If you’re living in the Midwest or across the "hail belt," you already know that 2025 was a brutal year for roofs. But here is the thing: a lot of people are sitting on damage they haven't even filed yet, and the clock is ticking loudly. Honestly, if you haven't checked your policy lately, you might be in for a nasty surprise.

Recent hail damage insurance news coming out of early 2026 shows a massive wave of deadlines hitting this month. Specifically, in states like Ohio and across the Great Lakes, many 12-month policy windows for those big May 2025 storms are closing on January 31, 2026. If you don't have your paperwork in by then, the insurance company basically gets to keep the money they owed you. It's harsh. It's often buried in 8-point font on page 40 of your policy, but it’s the law.

The 2026 Reality: Higher Deductibles and "Cosmetic" Catch-22s

The industry is changing fast. For a long time, insurance was a "replacement cost" game. You get hail, they buy you a new roof. Simple. But 2025 saw insured losses from "non-peak" perils—basically storms that aren't hurricanes—cross the $42 billion mark by September alone.

Because of this, carriers are tightening the screws.

🔗 Read more: Lake Nyos Cameroon 1986: What Really Happened During the Silent Killer’s Release

We’re seeing a huge shift toward percentage-based deductibles. Instead of a flat $1,000, you might now be responsible for 1% or 2% of your home's total value. On a $500,000 home, that’s a $10,000 bill you have to cover before the insurance company pays a cent. It’s a gut punch for homeowners who aren't prepared.

The "Cosmetic Damage" Trap

This is a big one. A federal court ruling in late 2025 (Cannon Falls Area Schools v. Hanover American Insurance Co.) upheld a "Cosmetic Damage Exclusion." Basically, if the hail dented your metal roof but didn't cause a leak, the insurer didn't have to pay. The court decided that since the roof still worked, the damage was just "ugly," not "functional." This sets a scary precedent for homeowners with metal or specialized roofing.

Fraud is Peaking Right Now

As deadlines approach, the "storm chasers" are out in full force. North Carolina’s Insurance Commissioner Mike Causey just issued a high-alert warning this January because of a surge in roofing scams.

💡 You might also like: Why Fox Has a Problem: The Identity Crisis at the Top of Cable News

The play is usually the same. They knock on your door, offer a "free inspection," and then ask you to sign over the entire insurance check before they even bring a ladder to the job site. You’ve got to be careful. In Wake County, contractors were recently caught on camera actually bending shingles to fake hail damage.

If you're dealing with a roofer who wants the money upfront, walk away. Period.

Why Your Roof Age Actually Matters for the Check

In 2022, the "premium gap" between a new roof and a 15-year-old roof was about $50. By late 2025, that gap jumped to $155 on average.

📖 Related: The CIA Stars on the Wall: What the Memorial Really Represents

Insurers are now using satellite imagery and AI-driven drones to scan neighborhoods. They know exactly how old your shingles are. If your roof is over 15 years old, many companies are switching you to "Actual Cash Value" (ACV) instead of "Replacement Cost." This means they'll subtract a decade of wear and tear from your payout. You might expect a $20,000 check and end up with $6,000.

What’s happening in the courts?

Texas is seeing a lot of action regarding Section 542A of the Insurance Code. The courts are being much stricter about "pre-suit notice." If you don't tell the insurance company exactly what's wrong and give them a chance to fix it before you sue, your case can be tossed out. It’s a win for the big guys, honestly, and it makes it harder for the "little guy" to fight a lowball offer.

Actionable Steps to Protect Your Home

Don't wait for a leak. If you had a storm in 2025, you need to act before the spring 2026 storms start.

- Audit your declaration page. Look specifically for a "Wind/Hail Deductible." If it’s a percentage, calculate that dollar amount now so you aren't shocked later.

- Get a 2026 inspection. Use a local, reputable company. Ask for "date of loss" documentation. If they can't pinpoint the exact storm date from 2025, your claim will likely be denied.

- Check for the "Date of Discovery" clause. Some newer policies start the clock not when the hail fell, but when you should have noticed the damage. This is a double-edged sword that can help or hurt you depending on the wording.

- Avoid signing "Assignments of Benefits" (AOB). This gives the roofer total control over your claim. You want to stay in the driver's seat when it comes to the money.

