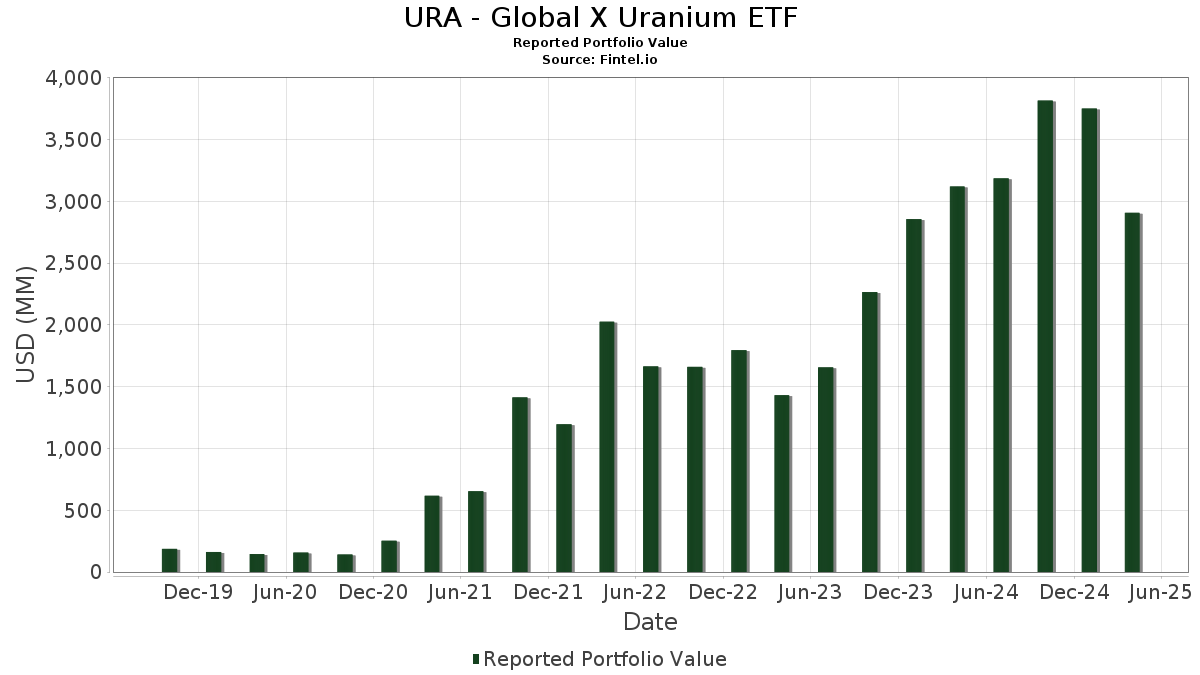

Let’s be honest. Most people didn't give a rip about uranium five years ago. It was the "forgotten" commodity, buried under the weight of the Fukushima disaster and a decade-long bear market that saw mines shuttered and investors fleeing for the hills. But walk into any trading floor or browse a financial forum today, and the Global X Uranium ETF (URA) is basically the belle of the ball. It’s weird how fast things change. Suddenly, nuclear energy isn't the bogeyman of the 70s; it’s the "green" savior of a world that’s terrified of rolling blackouts and carbon emissions.

Buying the Global X Uranium ETF isn't just a bet on a metal. You're betting on a massive, slow-moving geopolitical shift. The fund tracks the Solactive Global Uranium & Nuclear Components Total Return Index. That’s a fancy way of saying it buys the companies that dig the stuff up, the ones that build the reactors, and the ones that keep the lights on. It’s the largest and most liquid uranium ETF on the market, which makes it the default choice for anyone trying to catch this particular wave.

💡 You might also like: Is the Price of Gold Today Just the Beginning? What Most People Get Wrong About This Rally

The Supply Squeeze That Everyone Is Talking About

Why is everyone obsessed with URA right now? It comes down to a simple, brutal math problem. For years, the world was oversupplied with uranium. We had tons of secondary supply—old cold war warheads being turned into fuel and stockpiles that countries were sitting on. That’s gone. Or at least, it’s not enough anymore.

Kazatomprom, the world’s largest producer out of Kazakhstan, has been hitting production snags. They’ve cited shortages of sulfuric acid—which is essential for their leaching process—and general logistical nightmares. When the "Saudi Arabia of Uranium" says they might miss their targets, the market listens. Then you have Cameco (CCJ), the Canadian giant that makes up a huge chunk of the Global X Uranium ETF’s holdings. They’ve had their own struggles getting production back up to full tilt after years of "care and maintenance."

Demand? It’s going vertical. We aren't just talking about keeping the old plants running. We’re talking about China building reactors like they’re LEGO sets. We're talking about the U.S. extending the lives of aging plants that were supposed to be decommissioned. And then there’s the AI factor. Every time you ask a chatbot a question, it gulps down electricity. Data centers are energy hogs, and Big Tech—think Amazon, Microsoft, and Google—is starting to realize that wind and solar can’t provide the 24/7 "baseload" power these servers require. Nuclear can.

What’s Actually Inside the Global X Uranium ETF?

