You’ve seen the flashing red and green numbers on the bottom of the news screen. Usually, it’s just called "the Dow." People talk about it like it’s the literal heartbeat of the American economy, but honestly, it’s kind of a weird, old-school relic when you actually look under the hood. If you’ve ever wondered how did the Dow Jones become the world's most famous yardstick for money, you have to go back to a time before computers, before the Federal Reserve, and even before lightbulbs were a common household item.

It started with a guy named Charles Dow. He wasn't some billionaire hedge fund manager; he was a journalist with a notebook and a very simple theory. He figured that if you wanted to know how the country was doing, you shouldn't just look at one company. You needed a "mean" or an average. In 1896, he took 12 of the biggest industrial companies—mostly stuff like sugar, tobacco, oil, and rubber—added up their stock prices, and divided by 12. That was it. That was the magic formula.

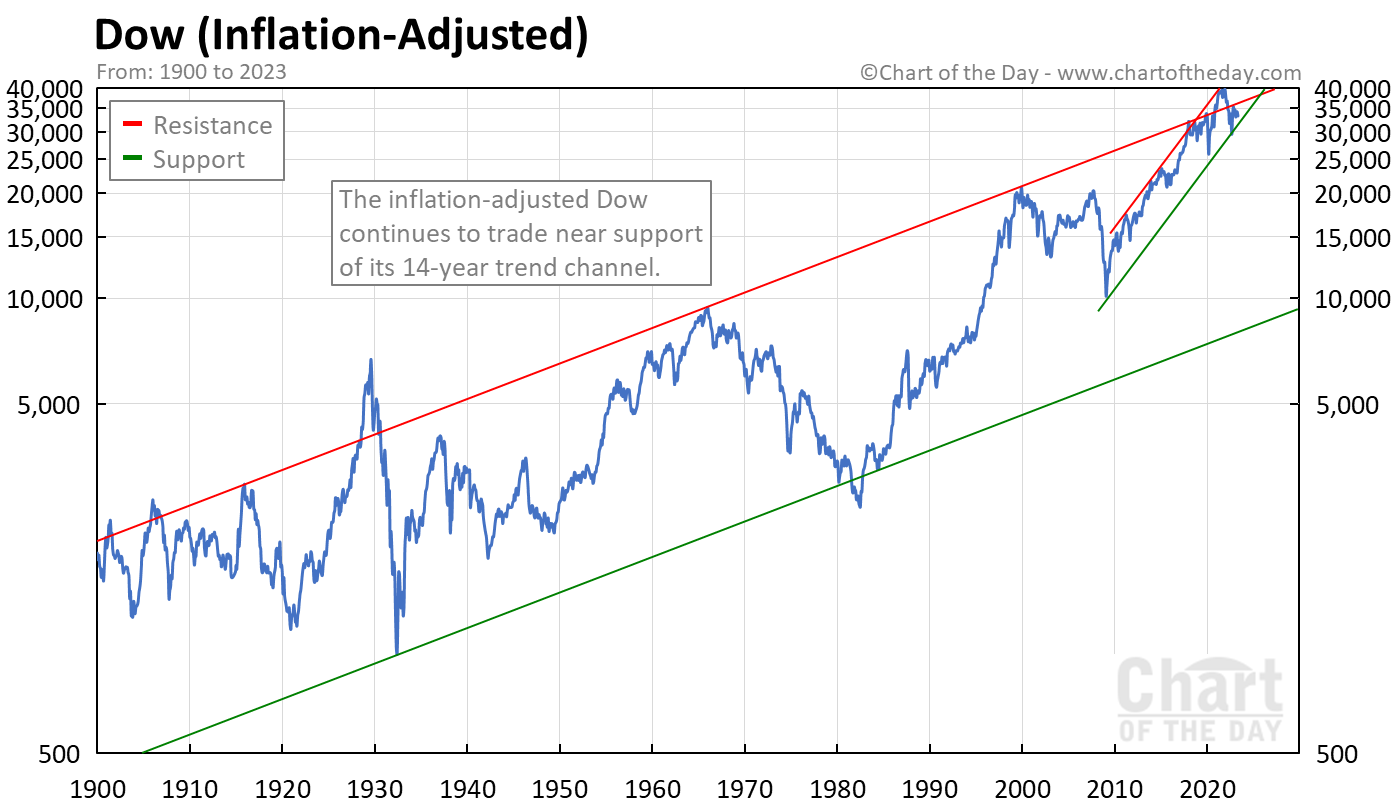

The first day it was calculated, May 26, 1896, the Dow Jones Industrial Average (DJIA) closed at 40.94. To put that in perspective, the index has spent recent years flirting with 40,000. That is a lot of growth, but the way we get to that number today is much more complicated than Charles's simple division.

The Messy Evolution of the 30 Stocks

When people ask how did the Dow Jones survive over a century of wars, depressions, and tech bubbles, the answer is constant tinkering. It’s not a static list. It’s a curated club. The editors of the Wall Street Journal (which Charles Dow also co-founded) basically sit in a room and decide who's "in" and who's "out." There isn't a rigid mathematical rule for entry like there is for the S&P 500. It’s more of a vibe check on the American economy.

