If you’ve been watching the global x uranium etf share price lately, you know it’s been a bit of a rollercoaster. One day it’s soaring on news of a new AI data center needing "baseload" power, and the next, it’s dipping because some macro data point spooked the broader market. Honestly, it’s enough to give any investor whiplash.

But here’s the thing: most people looking at the ticker symbol URA are missing the forest for the trees. They see a price move and think "speculative bubble," when the reality on the ground—in the actual mines and nuclear boardrooms—is much more calculated.

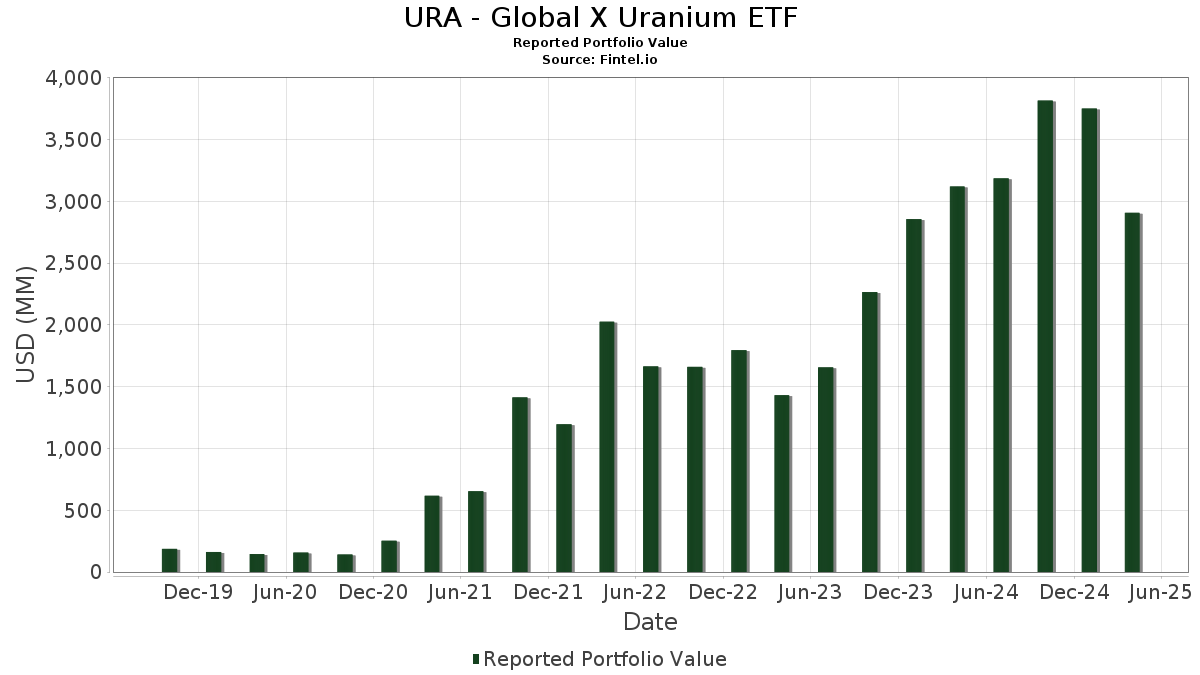

As of mid-January 2026, the global x uranium etf share price has been hovering in the $52 to $55 range. Just a few weeks ago, at the start of the year, it was closer to $46. That’s a massive jump in a very short window. You’ve got to ask yourself why.

The AI "Power Hunger" is More Than Just Hype

We’ve all heard the stories. Tech giants like Microsoft and Google are essentially becoming energy companies. They aren't just buying offsets anymore; they are signing massive, long-term power purchase agreements (PPAs) with nuclear operators.

Why? Because wind and solar are great, but they don't run a 1,000-terawatt-hour data center at 3:00 AM when the wind is dead. Nuclear does.

This shift has fundamentally changed how people value the global x uranium etf share price. It used to be just about "old" nuclear plants being retired. Now, it's about a high-growth tech sector that literally cannot exist without the carbon-free, 24/7 reliability that uranium provides.

👉 See also: How Much Do Chick fil A Operators Make: What Most People Get Wrong

What’s actually inside the URA ticker?

When you buy URA, you aren't just buying yellowcake. You’re buying a basket of companies that do the heavy lifting.

