You're standing there with your phone in hand, or maybe sitting at a cluttered desk, wondering how that digital cash actually lands in your pocket. It’s a simple question. How do I receive payment via PayPal without the headache? Honestly, the process is pretty straightforward, but the nuances of fees, account types, and hold periods can make you want to toss your laptop out a window.

PayPal has been around forever. It’s the dinosaur that survived the meteor. While newer apps like Venmo or Cash App feel "cooler," PayPal remains the backbone of global freelance work and international business. If you're selling a vintage camera on eBay or invoicing a client in Berlin, you’re likely using it.

The first thing you need to grasp is that you don't actually "pull" the money. People "push" it to you. All they need is your email address or your mobile number. That’s it. No routing numbers. No IBANs. Just that email you’ve had since high school.

The Basic Mechanics of Getting Paid

When someone sends you money, PayPal sends you an email. "You've got money!" It's a great feeling. But if you haven't set up your account correctly, that money is just sitting in a digital limbo.

To actually see those numbers in your balance, you need a verified account. This means linking a bank account or a debit card. PayPal wants to know you're a real human being, not a bot living in a server farm. They’ll usually do those tiny "micro-deposits"—sending you like $0.03 and $0.12—which you then have to report back to them to prove the account is yours. It’s tedious. It’s 1990s technology in 2026. But it works.

Once you're verified, there are basically three ways to get paid. First, the sender just types in your email. Second, you send a formal invoice. Third, you use a PayPal.Me link.

Why the Invoice is Your Best Friend

If you’re doing business, don't just tell people "send it to my email." Send an invoice.

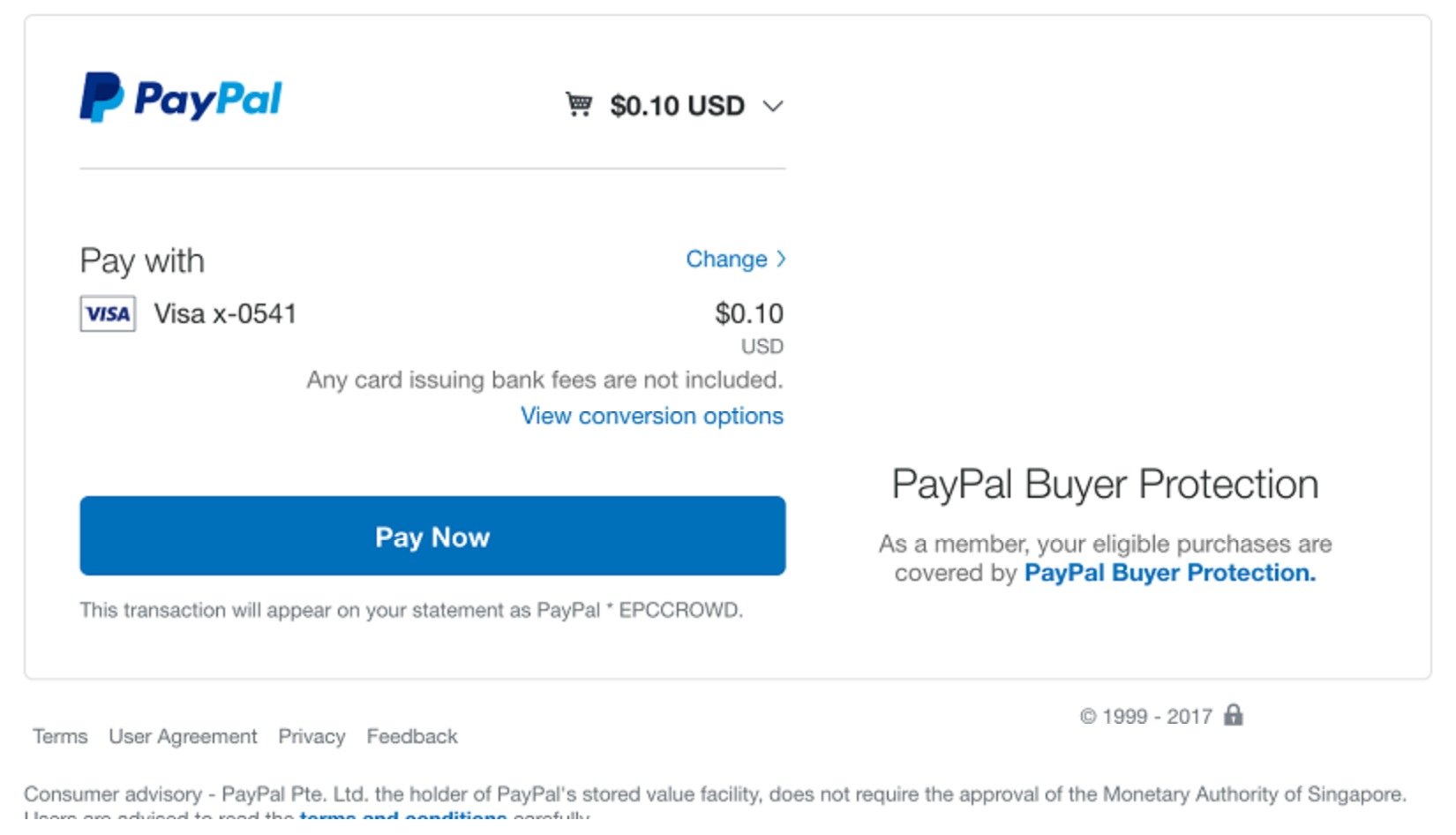

Why? Because it looks professional and it tracks everything for tax season. PayPal’s invoicing tool is surprisingly robust. You can add your logo, itemize the work, and even set up recurring payments. When the client pays the invoice, the money hits your PayPal balance almost instantly, minus the "Goods and Services" fee.

