You've probably heard the "10%" rule a thousand times. It’s the standard line from financial advisors, YouTubers, and that one uncle who thinks he’s a day trader. They tell you that the historical rate of return s&p 500 is basically a guaranteed ticket to doubling your money every seven years. But honestly? That number is a bit of a mirage. It’s true, but it’s also kinda lying to you.

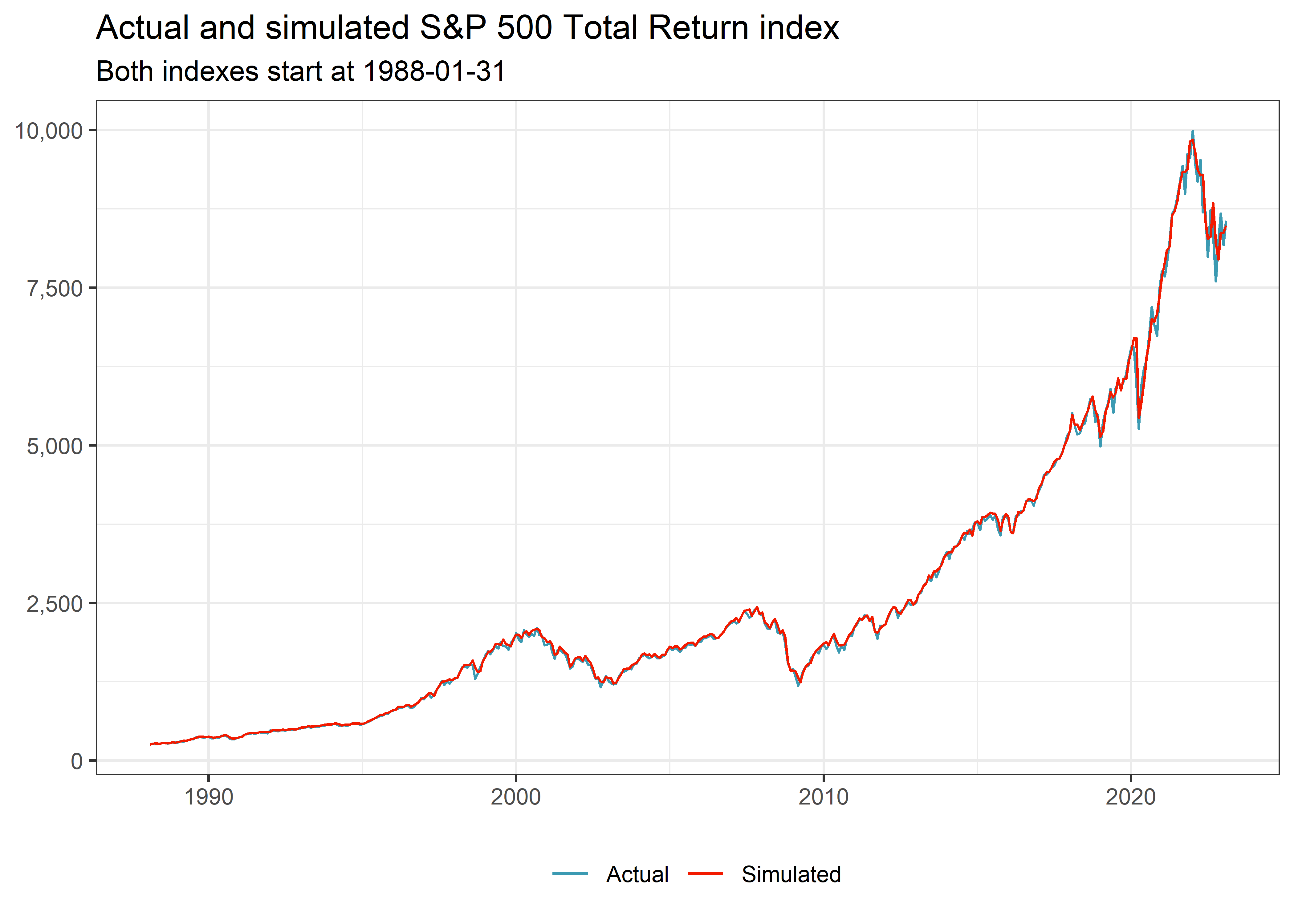

The S&P 500 isn't just a list of stocks; it's a living, breathing representation of American capitalism. It’s 500 of the largest companies in the U.S., weighted by market cap. When you look at the raw data, the average annual return since its inception in 1957 through the end of 2023 is roughly 10.26%. If you go all the way back to the index's precursors in the 1920s, it’s still hovering right around that 10% mark.

But nobody actually experiences "average" returns.

The Inflation Thief and the "Real" Return

If you're planning your retirement based on a 10% return, you're going to be disappointed. Inflation eats your gains like a termite in a log cabin. While the nominal historical rate of return s&p 500 looks flashy, the "real" rate of return—which is what you can actually buy with your money—is closer to 6.5% or 7%.

