You've probably heard the pitch. Buy some "munis," sit back, and collect tax-free checks while helping a city build a new bridge or a school. It sounds cozy. It sounds safe. But if you’re hunting for the highest yielding municipal bonds right now, you’re not just looking for a steady paycheck—you’re basically walking into a high-stakes poker game where the rules are written in fine print and 400-page prospectuses.

The yield isn't free. High yield in the muni world usually means one of two things: the market thinks the borrower might go broke, or the project being funded is a total gamble. We're talking about unrated junk bonds for retirement homes in Florida or massive stadium projects that might never see a sell-out crowd.

Honestly, the "safe" 2% yields are boring. That’s why people go hunting. But there’s a massive gap between a taxable 8% yield and a tax-exempt 5.5% yield that most people just glaze over. If you’re in a high tax bracket—say, California or New York—that 5.5% tax-exempt yield could be the equivalent of double digits in a standard brokerage account. That’s the "kinda-sorta" magic of the muni market, but only if you don't get burned by a default.

What’s Actually Driving the Highest Yielding Municipal Bonds Today?

Interest rates have been a roller coaster. When the Fed moves, the muni market shakes. But beyond the macro stuff, the real "juice" in high-yield munis comes from the "story bonds." These are bonds issued for specific projects rather than general city obligations.

Think about a charter school. If the school doesn't hit its enrollment numbers, the bondholders don't get paid. There’s no "taxpayer" to bail you out. That’s a revenue bond. According to data from MSRB (Municipal Securities Rulemaking Board), revenue bonds make up a huge chunk of the high-yield sector. You’re betting on the success of a specific business that just happens to be using tax-exempt financing.

Recent years have shown us some wild examples. Remember the American Dream Mall in New Jersey? It’s a massive complex with an indoor ski slope and a theme park. It’s also been a poster child for the risks involved in these high-stakes municipal plays. When a project like that struggles, the "yield" looks incredible on paper—maybe 10% or 12%—but that's only because the price of the bond has cratered. You aren't buying a winner; you're buying a recovery play.

The Junk Grade Reality

Most people think "municipal" means "government-backed." It doesn't.

