You've probably seen the "trust fund baby" trope in movies—the kid in the cashmere sweater who never works a day in their life because a check magically appears in the mail every month. It sounds like a dream. But if you’re sitting there asking, how do i get a trust fund, the answer is rarely as simple as waiting for a long-lost uncle to leave you a fortune.

Trusts aren't just for the ultra-wealthy anymore. They are practical legal tools used by millions of regular families to protect assets, avoid the nightmare of probate court, and make sure money doesn't get blown on a weekend in Vegas.

If you weren't born into one, you might feel like you're locked out of the club. You aren't. But you do need to understand how these legal "buckets" actually work.

The Brutal Truth About Inheriting a Trust

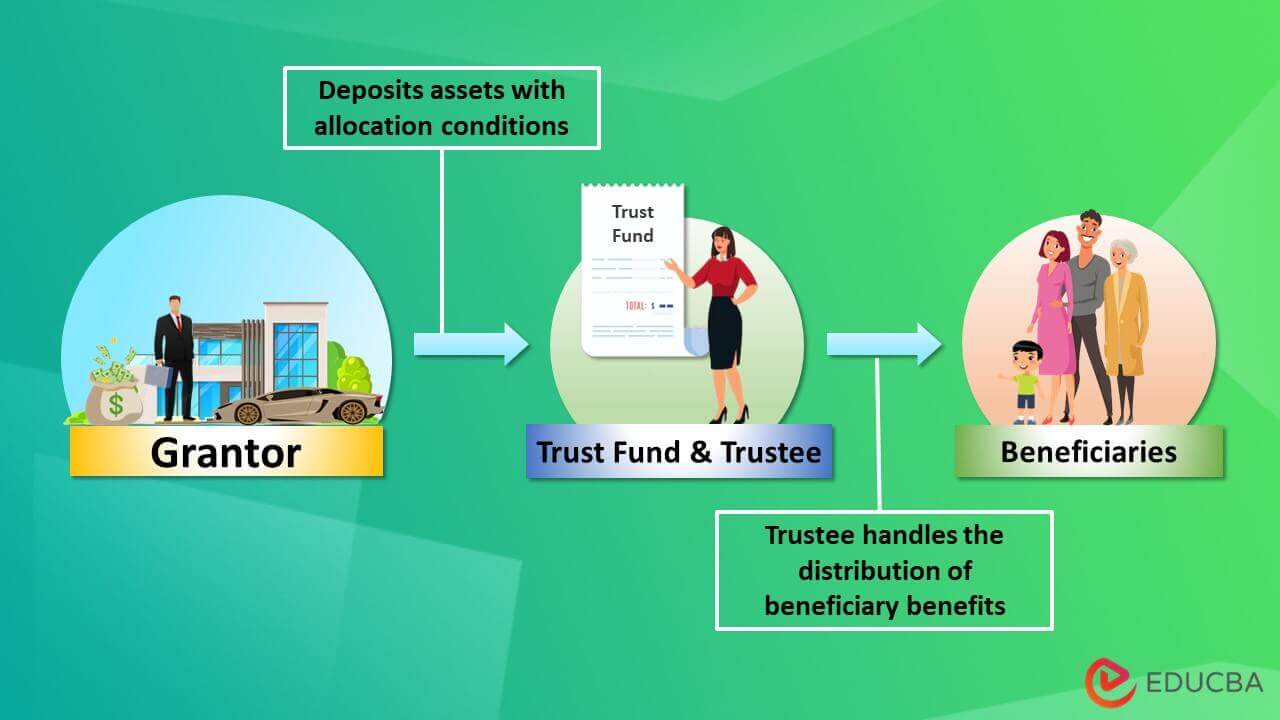

Let's be real for a second. You can't just "apply" for a trust fund like you would a credit card or a student loan. A trust is a fiduciary arrangement where a "grantor" (the person with the money) gives a "trustee" (the person managing the money) the right to hold assets for a "beneficiary" (you).

To get one, someone usually has to put you in their will or estate plan.

Most people discover they have a trust fund after a death in the family. It's grim, but that’s the reality. However, "getting" a trust isn't always about inheritance. Sometimes, it’s about high-net-worth individuals setting up structures for their children while they are still very much alive. According to the Federal Reserve's Survey of Consumer Finances, only about 1.5% of households in the U.S. receive a trust inheritance. It’s a small club.

If you're asking how do i get a trust fund because you want to build one for your own kids, that’s a different story. You start by talking to an estate attorney. You don't need $10 million. If you own a house and have a decent life insurance policy, you already have enough "stuff" to justify a living trust.

Why Do People Even Use These Things?

Trusts aren't just about hoarding cash. They serve very specific functions that a standard will can't touch.

🔗 Read more: Pink White Nail Studio Secrets and Why Your Manicure Isn't Lasting

- Privacy. When a person dies with just a will, that document goes through probate. It becomes public record. Anyone can go down to the courthouse and see exactly what you left behind. A trust is private. No one knows the business except the trustee and the beneficiaries.

- Control from the Grave. This sounds morbid, but it’s true. A grantor can set rules. "You get $20,000 when you turn 25, another $50,000 when you graduate college, and the rest when you turn 35." This prevents a 19-year-old from blowing an entire life's savings on a fleet of jet skis.