That’s a massive difference. Over 30 years, that gap represents hundreds of thousands of dollars in purchasing power.

Then there’s the sequence of returns risk. The market doesn't just hand you 10% every January. Some years, like 2008, you lose 37%. Other years, like 1954, you gain 52%. If you happen to start investing right before a "lost decade"—think 2000 to 2010—your personal historical rate might be closer to zero for a long time. People who retired in 1999 had a much harder time than those who retired in 1982. It’s basically a lottery of birth years.

Dividends: The Silent Workhorse

Most people just look at the price chart. That's a mistake. If you ignore dividends, you're missing about 40% of the total return history of the S&P 500. Back in the 1940s and 50s, dividend yields were often 5% or higher. Today, they're much lower, often under 2%, because companies prefer share buybacks.

But when you reinvest those dividends? That's where the magic happens.

Why the Historical Rate of Return S&P 500 Varies So Much

Why does the number keep changing depending on who you ask? Because the "start date" matters more than almost anything else.

If you measure from the bottom of the Great Depression, the numbers look legendary. If you measure from the peak of the Dot-com bubble, they look mediocre. Jeremy Siegel, a professor at Wharton and author of Stocks for the Long Run, argues that over very long periods—we’re talking 100+ years—the real return of stocks has been remarkably consistent at about 6.7%. He calls it the "Siegel Constant."

But the path to that constant is a nightmare of volatility.

Look at the 1970s. The market was basically flat for a decade while inflation was skyrocketing. You were losing money in real terms even if the S&P 500 stayed level. Then look at the 1990s, where the index returned nearly 20% annually. It’s a wild ride. It’s not a ladder; it’s a jagged mountain range with sheer cliffs.

The Impact of Modern Tech Giants

Today’s S&P 500 isn't the same beast it was in the 70s. It’s heavily concentrated. A handful of companies—Apple, Microsoft, Nvidia, Alphabet, Amazon—now make up a huge chunk of the index’s value. This "top-heavy" nature means the historical rate of return s&p 500 is increasingly driven by the tech sector.

If Big Tech sneezes, the whole index catches a cold.

Some analysts, like those at Vanguard, have actually predicted that future returns might be lower than the historical average because current valuations (Price-to-Earnings ratios) are so high. When you pay a premium for stocks today, you're often "borrowing" from future returns.

Surviving the Volatility

How do you actually capture that 10% (or 7% real) return? You have to stay in the game.

Data from Dalbar shows that the average individual investor vastly underperforms the S&P 500. Why? Because they panic. They sell when the market drops 20% and buy back in after it’s already recovered.

Missing just the 10 best days in the market over a 20-year period can cut your total return in half. Think about that. Twenty years of investing, and if you were "out of the market" for just two weeks of peak performance, you’re broke compared to the guy who just sat on his hands.

Volatility is the "Fee" for Performance

Morgan Housel, author of The Psychology of Money, says it best: Volatility isn't a fine; it's an admission fee. You have to be willing to feel the pain of a 30% drop to earn the right to the long-term gains.

Actionable Steps for Using This Data

Knowing the historical rate of return s&p 500 is useless if you don't apply it correctly to your own life.

First, stop using 10% in your spreadsheets. Use 6% or 7% if you want to be realistic about what your money will actually buy in the future. This accounts for inflation and the likelihood that future returns might be slightly lower due to current high valuations.

Second, check your stomach. If you see your $100,000 portfolio drop to $65,000, will you sell? If the answer is yes, you shouldn't be 100% in an S&P 500 index fund. You might need some bonds or cash to dampen the swings, even if it lowers your total expected return.

💡 You might also like: Converting RM to US Dollar: What Most People Get Wrong About Exchange Rates

Third, automate everything. Since we know that timing the market is a fool's errand and that missing the "best days" is a portfolio killer, dollar-cost averaging is the only logical move for most people. Buy every month, regardless of whether the news is saying the economy is booming or crashing.

Finally, keep an eye on the "Cape Ratio" or Shiller P/E. It's a valuation measure that looks at real earnings over ten years. When it's very high, like it is now by historical standards, it doesn't mean a crash is coming tomorrow, but it does mean you should probably temper your expectations for the next decade.

The S&P 500 is a powerful wealth-building tool, arguably the best ever created for the average person. But it’s not a straight line. It’s a jagged, stressful, and often frustrating path that only rewards those who can stay strapped in for the entire ride.

Next Steps for Your Portfolio:

- Audit your "Retirement Number": Recalculate your goals using a 6% "real" return instead of 10% nominal.

- Rebalance annually: If tech has surged, you might be more exposed than you realize. Sell a little of what’s grown and buy what’s lagging to maintain your risk profile.

- Set up an "Ouch" Fund: Keep enough cash in a high-yield savings account so that when the market inevitably drops 20%, you don't have to sell your stocks to pay for a new water heater.

- Ignore the daily noise: The historical rate of return is measured in decades, not days. Turn off the financial news if it makes you want to trade.