You’re standing at the pharmacy counter, or maybe you’re staring at a stack of mail that’s been gathering dust on the kitchen table, and it hits you. You aren’t actually sure if you’re covered. It sounds ridiculous, right? How could someone not know their own insurance status? Honestly, it happens way more than you’d think. Medicare isn't exactly a simple "yes or no" checkbox for everyone, especially if you’re transitioning from a workplace plan or dealing with Social Security benefits that started years ago.

The system is dense. It’s a labyrinth of red tape, acronyms, and various "Parts" that seem designed to confuse the average human being. If you're asking how do you know if you have Medicare, you’re likely in one of two camps: you’re approaching 65 and wondering if the government just "knows" to sign you up, or you’re already there and can’t find your card.

Let's cut through the noise.

The Red, White, and Blue Paperwork Trail

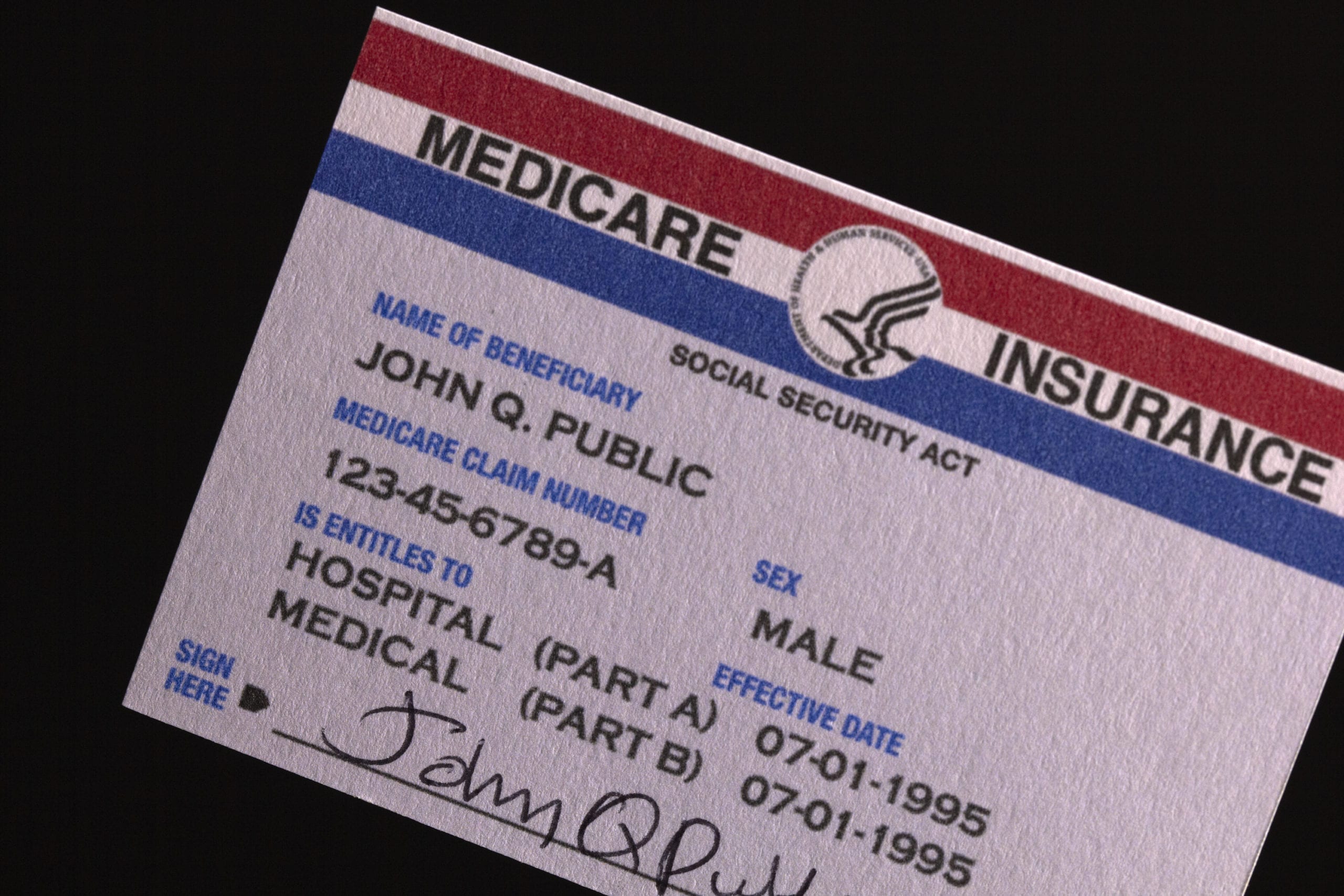

The most obvious sign is that 3.5-by-2-inch piece of cardstock. The official Medicare card is iconic for a reason. If you have one of these in your wallet—the one with the red and blue stripes at the top—you’re in. It lists your name and a unique Medicare Number, which is a mix of numbers and uppercase letters.

But wait.

If you just turned 65 and haven't seen a card, don't panic. If you are already receiving Social Security benefits (or Railroad Retirement Board benefits), the government usually enrolls you automatically. You’ll typically get your card in the mail about three months before your 65th birthday. If you haven't started taking Social Security yet, you actually have to go out and sign up yourself through the Social Security Administration (SSA) website. They won't just hunt you down.

Checking Your Status Online (The Fast Way)

We live in a digital age, even if the government sometimes acts like it's 1985. The absolute fastest way to verify your coverage is to create or log in to your mySocialSecurity account.

Once you’re in, look for the "Replacement Documents" tab. If you are enrolled, you can view your "Benefit Verification Letter" right there. This letter is the gold standard of proof. It doesn't just say "Yes, you have it"; it breaks down exactly when your Part A (Hospital Insurance) and Part B (Medical Insurance) started.

