If you’ve been watching the Golar LNG stock price lately, you’ve probably noticed it feels like a bit of a tug-of-war. One day, analysts are screaming "Strong Buy" because of a massive $17 billion backlog, and the next, technical indicators are flashing warning signs about short-term volatility. Honestly, it’s a lot to digest.

As of mid-January 2026, Golar LNG (GLNG) is trading around the $39.53 mark. It’s been a choppy ride. Just a year ago, we were looking at prices closer to $43, but the stock has spent much of the last few months bouncing between $30 and $40. It’s the kind of price action that keeps day traders busy and long-term investors checking their portfolios way too often.

The Big Picture: What’s Actually Moving the Needle?

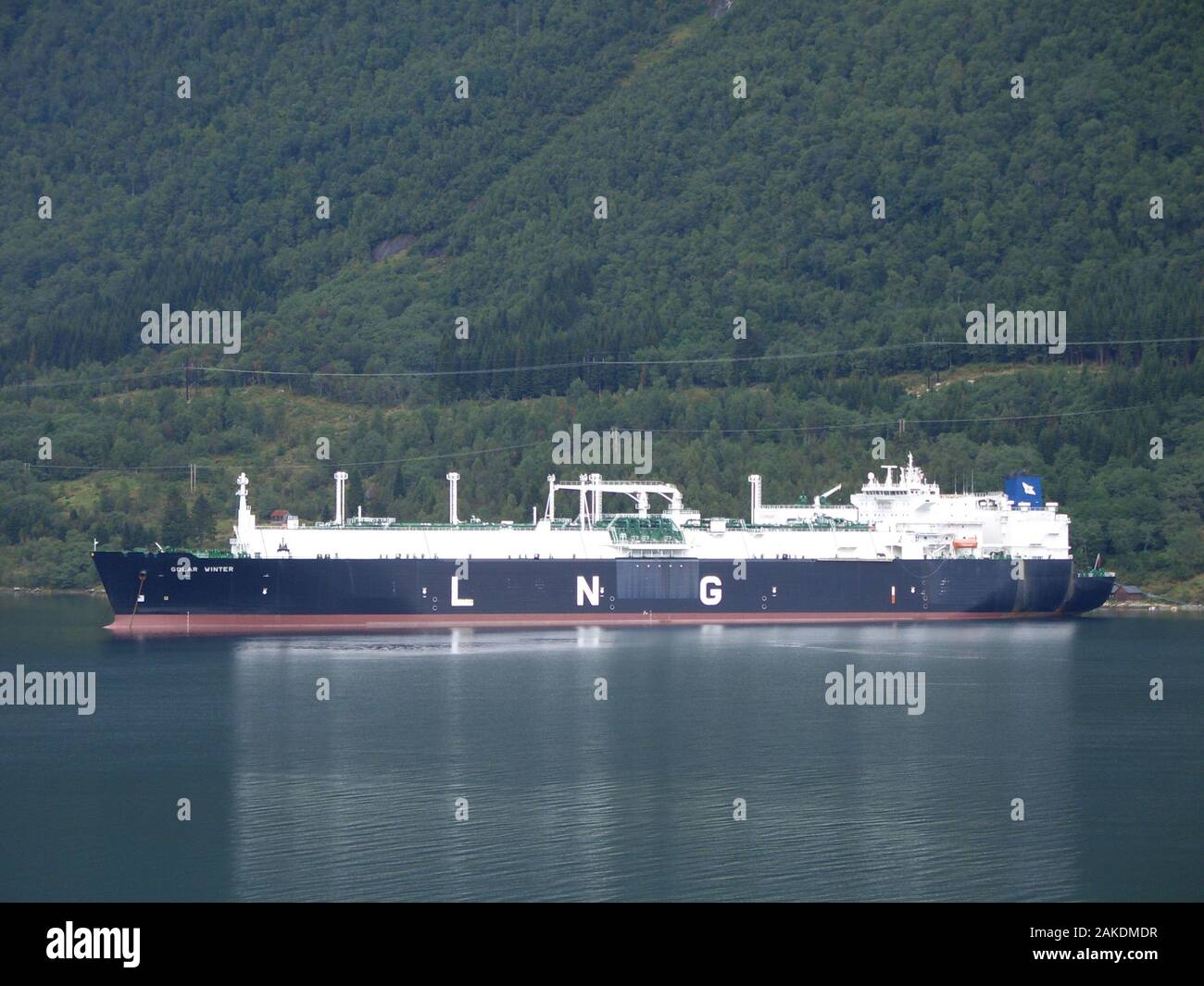

Why does the market seem so undecided? Basically, Golar has finished its transformation from a simple shipping company into a Floating Liquefied Natural Gas (FLNG) powerhouse. They sold off the old "Golar Arctic" ship in early 2025, effectively exiting the traditional shipping business. They’re all-in on FLNG now.