- Cameco Corp (CCJ): The giant. They make up roughly 23% of the fund. If Cameco sneezes, the whole ETF catches a cold.

- Oklo Inc (OKLO): A newer addition that’s been grabbing headlines with its small modular reactor (SMR) tech. It’s about 10% of the portfolio now.

- Uranium Energy Corp (UEC): The pure-play miners focused on North American production.

- Sprott Physical Uranium Trust: This is interesting because it’s actual physical uranium held in a vault. It’s a direct link to the spot price.

Why the Spot Price and the Share Price Aren't Twins

There’s a weird disconnect in this market. In 2025, the spot price of uranium—the actual cost to buy a pound of the stuff—was kinda boring. It stayed mostly between $70 and $80.

Yet, the global x uranium etf share price has often moved much more aggressively.

Investors are forward-looking. They see that utilities (the folks who run the power plants) have been "anemic" with their contracting for the last year. Basically, they’ve been living off their cupboards. But those cupboards are getting bare. Market experts like Ben Finegold from Ocean Wall have suggested we could see uranium hit $150 or even $200 a pound once those utilities are forced back into the market in 2026.

The ETF is front-running that reality.

✨ Don't miss: ROST Stock Price History: What Most People Get Wrong

The supply side is a mess (in a good way for investors)

Mining uranium isn't like turning on a tap. You can't just "produce more" because the price went up yesterday. It takes 12 to 15 years to bring a new mine online. Even restarting an "old" mine is a nightmare. You have to re-hire engineers who might have left the industry to, I don't know, teach piano or write code.

Kazakhstan, which produces a huge chunk of the world's supply through Kazatomprom, has been facing logistical "bottlenecks." Acids needed for extraction are in short supply. Geopolitical tensions make shipping a headache.

When supply is stuck and demand is accelerating, price is the only thing that can break.

Understanding the Risks: It’s Not All "To the Moon"

I’d be lying if I said this was a sure bet. The global x uranium etf share price has plenty of ways to break your heart.

- Macro Crashes: Because URA is an equity fund, it often drops when the S&P 500 drops, even if the uranium fundamentals are perfect.

- Regulatory Shifts: One bad headline about a reactor safety issue can set the industry back years in terms of public sentiment.

- Expense Ratios: URA isn't cheap to own. It has a gross expense ratio of 0.69%. That’s high compared to a basic S&P 500 fund.

Also, let's talk about the dividend. URA actually pays out a decent amount for a commodity fund—it recently had a distribution yield of nearly 4.8%. But don't get too attached. Those payouts can fluctuate wildly depending on the capital gains the fund realizes. In some years, they might give you back your own capital (ROC), which can complicate your taxes.

🔗 Read more: 53 Scott Ave Brooklyn NY: What It Actually Costs to Build a Creative Empire in East Williamsburg

What Most People Get Wrong About Timing

Most retail investors wait for the "breakout" to buy. They see the global x uranium etf share price hit a 52-week high and jump in.

The pros? They watch the contracting cycles.

The real money is made before the utilities sign those massive 10-year deals. Right now, in early 2026, we are seeing the beginning of a "contracting wall." If you wait until the price of uranium is $120 to buy the ETF, you’ve probably missed the biggest part of the move.

Actionable Insights for Your Portfolio

If you’re looking at adding uranium to your mix, stop obsessing over the daily charts. Instead, do this:

- Check the Weighting: Understand that you are heavily exposed to Cameco. If you don't like that company, look at the Sprott Uranium Miners ETF (URNM) instead; it’s more diversified across smaller miners.

- Watch the SMR News: Small Modular Reactors are the future of the global x uranium etf share price. Keep an eye on companies like Centrus Energy (LEU) and Oklo. They are the "tech" side of the nuclear trade.

- Mind the Gap: There is often a gap between the NAV (Net Asset Value) of the ETF and its market price. If the ETF is trading at a significant premium, maybe wait for a dip.

- Set a Multi-Year Horizon: This is a "decade trade," not a "weekend trade." The 52-week range has been as wide as $19 to $60. You need a stomach for that kind of volatility.

The bottom line is that the world is electrified, and that electricity needs a fuel. Uranium is the only carbon-free fuel that can meet the massive scale required by the 2026 tech economy. The global x uranium etf share price is simply the market's way of trying to figure out what that fuel is worth before the bill comes due.