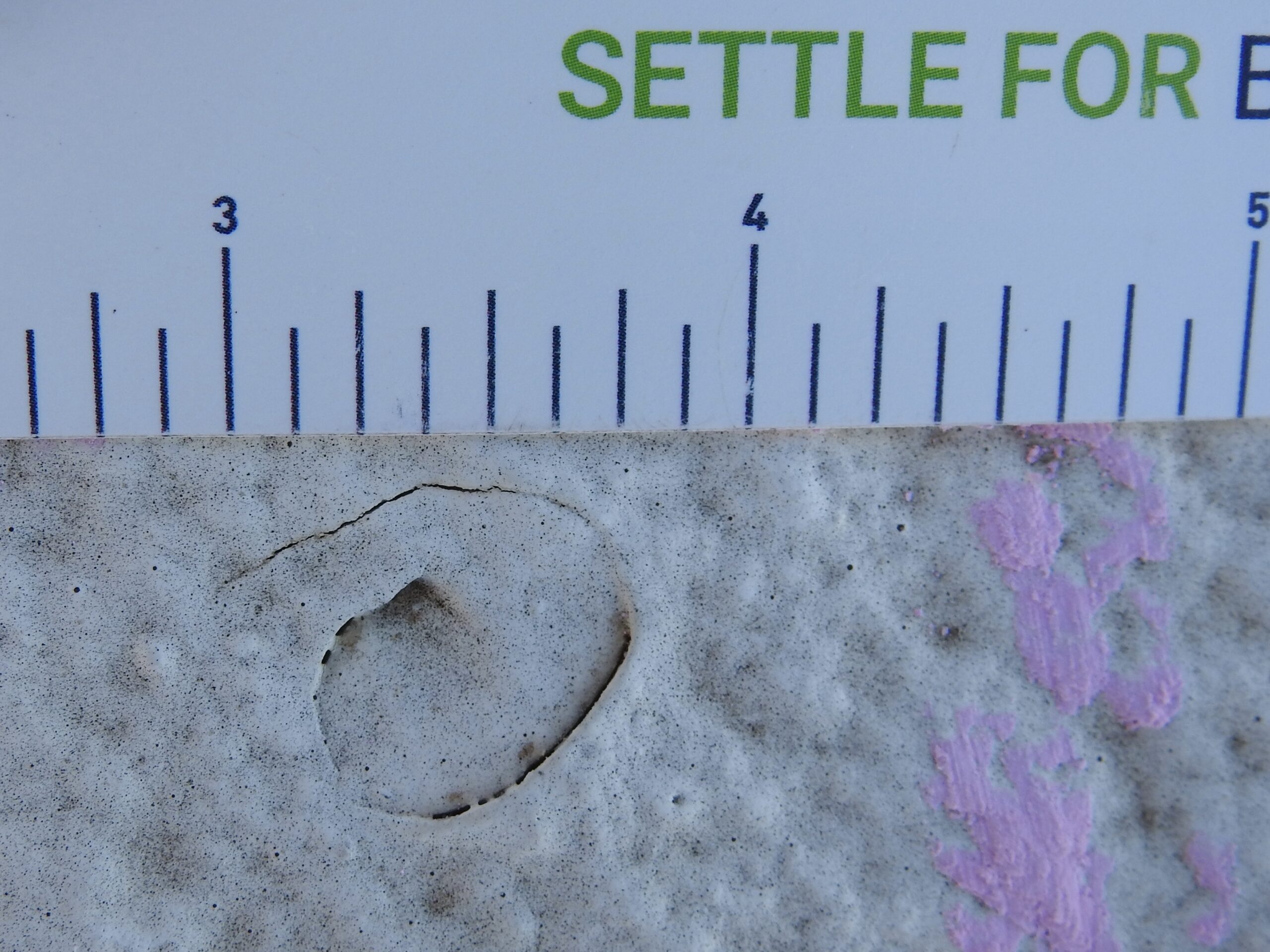

- Take your own photos. Even if it’s just from the ground. Documenting the size of hail stones (use a coin for scale) on the day it happens is the best evidence you can have.

The bottom line is that the "easy" days of hail claims are over. Between rising reinsurance costs and stricter state laws, you have to be your own advocate. If you think you have damage from last summer, find your 2025 paperwork today. Those deadlines are closer than they look.

Your Next Steps: Locate your current insurance policy and verify if you have "Replacement Cost" or "Actual Cash Value" coverage for your roof. Once you know your coverage type, contact a licensed public adjuster or a local roofing contractor with a permanent physical office to conduct a non-invasive inspection before the one-year anniversary of your area's last major storm.