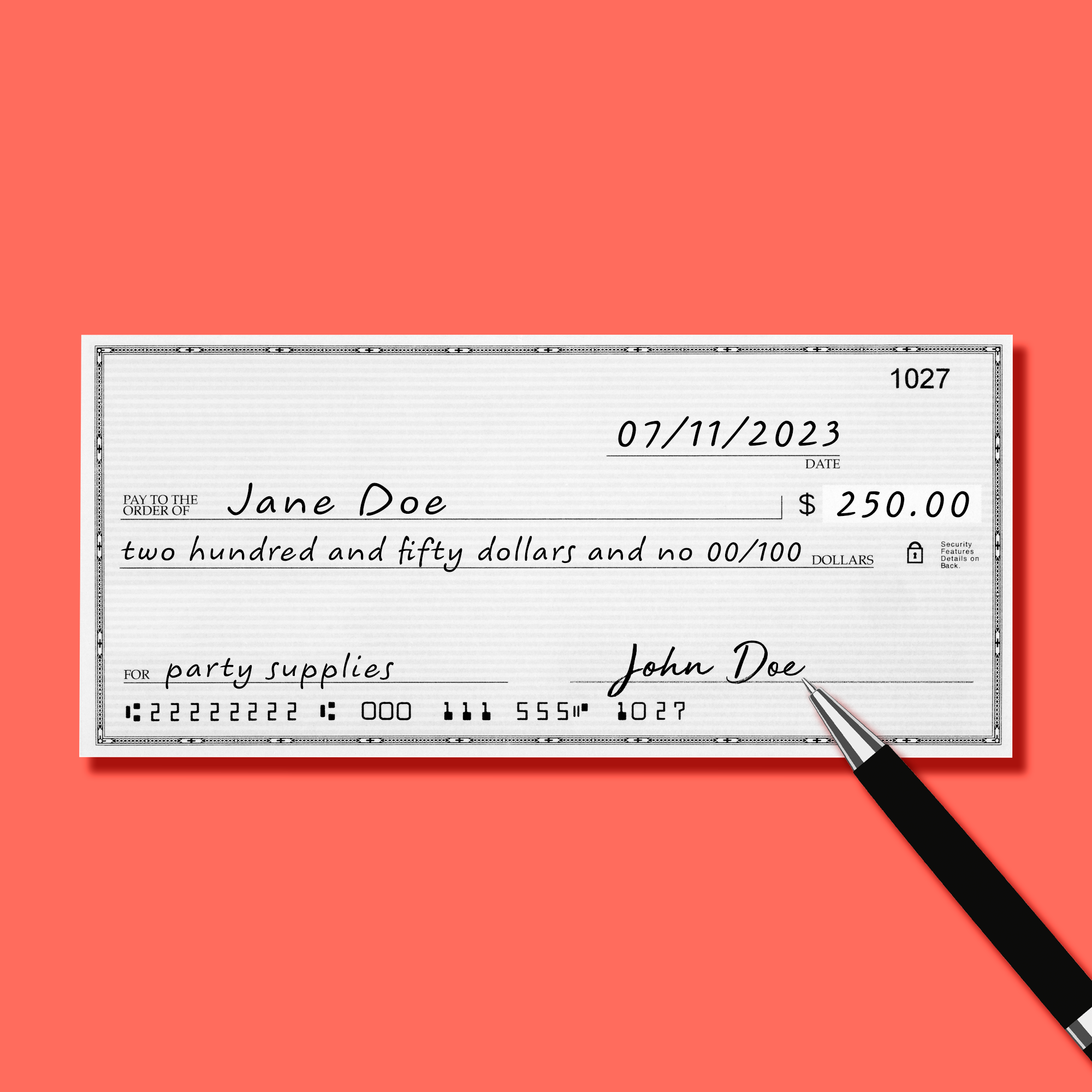

The Anatomy of Your $500 Check

First things first. You need a pen. Blue or black ink only. Don't even think about using a pencil or one of those erasable pens because that is a massive red flag for fraud. Banks will often reject checks that look like they've been tampered with, and graphite is too easy to lift off the page.

Grab your checkbook. Look at the top right corner. You'll see a line for the date. Writing the current date is standard, but some people try to "post-date" checks—meaning they put a future date on it so the person can’t cash it until then. Here’s the kicker: banks don't actually have to honor that future date. If they see the check, they might just process it anyway, and if your balance is low, you’re looking at a $35 overdraft fee. Just use today's date. It keeps things clean.

