You've probably seen the headlines about Guyana being the world's fastest-growing economy. It's wild. One day it’s a quiet South American nation known for bauxite and sugar, and the next, it’s the "Dubai of the Caribbean" because of massive offshore oil finds. But if you’re looking at the Guyana dollar to US dollar exchange rate, you might notice something weird. Despite all those billions of barrels of oil, the currency hasn't exactly "mooned."

Honestly, it’s kind of a head-scratcher if you only look at GDP numbers.

Most people expect a country’s currency to skyrocket when they strike gold—or in this case, "black gold." Instead, the Guyana Dollar (GYD) stays remarkably steady, hovering around that 208 to 215 mark against the Greenback. Why? Because the Bank of Guyana keeps a very tight leash on it. They aren't interested in a rollercoaster ride.

The Reality of the Guyana Dollar to US Dollar Rate Today

Right now, if you walk into a commercial bank in Georgetown, like Republic Bank or GBTI, you’re looking at a selling rate for US dollars somewhere between $214 and $216 GYD. On the flip side, if you’re selling your US cash, you’ll probably get around $208 to $210 GYD.

It’s a managed float.

Basically, the central bank intervenes to make sure the rate doesn't twitch too much. They want stability for importers. If the Guyana dollar got too strong too fast—a classic case of "Dutch Disease"—it would actually hurt the country’s other exports like rice and gold. Nobody wants a $10 bag of rice just because the currency is overvalued.

Why the Rate Moves (And Why It Doesn't)

- The Oil Factor: ExxonMobil and its partners are pumping over 600,000 barrels a day now, with sights set on a million. This brings in a massive influx of US dollars.

- Infrastructure Spending: The government is building bridges, hospitals, and highways at a breakneck pace. This requires importing heavy machinery, which means the country is constantly "buying" US dollars to pay foreign contractors.

- The Black Market vs. Official Rate: There’s often a slight gap between what the Bank of Guyana says and what you’ll find at a small "cambio" (exchange house). Sometimes, during periods of high demand—like the Christmas season or around the big CPL cricket matches—the US dollar gets a bit scarce, and the street rate might creep up.

Real World Numbers for 2026

As of mid-January 2026, the weighted average market rate is holding firm at approximately $208.50 GYD to $1 USD.