Originally, it was all about "smokestack" industries. General Electric was the longest-running member, joining in 1907 and finally getting the boot in 2018. That was a huge deal. It signaled that the old industrial era was officially over. Now, the index is a strange mix of tech giants like Apple and Microsoft, healthcare players like UnitedHealth, and retailers like Home Depot.

🔗 Read more: Ohio Salary Tax Calculator: Why Your Take-Home Pay Might Surprise You

Why the Price Matters (and Why It’s Kinda Dumb)

Here is the thing that confuses everyone: the Dow is "price-weighted." Most modern indexes, like the S&P 500 or the Nasdaq, are "market-cap weighted." In those indexes, the bigger the company’s total value, the more it moves the needle. But in the Dow, a stock with a $500 share price has way more influence than a stock with a $50 share price, even if the $50 company is actually ten times bigger in total size.

It's a quirky system. If Goldman Sachs has a bad day, the Dow drops hard. If Apple has a bad day but its share price is lower because of a recent stock split, the index might barely move. Critics hate this. They say it’s an outdated way to measure the market because it rewards high share prices rather than actual company value. But we still use it. Why? Because it’s the "brand name" of the stock market. It's what your grandpa checks, and it's what the evening news reports.

Breaking Down the "Dow Divisor"

You might be thinking: if the Dow is just an average of 30 stocks, and those stocks are all trading at around $100 to $500, why is the index at 40,000?

This is where the Dow Divisor comes in.

Back in the day, if a company did a 2-for-1 stock split, its share price would cut in half. If Charles Dow just kept dividing by 12 (or later, 30), the index would suddenly look like it crashed even though nothing actually happened to the value of the companies. To fix this, they created a "divisor." Every time there is a stock split or a company is replaced, they change this divisor number to keep the index level consistent.

As of late 2024, the divisor is a tiny fraction—somewhere around 0.15. This means that for every $1 change in any of the 30 stocks, the Dow moves by about 6.6 points ($1 / 0.15). It’s a mathematical trick to ensure the chart looks like a continuous line over 120 years rather than a series of jagged jumps.

How the Dow Jones Actually Reacts to History

History isn't just numbers; it's panic and euphoria. Looking at how did the Dow Jones react to the 1929 crash versus the 2008 financial crisis or the 2020 COVID-19 plunge tells you everything about human psychology.

- The Great Depression: The Dow lost 89% of its value between 1929 and 1932. It took until 1954—nearly 25 years—just to get back to where it started before the crash.

- Black Monday (1987): On October 19, the Dow fell 22.6% in a single day. People thought the world was ending. But unlike the Depression, the market recovered much faster.

- The Modern Era: In 2020, we saw the fastest drop into a bear market in history, followed by a massive surge fueled by government stimulus.

The Dow is basically a mirror of American anxiety. When the president speaks, the Dow moves. When oil prices spike in the Middle East, the Dow moves. It represents the "Blue Chips"—the companies that are supposed to be too big to fail.

💡 You might also like: Why Is H\&R Block Charging Me? The Real Reason Your Tax Bill Just Spiked

The Problem With 30 Stocks

Can 30 companies really tell you what 10,000 companies are doing? Probably not. That is the biggest criticism of the Dow Jones. It ignores the small businesses, the mid-sized tech firms, and the vast majority of the "real" economy. If you only look at the Dow, you’re looking at the penthouse of a very tall skyscraper and ignoring the other 90 floors.

However, because these 30 companies are so massive—think Coca-Cola, Visa, and Disney—they employ millions of people and have tentacles in every corner of the globe. If Disney is struggling, it’s a safe bet that consumer spending is down. If Caterpillar is selling fewer tractors, it’s a safe bet that construction is slowing down. That’s why the Dow still works as a shorthand. It’s a "quick and dirty" check-up on the health of global capitalism.

Actionable Steps for Using the Dow as an Investor

If you're looking at the Dow Jones and trying to figure out what to do with your own money, don't get caught up in the daily point swings. A 400-point drop sounds scary, but when the index is at 40,000, that’s only a 1% move. That’s a normal Tuesday.

- Look at the Percentage, Not the Points: Always translate the "points" into a percentage to keep your emotions in check.

- Don't Buy Just Because a Stock is in the Dow: Being added to the Dow is often a "lagging" indicator. A company is usually added after it has already become huge and successful. Sometimes, the best growth is already behind it by the time it joins the 30.

- Check the S&P 500 for Balance: If the Dow is up but the S&P 500 is down, it means the "Old Guard" companies are doing well while the rest of the market is struggling. This often happens during "rotations" where investors move money out of risky tech and into safe stuff like Procter & Gamble.

- Understand the "Dogs of the Dow" Strategy: Some investors use a system where they buy the 10 stocks in the Dow with the highest dividend yields at the start of the year. The idea is that these are "undervalued" blue chips that are likely to bounce back. It’s a classic value-investing move that has historically performed pretty well.

The Dow Jones started as a pencil-and-paper calculation in a smoky newsroom. Today, it’s a digital titan that dictates the flow of trillions of dollars. It’s imperfect, it’s a bit weird, and it’s definitely old-fashioned, but it remains the primary way the world answers the question: "How's the market doing today?"