Most people look at a house and see a kitchen island or a backyard for the dog. Banks see a math problem. When you’re staring at a $450,000 listing, your brain probably jumps straight to "Can I afford the monthly payment?" That’s a fair start, but it's also where most people stop. They use a basic tool to get a single number, like $2,800, and call it a day. Honestly, that’s a mistake. Using a mortgage payment calculator with amortization schedule is less about that final monthly number and more about seeing how much of your hard-earned money is being set on fire by interest over thirty years.

It’s brutal.

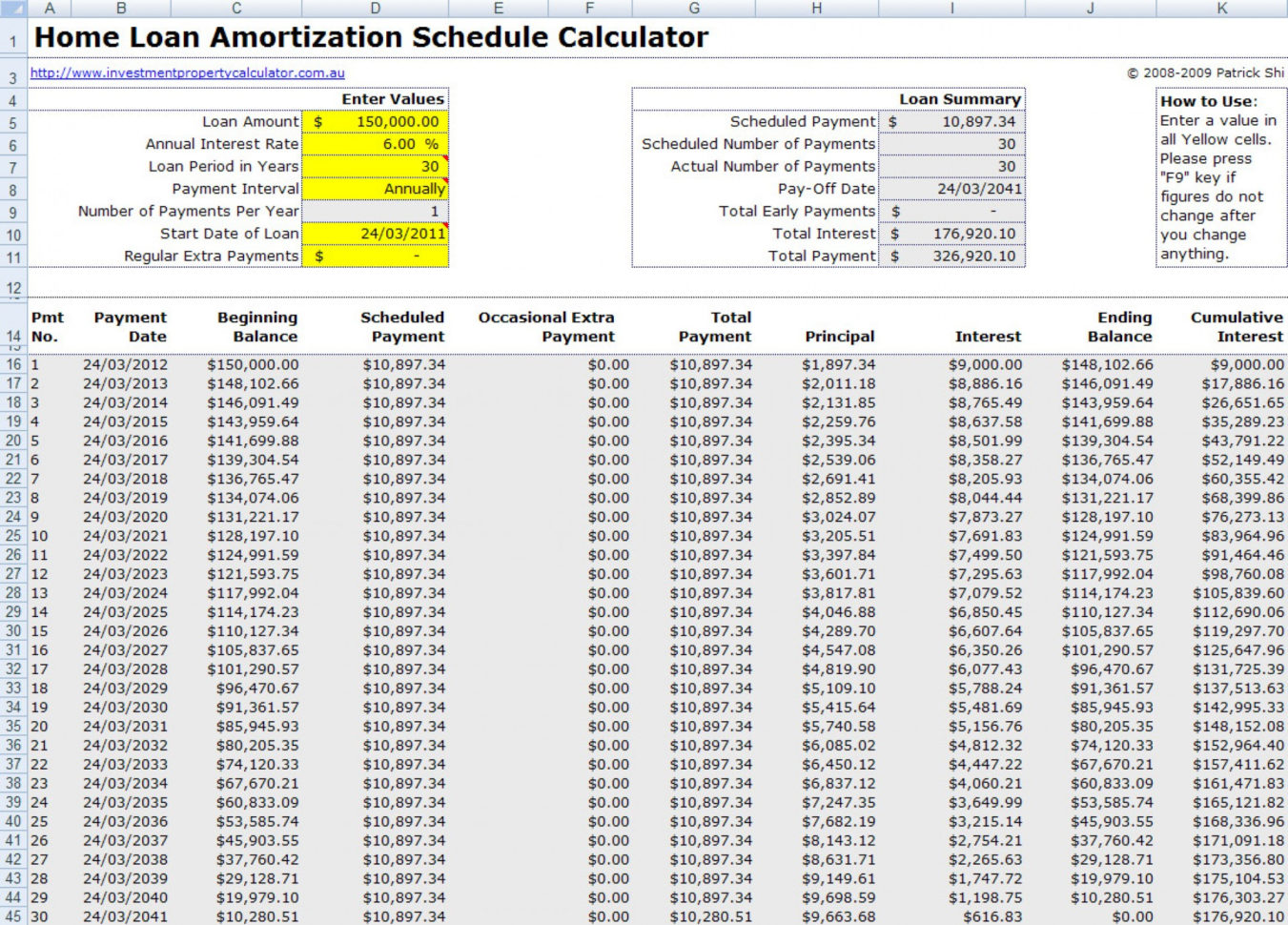

If you look at the first few years of a standard 30-year fixed loan, you’re barely chipping away at the house itself. You’re mostly just paying the bank for the privilege of borrowing their cash. A mortgage payment calculator with amortization schedule peels back the curtain on this process. It shows you the month-by-month breakdown of principal versus interest. Seeing that $1,500 of your $2,800 payment is going toward interest in month one is a wake-up call. It’s also the only way to realize how much power you actually have to change those numbers.

Why the Schedule Matters More Than the Payment

When you sign those papers, you're agreeing to a math formula. Most US mortgages use "ordinary simple interest," which is calculated monthly. Because your balance is highest at the beginning, your interest charges are also highest then.

It’s front-loaded.

An amortization schedule is basically a map of this journey. Without it, you’re driving blind. You might think that paying an extra $100 a month doesn't matter much on a massive loan. You’d be wrong. Because of how the math works, that extra hundred bucks in year one is worth way more than an extra hundred in year twenty-five. It kills the interest-generating potential of that part of the principal forever.

The Math Behind the Magic

Let’s talk about the formula. It isn't just $Price / Months$. The standard formula for a monthly payment $M$ is:

$$M = P \frac{r(1+r)^n}{(1+r)^n - 1}$$

Where:

- $P$ is the principal loan amount.

- $r$ is your monthly interest rate (annual rate divided by 12).

- $n$ is the total number of months.

Every time you make a payment, the bank calculates the interest on the current balance. Whatever is left over from your check goes to the principal. This is why the early years feel like you're running in place. If you don't use a mortgage payment calculator with amortization schedule, you won't see the exact "crossover point"—the month where you finally start paying more toward your house than toward the bank’s profit. In a 30-year loan at 7%, that crossover doesn't happen until roughly year 22. That’s a long time to wait to start actually owning your home.

