Walk into any grocery store today and you’ll see it. The price of a gallon of milk isn't skyrocketing like it did two years ago, but it’s still sitting at a level that makes you double-check your bank balance. People keep asking: has the economy improved in 2025, or are we just getting used to the chaos?

It's complicated.

Honestly, if you look at the Federal Reserve’s reports or the latest GDP prints from the Bureau of Economic Analysis (BEA), the numbers look decent. Better than decent, actually. We aren't in that "hard landing" recession everyone screamed about back in '23. But the "vibe-cession"—that weird gap between "the data is good" and "I can't afford a house"—is still very much alive.

The big picture: why the "improvement" feels like a lie

The short answer is yes, technically, the economy has stabilized. Inflation, the monster that ate everyone's savings in 2022 and 2023, has finally cooled off toward that 2% target the Fed obsesses over. Jerome Powell and the crew at the Fed managed to hike rates, hold them, and then start the slow, agonizing process of bringing them back down without crashing the labor market. That’s a massive win. Historically, that almost never happens.

But here is the catch.

Lower inflation doesn't mean prices are going down. It just means they are rising more slowly. If a steak went from $15 to $22 during the surge, and now it’s $22.50, the "inflation rate" looks great to an economist. To you? It still feels like you're getting ripped off every time you fire up the grill. That is the fundamental disconnect when we discuss if the economy has improved in 2025.

Rent, Mortgages, and the Housing Lock-in

Housing is the giant elephant in the room. We’re seeing a bifurcated world. If you bought a home in 2019 with a 3% mortgage, you’re probably feeling okay. Your biggest asset has ballooned in value. But for everyone else? It's rough.

💡 You might also like: What is the S\&P 500 Doing Today? Why the Record Highs Feel Different

Mortgage rates have ticked down from their 8% peaks, but they haven't crashed back to the "free money" era of the pandemic. This has created a "lock-in" effect where nobody wants to sell because they don't want to trade a 3% rate for a 6.5% rate. Supply stays low. Prices stay high. For a Gen Z worker or a Millennial looking to start a family, the "improved" economy feels like a closed club they aren't invited to join.

The Jobs Market: Is your paycheck actually winning?

Real wages—that’s your pay adjusted for the cost of living—have finally started to outpace inflation in several sectors. According to the Bureau of Labor Statistics (BLS), low-wage workers actually saw some of the biggest percentage gains over the last eighteen months. It's a weird irony. The people at the bottom of the pay scale often have more leverage now than the middle-management tech workers who got hit by "efficiency" layoffs.

Think about the healthcare sector. Or construction. These industries are desperate for bodies. If you’re a nurse or a plumber, 2025 feels pretty good. If you’re a copywriter or a mid-level marketing manager at a SaaS company, you’re probably looking over your shoulder at AI and "restructuring" emails.

- Manufacturing is seeing a localized boom. Thanks to the CHIPS Act and the Inflation Reduction Act, we’re seeing actual factories being built in places like Ohio and Arizona.

- The "Great Resignation" is over. People aren't quitting for 20% raises every six months anymore. Stability has returned, but the "easy money" job hopping era is dead.

- Part-time vs. Full-time. One worrying trend in the 2025 data is the slight uptick in people holding multiple part-time jobs to make ends meet. It pads the employment numbers, but it doesn't necessarily mean people are thriving.

Gas, Groceries, and the "Small Stuff"

Energy prices have been a saving grace lately. We’ve seen domestic oil production hit record highs, which has kept a lid on gas prices despite all the geopolitical tension in the Middle East and Eastern Europe. When gas is under $3.50 in most of the country, people feel significantly better. It’s the most visible economic indicator in existence.

But then there's the "shrinkflation" issue. Have you noticed the cereal boxes? They're thinner. The "family size" chip bag has more air than potato. Brands are trying to maintain profit margins without raising the sticker price, and consumers are getting wise to it. It breeds a certain type of resentment that doesn't show up in a GDP report but absolutely impacts consumer confidence.

