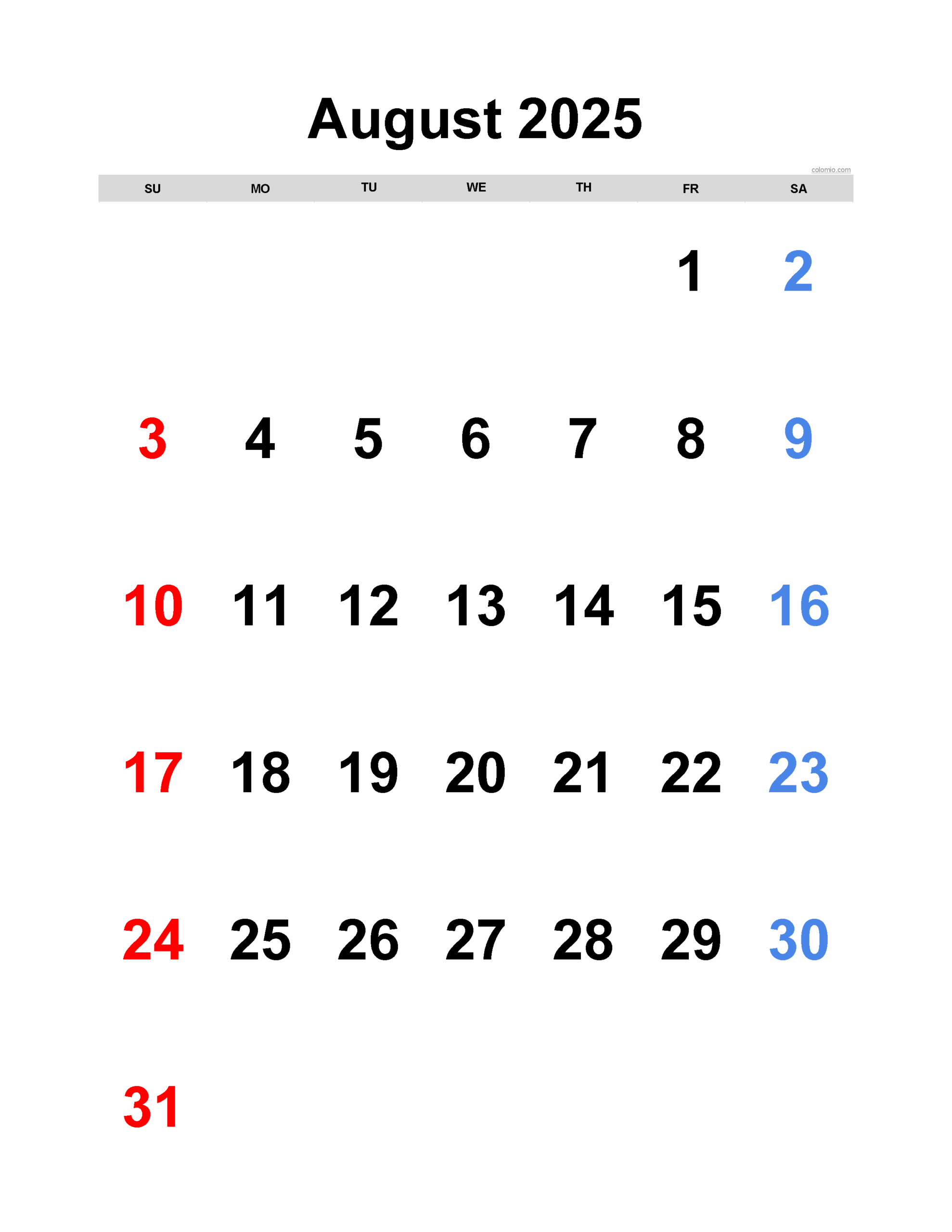

If you were watching the tickers on Friday, you saw it. That massive 846-point surge in the Dow wasn't just some random summer fluke. Honestly, it felt like the entire world of finance took a collective breath for the first time in months. Global business news today August 23 2025 is dominated by one thing: the "Powell Pivot" at Jackson Hole. Fed Chair Jerome Powell basically signaled that the era of aggressive rate hikes is over, and the market reacted like it just won the lottery.

It’s wild how much can change in a single afternoon.

📖 Related: Navitas Stock Price Today: What Most People Get Wrong

The Dow Jones Industrial Average didn't just go up; it slammed through to a record high of 45,631.74. That’s the first time we’ve seen an all-time high since late 2024. For a while there, it sort of felt like the market was stuck in a rut, but Powell’s admission that a weakening labor market "may warrant" cuts has flipped the script.

The Jackson Hole Effect and the New Market Reality

Jerome Powell stood up in Wyoming and finally said what everyone wanted to hear. The "higher for longer" mantra is being quietly retired. While the S&P 500 and the Nasdaq didn't quite hit new records today, they were up 1.5% and 1.9% respectively. They were actually on track for their worst week since May until that speech happened.

