Waiting for that tax money is basically a national pastime every February. You check the app. You refresh your bank balance. You wonder if H&R Block is holding onto it or if the IRS is just moving at a snail's pace. Honestly, the h and r block refund dates aren't as mysterious as they seem, but there are some specific rules that can make or break your timeline.

Let's be real. The IRS says most refunds arrive within 21 days. That sounds great on paper. In reality? If you're claiming certain credits or using specific H&R Block products like the Refund Transfer or the Emerald Card, that 21-day window starts looking a lot more like a "best-case scenario" than a guarantee.

The Reality of H and R Block Refund Dates in 2026

The IRS doesn't send money to H&R Block first just because you used their software. They send it to you. However, the path that money takes depends entirely on how you chose to pay for your tax preparation.

If you paid upfront with a credit card, the IRS sends the money directly to your bank account or your Emerald Card. If you chose to have your tax prep fees deducted from your refund—a super popular option—that money has to take a detour. It goes to a third-party bank (often Pathward, N.A.) first. They take out the H&R Block fees, and then they shoot the remaining balance over to you. This "detour" usually adds about one to two business days to your wait time.

The PATH Act Bottleneck

You've probably heard of the PATH Act. It stands for the Protecting Americans from Tax Hikes Act of 2015. It’s the reason why, if you claim the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC), you aren't getting a dime before mid-to-late February.

👉 See also: Palantir Alex Karp Stock Sale: Why the CEO is Actually Selling Now

By law, the IRS cannot issue these refunds before February 15. Even if you filed on the very first day the season opened in January, your money is sitting in a digital holding pen. When you add in the time it takes for banks to process those transfers, most PATH Act filers don't see their cash until the final week of February.

