So, here we are in 2026. If you’ve been sitting on the sidelines waiting for a "return to normal," I have some bad news. The "normal" you're remembering—those 3% rates from the pandemic era—wasn't normal at all. It was a glitch in the matrix. Now, the home interest rate forecast is finally looking like something we can actually work with, but it’s not the fire sale everyone hoped for.

Markets are messy. Honestly, anyone telling you they know exactly where the 30-year fixed will be in December is probably selling a course you shouldn't buy. We’ve watched the Federal Reserve dance around inflation for years now, and while the "higher for longer" era has technically cooled off, the floor is much higher than it used to be. You've probably noticed that mortgage lenders are acting a bit more skittish lately. That’s because the spread between the 10-year Treasury yield and mortgage rates remains stubbornly wide, a lingering hangover from the volatility of '24 and '25.

Why the Home Interest Rate Forecast Feels Like a Rollercoaster

You can’t talk about rates without talking about the Fed. Even though they don't set mortgage rates directly, they set the vibe. When Jerome Powell nudges the federal funds rate, the bond market reacts like a startled cat. We're seeing a trend toward stabilization, though. Most analysts at firms like Goldman Sachs and the Mortgage Bankers Association (MBA) are signaling that we’ve finally entered a period of "boring" fluctuations. Boring is good. Boring means you can actually plan a budget without the rug being pulled out from under you.

✨ Don't miss: Columbia Bank Saddle Brook: Why This Local Branch Actually Matters

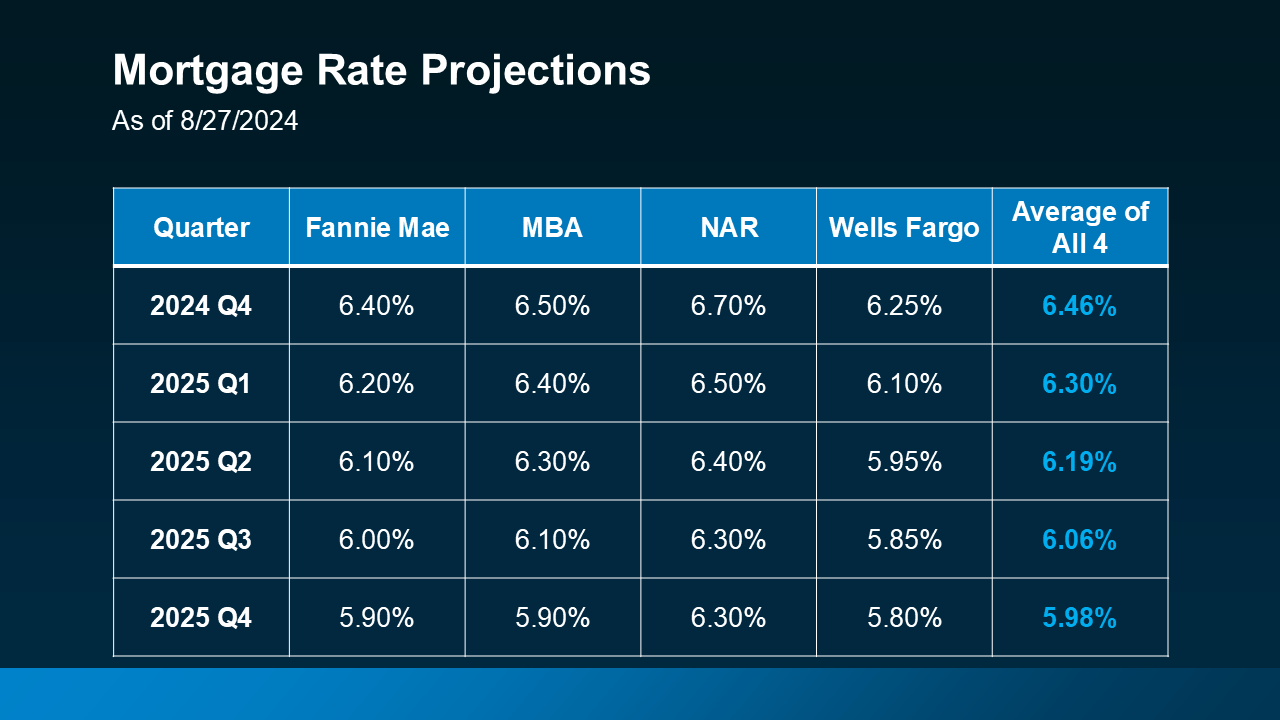

What's weird is how the inventory crisis is still propping up prices even as rates hover in that 5.8% to 6.4% range. You'd think high rates would kill demand. Nope. People still need roofs.

