You just landed a job with a six-figure salary. You’re stoked. You start doing the mental math—"Okay, $100,000 divided by twelve, that’s over eight grand a month." Then the first paycheck hits. It’s significantly smaller than you expected. Like, "did someone steal my money?" smaller. Honestly, it's the classic American wake-up call. Between the federal government, your state, Social Security, and that Medicare line item, your "gross" pay is basically just a suggestion. This is exactly where a salary tax calculator USA becomes your best friend, or at least your most honest one. It stops the guessing game before you sign a lease on an apartment you can't actually afford.

Most people treat taxes like some mysterious weather event they can't control. They just wait for the W-2 to show up in January and hope for a refund. But if you’re trying to build a budget in 2026, you can't afford to be that passive. Tax brackets shifted again recently to account for inflation, and if you aren't tracking how those adjustments affect your specific bracket, you're flying blind.

Why Your Salary Tax Calculator USA Is Probably Giving You Different Numbers

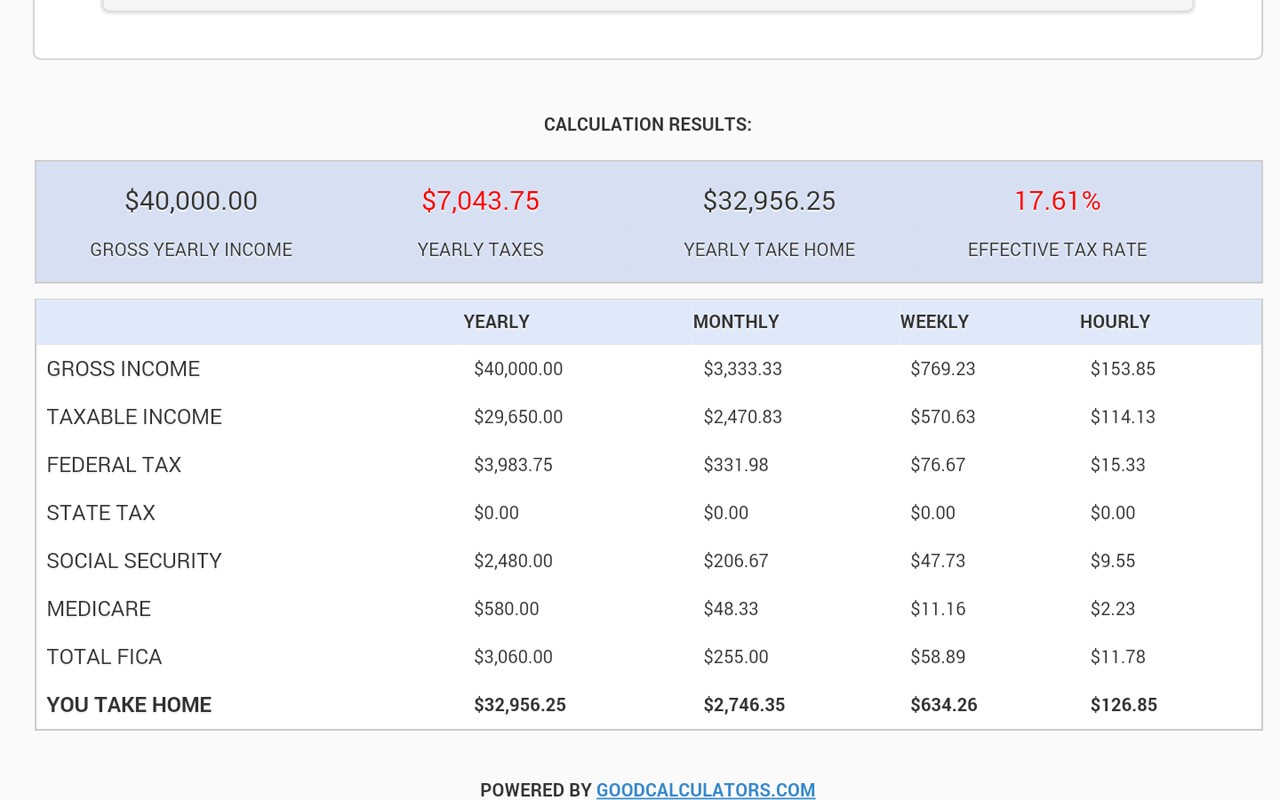

Have you ever noticed that two different websites give you two different "take-home" totals for the exact same salary? It’s frustrating. You’d think math is math, right? Not really. Most basic calculators only look at the Federal Income Tax and maybe the FICA (Social Security and Medicare) taxes. But your life is more complicated than a single data point.

Take the "Tax Cuts and Jobs Act" (TCJA) changes. We are currently staring down the barrel of the 2025 sunset provisions. If Congress doesn't act, tax rates for almost everyone are going to bounce back up to 2017 levels. A good salary tax calculator USA needs to account for whether it's calculating based on current 2026 law or the legacy structures. Then there’s the state level. If you live in Florida or Texas, you’re laughing because there’s no state income tax. But if you move to California or New York? You might see an extra 9% or 10% of your paycheck vanish before it touches your bank account.

Then there’s the Local Tax. People always forget about this. If you work in Philadelphia or New York City, there’s an extra "city tax" on top of everything else. A calculator that doesn't ask for your specific zip code is basically just guessing. It’s like trying to predict the price of gas in the entire country by looking at one station in Iowa.

