Compound interest is a bit like magic, but without the top hats and rabbits. Most people think they understand how their savings grow, but then they actually sit down with a roth ira growth calculator and realize they were way off. Usually, they’re off by a few hundred thousand dollars. That’s the kind of math error that keeps you working until you’re eighty when you could have been on a beach at sixty.

It’s wild.

You put in five hundred bucks a month. You assume a seven percent return. You look at the thirty-year mark. The number that pops up doesn't even look real. But that’s the beauty of the Roth. You aren’t just looking at growth; you’re looking at your money. Every cent the calculator spits out is yours to keep because Uncle Sam already took his cut when you earned the paycheck.

Why the Math Behind a Roth IRA Growth Calculator Matters

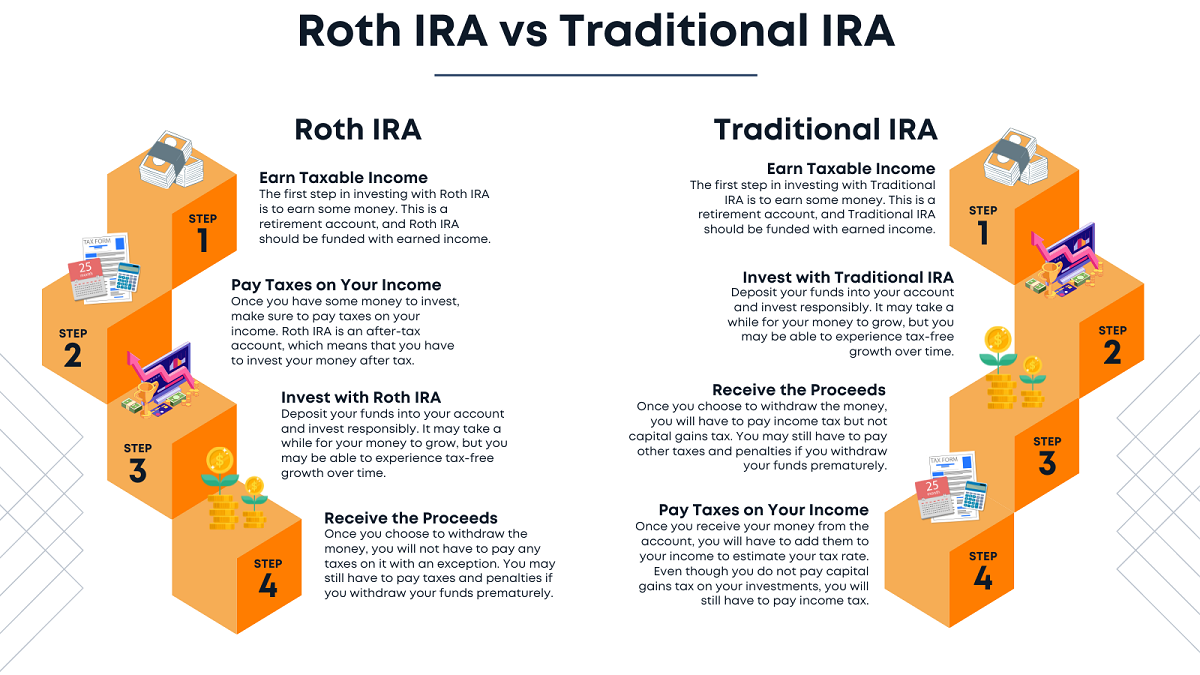

Most people obsess over the "now." They care about the tax deduction they get with a Traditional IRA or a 401(k). It feels good to see that tax bill drop in April. But honestly? That’s short-term thinking. A roth ira growth calculator shows you the "later," and the later is almost always more expensive than people realize.

When you use one of these tools, you’re basically simulating a thirty-year timeline in three seconds. It takes your current age, your expected retirement age, and that spicy little variable called the "annual rate of return."

Let’s look at a real-world scenario. Say you’re thirty years old. You’ve got nothing saved yet (don’t panic, lots of people are in that boat). You decide to max out your Roth IRA. For 2024, that’s $7,000. If you do that every year and hit an average 8% return—which is actually slightly below the S&P 500’s historical average—you’re looking at over $800,000 by age sixty-five.

👉 See also: Why Are Energy Stocks Down Today? What Most People Get Wrong

If you did that in a taxable brokerage account? You’d be handing over a massive chunk of that $800k in capital gains taxes. The calculator proves that the tax-free nature of the Roth is actually the most powerful "hidden" multiplier in finance.

The Problem With Average Returns

Here is where it gets tricky. Most calculators use a flat percentage. They ask for "7%" or "8%." But the stock market isn't a flat line. It’s a jagged mountain range.

If the market drops 20% in year two and then gains 20% in year three, you aren't back to even. You're actually down. This is called "sequence of returns risk." While a basic roth ira growth calculator gives you a great baseline, it can't predict the exact path. It’s a roadmap, not a GPS. You have to account for the fact that some years will be ugly.

Contribution Limits: The Ceiling You Have to Respect

You can't just dump a million dollars into a Roth IRA tomorrow. I wish. The IRS is very picky about how much "tax-free" joy they allow you to have.