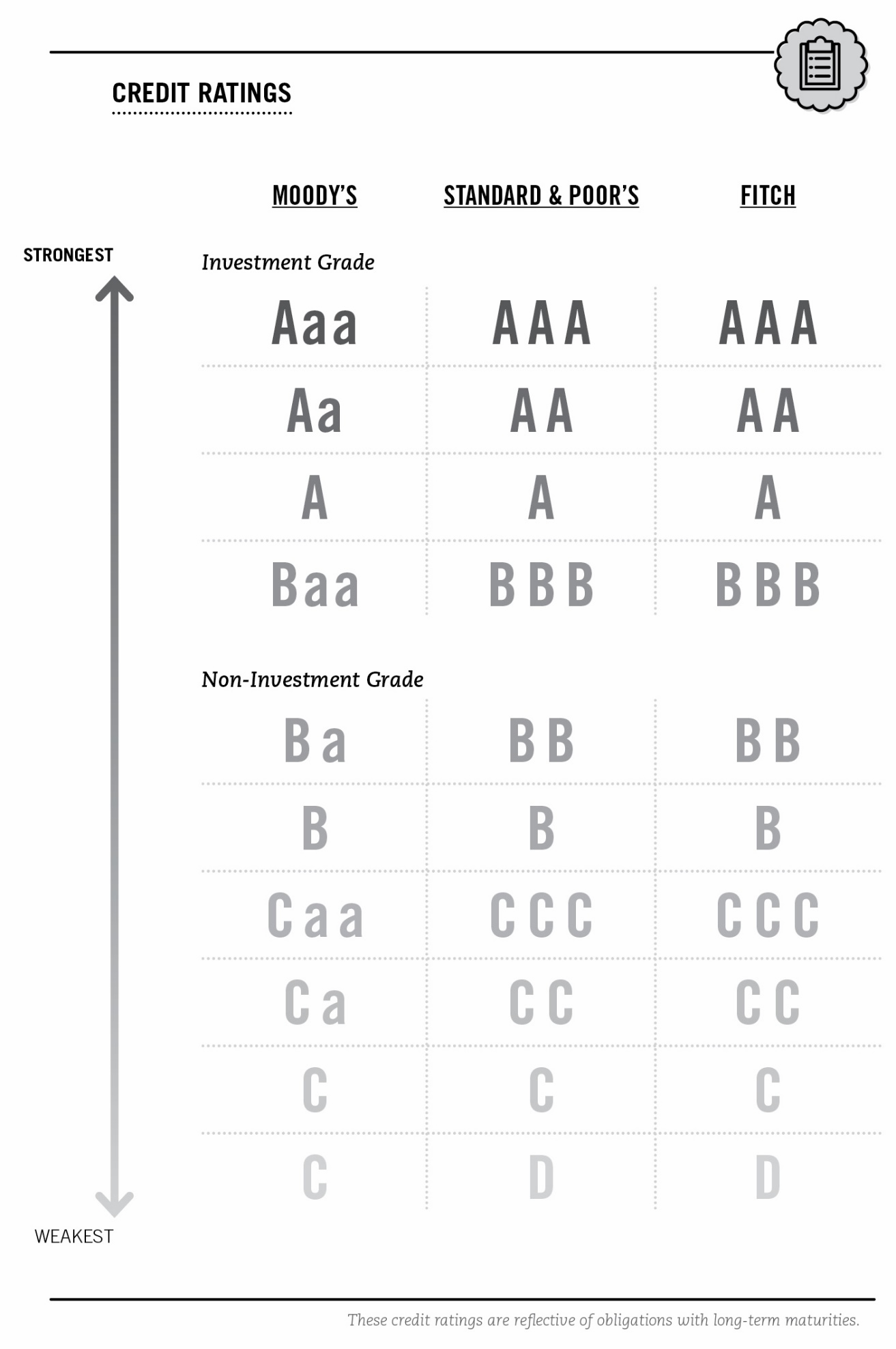

There’s a massive sub-sector of the market that is completely unrated. These are bonds where the issuer didn't even bother to pay Moody’s or S&P to look at them because they knew they’d get a "junk" rating. This is where the highest yielding municipal bonds live.

💡 You might also like: Rite Aid Bethlehem PA: Why It’s Getting Harder to Find Your Local Pharmacy

- Tobacco Settlement Bonds: These are weird. They are backed by the money big tobacco companies pay to states. If people stop smoking faster than expected, the yield goes up because the risk goes up.

- Senior Living Facilities: This is a huge part of the high-yield muni space. It’s a demographic bet. If a facility in a competitive market stays half-empty, the bond defaults.

- Hospitals: Smaller, rural hospitals often issue high-yield debt. They are facing massive labor costs and shrinking insurance reimbursements.

You have to be careful. A yield of 6% sounds great until the facility files for Chapter 9 or a similar restructuring. Nuveen and Vanguard have high-yield muni funds that try to diversify this risk, but even they get caught in the rain sometimes.

Why "Tax-Equivalent Yield" Is the Only Number That Matters

Let's do some quick math. If you're looking at a 5% yield on a muni bond, and you’re in the 37% federal tax bracket, your Tax-Equivalent Yield (TEY) is significantly higher.

$$TEY = \frac{Tax-Exempt Yield}{1 - Marginal Tax Rate}$$

In this case:

$$5% / (1 - 0.37) = 7.93%$$

Basically, a "boring" 5% muni is outperforming an 7.5% corporate bond. That’s why the wealthy pile into this stuff. It’s not just about the yield; it’s about what the IRS can’t touch.

But wait. There’s the Alternative Minimum Tax (AMT). Some of the highest yielding bonds—specifically those for "private activities" like airports or industrial development—are subject to the AMT. If you aren't checking the bond's "AMT status," you might find that your "tax-free" income is actually shrinking your refund come April. Always check the CUSIP. Seriously.