The FICA Trap and the Social Security Wage Base

Let's talk about the FICA tax because it catches high earners off guard every single year. For 2026, the Social Security wage base has likely climbed again. For those who don't know, you only pay the 6.2% Social Security tax on your earnings up to a certain limit. Once you hit that cap—usually somewhere around $170k or $180k depending on the year's adjustments—your paycheck suddenly gets a 6.2% "raise."

✨ Don't miss: Is US Stock Market Open Tomorrow? What to Know for the MLK Holiday Weekend

I’ve seen people freak out in November because their paycheck is suddenly $500 bigger. They think the payroll department made a mistake. Nope. You just finished paying your Social Security dues for the year. A smart salary tax calculator USA will show you exactly when that "raise" kicks in.

Deductions vs. Credits: The Math That Actually Matters

Most people confuse these two. It's a huge mistake. A deduction reduces the amount of income you are taxed on. A credit is a dollar-for-dollar reduction in the tax you owe.

- Standard Deduction: For 2026, the standard deduction for single filers is roughly $15,000 (adjusted for inflation). If you make $70,000, the IRS only cares about $55,000 of it.

- 401(k) Contributions: This is the big one. If you put $23,000 into a traditional 401(k), you are effectively "hiding" that money from the IRS today. A calculator that doesn't let you input your 401(k) or HSA contributions is useless for real-world budgeting.

- Child Tax Credit: This is a credit. If you owe $10,000 in taxes and have two kids, that credit might wipe out $4,000 of that debt instantly.

The difference between a "good" salary and a "comfortable" life often comes down to how you use these levers. If you’re just taking the standard deduction and not looking at pre-tax benefits, you’re essentially leaving a tip for the IRS. They don't need a tip.

The "Ghost" Taxes Nobody Mentions

Beyond the big federal and state numbers, your "salary tax calculator USA" experience needs to include the stuff your employer takes out for you. Health insurance premiums are the biggest culprit. According to data from the Kaiser Family Foundation, the average worker pays several thousand dollars a year toward their employer-sponsored health plan. That money comes out "pre-tax," which is good, but it still means your net pay is lower.

Then there’s the Supplemental Tax Rate. If you get a bonus or a commission, you might notice it's taxed at a flat 22% (federally) regardless of your normal bracket. People see their $5,000 bonus turn into $3,200 and think they're being "penalized" for working hard. You aren't. It's just a withholding rule. You’ll usually get some of that back when you file your return if your actual tax bracket is lower than 22%.

🔗 Read more: Big Lots in Potsdam NY: What Really Happened to Our Store

The Reality of Marginal Tax Brackets

This is the biggest misconception in American finance. I hear it all the time: "I don't want a raise because it will push me into a higher tax bracket and I'll take home less money."

That is literally impossible in the U.S. tax system. We use marginal brackets.

Think of your income like a series of buckets. The first bucket (up to about $11,600) is taxed at 10%. The next bucket is taxed at 12%. Moving into a higher bracket only means the extra money you earned is taxed at the higher rate. The money you earned in the lower buckets stays taxed at the lower rates.

If a salary tax calculator USA tells you your "effective tax rate" is 18%, that’s an average of all your buckets combined. It’s a much more useful number than your marginal rate when you're trying to figure out if you can afford a new car payment.

Actionable Steps to Master Your Take-Home Pay

Stop guessing. If you want to actually control your finances instead of letting the payroll department do it for you, follow this checklist.

💡 You might also like: Why 425 Market Street San Francisco California 94105 Stays Relevant in a Remote World

1. Run a "What-If" Analysis

Use a high-quality salary tax calculator USA to run three scenarios: your current pay, your pay if you max out your 401(k), and your pay if you move to a different state. You’d be shocked how much a move from New Jersey to Florida changes your lifestyle without a single cent of a "raise."

2. Audit Your W-4

If you got a massive tax refund last year—say, $5,000—that's not a win. That’s an interest-free loan you gave the government. You could have had an extra $400 a month in your pocket. Use the IRS Tax Withholding Estimator (it’s the gold standard) to adjust your W-4 so you break even at the end of the year.

3. Factor in the HSA

If you have a High Deductible Health Plan, use an HSA. It’s the only "triple tax-advantaged" account in the USA. The money goes in tax-free, grows tax-free, and comes out tax-free for medical expenses. A salary tax calculator will show you that even a $100 monthly contribution reduces your taxable income, saving you money on two fronts.

4. Account for Local Variations

Don't just look at state taxes. Look at "Local Services Taxes" (LST) or "Occupational Privilege Taxes." Some cities charge a flat $52 a year; others take a percentage. It sounds small, but when you're calculating a tight budget, $50 matters.

5. Track the 2026 Legislative Changes

Stay updated on the "Tax Cuts and Jobs Act" extensions. If the standard deduction is scheduled to drop, your take-home pay will decrease even if your salary stays the same. Knowing this six months in advance prevents a financial crisis in January.

The math behind a salary tax calculator USA isn't just about numbers; it's about freedom. When you know exactly what is hitting your bank account every second Friday, you stop living in fear of the IRS and start living within your means. Taxes are mandatory, but overpaying throughout the year is optional. Take the ten minutes to run the numbers properly. Your future self will thank you for the extra breathing room.