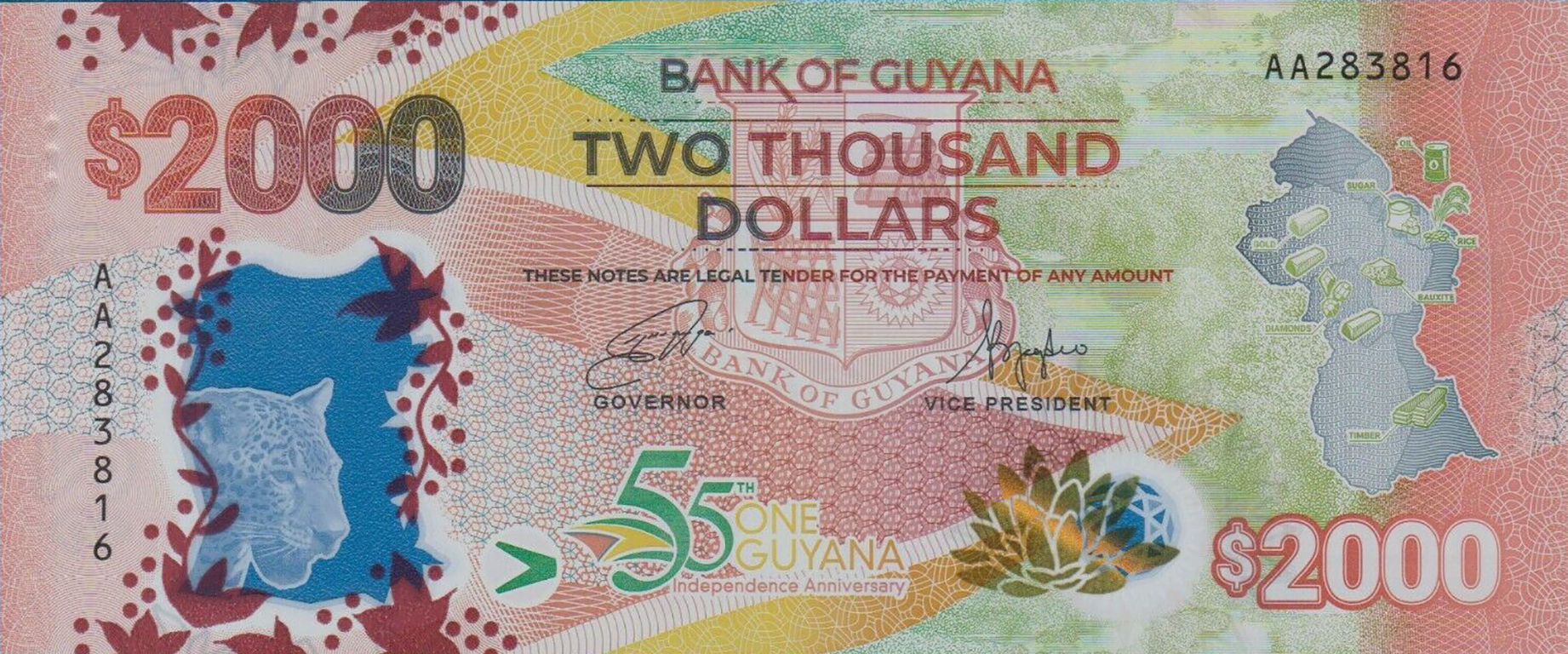

The Bank of Guyana's latest reports show that while the demand for foreign currency is rising because of all the new businesses opening up, the supply from oil royalties is keeping things balanced. It’s a delicate dance. If you're a traveler, don't expect to use your credit card everywhere. Guyana is still very much a cash-heavy society. You’ll need those colorful $1,000 and $5,000 GYD bills for your taxi from Cheddi Jagan International or for a plate of pepperpot at a local spot.

How to Get the Best Exchange Rate

Look, don't just swap your money at the airport. You’ll get killed on the spread.

The best move is usually the commercial banks in the city center. Scotia Bank and Demerara Bank often have competitive rates, but be prepared for lines. Guyanese banks take security and paperwork seriously. If you’re exchanging more than a couple hundred US dollars, bring your ID and be ready to explain where the cash came from. It's all part of the global anti-money laundering "know your customer" (KYC) rules that have hit the region hard.

💡 You might also like: Why Structural Steel and Plate Fabrication Is the Hardest Part of Modern Building

Small Cambios are Faster

If you're in a hurry, the licensed cambios—little exchange windows often found inside malls or near the markets—are way faster. They might charge a tiny bit more (maybe $217 GYD for $1 USD), but you won't spend two hours standing on a tiled floor under an AC unit.

Just make sure they are licensed. Look for the official Bank of Guyana sticker.

The "Dutch Disease" Threat

There’s a lot of talk among local economists like Dr. Tarron Khemraj about the "Real Effective Exchange Rate." Essentially, they’re worried that while the nominal rate of the Guyana dollar to US dollar stays flat, the internal cost of living is exploding.

Rent in Georgetown has tripled in some areas. A decent apartment that used to be $500 USD is now $2,500 USD. This is "inflationary pressure" in its purest form. If the currency was allowed to float freely, it might strengthen to $150 GYD to $1 USD, making imports cheaper but completely destroying the local farming sector. The government is trying to avoid this by keeping the currency pegged—unofficially—to the US dollar.

Key Factors to Watch in 2026

- New FPSOs: Every time a new "Floating Production Storage and Offloading" vessel (basically a giant floating oil factory) comes online, the revenue stream grows.

- The Gas-to-Energy Project: This is huge. Guyana is building a pipeline to bring natural gas onshore to lower electricity costs. If this works, it reduces the need to spend US dollars on importing heavy fuel oil.

- Regional Stability: Keep an eye on the border situation. Any tension tends to make investors nervous, which can cause a temporary "run" on the US dollar as people look for a safe haven.

Actionable Steps for Handling Guyana Dollars

If you're dealing with the Guyana dollar to US dollar exchange in 2026, keep these tips in your back pocket:

- Check the "Spread": Always look at both the "Buy" and "Sell" rates. If the gap is more than $6 GYD, you're probably getting a bad deal.

- Use ATMs Wisely: Scotiabank and Republic Bank ATMs usually accept international Visa/Mastercard, but they will give you Guyana dollars at the bank's daily rate plus a foreign transaction fee. It’s often better than a shady exchange window.

- Don't Hoard GYD: The Guyana dollar isn't a "hard currency." Once you leave the country, it's very difficult to exchange it back to US dollars or Euros elsewhere. Only change what you need.

- Monitor the Bank of Guyana Website: They publish the "Daily Report on Foreign Exchange Market Activities." It’s a dry PDF, but it tells you exactly what the big players are paying.

The story of the Guyana dollar is really the story of a country trying to grow up too fast without breaking its own pockets. It’s stable for now, but in a country where the GDP is growing by double digits every year, "stable" is a relative term.

Keep your eyes on the oil production numbers. As Guyana crosses the 1.2 million barrels-per-day mark later this decade, the pressure to revalue the currency is only going to get stronger. For now, just enjoy the fact that your US dollar still goes a pretty long way when it comes to buying a cold Banks Beer or a massive portion of cook-up rice.

To stay ahead of the curve, you should bookmark the Bank of Guyana's official exchange rate page and check it weekly if you have ongoing business interests in the region. Understanding the "mid-rate" versus what you actually get at the window will save you thousands of GYD over the course of a trip or a business contract.