You've probably noticed it. That feeling that your money isn't working quite as hard as it did a year ago. If you’re looking at hdfc bank ltd fd interest rates right now, you’re seeing a landscape that’s shifted under your feet.

Honestly, the days of coasting on 7% plus for standard deposits are getting harder to find. Ever since the Reserve Bank of India (RBI) slashed the repo rate to 5.25% in December 2025, the big players—HDFC Bank included—have been trimming the fat off their deposit rates.

The Current State of Play for Your Cash

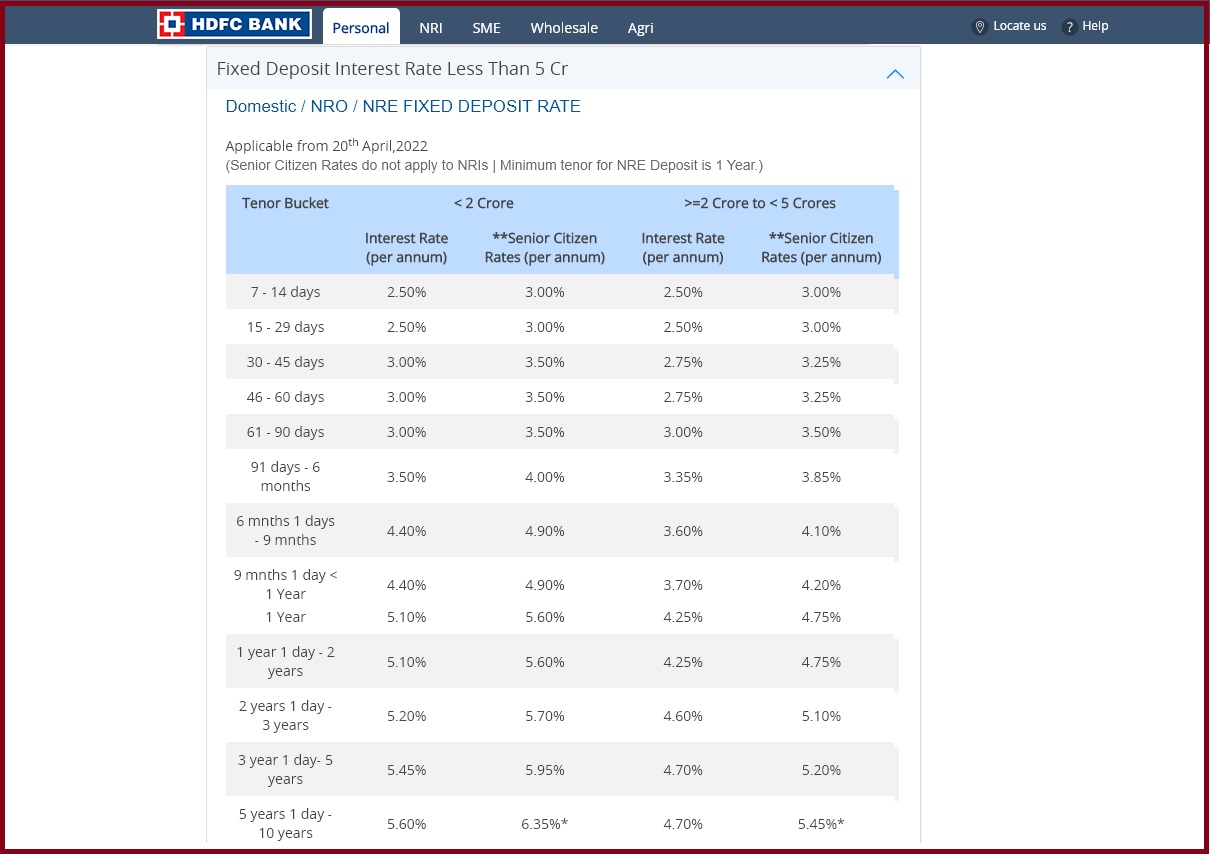

So, what's the actual damage? As of mid-January 2026, HDFC Bank is hovering in a range that requires a bit of strategy to navigate. For the general public, you're looking at rates starting as low as 2.75% for those super short 7-day parkings, moving up to a peak of around 6.45% or 6.60% depending on how long you're willing to lock your money away.