👉 See also: Why the Cowboy Church of Colbert County is Changing How Alabamians Do Sunday Morning

Next up is the "Pay to the Order of" line. This is where you write the name of the person or the business getting the $500. Write it clearly. If you’re paying an individual, use their full legal name—no nicknames. If it's a business, make sure you have the exact entity name. Writing "The Landlord" instead of "Oak Ridge Property Management" is a fast track to getting your payment rejected.

Writing the Numbers and Words (The Tricky Part)

Now we get to the actual math. There are two places where the amount goes, and they must match perfectly. If they don't, the bank usually defers to the amount written out in words, but often they'll just reject the whole thing to be safe.

In the small box on the right side with the dollar sign ($) in front of it, write 500.00. Make sure those zeros are clear. Don't leave a huge gap between the dollar sign and the "5," or some enterprising thief might try to turn your $500 into $1,500.

Then comes the long line in the middle. This is where you write the amount in words. For a five-hundred-dollar check, you write: Five hundred and 00/100.

✨ Don't miss: African American Woman in Black History: The Truth About the Figures You Weren't Taught

Why the fraction? It represents the cents. Even if there are zero cents, you need that fraction to "close" the amount so no one can add words later. After you write "00/100," draw a straight line through the rest of the blank space over to the word "Dollars." This is a security pro-tip. It prevents anyone from adding more words to increase the value of the check. It’s an old-school move, but it works.

Why the $500 Threshold Matters

Five hundred dollars is a specific psychological and institutional threshold. For many banks, it’s the point where "Mobile Deposit" limits might kick in for new accounts. If you’re giving this check to someone who just opened their account, they might have to walk it into a physical branch rather than just snapping a photo of it on their phone.

Also, consider the "Memo" line at the bottom left. While it’s technically optional, you should always use it. If this $500 is for rent, write "January Rent." If it’s a gift, write "Happy Birthday." If you ever get into a legal dispute or a tax audit, that memo line is your best friend. It turns a random transaction into a documented record. According to the Consumer Financial Protection Bureau (CFPB), keeping clear records of payments is the easiest way to resolve "he-said, she-said" financial disputes.

Safety Measures You Probably Forgot

Security isn't just about the ink you use. It’s about how you handle the check after the pen hits the paper.

- Never sign a blank check. Seriously. If you lose it, anyone can write in any amount and drain your account.

- Double-check your balance. It sounds insulting to mention, but people forget. Do you actually have $500 in the account right now? Remember that some banks take a day or two to reflect recent debit card purchases.

- The Signature. Your signature on the bottom right should match what the bank has on file. If you've changed your name or your handwriting has evolved significantly since you opened the account at age 16, you might want to update your signature card at the branch.

What Happens if You Mess Up?

We all have brain farts. Maybe you started writing "Four hundred" instead of "Five."

If you make a mistake, don't try to scribble over it. Most banks will not accept a check with "white-out" or heavy alterations. The safest thing to do is write VOID in large letters across the face of the check, rip it up, and start over with a fresh one. It’s better to waste a ten-cent piece of paper than to have a $500 payment stuck in limbo because the teller thought the "5" looked like an "8."

Digital Alternatives to Paper Checks

While we're talking about how do you write a check for $500, it’s worth asking if you actually need to. If you’re worried about it getting lost in the mail—which is a very real concern given the rise in mail theft and check washing—you might want to use a cashier’s check or an ACH transfer.

💡 You might also like: Happy Birthday For A Wonderful Woman: What Most People Get Wrong About Celebrating Her

Check washing is a process where criminals use chemicals to erase your ink and write in a new recipient and a much larger amount. They target blue mailboxes specifically. If you must mail a $500 check, take it inside the post office. Don't leave it in your residential mailbox with the little red flag up; that’s basically a neon sign for thieves.

Immediate Steps to Take

- Verify the Recipient: Call the person or business to confirm exactly who the check should be made out to.

- Check Your Ledger: Log into your banking app. Ensure the $500 is "Available Funds," not just "Account Balance" (which might include pending deposits that haven't cleared yet).

- Use a Gel Pen: If possible, use a Uni-ball Signo 207 or a similar gel pen. These contain ink that traps itself in the paper fibers, making "check washing" nearly impossible.

- Record the Transaction: Don’t rely on your memory. Write down the check number, the date, and the amount in your check register or a tracking app immediately.

- Deliver Securely: If you aren't handing it over in person, use a secure mailing method or a trackable envelope if the payment is time-sensitive.

Writing a check is a bit of a lost art, but doing it correctly ensures your money goes where it's supposed to without the headache of fees or fraud. Just take your time, watch your decimals, and remember that "and" always comes before the cents, never before the hundreds.