Let's talk about that fee. It’s the elephant in the room. Currently, for domestic US transactions, it’s usually around 2.99% plus a fixed fee. If you’re receiving money from abroad, that percentage climbs because of currency conversion and international "cross-border" costs. It hurts. But it also gives you Purchase Protection. If you’re a seller and the buyer claims they never got the item, PayPal has a mediation process. It's the price of safety.

Using PayPal.Me for the Quick Wins

Maybe you don't need a fancy invoice. Maybe you just sold a couch on Facebook Marketplace.

PayPal.Me is a personalized link. Mine looks like paypal.me/YourName. You text that link to someone, they click it, type the amount, and boom. Done. It’s much faster than them trying to spell your name correctly in the search bar.

But be careful.

When someone uses PayPal.Me, they have a choice: "Sending to a friend" or "Paying for an item or service."

If they choose "Friend," there’s no fee for you, but there’s also no protection. If they choose "Service," you get hit with the fee. Never, ever ask a stranger to pay via "Friends and Family" for a business transaction. It’s a violation of PayPal’s Terms of Service and is a massive red flag for scams. If PayPal catches you doing this repeatedly to dodge fees, they will freeze your account. They’re very good at spotting patterns.

Dealing with the Infamous "Money on Hold"

Nothing ruins a Tuesday like seeing a balance of $1,000 but an "Available" balance of $0.

New users often face the 21-day hold. PayPal does this to ensure you actually deliver what you promised. They’re holding the money in escrow, basically. You can speed this up. If you’re shipping a physical item, upload the tracking number immediately. Once the carrier marks it as "Delivered," PayPal usually releases the funds within 24 to 48 hours.

If it’s a service (like graphic design or consulting), you can mark the order as "Processed." The buyer then has the option on their end to "Confirm Receipt." If they click that button, your money is released instantly.

Tax Implications You Can't Ignore

In the United States, the IRS has been waffling on the reporting threshold for years. You might have heard of the $600 rule. If you receive more than $600 in "Goods and Services" payments in a calendar year, PayPal is legally required to send you (and the IRS) a 1099-K form.

This isn't a "PayPal fee." This is the government wanting their cut.

🔗 Read more: Smith Evans Funeral Home: What Most Families Don't Realize About Their Services

Keep your receipts. Track your expenses. If you’re using PayPal for a side hustle, that 1099-K makes it very easy for the IRS to see exactly what you earned. Don't let it surprise you in April.

Getting the Money into Your Real Bank Account

So, the money is in your PayPal balance. Now what? You can’t pay your mortgage with "PayPal Credit" (well, usually).

You have two main paths:

- The Standard Transfer: This is free. It takes 1 to 3 business days. In my experience, if you trigger it on a Monday morning, it’s usually there by Tuesday afternoon.

- The Instant Transfer: This costs 1.75% of the transfer amount (up to a maximum cap, usually around $25). It hits your debit card in minutes.

If you're in a rush, the fee is annoying but worth it. If you can wait, save your money.

The Security Reality Check

PayPal is a massive target for phishing.

✨ Don't miss: Exxon Mobil Corporation CEO Darren Woods: How He Actually Runs the World’s Biggest Oil Giant

You will get fake emails. They will look real. They will say "Your account has been suspended" or "You received a payment of $500—click here to claim."

Never click the link in the email. If you want to check if you've received a payment, open a new browser tab, go to PayPal.com, and log in manually. If the money isn't in your "Activity" feed on the official site, that email was a scam. Period.

Also, enable Two-Factor Authentication (2FA). Use an app like Google Authenticator or Authy. Text message 2FA is okay, but it's vulnerable to SIM swapping. If you're receiving large sums of money, treat your account like a vault.

Actionable Steps for New Users

Getting started doesn't have to be a mess. Follow this sequence to ensure your first payment goes through without a hitch:

- Confirm your email address immediately. PayPal won't show you payments sent to an unconfirmed email. Check your spam folder for that verification link.

- Upgrade to a Business Account if you're selling. It’s free to upgrade, and it lets you use a "Business Name" instead of your legal name on receipts. It adds a layer of privacy.

- Create your PayPal.Me link today. Even if you don't use it yet, grab your name before someone else does.

- Link and verify your bank. Don't wait until you have $500 sitting in there to find out your bank name doesn't match your PayPal name exactly.

- Download the app. The mobile app notifications for "Money Received" are more reliable than email, which can get buried or filtered.

PayPal is a tool. It’s not perfect—the customer service can be a nightmare if things go wrong—but for receiving payments quickly and globally, it’s still the industry standard. Understand the fees, protect your login, and always send an invoice for professional work.

Key Takeaways for Success

- Goods vs. Friends: Always use "Goods and Services" for business to keep your protection intact.

- Fee Management: Factor the 2.99% + fee into your pricing so you don't end up underpaid.

- Speeding Up Holds: Use tracking numbers or ask buyers to "Confirm Receipt" for services.

- Verification: Complete the "Know Your Customer" (KYC) requirements early to avoid account freezes during high-volume periods.