Senior citizens still get the usual 0.50% "loyalty" bump. This pushes their ceiling to about 7.10%. It’s decent, but it’s a far cry from the high-yield party we saw in 2024.

The bank recently tweaked the 18 to 21-month bucket. It used to be a sweet spot, but they've softened it a bit. Now, that same tenure sits around 6.45% for regular folks. If you’re a senior citizen, you're still pulling 6.95% on that specific timeframe.

Why 18 to 21 Months is the New "Sweet Spot"

Most people just pick a round number. One year, two years, five years. That’s usually a mistake.

Banks often have these "odd" tenures where they need to balance their books. Right now, the 18 months to less than 21 months window is where HDFC is putting its best foot forward. Why? Because they want to lock in your liquidity for just under two years without committing to the higher long-term payouts if the economy shifts again.

If you go shorter, say 1 year to 15 months, the rate drops to 6.25%.

Go longer, past 5 years, and you’re down to 6.15%.

It’s a bell curve. You want to be at the top of that curve.

The Senior Citizen Advantage (and the NRI catch)

If you're over 60, HDFC Bank is still one of the safest places to park a retirement corpus. Their Senior Citizen Care FD usually adds an extra premium on top of the base 0.50% for long-term buckets, but you have to check if the specific promotional window is open.

Here is the thing though: NRIs don’t get these extra perks. If you’re holding an NRO or NRE account, you’re usually tied to the regular citizen rates. It’s a bit of a bummer, but that’s the regulatory framework we’re living in.

Tax Saving FDs: The 5-Year Lock-in Reality

We all hate taxes. The 5-year tax-saving FD is the classic go-to for Section 80C deductions. HDFC offers about 6.40% for the general public here.

But let’s be real. You’re locking your money for 1,825 days. You can’t touch it. No premature withdrawal. No loan against it.

If you’re in the 30% tax bracket, that 6.40% is actually much lower in real terms once you factor in the "opportunity cost" of not having that cash liquid. Sometimes, it's better to pay the tax on a shorter-tenure FD with a higher rate than to trap your money for five years at a lower one just to save a few thousand in TDS.

What Most People Get Wrong About TDS

Speaking of TDS, there’s a massive misconception that "no TDS" means "no tax."

If your interest income from all FDs at HDFC Bank exceeds ₹40,000 (or ₹50,000 for seniors), the bank will chop 10% off the top. If you didn't provide your PAN, they’ll take 20%.

But even if they don't deduct it—say you earned ₹30,000—you still owe that tax. It gets added to your total income and taxed at your slab. Don’t let a lack of TDS fool you into thinking the money is tax-free.

💡 You might also like: Bunker Hill Mine Stock: What Most People Get Wrong About This Idaho Restart

Is it Time to Look Elsewhere?

Look, HDFC is a powerhouse. It’s safe. It’s the "too big to fail" of India. But if you’re chasing pure yield, the Small Finance Banks (SFBs) are currently dangling 7.5% to 8.0% in your face.

The trade-off is risk perception. Even though DICGC insures up to ₹5 lakhs per bank, many people feel "safer" with HDFC's 6.45% than an SFB's 8%. It’s the price you pay for sleeping well at night.

Actionable Steps for Your Next Deposit

If you have a lump sum sitting in a savings account earning a measly 3% or 3.5%, you’re losing money to inflation every single day.

- Check the 18-21 month tenure: It’s currently the highest-yielding regular bucket.

- Use the Laddering Strategy: Instead of putting ₹10 lakhs in one FD, break it into four FDs of ₹2.5 lakhs with different maturities. This gives you "liquidity vents" so you don't have to break the whole thing if you need cash.

- Update your Form 15G/15H: Do this at the start of the financial year. It prevents the bank from deducting TDS if your total income is below the taxable limit.

- Opt for Reinvestment: If you don’t need the monthly payout, choose the cumulative option. Compounding is a slow burn, but it’s the only way to actually grow the principal.

The rate cycle is currently on a downward slope. If you’ve been waiting for rates to "go back up" before booking, you might be waiting a long time. Locking in these hdfc bank ltd fd interest rates now is likely better than seeing what’s available in six months.

Log into your NetBanking or the HDFC mobile app, look for the 'Transact' tab under deposits, and compare the tenure list one last time before you click confirm.