If you’ve been scrolling through micro-cap tickers lately, you’ve probably seen Hillcrest Energy Technologies stock pop up on a few watchlists. It’s one of those companies that sounds like a generic green energy firm until you actually look at the hardware they’re building. Honestly, most people see a penny stock and assume it’s all "hopes and dreams," but Hillcrest is currently sitting at a weirdly specific crossroads between heavy industrial power and the AI data center boom.

The stock, which trades under HEAT on the CSE and HLRTF on the OTCQB, has had a wild ride over the last year. As of mid-January 2026, it’s been hovering around the $0.14 to $0.16 USD range. It’s small. It’s volatile. But it’s also just finished a series of technical validations that usually belong to companies with much bigger balance sheets.

The Secret Sauce: It’s Not Just "Clean Energy"

Most investors talk about Hillcrest like it’s a solar company or a wind farm play. It isn't.

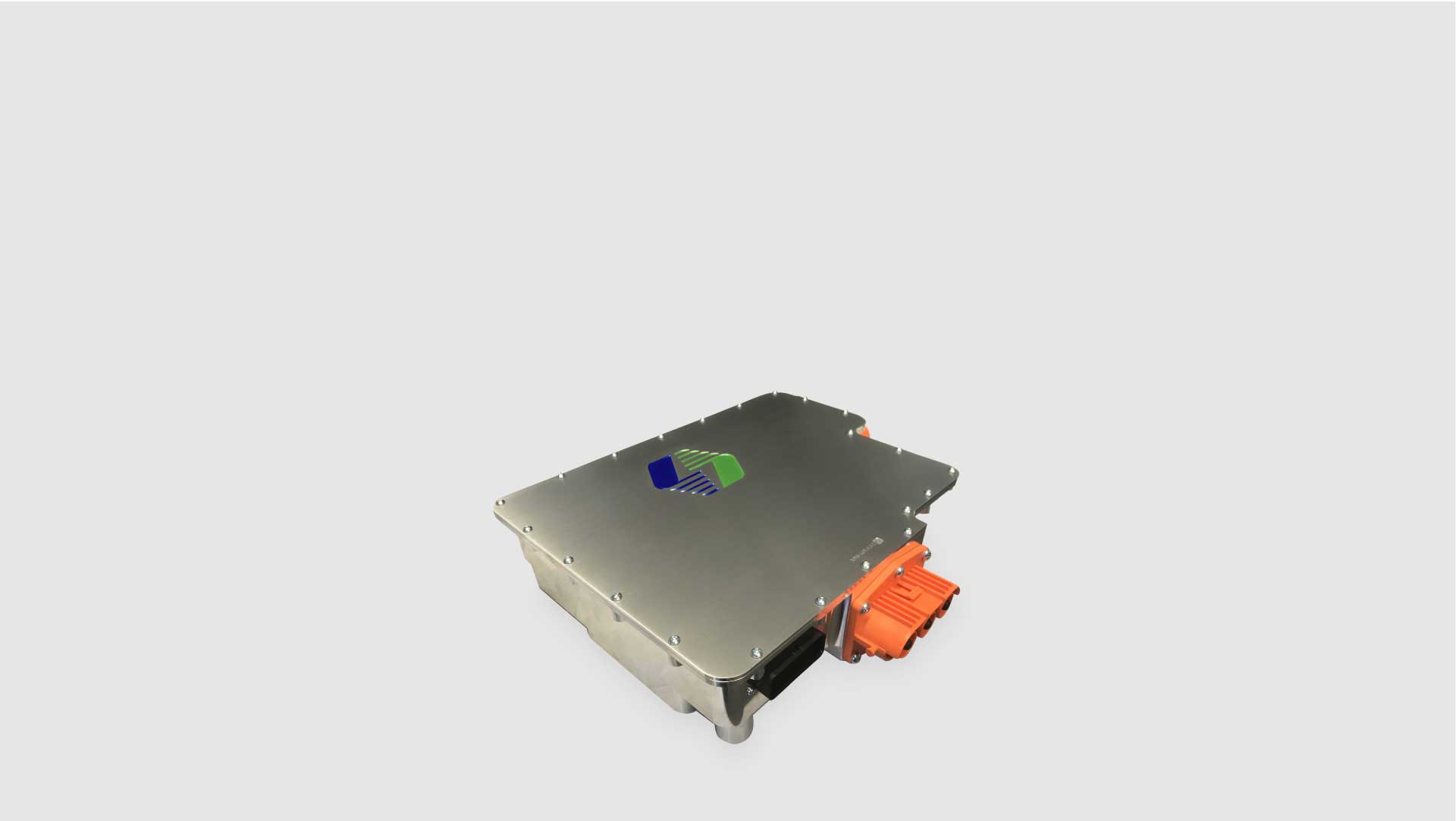

Basically, they specialize in something called Zero Voltage Switching (ZVS). If that sounds like engineering jargon, think of it this way: every time an electric vehicle (EV) or a data center server switches power on and off, it loses energy as heat. This "switching loss" is the enemy of efficiency. Hillcrest’s ZVS technology essentially waits for the voltage to hit zero before flipping the switch.