The APR Trap and Closing Costs

People obsess over the "sticker price" interest rate. The Federal Reserve might move rates, and everyone panics. But the rate you see in an ad isn't your APR. The Annual Percentage Rate (APR) includes the interest rate plus points, broker fees, and other credit charges.

It’s the real cost.

👉 See also: 30 Broad Street NY NY 10004: Is It Still the Power Address of Lower Manhattan?

When you plug numbers into a mortgage payment calculator with amortization schedule, make sure you're using the loan amount after your down payment, but including any financed closing costs. If you’re rolling $10,000 of closing costs into a $400,000 loan, you’re paying interest on those fees for 30 years. That $10,000 could end up costing you $25,000 by the time the house is yours.

Don't Ignore Escrow

Your mortgage payment isn't just principal and interest. It’s usually PITI: Principal, Interest, Taxes, and Insurance. A good calculator helps you separate these. Taxes and insurance don't build equity. They’re just the cost of doing business. If you live in a high-tax state like New Jersey or Illinois, your "actual" mortgage payment might be 40% taxes. The amortization schedule only applies to the P and I. If you ignore the rest, your budget will explode.

How to Hack Your Amortization

This is where it gets interesting. Once you have the schedule in front of you, you can start playing "what if." What if you paid bi-weekly instead of monthly? By paying half your mortgage every two weeks, you end up making 26 half-payments.

That’s 13 full payments a year.

That one extra payment usually shaves 5 to 7 years off a 30-year mortgage. Just one. It happens because you’re reducing the principal faster, which means there’s less balance for the interest to compound on next month. A mortgage payment calculator with amortization schedule lets you see this in real-time. You can literally see the "Total Interest Paid" number drop by tens of thousands of dollars.

The Psychology of Extra Payments

Some financial advisors say you shouldn't pay off a mortgage early if your interest rate is low. They argue you could make more in the S&P 500. Mathematically? They're often right. If your mortgage is at 3% and the market returns 8%, you're "winning" by 5%.

