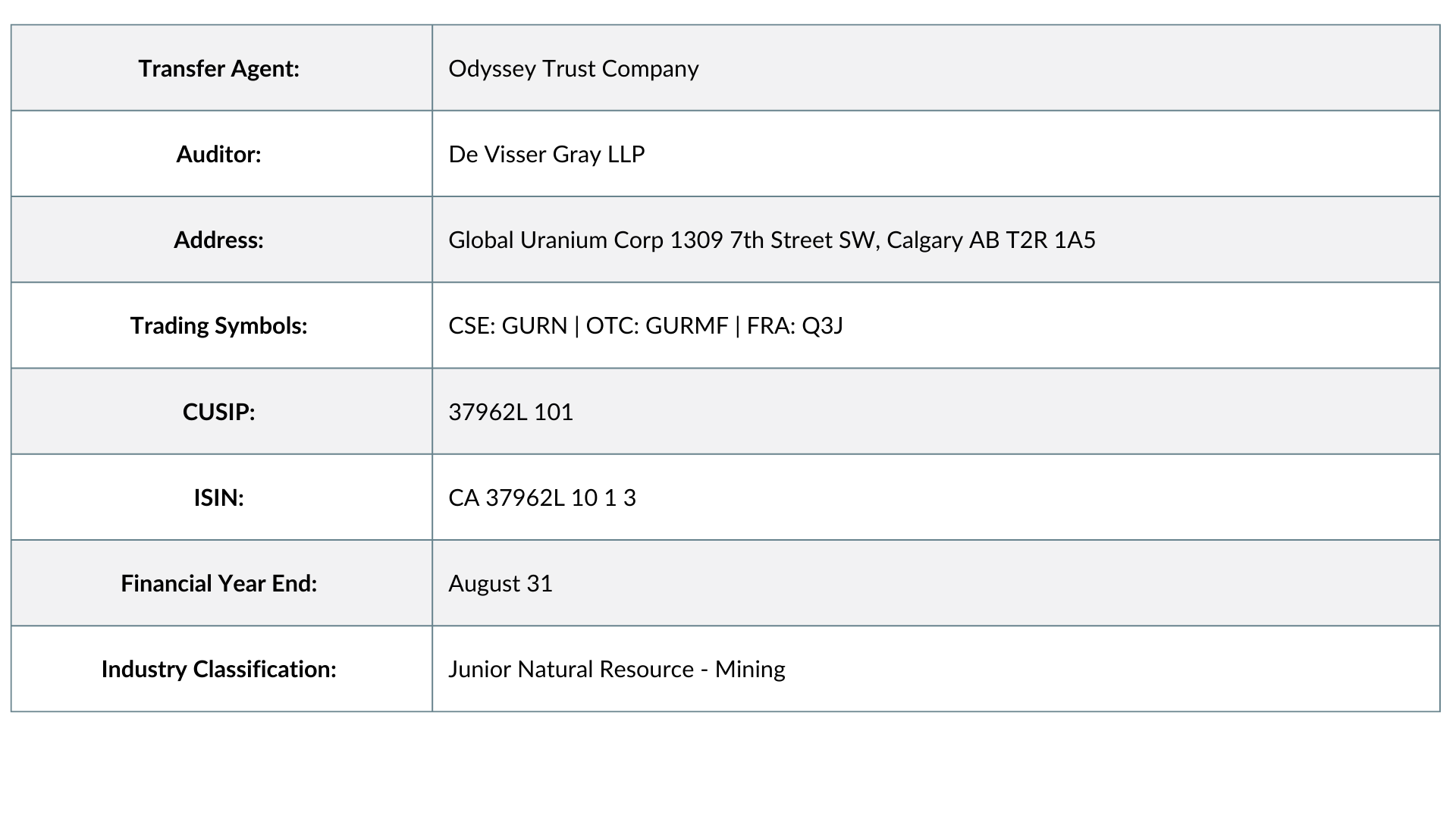

So, you’re looking at Global Uranium Corp. It’s okay. Most people are these days. The ticker—GURFF on the OTC or GURN on the CSE—has been popping up on scanners a lot lately. Honestly, it’s easy to see why. Uranium is the "it" commodity of 2026. Data centers are hungry. Governments are terrified of losing the lights. And here is this tiny company sitting in Wyoming, the heart of American uranium country.

But let’s be real for a second.

Investing in a micro-cap like this isn't the same as buying Cameco. It’s a different beast entirely. While the big guys are signing billion-dollar offtake agreements, Global Uranium Corp is still very much in the "boots on the ground" phase. They are hunting for the stuff. If you're looking at the Global Uranium Corp stock price and wondering if it's a "lottery ticket" or a legitimate long-term play, you've got to look past the hype.

The Wyoming Factor: Why Location is Everything

Wyoming is basically the Saudi Arabia of US uranium. It’s got the right rocks, sure, but more importantly, it has the right rules. Global Uranium Corp has been doubling down on its Airline Project in the Wind River Basin.