For 2024, the limit is $7,000 for those under age 50. If you’re 50 or older, you get a "catch-up" contribution, bringing the total to $8,000. These numbers usually creep up every year or two based on inflation. When you’re plugging numbers into a roth ira growth calculator, you have to be realistic about these caps. You can’t tell the calculator you’re going to invest $2,000 a month if the law only lets you invest about $583.

Unless you’re doing a Backdoor Roth.

That’s a whole different animal. If you make too much money—specifically, if your Modified Adjusted Gross Income (MAGI) is over $161,000 for singles or $240,000 for married couples in 2024—you can’t contribute directly. You have to put money in a Traditional IRA and then convert it. A good calculator doesn't care how the money got there, only that it’s growing tax-free.

💡 You might also like: EGP to Dollar Black Market: What Most People Get Wrong

Inflation: The Silent Killer of Your Gains

A million dollars today sounds like a lot. In thirty years? It’ll probably buy you a nice used SUV and a sandwich. Okay, maybe it’s not that bad, but inflation is real.

When you use a roth ira growth calculator, you should honestly try running the numbers with a "real" rate of return. If you think the market will do 10%, put 7% into the calculator. That 3% difference is the historical average of inflation. It gives you a much better picture of what your "purchasing power" will actually look like when you’re ready to stop working.

The "Time" Factor is Not Negotiable

If you play around with the numbers, you’ll notice something crazy. The growth in the last five years of a thirty-year span is usually more than the growth in the first fifteen years combined.

That’s the "hockey stick" curve.

If you start at twenty-five, you’re a genius. If you start at forty-five, you’ve got to be a lot more aggressive. A roth ira growth calculator is actually a pretty good reality check for the procrastinators among us. It shows you the literal "cost of waiting." Waiting five years to start can cost you hundreds of thousands of dollars in the long run. It’s depressing, but it’s also the kick in the pants most people need to open an account.

Diversification and Risk Tolerance

Just because you have a Roth IRA doesn't mean the money is magically growing. It’s just a bucket. You have to choose what goes inside the bucket.

- Total Stock Market Indices: These are the fan favorites. Low fees, broad exposure.

- Target Date Funds: Set it and forget it. They get more conservative as you get older.

- Individual Stocks: High risk, high reward. Not for the faint of heart.

- Bonds: Boring, but they keep you from jumping off a ledge when the market crashes.

Your roth ira growth calculator results depend entirely on the risk you’re willing to take. If you’re twenty-two and holding 50% in bonds, you’re basically throwing money away. You have time to weather the storms.

Misconceptions About Taking Money Out

People think their money is locked in a vault until they’re 59.5 years old. That’s not entirely true with a Roth.

Since you already paid taxes on your contributions, you can actually take that specific money out whenever you want, for any reason, without a penalty. If you put in $10,000 over two years and you have an emergency, you can take that $10k back. It’s the earnings—the growth—that you have to leave alone.

If you touch the growth before 59.5 (and before the account has been open for five years), the IRS will come for their 10% penalty and income tax. There are exceptions for first-time home purchases or education, but generally, you want to let that roth ira growth calculator vision stay intact.

Real Example: The Tale of Two Savers

Let’s look at Sarah and Mike.

Sarah starts at 25. She puts in $300 a month until she’s 35, then stops entirely. She never adds another dime. She just lets it sit until she’s 65.

Mike waits until he’s 35 to start. He realizes he’s behind, so he puts in $300 a month for the next thirty years until he’s 65.

Who has more money?

Even though Mike invested way more total cash, Sarah ends up with more. Because she gave her money an extra ten years to compound, her roth ira growth calculator results would likely beat Mike’s, despite him contributing for three times as long. Time is more important than the amount. Read that again.

Actionable Steps to Maximize Your Growth

Stop looking at the calculator and start moving. Here is the play-by-play for actually hitting those numbers.

- Check your eligibility. If you're under the income limit, open a Roth at a low-cost brokerage like Fidelity, Vanguard, or Schwab. If you're over the limit, look into the Backdoor Roth process.

- Automate the "Ouch." Set up a recurring transfer from your checking account the day after you get paid. If you wait until the end of the month to see what’s left, the answer will be "zero."

- Invest the cash. This is the biggest mistake people make. They move money into the Roth IRA but forget to actually buy stocks or funds. It just sits there in a core position earning 0.01%. Check your account. Ensure your money is actually in the market.

- Rebalance annually. Once a year, maybe on your birthday, check your allocations. If your stocks did great and now make up 90% of your portfolio when you wanted 80%, sell some and buy some bonds or international funds.

- Ignore the noise. When the news says the market is "tumbling," don't log in. Don't sell. The roth ira growth calculator assumes you stay the course. The only way to guarantee you miss out on the growth is to get out of the car while it’s moving.

The math doesn't lie, but it does require patience. A Roth IRA isn't a get-rich-quick scheme. It's a "get-very-wealthy-slowly" scheme. It works every time, provided you actually give it the time it needs.