The Tech Factor

We can't talk about whether the economy has improved in 2025 without mentioning the AI bubble—or boom, depending on who you ask. Nvidia, Microsoft, and Google are still pouring billions into infrastructure. This has propped up the S&P 500, making everyone's 401(k) look fantastic.

📖 Related: To Whom It May Concern: Why This Old Phrase Still Works (And When It Doesn't)

But does a high stock market mean a good economy? For the top 10% of households who own 93% of the stocks, yes. For the person living paycheck to paycheck with zero market exposure, the "all-time high" headlines feel like they’re written in a foreign language.

Debt is the quiet killer

Household debt has hit record levels. Credit card balances are up. Auto loan delinquencies are creeping into the "concerning" zone. For the last few years, Americans kept spending like crazy, fueled by pandemic savings and a "YOLO" mentality. Those savings are mostly gone now.

Interest rates on credit cards are still hovering around 21-25%. If you're carrying a balance, any "improvement" in the national economy is being eaten alive by interest payments. We are seeing a massive gap between people with "clean" balance sheets and those who are drowning in high-interest consumer debt.

Why 2025 feels different than 2024

Last year felt like we were waiting for the other shoe to drop. This year, the shoe has dropped, and it turns out it wasn't a lead weight—it was more like a heavy boot. We've landed, we're walking, but it's a bit of a slog.

The volatility has calmed down. That’s the real improvement. Businesses can finally plan for the next six months without fearing a 9% inflation spike or a sudden 500-basis-point rate hike. Predictability is the secret sauce of a functional economy, and we finally have some of it back.