- Tax Strategy. For the very wealthy, irrevocable trusts can move assets out of an estate to lower the tax bill. The IRS has some pretty strict rules on this, especially with the 2026 sunset of the current gift tax exemptions looming.

Can You Set Up Your Own Trust?

Technically, yes. These are called "self-settled trusts."

If you’re a professional in a high-risk field—like a surgeon or a developer—you might put your assets into an Asset Protection Trust. This is a way of saying, "I own this, but it’s in a legal box that creditors can’t easily open."

But let’s talk about the more common scenario: The Revocable Living Trust.

This is the bread and butter of modern estate planning. You create it while you're alive. You're the trustee. You control everything. But the moment you pass away, the trust becomes "irrevocable," and the person you named as your successor trustee takes over. They follow your instructions to the letter. This is how you "get" a trust fund for your family without making them wait two years for a judge to sign off on a will.

The Different "Flavors" of Trusts You Might Encounter

Not all trusts are created equal. If you find out you’re a beneficiary, you need to know which one you’re dealing with because the tax implications are massive.

- Discretionary Trusts: The trustee has the power to decide when you get money. If the trustee thinks you're struggling with an addiction or making bad choices, they can legally withhold funds. You have very little leverage here.

- Spendthrift Trusts: These are designed specifically to protect the beneficiary from themselves—and their creditors. If you owe a credit card company $50,000, they usually can't sue the trust to get the money.

- Special Needs Trusts: These are vital. They allow a person with a disability to receive funds without losing their eligibility for government benefits like SSI or Medicaid.

The "Secret" Way People Get Trust Funds Without Inheritance

Can you get a trust fund through work? Sort of.

Some high-level executive compensation packages involve "rabbi trusts." These are non-qualified deferred compensation plans. The company puts money aside for your retirement in a trust. It’s not quite the same as a family trust, but it’s a legal structure that protects your future earnings from certain types of corporate risk.

💡 You might also like: Hairstyles for women over 50 with round faces: What your stylist isn't telling you

There are also incentive trusts.

I’ve seen cases where a mentor or a non-relative employer sets up a trust for a protégé. It’s rare. It’s the kind of thing that happens in old novels, but it does happen in the real world of ultra-high-net-worth philanthropy.

What Happens if You're Named a Beneficiary?

First, don't quit your job.

Getting a trust fund doesn't always mean you're rich. Sometimes the "fund" is just a house that you're allowed to live in but aren't allowed to sell.

You need to ask for the Trust Instrument. That’s the legal document that outlines the rules. You’ll want to see the accounting records too. Trustees have a "fiduciary duty," which is a fancy way of saying they are legally obligated to act in your best interest. If they’re using the trust's money to fund their own lifestyle, you can sue them.

The Downside Nobody Mentions

Trusts are expensive to maintain.

You have to pay the attorney to set it up (usually $2,000 to $5,000 for a basic one, and way more for complex ones). You might have to pay a professional trustee—like a bank's wealth management department—to manage the investments. They’ll take a percentage, usually around 1% to 1.5% of the total assets every year.

📖 Related: How to Sign Someone Up for Scientology: What Actually Happens and What You Need to Know

If the trust only has $100,000 in it, that fee starts to hurt.

Then there’s the "Dead Hand Control" issue. Living under the rules of someone who passed away twenty years ago can be frustrating. I knew a guy who couldn't get his trust money unless he remained married to his first wife. They hated each other. It was a mess.

Steps to Take If You Want to Establish a Trust

Maybe you aren't asking how do i get a trust fund because you want to receive one, but because you want to start one. Good for you. That's how generational wealth actually starts.

- Inventory Your Assets. Write down everything. Your house, your 401k, your vintage comic book collection.

- Pick Your People. Who do you trust to manage the money? Who do you want to receive it? These shouldn't always be the same person. Sometimes your most responsible friend should manage the money for your less-responsible sibling.

- Hire a Specialist. Do not use a DIY online form for a trust. Laws vary wildly by state. A trust that works in Florida might be useless in California.

- Fund the Trust. This is where most people fail. A trust is like a suitcase. If you don't put anything in it, it’s just empty leather. You have to retitle your bank accounts and your real estate in the name of the trust.

The Reality Check

Look, the idea of "getting" a trust fund is often tied to a desire for security.

In reality, most wealth is lost by the third generation. The "trust fund" isn't a permanent shield against the world. It’s a tool. If you're a beneficiary, treat it like a safety net, not a hammock. If you’re a grantor, focus more on teaching your heirs how to manage money than just giving it to them.

The most successful trusts I've seen are the ones where the beneficiaries didn't even know the full amount until they were already successful on their own. It kept them hungry. It kept them grounded.

Actionable Next Steps

- Check existing family documents: Ask your parents or grandparents if they have a "living trust" or "estate plan" rather than just a will.

- Consult a TEP (Trust and Estate Practitioner): If you are expecting an inheritance, find an advisor who specializes in fiduciary law to review the terms.

- Start small: If you want to create a trust, start by naming a "Transfer on Death" (TOD) beneficiary on your bank accounts—it's a free, "lite" version of what a trust accomplishes.

- Review your state's laws: Research whether your state allows "Domestic Asset Protection Trusts" if your goal is shielding money from lawsuits.