The Golar LNG stock price is currently anchored by two massive projects and one very ambitious conversion:

- FLNG Hilli: This is the steady workhorse. It’s been pumping out cargo in Cameroon, but that contract ends in July 2026. The stock is reacting to the transition plan: Hilli is heading to a Singapore yard for upgrades before starting a 20-year stint in Argentina in 2027.

- FLNG Gimi: Stationed offshore Mauritania and Senegal, Gimi is finally hitting its stride. After some post-launch tuning, it's actually exceeding its base capacity.

- The MKII Conversion: This is the "big bet." Golar is spending $2.2 billion to convert another vessel into an FLNG unit for Argentina. They’ve already sunk a billion into it, and it’s not expected to start earning until 2027 or 2028.

The Analyst Divide: $50 Target or "Strong Sell"?

You’ll find a massive gap in how experts view this stock. On one hand, firms like Goldman Sachs and Citigroup have been bullish, setting price targets as high as $54.00. They see the $8 billion EBITDA backlog from the Argentina deal and think the stock is a steal.

✨ Don't miss: Getting a Mortgage on a 300k Home Without Overpaying

On the other hand, Zacks Investment Research recently gave GLNG a "Strong Sell" (Rank #5). Why the hate? They’re looking at the immediate bottom line. Vessel operating expenses jumped over 44% in late 2025. When costs rise and earnings miss estimates—which happened in three out of the last four quarters—the "Value" and "Growth" scores take a hit.

Technicals vs. Fundamentals

If you’re a chart reader, the Golar LNG stock price just triggered what some call a "Golden Star" signal in late December 2025. That’s a rare alignment of moving averages that usually suggests a strong upward trend is coming.

But let’s be real: technicals don't mean much if the macro environment shifts. We’re seeing a lot of pressure from trade policies. Tariffs on steel directly impact the cost of these billion-dollar ship conversions. If it costs more to build the MKII, that eats into the future profit margins that investors are currently pricing in.

Dividends and the Buyback Safety Net

Golar is trying to keep shareholders happy while they wait for these long-term projects to pay off. They’ve held a steady $0.25 per share quarterly dividend. That’s roughly a 2.5% yield at current prices.

🔗 Read more: Class A Berkshire Hathaway Stock Price: Why $740,000 Is Only Half the Story

They also just launched a new $150 million share buyback program. This is a classic move to support the stock price. By reducing the number of shares on the market, they’re basically telling investors, "We think our stock is undervalued, and we're putting our money where our mouth is."

Risk Factors Nobody Talks About Enough

Everyone talks about natural gas prices, but Golar is actually more of a "toll booth" than a gas driller. They get paid to liquify the gas, regardless of the price—sorta.

The real risk is re-deployment gap. Between July 2026 (when Hilli leaves Cameroon) and Q2 2027 (when it starts in Argentina), that vessel isn't earning. It’s costing money for upgrades. If those upgrades take longer than expected, or if the Argentina project hits a snag, the Golar LNG stock price could see a sharp correction.

Then there’s the "Vaca Muerta" factor. The Argentina project relies on gas from the Vaca Muerta shale formation. Argentina’s political landscape is... let’s say "dynamic." While Golar has secured 30-year export authorizations, any shift in local energy policy could throw a wrench in the gears.

💡 You might also like: Getting a music business degree online: What most people get wrong about the industry

What You Should Watch Next

If you’re holding or looking to buy, keep your eyes on the Q4 2025 earnings report and the early 2026 updates on the MKII conversion progress.

The stock is currently a battleground between short-term "bears" worried about rising costs and long-term "bulls" looking at a $17 billion backlog. If the price can break above the **$40.28 resistance level**, technical analysts think it could run toward $45. If it falls below $37, we might be looking at a re-test of the 52-week lows.

Actionable Insights for Investors

- Monitor the Spread: Watch the gap between Brent oil prices and LNG spot prices. Golar has "commodity exposure" built into its contracts that can add $30M–$40M in extra annual profit for every $1 increase in gas prices above their base rate.

- Check the Yard Schedule: Any news out of the Seatrium shipyard regarding the Hilli upgrade is critical. Delays here are the biggest threat to the 2026–2027 fiscal bridge.

- Set Realistic Stops: If you're trading the technicals, the support at $38.64 is the line in the sand. A drop below that usually triggers a sell signal for the algorithms.

- Income Play: For those just here for the dividend, the 2.5% yield is safe for now, backed by $661 million in cash on the balance sheet.

The story of Golar isn't about shipping anymore; it’s about becoming the infrastructure backbone of the global energy transition. It’s a high-stakes, high-reward play that requires a lot of patience and a stomach for $2 daily swings.

Next Steps: Review your portfolio's energy exposure to see if a mid-cap infrastructure play like Golar fits your risk profile. You should also check the latest SEC filings for any updates on the $1.2 billion Gimi financing facility, which is a major pillar of their current liquidity.