The Pitfalls of "Yield Chasing" in 2026

The market is smarter than you. If a muni is yielding 7%, there is a reason. It’s not a "hidden gem" that the big banks missed. It’s usually a sign of "credit stress."

Take Puerto Rico. For years, people chased those high yields because they were "triple tax-exempt" (no federal, state, or local taxes). Then the island went through the largest municipal restructuring in U.S. history. Investors who thought they were buying "safe government debt" spent years in court and took "haircuts" on their principal.

✨ Don't miss: Retail Brew’s Jeena Sharma: How a Fashion Journalist Became the Industry’s Most Relatable Reporter

Liquidity is another monster.

If you buy a high-yield muni bond and decide you want out tomorrow, you might find that there are zero buyers. Or, the "bid-ask spread" is so wide you lose 5% of your value just trying to click "sell." This isn't like trading Apple or Tesla stock. It’s a "by-appointment" market.

How to Actually Navigate This Space

If you’re still dead-set on finding the highest yielding municipal bonds, you need a strategy that isn't just "buy the highest number on the screen."

- Look for "Kicked" Bonds: These are bonds that were once investment grade but got downgraded due to a temporary issue. Sometimes the market overreacts.

- Focus on Essential Services: Water and sewer bonds are generally safer than "stadium bonds." People might stop going to a baseball game, but they won't stop flushing the toilet.

- Check the Coverage Ratio: Look at how much cash the project generates versus how much it owes in interest. If the "debt service coverage ratio" is less than 1.2x, you’re in the danger zone.

- Diversify via ETFs or Mutual Funds: Honestly, for 99% of people, buying individual high-yield munis is a bad idea. Funds like HYD (VanEck High Yield Muni ETF) or MUNI (PIMCO Intermediate Municipal Bond Strategy) allow you to spread that default risk across hundreds of different issuers.

There’s also the "call risk" to consider. When interest rates drop, cities love to "call" their high-interest bonds and refinance them. You think you’ve locked in a 6% yield for ten years, but then the city sends your money back after three years and says, "Thanks, but we’re done." Now you’re stuck with cash in a lower-rate environment.

What Most People Get Wrong

They think all munis are equal. They aren't. There’s a world of difference between a "General Obligation" (GO) bond backed by the full taxing power of a state like Texas and a "Special Tax" bond backed by a specific hotel tax in a city that no one visits.

The highest yields are almost always in the "Special Assessment" or "Revenue" categories. You aren't just an investor; you’re a silent partner in a business project. If that project fails, your "tax-free" income disappears along with it.

📖 Related: Dollar to AUD conversion: Why you're probably losing money and how to stop

Actionable Next Steps for High-Yield Seekers

If you are ready to move beyond the theory and actually put capital to work, here is what you need to do immediately:

- Review your current tax bracket. If you aren't in at least the 24% federal bracket, the "tax-free" benefit of munis likely doesn't outweigh the higher raw yields you can get in corporate bonds or Treasuries.

- Run a TEY calculation. Compare the muni you're eyeing against a high-quality corporate bond. If the corporate bond's after-tax yield is higher, the muni is a bad deal regardless of the headline number.

- Screen for "Unrated" vs. "Junk." Some bonds are unrated because the issuer is small but wealthy (like a tiny, affluent school district). These can be gold mines. "Junk" (BB or lower) means the rating agencies have already spotted the fire.

- Use the EMMA (Electronic Municipal Market Access) website. This is a free tool provided by the MSRB. You can plug in a CUSIP and see every financial disclosure the issuer has made. If they haven't filed a report in eighteen months, run away.

- Consult a tax professional about the AMT. This is the "hidden tax" that kills high-yield muni strategies for the unwary. Make sure you know if your "Private Activity Bonds" will trigger an unexpected bill.

The municipal bond market is one of the last places where "doing your homework" actually pays off in higher returns. Just don't confuse a high yield with a safe bet. In 2026, the safest way to play this market is to assume every high-yielding bond has a skeleton in the closet until you prove otherwise.