If you peel back the lid on URA, you’ll find it’s not just a pure-play uranium miner fund. That’s a common misconception. It’s a bit of a hybrid. About 70% of the fund is tied directly to uranium mining and the production of nuclear components. The rest? It spills over into broader industrial and energy sectors that support the nuclear ecosystem.

Cameco is the heavy hitter here. It’s usually the largest holding, and for good reason. They are the blue-chip of the space. If Cameco sneezes, the whole sector catches a cold. But the fund also gives you exposure to the smaller, "junior" miners. These are the lottery tickets. They have names you’ve probably never heard of, companies with projects in the Athabasca Basin or Namibia. They are volatile. They can go up 10% in a morning and lose it by lunch. That’s the "spice" in the URA recipe.

You also get exposure to companies like NexGen Energy and Paladin Energy. But here's the kicker: because URA is a broad fund, it also includes companies that are just adjacent to nuclear. This is why some purists prefer smaller, more focused ETFs like URNM. However, for most folks, the liquidity of the Global X Uranium ETF—the ability to buy and sell millions of dollars worth of shares without moving the price—is the big draw.

The Geopolitical Mess We’re In

You can't talk about uranium without talking about Russia. Or the U.S. ban on Russian uranium imports. It’s a mess. Russia provides a massive portion of the world’s enriched uranium. When the U.S. government decided to pivot away from Russian supply, it sent a shockwave through the fuel cycle.

The Global X Uranium ETF reacted predictably: it stayed volatile. Investors are trying to figure out where the replacement fuel will come from. Can Western enrichers like Centrus Energy (LEU) pick up the slack fast enough? Probably not. It takes years, sometimes decades, to build this infrastructure. That "lag" is exactly what the bulls are betting on. They want to be positioned in the companies that own the physical resource while the world scrambles to build out a Western-aligned supply chain.

Is It Too Late to Buy In?

This is the question I get most often. "Did I miss the boat?"

Look, uranium prices hit decade-highs recently. It’s not the "steal" it was in 2018 when the price of U3O8 was dragging along the bottom at $20 a pound. We’ve seen prices spike toward $100. But "expensive" is relative. If you believe the world is entering a nuclear renaissance—one driven by climate goals and energy security—then we are still in the early innings.

But you have to be careful. The Global X Uranium ETF is not a "set it and forget it" index fund like the S&P 500. It’s cyclical. It’s aggressive. It has high fees compared to a standard total market fund (the expense ratio usually sits around 0.69%). You are paying for the niche access.

One thing people get wrong: they think uranium prices and URA move in a perfect 1:1 ratio. They don't. The ETF is made of stocks. Stocks have labor costs, fuel costs for their trucks, and management teams that sometimes make dumb decisions. A miner’s stock price can drop even if uranium goes up if that miner has a cave-in or a tax dispute with a local government. That’s "company risk," and URA spreads it out, but it doesn't eliminate it.

The Small Modular Reactor (SMR) Hype

There’s a new buzzword in the URA world: SMRs. Small Modular Reactors.

✨ Don't miss: Smith and Nephew Internships: What Nobody Tells You About Getting In

The idea is to build reactors in factories and ship them to the site, rather than building these massive, multi-billion dollar bespoke plants that always seem to go over budget and behind schedule. NuScale was the poster child for this, though they’ve had some public setbacks. Other players like X-energy and TerraPower (backed by Bill Gates) are pushing the tech forward.

The Global X Uranium ETF captures some of this sentiment. While most SMR companies are still private or in the early stages, the industrial giants that will build the components are often tucked away in the fund’s broader holdings. It’s a play on the future of the grid, not just the current one.

Understanding the Risks (The Stuff Nobody Likes to Hear)

Nothing goes to the moon in a straight line. The biggest risk to the Global X Uranium ETF isn't just a market crash; it’s another "event." Nuclear energy is safe—statistically the safest form of power—but it has a massive PR problem. One accident anywhere in the world would likely tank the sector overnight.

There’s also the risk of "thrift." Technology improves. If we figure out how to get more energy out of less fuel, or if fusion (the holy grail of energy) suddenly becomes viable sooner than expected, the demand for traditional uranium might soften. That’s a long-shot, but it’s a risk.

Finally, keep an eye on interest rates. Mining is capital-intensive. These companies borrow a lot of money to dig deep holes in the ground. If rates stay high, their margins get squeezed. URA investors often forget that they are investing in industrial businesses, not just a glowing green rock.

How to Actually Play This

If you're looking to jump into the Global X Uranium ETF, don't just dump your life savings in on a Monday morning. That’s a recipe for a heart attack.

- Dollar Cost Average: This sector is famous for 20% swings. If you buy a little bit every month, you blunt the impact of the volatility.

- Watch the Spot Price: Follow the "spot price" of uranium. It’s the leading indicator for how the stocks in URA will perform.

- Check the Holdings: Periodically look at what’s inside the fund. Global X rebalances it. Sometimes they add more service companies; sometimes they lean harder into miners.

- Time Horizon: This is a 5-to-10-year play. If you're trying to day-trade the Global X Uranium ETF, you're competing with algorithms that are faster than you.

The world is hungry for power. It’s hungry for clean power. And right now, nuclear is the only thing that can check all the boxes at scale. The Global X Uranium ETF is the most straightforward way for the average person to grab a seat at that table. Just make sure you can stomach the ride.