But it’s not just about the US.

Over in Europe, the Stoxx 600 climbed to six-month highs. There’s this weird mix of optimism over tentative peace talks in Ukraine and the relief of cooling inflation. Meanwhile, the UK and France are dealing with their own mess—specifically, a new "one-in, one-out" migrant return system that’s making waves in the labor markets there.

Tech is Back (Mostly)

Tech stocks had a weirdly bullish week despite the volatility. Companies like Palo Alto Networks and Intuit posted some seriously strong results, proving that the AI hype isn't just smoke and mirrors.

Specifically, Nvidia and OpenAI reportedly closed a $100 billion deal to build massive data centers. If you thought the AI spending spree was slowing down, you've got another thing coming. UBS is reporting that AI-driven M&A has already hit $170 billion this year. It's becoming the primary engine for deal-making globally.

The China Paradox: Tariffs vs. Surplus

You’ve probably heard about the "unstoppable" export engine in China. Despite some pretty heavy-handed US tariffs, China is actually on track for a record $1.2 trillion trade surplus. How? Basically, they just pivoted. Instead of the US, they are flooding India and Southeast Asia with cheap goods.

In fact, Indian purchases of Chinese goods hit an all-time high this month. It’s a bit of a slap in the face to the trade war narrative. At the same time, the Indian stock market is hitting its own milestones. The Sensex crossed 85,000 for the first time this week. It’s a massive sign of confidence in the region, even as the US and China keep bickering over chips and trade routes.

What’s Actually Happening with Your Money?

If you're looking at your own portfolio, the news is a bit of a mixed bag.

- Mortgage Rates: The 30-year fixed rate stayed flat at 6.58%. Even with the Fed talking about cuts, the housing market isn't exactly "cheap" yet.

- Gold: It’s holding steady around $2,400. People are still scared, despite the stock rally.

- Oil: Brent crude is back up over $79. Supply disruptions in the Middle East and OPEC+ cuts are keeping prices sticky at the pump.

Honestly, the real story beneath the surface is that investors are hedging. Even as the Dow hits records, billions of dollars are flowing into "safe" assets like bond funds. It’s like everyone is at a party but keeping their coat on just in case they need to run for the exit.

The Crypto Rebound and Corporate Moves

Bitcoin is back above $109,000. It’s a psychological level that seems to be holding for now. On the corporate side, Elon Musk just got another $24 billion in Tesla shares after a bit of a standoff with the board.

🔗 Read more: Aadhaar PAN Link Status: Why You Might Be Stuck in Inoperative Limbo

Also, keep an eye on Reliance Jio in India. They are gearing up for what could be one of the biggest IPOs in history. If you're into global finance, that’s going to be a massive liquidity event that will ripple through the emerging markets.

Consumer Struggles are Real

Don't let the record-breaking Dow fool you into thinking everything is perfect. Walmart’s recent earnings showed some real cracks. People are still spending on essentials, but discretionary spending is slowing down big time. The University of Michigan’s Consumer Sentiment index actually fell to 58.2. People are worried about their jobs, even if Wall Street is cheering.

Why This Matters for the Rest of 2025

We are moving from a period of "inflation anxiety" to "growth anxiety." The Fed is worried about the labor market now, not just the price of eggs. This shift means that for the rest of the year, every single jobs report is going to be a market-moving event.

Next week, we get the PCE inflation data. That’s the Fed’s favorite gauge. If that comes in cool, the September rate cut is basically a done deal. If it’s hot? Well, today’s rally might evaporate pretty quickly.

Actionable Insights for Investors

If you want to navigate this mess, here's what you should actually be doing:

- Watch the Yield Curve: It’s starting to flatten. This usually means the market is bracing for multiple cuts. If you're in fixed income, keep your eye on the 10-year Treasury, which just slipped toward 3.7%.

- Don't Ignore India: With the Sensex at 85,000 and the Jio IPO on the horizon, the growth story has shifted East. If you're heavily weighted in US tech, it might be time to diversify.

- AI is Still the Play: But be selective. Focus on the companies actually building the infrastructure (like the Nvidia/OpenAI data center play) rather than just the ones putting "AI" in their press releases.

- Check Your Cash: With rate cuts coming, those high-yield savings accounts aren't going to stay high forever. It might be time to lock in some longer-term yields before the Fed actually pulls the trigger.

The reality of global business news today August 23 2025 is that the floor has shifted. We aren't fighting the Fed anymore; we're watching to see if they can stick the "soft landing" without the labor market falling apart. It's a delicate balance, and honestly, it's going to be a bumpy ride into September.

Stay liquid, stay informed, and maybe don't go all-in on that record-high Dow just yet.