If you see dates next to those, you're covered. If the screen is blank or says you aren't receiving benefits, you’ve got your answer.

What Part Are You Even Looking For?

Medicare isn't a monolith. It’s a collection of pieces. To truly answer how do you know if you have Medicare, you have to know which flavor of Medicare we're talking about.

Part A is the "free" one for most people (if you worked at least 10 years). It covers hospitals. Part B is the one you usually pay a monthly premium for, and it covers doctors and outpatient stuff. Most people have both.

Then there’s Part C. You might know it as Medicare Advantage.

If you’re enrolled in an Advantage plan—like something from UnitedHealthcare, Aetna, or Humana—you might not use that red, white, and blue card at all. Instead, you'll have a private insurance card. This trips people up constantly. They look for "Medicare" on the card, don't see the word in giant letters, and assume they don't have it. In reality, that private plan is your Medicare coverage. It just replaces the traditional government-run version.

The "Welcome to Medicare" Visit

Think back to the last twelve months. Did you go to the doctor for a "Welcome to Medicare" preventive visit? This is a one-time introductory appointment covered at no cost within the first 12 months you have Part B. If your doctor’s office billed this and it went through, you’re definitely in the system.

Medical billing departments are incredibly efficient at telling you when you don't have insurance. If you’ve seen a doctor recently and they didn't hand you a massive bill for the full "sticker price" of the visit, chances are your Medicare (or a secondary payer) picked up the tab.

Common Misconceptions That Mess People Up

A lot of folks think that because they have "Medicaid," they don't have Medicare. That’s a mistake. You can actually have both. This is called being "dual eligible."

Medicaid is for low-income individuals, while Medicare is primarily based on age or disability. If you have a state-issued health card, check it closely. It might be acting as a supplement to your Medicare.

Another weird one? The disability loophole. If you’ve been receiving Social Security Disability Insurance (SSDI) for 24 months, you are automatically enrolled in Medicare regardless of your age. If you hit that 25th month and start seeing a deduction in your disability check (usually around $174.70 in 2024/2025, though it adjusts), that deduction is your Part B premium.

Money leaving your check is a very reliable, if annoying, way to know you’re covered.

How to Check If Your Card is Lost

If you're pretty sure you have it but the card is missing, you have options. You can call 1-800-MEDICARE (1-800-633-4227).

Warning: The hold times can be brutal.

When you get a human on the line, they will ask for your Social Security number, date of birth, and address. They can confirm your enrollment status over the phone. They can also trigger a new card to be mailed to you, which usually takes about two weeks.

Alternatively, if you use a Medicare Advantage plan, you should call the number on the back of your member ID card. Those private companies have their own databases and can tell you exactly when your "plan year" started and ended.

Looking at Your Paystub or Tax Forms

If you’re still working and over 65, you might be wondering if you’re paying into it or actually on it. Look at your W-2 or your paystub. You'll see a line for "Medicare Tax."

Don't get it twisted.

Paying that tax does not mean you "have" Medicare coverage yet. It means you are earning the credits to be eligible for it later. Having the insurance means you’ve gone through the enrollment process.

For those who are already retired, keep an eye out for Form 1095-B or 1095-C during tax season. These forms are basically the "Proof of Health Coverage" documents that providers send out. If you get one of these and it mentions CMS (Centers for Medicare & Medicaid Services), you’re officially in the club.

What to Do if You Discover You Don't Have It

Let’s say you did the checks and realized—oops—you aren't enrolled. This is where things get time-sensitive.

If you’re in your Initial Enrollment Period (the 7-month window around your 65th birthday), just go to the SSA website and sign up.

If you missed that window, you might have to wait for the General Enrollment Period, which runs from January 1 to March 31 each year. Be careful here. Waiting too long to sign up for Part B can result in a lifetime late-enrollment penalty. That penalty adds an extra 10% to your premium for every 12-month period you were eligible but didn't sign up. It’s a sting that never goes away.

✨ Don't miss: ICD 10 Abdominal Pain Generalized: Why Your Doctor Uses This Vague Code

Direct Steps to Take Right Now

If you are still staring at the screen wondering how do you know if you have Medicare, stop guessing and do these three things in this exact order:

- Check your Social Security Statement: Log into ssa.gov. If it says "You are entitled to Medicare," you are active. Note the start dates for Part A and Part B.

- Scan your bank statements: Look for a deduction of approximately $170-$180 labeled "SSA" or "CMS." If you pay your premiums directly (because you aren't taking Social Security yet), look for payments made to "Medicare Premium Bill."

- Call your primary doctor's office: Ask the billing coordinator what insurance they have on file for you. They see the "backend" of the insurance world every day and can tell you in thirty seconds what’s active.

If you find out you have Part A but not Part B, and you’re no longer working, you need to fix that immediately to avoid gaps in coverage for doctor visits. If you have both, keep a digital photo of your card on your phone. It’s much harder to lose a phone than a tiny piece of paper.

Knowing your status isn't just about peace of mind. It's about avoiding a $50,000 hospital bill because you assumed a "system" was taking care of you when you actually needed to click a button on a website. Verify it today so you don't have to worry about it tomorrow. Regardless of whether you have the traditional card or a private Advantage plan, having that proof in your hand is the only way to be certain.

Once you've confirmed your enrollment, check your "Summary of Benefits" to see what your specific plan covers, as deductibles and co-pays can vary wildly depending on whether you're in the original program or a private alternative. Look for your "Notice of Change" letter every September to see how your coverage might shift in the coming year. This keeps you ahead of the curve.