Money is weird. One day you feel like you've got a handle on your checking account, and the next, you realize inflation just ate your lunch. Most people treat their savings like a stagnant pool. They drop a few bucks in, hope for the best, and check back in six months only to find they’ve earned a whopping twelve cents in interest. It’s frustrating. But honestly, the gap between "getting by" and "getting wealthy" usually comes down to math that most of us haven't looked at since high school. That’s where a saving and interest calculator becomes less of a "tool" and more of a reality check.

You see, humans are biologically terrible at understanding exponential growth. We think linearly. If I give you three dollars today and three dollars tomorrow, you think, "Cool, I have six dollars." But compound interest doesn't play by those rules. It’s a snowball rolling down a mountain that eventually turns into an avalanche.

Why Your Bank Account Feels Stuck

Most traditional savings accounts are offering peanuts. We’re talking 0.01% or 0.05% APY at some of the "big box" banks. If you put $10,000 in there, you’re basically paying the bank to hold your money while they lend it out to someone else for a 7% car loan. It’s a bad deal.

When you plug those numbers into a saving and interest calculator, the results are depressing. You see a flat line. But then, you toggle the interest rate to 4.50% or 5.00%—rates currently available in High-Yield Savings Accounts (HYSAs) or Money Market Accounts—and the graph suddenly has a curve. That curve is your freedom.

👉 See also: How Many Pounds Are a Dollar: The Truth About Exchange Rates and Your Wallet

The Federal Reserve’s decisions over the last few years have shifted the landscape. For a long time, "saving" was a losing game because interest rates were pinned to the floor. Now? It’s a different story. If you aren't using a calculator to compare your current bank’s rate against the market leaders like Ally, Marcus by Goldman Sachs, or SoFi, you are literally leaving thousands of dollars on the table over a decade.

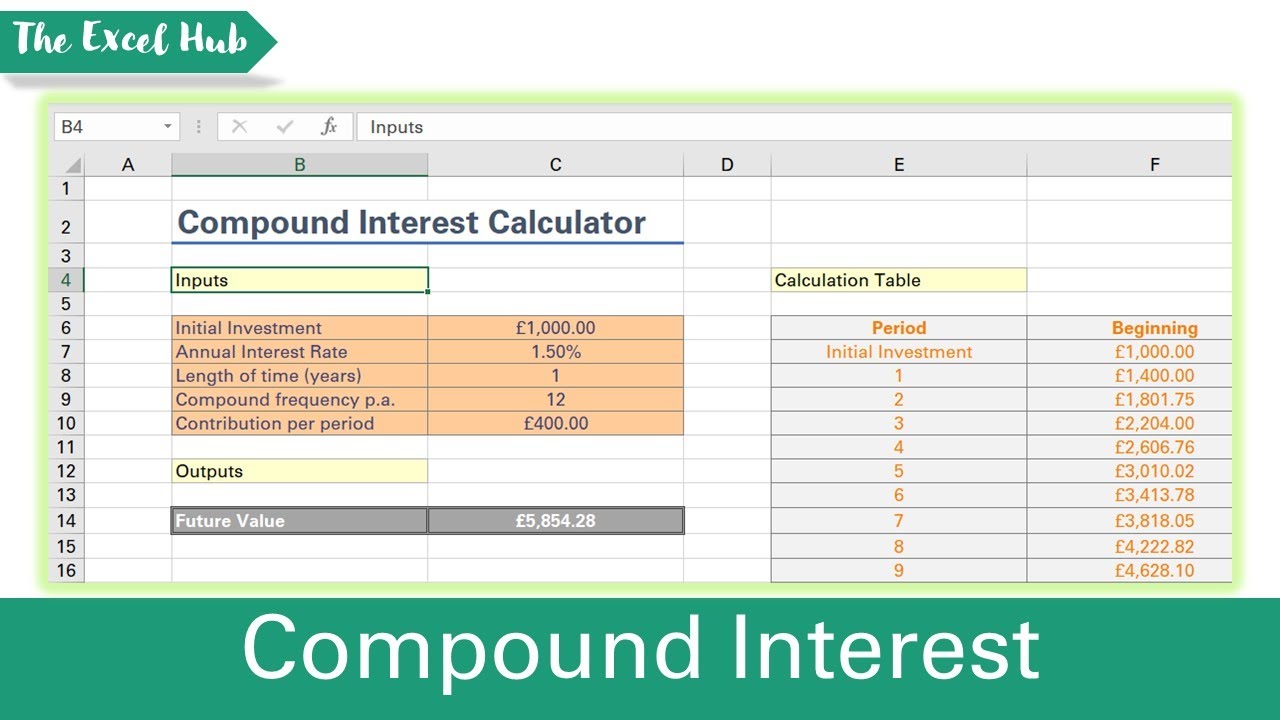

The Magic of the Frequency Toggle

Most people forget about compounding frequency. Does your interest compound annually? Monthly? Daily?