Just recently—we're talking late 2025 and into January 2026—they’ve been busy. They didn't just sit on their claims. They expanded them. They’ve now got over 600 hectares of land in the Copper Mountain district.

What did they actually find?

The technical team, led by folks from Big Rock Exploration, spent a chunk of the fall doing high-resolution radiometric surveys. They found what they call "coincident radiometric highs." Basically, their sensors started screaming in certain spots.

🔗 Read more: ROST Stock Price History: What Most People Get Wrong

- The Wagon Bed–Archean unconformity: This is a fancy geological term for where two different rock layers meet. In uranium mining, these "unconformities" are often where the big deposits hide.

- The Scorpion Unit: This is an arkosic sandstone horizon they've identified. It showed anomalous radioactivity in hand samples.

They are currently waiting on lab results from ALS Reno to see if the "yellow" in the rocks is actually the grade they need to make a mine. If those assays come back strong, 2026 could be a very loud year for this quiet stock.

The Reality of the Financials

Let's talk money. Or, more accurately, the lack of it.

Global Uranium Corp is a junior explorer. That means they don't have revenue. They have expenses. As of early 2026, their market cap is hovering around the $5 million to $10 million range. That is tiny. For context, a single "Strong Buy" recommendation from a major newsletter could send a stock this size to the moon, but a bad assay result could also send it into the floor.

- Cash on Hand: They recently reported around $980,000 in cash.

- Burn Rate: They’ve been spending roughly $4 million a year on operations and exploration.

- Debt: Surprisingly low. They aren't bogged down by massive loans, which gives them some breathing room.

You've got to understand the dilution risk here. Since they aren't selling uranium yet, they have to sell shares to keep the lights on. It's the standard "junior miner" lifecycle. You hope they find enough in the ground to make the dilution worth it.

Why the Uranium Market is Different in 2026

You might be wondering why anyone cares about a tiny explorer in Wyoming. Well, the macro picture is kind of insane.

💡 You might also like: 53 Scott Ave Brooklyn NY: What It Actually Costs to Build a Creative Empire in East Williamsburg

In the past, uranium was a sleepy market. Not anymore. The US just dumped $2.7 billion into domestic enrichment contracts. Why? Because we’re trying to stop buying from Russia, who currently controls about 40% of the world's enrichment.

Then you have the "Big Tech" factor. Microsoft, Google, and Amazon are all looking at nuclear to power their AI data centers. They need reliable, carbon-free power 24/7. Wind and solar can't do that alone. This has pushed uranium spot prices toward the $80-$85 per pound range, and some analysts—like the folks at Uranium Insider—think we’re heading for $100+ soon.

When the price of the metal goes up, the value of the "pounds in the ground" for companies like Global Uranium Corp theoretically goes up too. Even if they never build the mine themselves, they become a very attractive acquisition target for a mid-tier producer looking to expand.

What Most People Get Wrong

The biggest mistake? Treating Global Uranium Corp like a tech stock.

Mining is slow. It is agonizingly slow. You have to map, then drill, then test, then permit, then build. We are years away from this company pulling a single pound of yellowcake out of the ground for sale.

📖 Related: The Big Buydown Bet: Why Homebuyers Are Gambling on Temporary Rates

Another thing: GURFF is an OTC stock. Liquidity can be a nightmare. On some days, only 15,000 shares might trade. If you try to sell a huge position all at once, you’ll crash the price yourself. It's a "nibble" stock, not a "dump the retirement fund" stock.

The Competition

It’s not just Global Uranium. You have Uranium Energy Corp (UEC), which just hit all-time highs of over $17. You have Cameco (CCJ), the king of the sector. Compared to them, Global Uranium is a speck. But the "specks" are where the 5x or 10x returns happen—if they strike it rich.

Actionable Insights for Your Watchlist

If you're tracking Global Uranium Corp stock, don't just watch the daily price fluctuations. That's noise. Instead, keep an eye on these specific triggers:

- Assay Results: Look for the lab results from the 2025 fall program. If they show high-grade uranium (anything above 0.05% U3O8 in Wyoming is decent, but 0.1% or higher gets people excited), the stock will likely react.

- Drill Permits: Mapping is great, but the "truth machine" is the drill rig. Watch for news that they've secured permits for a 2026 drilling campaign.

- The $80 Support Level: Keep an eye on the uranium spot price. If it stays above $80, the entire sector remains "hot." If it drops to $60, the money will dry up for small explorers fast.

- Institutional Interest: Watch the volume. If you see a sudden spike in daily volume without a massive price move, it might mean a bigger player is quietly accumulating a position.

Honestly, this isn't a "safe" investment. It's a speculative play on the future of American energy independence. If you're going to play in this sandbox, make sure you're okay with the volatility.

Start by pulling up the latest "Management’s Discussion and Analysis" (MD&A) on SEDAR+. It’s boring, it’s dense, but it tells you exactly where the money is going. If you see them spending more on "investor relations" than on "drilling," that’s your red flag to walk away. If they’re putting the cash into the ground, you might just have a winner on your hands.