But math doesn't account for sleep.

For a lot of people, the security of a paid-off home is worth more than a theoretical 5% spread. Using a mortgage payment calculator with amortization schedule allows you to find a middle ground. Maybe you don't pay the whole thing off, but you pay enough to get rid of Private Mortgage Insurance (PMI).

👉 See also: The Rookie Escape Plan: Why New Investors Are Getting Out While They Still Can

PMI is basically a "low down payment tax." It protects the lender, not you. Usually, once you hit 20% equity, you can ask to drop it. The schedule tells you exactly which month that will happen. If you’re at 18% equity, throwing a few thousand dollars at the principal to hit that 20% mark can save you $150 a month instantly. That’s a massive return on investment.

Common Mistakes When Using Calculators

I see people do this all the time: they put in the purchase price instead of the loan amount. If the house is $500k and you put $100k down, your loan is $400k. Calculating based on $500k makes your amortization schedule useless.

Another one? Not adjusting for "points." Sometimes lenders offer a lower rate if you pay "points" upfront (1 point = 1% of the loan). You need to calculate if the monthly savings from that lower rate actually cover the upfront cost before you sell the house. If it takes 7 years to "break even" on the points, but you plan to move in 5, you just gave the bank a gift.

The "Hidden" Costs of Refinancing

When rates drop, everyone rushes to refinance. They see a lower monthly payment and think they’re winning. But check your mortgage payment calculator with amortization schedule first. If you’ve been paying your 30-year mortgage for 10 years and you refinance into a new 30-year mortgage, you just reset the clock. You’re back at year one, where interest is highest. You might save $200 a month, but you added 10 years of interest payments. You might actually end up paying more in the long run.

Real-World Example: The $300k Loan

Let’s look at a $300,000 loan at 6.5% interest.

- Monthly P&I: $1,896.20

- Total Interest over 30 years: $382,633

Wait. Read that again. You’re paying $382k in interest for a $300k house. You’re literally buying the house for yourself and more than one house for the bank.

Now, look at the amortization schedule. In month one, $1,625 goes to interest. Only $271 goes to the principal.

If you add just $100 to that first payment, your principal hit goes from $271 to $371. That’s a 37% increase in how much of your house you actually own that month. Over the life of the loan, that $100 extra per month saves you over $60,000 in interest and knocks 4 years off the loan. This is why the schedule is the most powerful tool in your financial belt. It turns abstract numbers into a strategy.

📖 Related: Definition Rules of Engagement: Why They Keep Most Leaders From Succeeding

What to Do Next

Don't just look at the monthly payment and assume you're good. Pull up a mortgage payment calculator with amortization schedule and run three different scenarios.

- The Baseline: Put in your actual expected loan amount, rate, and term. Look at the "Total Interest" figure. Let that number sink in. It should be slightly painful.

- The "Lump Sum" Test: See what happens if you take your tax refund—say $3,000—and apply it as a one-time principal payment in Year 2. Look at how many months that single payment deletes from the end of your loan. Usually, it's more than you’d think.

- The PMI Exit: If you’re putting down less than 20%, find the month on the schedule where your balance hits 80% of the original value. Mark that date on your calendar. That is your "raise" day—the day you stop paying for insurance that doesn't benefit you.

Before you lock in a rate, ask your lender for a "closing disclosure." It’s a legal document that mirrors what a mortgage payment calculator with amortization schedule tells you. Compare it to your own numbers. If the "Finance Charge" (total interest + fees) is way higher than you calculated, ask why. Sometimes there are hidden fees tucked into the "prepaid" section.

Take control of the math before the bank takes control of your paycheck. Look at the principal column, not just the total. Every dollar you move from the "Interest" column to the "Principal" column is a dollar that stops working for the bank and starts working for your net worth. It’s the closest thing to a "free lunch" in the financial world. Use the schedule to find where those dollars are hiding.

Go run the numbers. Seriously. You might find that a slightly smaller house or a slightly larger down payment changes your entire financial future. The schedule doesn't lie, and it doesn't care about the "dream home" hype. It just shows you the cost of the money. Know that cost before you sign.