The result? They’ve hit inverter efficiency levels of 99.7% in recent tests.

That might not sound like much of a jump from, say, 94% or 95%, but in the world of high-performance EVs or massive AI server farms, those fractional gains are worth millions. It’s the difference between a car getting 300 miles on a charge versus 315, or a data center needing a massive cooling system versus something much smaller and cheaper.

Why the Market is Suddenly Paying Attention

For a long time, Hillcrest was in "prove it" mode. They had white papers, but they didn't have the big-name handshakes. That shifted at the end of 2025.

On December 30, 2025, the company announced they’d successfully finished the first phase of a tech evaluation with a Global Tier 1 automotive supplier. We're talking about a top-15 global player. They didn't just look at the tech; they integrated Hillcrest’s ZVS into their own power modules.

🔗 Read more: Apple Store Rockingham Mall Salem: What You Should Know Before Driving to New Hampshire

Then, just a few days ago on January 15, 2026, CEO Don Currie dropped a major update about their 2026 roadmap. They’ve secured a $3.0 million strategic investment from the Pasqua First Nation. It’s a unique partnership that isn't just about cash—it’s about building a Canadian manufacturing hub for grid-scale inverters.

- ZVS PCS1000: This is their 200kW power conversion system.

- Customer Demos: Planned for Q2 2026.

- Scalability: The tech can supposedly scale up to 1.2MW.

This isn't just a lab experiment anymore. They are moving toward "A-sample" prototypes. In the automotive world, getting an A-sample into a manufacturer's hands is the equivalent of a musician finally getting a meeting with a major record label.

The Reality of the Numbers

Let's be real—investing in Hillcrest Energy Technologies stock isn't for the faint of heart. The company recently cleared about $2.8 million in debt by issuing shares, which is great for the balance sheet but does cause some dilution for existing holders.

The market cap sits around $36 million USD. That is tiny. When a company is this small, even a minor piece of news can send the price swinging 20% in either direction. For example, between January 12 and January 13, 2026, the price jumped from $0.14 to $0.16. That’s a massive move in 24 hours.

You also have to look at the "Momentum Trap" label some analysts have thrown around. Because the stock has outperformed the TSX 300 by over 50% in the last six months, some technical indicators suggest it might be overextended. On the flip side, the analyst consensus target price—though you should always take those with a massive grain of salt—is sitting way up at CAD $1.40.

What Most People Get Wrong

The biggest misconception? That Hillcrest is only an EV play.

While the Tier 1 auto partnership is the "sexy" headline, the real sleeper hit might be AI data centers. AI chips like those from Nvidia consume a terrifying amount of power. They require incredibly precise, efficient power conversion to keep from melting down or driving electricity bills into the stratosphere.

🔗 Read more: Apple EU DMA News: What Most People Get Wrong About the New iPhone Rules

Hillcrest’s ZVS technology is being pitched as a way to reduce the size of power inductors by up to 3.3x and cut costs by 75%. If they can actually prove those numbers in a data center environment during their Q2 2026 demonstrations, the EV side of the business might actually become the secondary story.

The Risks You Can't Ignore

It’s not all sunshine and 99% efficiency.

- Funding: They just raised about $4.4 million, but tech development is expensive. They’ll likely need more capital before they hit massive commercial revenues.

- Execution: Moving from a "successful evaluation" to a "mass production contract" is a huge leap.

- Competition: They aren't the only ones looking at soft-switching technology, though their IP portfolio is 100% owned and quite broad.

Actionable Insights for 2026

If you're watching Hillcrest Energy Technologies stock, the next six months are the "make or break" window. Here is how to actually track this:

💡 You might also like: Celsius to F Calculator: Why Your Kitchen and Travel Math Keeps Failing

- Watch the Q2 2026 Demos: This is the biggest catalyst on the calendar. If the ZVS PCS1000 performs as advertised for grid and data center customers, expect a shift in the investor base from retail "speculators" to more institutional "tech-value" hunters.

- Monitor the Tier 2 Automotive News: Phase 1 is done. Phase 2 would likely involve moving toward commercial licensing. A signed licensing agreement is the "Holy Grail" for this business model because it brings in high-margin revenue without the company needing to build its own massive factories.

- Check the Burn Rate: Keep an eye on their quarterly filings (the next one is expected around May 1, 2026). You want to see how much of that $4.4 million is going into R&D versus just keeping the lights on.

Hillcrest is basically a high-stakes bet on the "physics" of electricity. If their firmware and hardware truly solve the switching loss problem better than anyone else, $0.14 will look like a footnote in a few years. If they can't scale, it stays a niche Canadian tech story. Either way, the 2026 commercialization push means we won't have to guess for much longer.