How H&R Block Products Change the Math

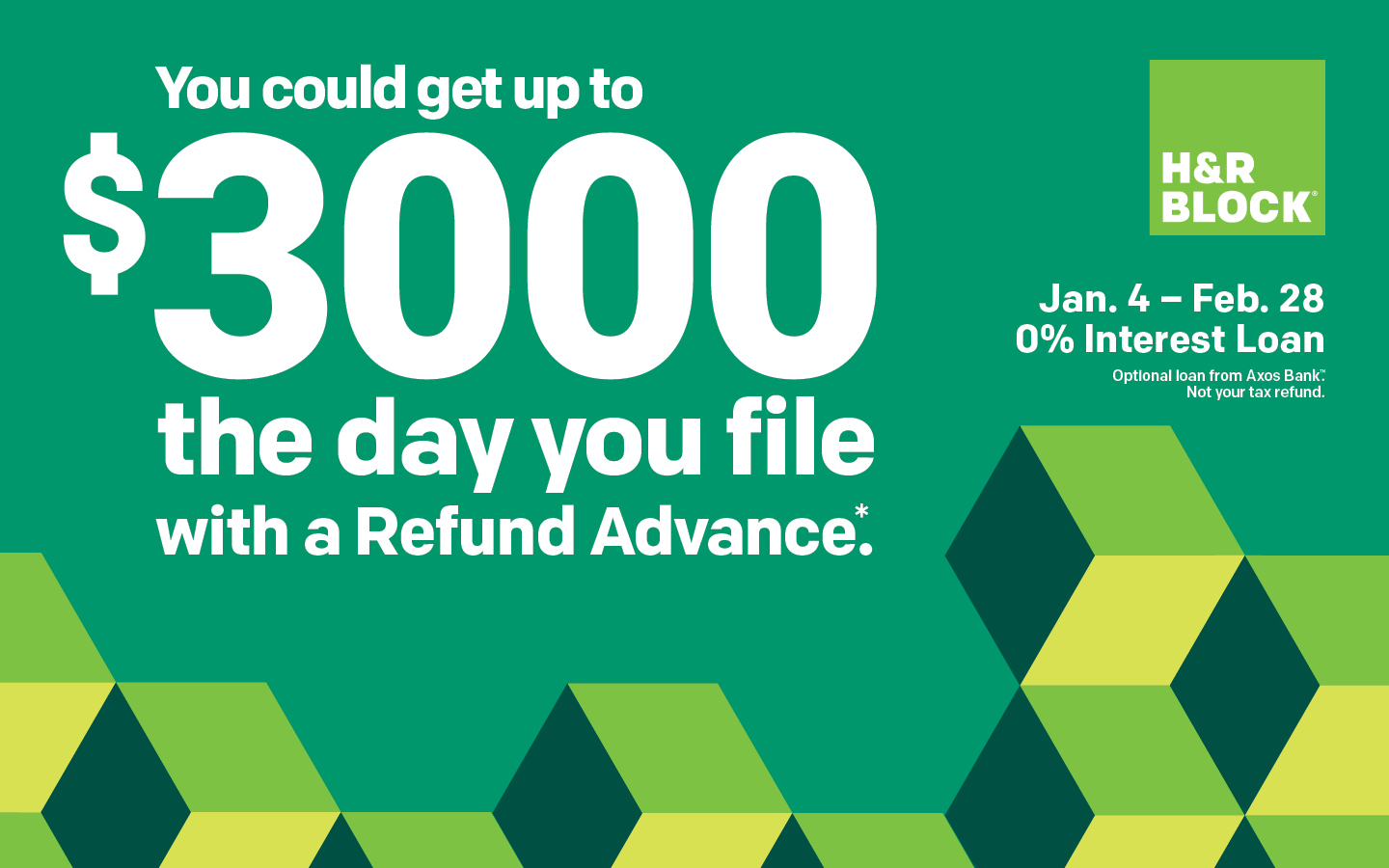

The h and r block refund dates are also heavily influenced by the "Refund Advance" and the "Refund Transfer." These are two different beasts.

The Refund Advance is a loan. It’s not your actual refund. If you're approved, you often get that money within minutes or hours of the IRS accepting your return. It’s a 0% interest loan that gets paid back automatically when your real refund finally arrives.

Then there’s the Emerald Card. Many people think the Emerald Card is faster than a traditional bank. Sorta. Because H&R Block's partner bank manages the card, there's less "inter-bank" friction. While a traditional big-name bank might hold a direct deposit for 24-48 hours to "verify funds," the Emerald Card often makes those funds available the second they receive the notification from the IRS.

✨ Don't miss: USD to UZS Rate Today: What Most People Get Wrong

Why Your Status Says "Accepted" But Not "Approved"

This is where people get stressed. You see "Accepted" in the H&R Block tracker and think the check is in the mail.

Nope.

"Accepted" just means the IRS looked at your return and said, "The math looks okay, and the social security numbers match." It does not mean they have finished auditing or processing your return. "Approved" is the golden ticket. Once the IRS "Where’s My Refund" tool shows a personalized date, that is when the clock actually starts.

Common Delays Nobody Mentions

Mistakes happen. A typo in a bank account number is the fastest way to turn a 10-day wait into a 10-week nightmare. If the bank rejects the deposit because of a digit error, the money goes back to the IRS. The IRS then has to cancel the digital payment and cut a paper check.

🔗 Read more: PDI Stock Price Today: What Most People Get Wrong About This 14% Yield

Paper checks are the worst.

If you chose a paper check, add at least four weeks to your timeline. The postal service isn't getting any faster, and the IRS processing center for paper mail is famously backed up.

Another weird delay? Identity verification. The IRS has been ramping up security. Sometimes they’ll "accept" your return but then send a letter (Letter 4883C or 5071C) asking you to prove you are who you say you are. Your refund won't move an inch until you call them or use their online portal to verify your ID.

The Weekend Factor

The IRS usually processes refunds in batches. Many people notice that their "Where's My Refund" status updates on Saturdays. However, banks don't usually move money on Sundays or federal holidays. If your scheduled h and r block refund dates fall on a Monday that happens to be Presidents' Day, you’re waiting until Tuesday at the earliest.

Actionable Steps to Track Your Cash

Don't just sit there refreshing your bank app. There are better ways to know what's going on.

- Check the IRS Transcripts: This is the "pro" move. Instead of using the simplified "Where's My Refund" tool, log into your IRS online account and look at your Tax Account Transcript. Look for "Code 846." That code literally means "Refund Issued" and will usually have a date next to it that is more accurate than any other tracker.

- Use the H&R Block App, but verify with the IRS: H&R Block’s tracker is great for knowing when they sent it, but the IRS is the source of truth.

- Monitor your Emerald Card alerts: If you use the card, turn on text alerts. Often, the text arrives before you even think to check the balance.

- Review your 1040: Look at lines 27 and 28. If there are numbers there, you are a PATH Act filer. Don't expect your money before the end of February, no matter what your "estimated date" says.

If you hit the 21-day mark and still have nothing, check for an IRS letter. Most delays aren't random; they are caused by a specific request for more information. Dealing with it the day the letter arrives can save you a month of waiting. Otherwise, it's just a game of patience with the federal government's 1970s-era computer systems.