Global context matters

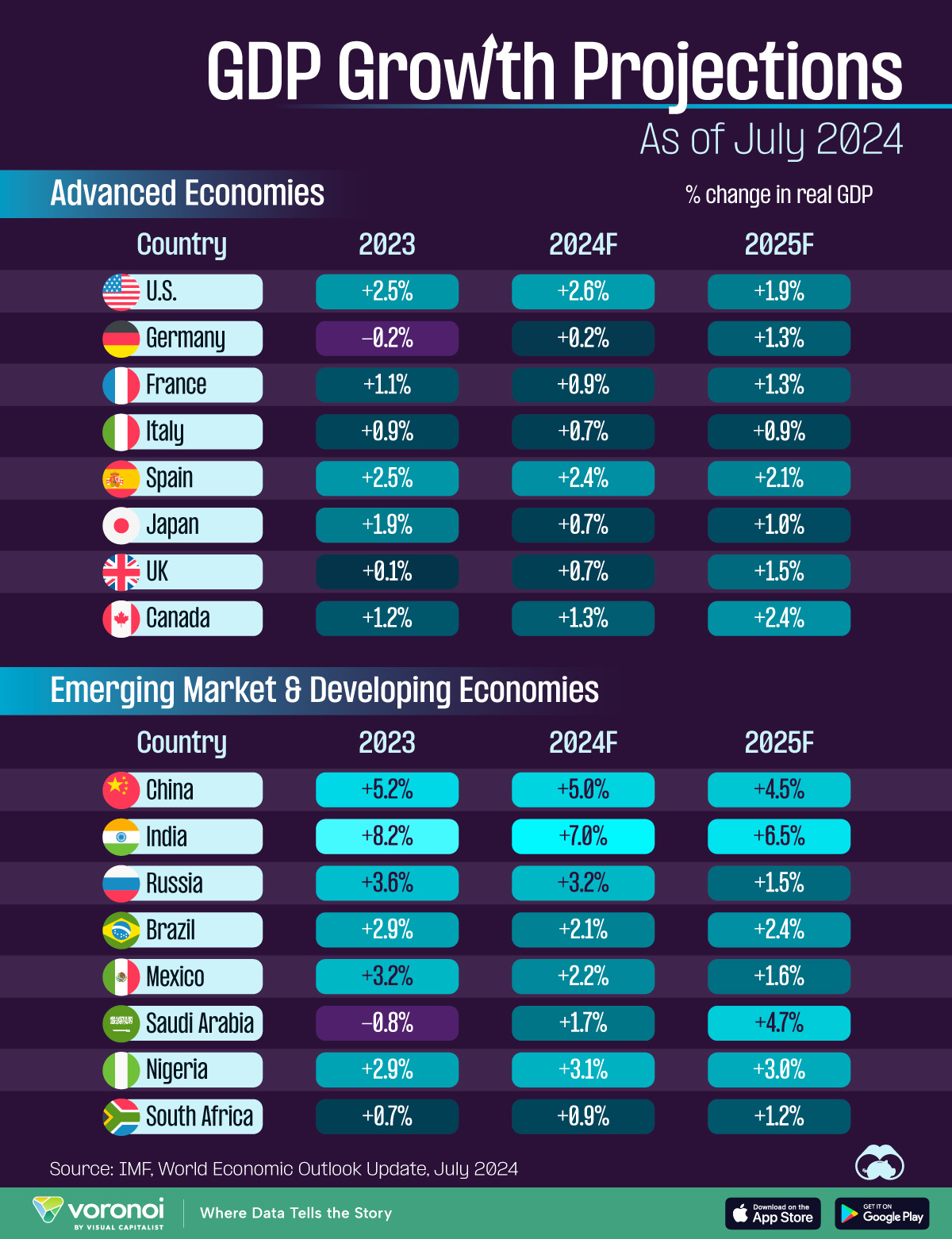

The U.S. is actually doing way better than its peers. If you look at Germany or the UK, they’ve been flirting with stagnation and actual recession for a while. China is struggling with a massive real estate collapse. In the land of the blind, the one-eyed man is king. The U.S. dollar remains the world’s safe haven, which keeps our borrowing costs lower than they otherwise would be.

👉 See also: The Stock Market Since Trump: What Most People Get Wrong

What you should actually do about it

Stop waiting for 2019 prices to come back. They aren't. Deflation (prices actually falling) usually only happens during a Great Depression-style collapse, and you definitely don't want that. The "new normal" is here.

First, audit your high-interest debt. If you’re paying 24% on a credit card, that is your personal economic crisis. No amount of national "improvement" will save you until that's gone. Look into debt consolidation or balance transfers now that rates are beginning to soften.

Second, look at your "personal" inflation rate. The CPI is an average. If you drive a gas-guzzler 50 miles a day, your inflation rate is higher than a remote worker who rides a bike. Track where your money goes for 30 days. You’ll find "leaks"—subscriptions you forgot about, or that $14 lunch habit—that matter more than the Fed’s interest rate decisions.

Third, don't ignore the labor market shift. Skills that were valuable in 2022 might be getting commoditized by AI in 2025. If you haven't looked at a job description in your field lately, do it. See what’s changed. The best hedge against a weird economy is being too valuable to fire.

The Verdict

So, has the economy improved in 2025?

If you're looking at the macro data—unemployment under 4%, cooling inflation, steady growth—then yes, it’s a miracle we’ve made it this far without a crash. But if you’re looking at the "cost of living" versus "quality of life," the answer is a resounding "sorta." We are in a period of stabilization. It’s not a boom, and it’s not a bust. It’s the "Great Reset," where we all have to figure out how to live in a world where everything costs 30% more than it did five years ago, but the world hasn't ended.

Next Steps for You:

- Refinance Check: If you have a mortgage or auto loan taken out in late 2023 or 2024, talk to a lender about a refinance. Rates aren't at 3%, but they are better than they were.

- High-Yield Savings: Don't leave your cash in a standard checking account. Even as the Fed cuts, high-yield savings accounts are still offering 4% or more. Make your money work.

- Skill Audit: Spend an hour researching how AI is affecting your specific job. If your tasks are "repetitive and data-heavy," start looking into how to use those AI tools yourself before someone else uses them to replace you.