The data suggests that for every half-point drop in the home interest rate forecast, another five million households suddenly become "eligible" or interested in jumping back into the fray. This creates a ceiling. If rates drop too fast, demand spikes, prices moon, and we’re right back where we started with an affordability crisis. It's a delicate balancing act that the central bank is trying to manage with the grace of a toddler on a tightrope.

The 10-Year Treasury Connection

If you want to be the smartest person at the dinner party, stop looking at the Fed and start looking at the 10-year Treasury yield. Mortgage rates generally track this pretty closely. Usually, there’s about a 1.5 to 2 percentage point "spread" between the two. Recently, that spread has been closer to 2.5 or 3 points because banks are terrified of "prepayment risk." They don't want to give you a loan today that you’re just going to refinance in six months when rates tick down another quarter point.

Predicting the Unpredictable: 2026 and Beyond

Let's get into the weeds. Lawrence Yun, the Chief Economist at the National Association of Realtors, has been banging the drum about supply for a long time. He’s right. The home interest rate forecast is only one half of the equation. Even if we see a dip toward 5.5% by the end of the year, the "locked-in" effect is still real. Millions of homeowners are sitting on 2.75% mortgages. They aren't moving unless they absolutely have to—divorce, death, or a massive promotion in a different state.

This lack of churn keeps the market tight.

- New construction is trying to fill the gap, but builders are facing their own high borrowing costs.

- Foreclosures haven't spiked like the doomers predicted because equity is at an all-time high.

- Institutional investors are still scooping up single-family homes, though at a slower pace than the 2021 gold rush.

I talked to a loan officer in Chicago last week who said her phone is finally ringing again, but the callers aren't looking for "deals." They're looking for "stability." They’ve accepted that the 6% range is the new 3%. Once you accept that, you can actually start living your life.

Geopolitics and Your Monthly Payment

It sounds crazy, but a conflict halfway across the world affects what you pay for a bungalow in Ohio. Global instability drives investors toward "safe havens" like U.S. Treasuries. When everyone buys Treasuries, yields go down. When yields go down, your mortgage rate usually follows. So, ironically, bad news globally can sometimes mean a slightly better home interest rate forecast for your Refi. It's a grim trade-off, but that's how the global gears grind.

Stop Waiting for the "Crash"

Here is the truth: the crash isn't coming. We don't have the subprime "ninja" loans (No Income, No Job or Assets) that blew up the world in 2008. The people buying homes today have high credit scores and significant down payments. They can afford their mortgages.

If you're waiting for rates to hit 4% before you buy, you might be waiting until 2030, or forever. Meanwhile, rents are climbing. You're paying a mortgage regardless; the only question is whether it's yours or your landlord's. The real risk in the current home interest rate forecast isn't that rates will go up to 10%—it's that they will stay exactly where they are while home prices continue to drift upward at 3-5% a year.

Missing out on a year of appreciation because you wanted to save $150 a month on your payment is a math error.

Practical Moves to Make Right Now

Don't just watch the news. Act. If you're looking to buy or refinance, there are specific things you can do to beat the averages.

Focus on your DTI ratio. Debt-to-income is the metric lenders are obsessed with right now. Even if the national home interest rate forecast looks bleak, a borrower with a 25% DTI is going to get a much better "par" rate than someone sitting at 45%. Pay off the car. Kill the credit card balance.

🔗 Read more: China Tariff Update Today: Why the $1.2 Trillion Surplus Changes Everything

Consider the 15-year fixed. Everyone defaults to the 30-year. But the rate gap between a 30-year and a 15-year has widened. If you can swing the higher payment, you'll save hundreds of thousands in interest and likely shave a full point off the advertised 30-year rate.

Look into "Buy-Downs." Sellers are still willing to negotiate in many markets. Instead of asking for a price drop, ask the seller to fund a 2-1 buy-down. This drops your interest rate by 2% the first year and 1% the second year. It gives you a "ramp up" period while you wait for a potential permanent refinance opportunity later.

The era of easy money is over, but the era of smart money is just starting. Keep your eye on the 10-year yield, keep your credit score above 760, and stop listening to "crash" influencers on TikTok. The market is stabilizing, and in the world of real estate, stability is the greatest gift you can get.

Next Steps for Your Portfolio

First, get a "soft pull" pre-approval to see where you actually stand today. Don't guess. Second, run a "break-even" analysis on any refinance—if it takes you more than 24 months to recoup the closing costs, it's probably not worth it yet. Finally, keep a close watch on the monthly Consumer Price Index (CPI) reports; as long as inflation stays near that 2% target, the pressure on rates will remain downward, giving you a better window to jump in by Q3 or Q4.