It sounds like splitting hairs. It isn't. Daily compounding means your interest earns interest starting tomorrow. Monthly means you wait thirty days. Over twenty years, that discrepancy can fund a vacation. When you’re messing around with a saving and interest calculator, pay attention to that tiny dropdown menu for "compounding period." It’s the secret sauce.

The $500 Monthly Myth

There’s this idea that you need to be dropping thousands of dollars into an account to see progress. That’s nonsense. Let’s look at a real-world scenario. Say you’re 25 years old. You find a way to scrape together $500 a month. Maybe you cut out the daily $7 lattes—cliché, I know, but the math holds up—and you stop paying for three streaming services you never watch.

🔗 Read more: 1 US Dollar to Birr: What Most People Get Wrong About the New Rate

If you put that $500 into an account with a 5% return, in 30 years, you’ve contributed $180,000. But your balance? It’s over $416,000.

More than half of that money is "free" money. You didn't work for it. Your money worked for it. But if you just kept that cash in a standard 0.01% savings account, you’d have about $180,270. You would have lost out on $235,000 because you didn't check the math. That is the power of a saving and interest calculator. it exposes the "opportunity cost" of being lazy with your bank choice.

Taxes: The Silent Interest Killer

We have to talk about Uncle Sam.

Interest earned in a standard savings account is taxed as ordinary income. If you're in a high tax bracket, that 5% yield might actually feel like 3.5% after the IRS takes their cut. This is why sophisticated savers use calculators to compare taxable accounts versus tax-advantaged ones like a Roth IRA or a 401(k).

If you’re using a saving and interest calculator to plan for retirement, you have to account for the "drag" of taxes. Some tools allow you to input an estimated tax rate. If yours doesn't, just manually drop the interest rate by 20-30% to see the "real" number. It’s a sobering exercise, but it's better to know now than when you’re 65 and trying to buy a beach house.

Real Examples of Compound Interest in Action

Let’s get specific. There was a study by Fidelity that looked at their best-performing accounts over several decades. The winners? Often, they were accounts belonging to people who had literally forgotten they existed. They didn't trade. They didn't "optimize." They just let interest do its thing.

- The Early Starter: Starts at age 20, puts in $200 a month for 10 years, then stops entirely.

- The Late Bloomer: Starts at age 30, puts in $200 a month for 30 years.

Even though the Late Bloomer put in way more money over a longer period, the Early Starter often ends up with a similar or even larger nest egg because those first 10 years had more time to compound. Time is a bigger factor than the amount of money. You can't buy more time.

What People Get Wrong About "Simple" Interest

Simple interest is a scam when it comes to long-term wealth. Simple interest means you only earn money on the principal—the original amount you put in. Compound interest means you earn on the principal plus the accumulated interest.

Most car loans use a form of simple interest (calculated via the U.S. Rule or similar), which is great for the lender. But for your savings, you want the "interest on interest" effect. If your saving and interest calculator shows a straight diagonal line instead of a curve, you’re looking at simple interest. Run away.

How to Use a Calculator for Debt, Too

Interestingly, a saving and interest calculator works in reverse for debt. Credit cards are basically "anti-savings" accounts. They compound interest against you at 20% or 25%.

If you have $5,000 in credit card debt and $5,000 in savings, you aren't "breaking even." Your savings is earning 5% while your debt is costing 25%. You are losing 20% every year. Use the calculator to see how much that debt will cost you if you only pay the minimum. It’s usually enough to make you want to vomit. Then, use the same tool to see how much faster you'd be "in the green" if you diverted your savings contributions to killing that high-interest debt first.

Nuance: The Inflation Factor

We can't ignore the elephant in the room. If your savings account is earning 4% but inflation is running at 5%, you are technically losing purchasing power.

A good saving and interest calculator helps you visualize this. To get a "real" sense of what your money will buy in the future, you should subtract the expected inflation rate from your interest rate. If you expect 3% inflation and you're getting 5% interest, plug 2% into the calculator. That final number is what that money will actually "feel" like in today's dollars.

Actionable Steps to Maximize Your Interest

Stop letting your money sit in a 0.01% account. Just stop. It’s 2026, and moving money between banks takes about three minutes on a smartphone.

- Find your current APY. Look at your last bank statement. If it doesn't say at least 4%, you’re being robbed.

- Run three scenarios. Use a saving and interest calculator to model your current savings path, a "high-yield" path, and an "aggressive" path where you add an extra $100 a month.

- Check for "Bonus" Rates. Many online banks offer a higher rate if you have a direct deposit.

- Automate the "Ouch." Set up an automatic transfer the day after you get paid. If you never see the money in your checking account, you won't miss it.

- Re-evaluate quarterly. Interest rates fluctuate based on the Fed. Don't set it and forget it forever; set a calendar reminder to make sure your bank is still competitive.

Wealth isn't usually about a "big score" or a lottery win. It’s about boring, consistent math. It’s about understanding that a 1% difference in interest isn't just "one percent"—it’s a massive divergence in your future quality of life. Use the tools. Look at the numbers. Then move your money.