Walk into a bank today and ask for 50 100 dollar bills. It sounds simple. It’s $5,000. In the grand scheme of the global economy, five grand is a drop in the bucket, right? But the moment you ask for that specific stack, you’re stepping into a world of federal regulations, bank liquidity quirks, and security protocols that most people never think about until they’re standing at the teller window feeling slightly awkward.

Cash is weird. We use it less and less, yet the $100 bill—the "Benjamin"—is the most printed note in the United States. According to Federal Reserve data, there are actually more $100 bills in circulation than $1 bills. Most of them are overseas, acting as a global store of value. When you want fifty of them at once, you’re basically asking for a small, dense brick of purchasing power that fits easily into a standard envelope. It’s a specific kind of financial flex, but it comes with paperwork you might not expect.

Why 50 100 Dollar Bills Is the Magic Threshold for Banks

Most people think the "red flag" number is $10,000. That’s the threshold for a Currency Transaction Report (CTR) under the Bank Secrecy Act. But honestly, $5,000—which is what fifty hundreds adds up to—is often the internal "soft limit" where bank managers start squinting.

Banks don't keep as much cash on hand as they used to. It’s a liability. If you walk into a small suburban branch on a Tuesday morning, they might not even have fifty crisp hundreds ready to give you without depleting their drawer for the rest of the day. They have to manage their "vault cash" carefully. If you want that specific amount, you’ve basically got to hope they had a few local businesses make large deposits earlier that morning.

There’s also the "Know Your Customer" (KYC) factor. If you suddenly withdraw $5,000 in large bills and your usual activity is just direct deposits from a tech job and Netflix subscriptions, the bank's automated fraud systems might take a mental note. It's not illegal. Not even close. But it is "out of pattern."

🔗 Read more: USD to UZS Rate Today: What Most People Get Wrong

The Physicality of the Benjamin

Let’s talk about the bills themselves. A single $100 bill weighs exactly one gram. This means your stack of 50 100 dollar bills weighs 50 grams, or about 1.76 ounces. That is lighter than a deck of cards.

It’s incredibly easy to conceal. This is exactly why the $100 bill is the favorite of both high-net-worth individuals who like privacy and, unfortunately, people doing things they shouldn't. If you’re carrying that much cash, you've got to be smart. A stack of fifty bills is roughly 0.21 inches thick if they are brand new and "uncirculated." If they are "fit" (bank-speak for used but clean), the stack will be thicker, maybe closer to half an inch.

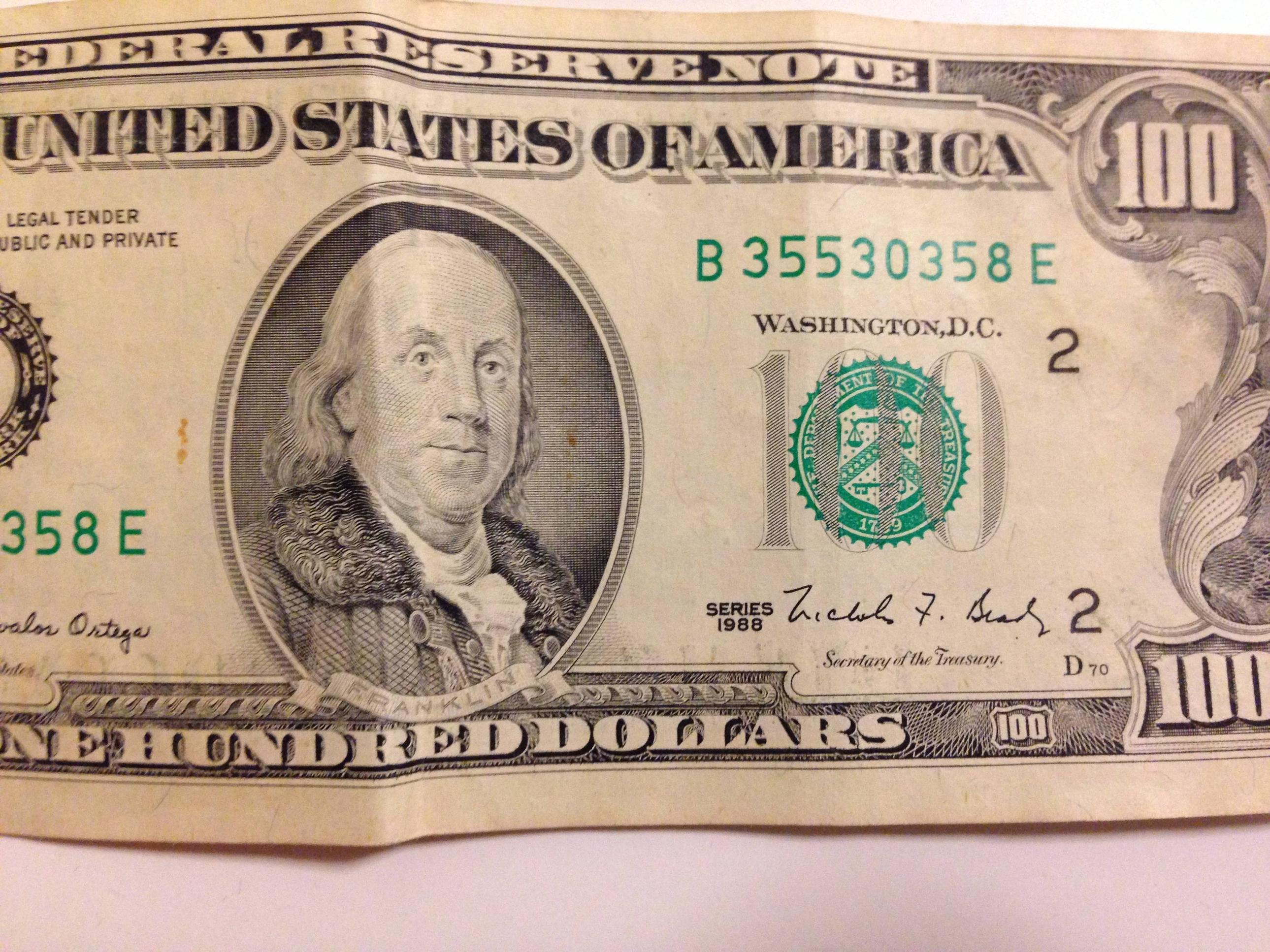

Spotting the Fakes in Your Stack

If you are selling a car or a piece of equipment and someone hands you fifty hundreds, you better know how to check them. Don't just rely on those cheap pens. The pens only detect starch in wood-based paper; sophisticated counterfeiters often use "bleached" lower-denomination bills.

- The 3D Security Ribbon: That blue strip in the middle of modern 100s isn't printed on. It's woven into the paper. Move the bill; the bells change to 100s.

- The Color-Shifting Ink: The copper-colored inkwell on the front has a bell inside that changes to green. It’s a subtle shift.

- The Texture: Rub your fingernail over Ben Franklin’s shoulder. It should feel "ridged" or rough. That’s intaglio printing. It’s very hard to fake.

The Reality of "Structuring" and Federal Oversight

Here is where people get into trouble without meaning to. Let's say you need $10,000 but you're worried about the IRS or "the man" watching you. You decide to go in on Monday and get 50 100 dollar bills. Then you go back on Wednesday and get another fifty.

💡 You might also like: PDI Stock Price Today: What Most People Get Wrong About This 14% Yield

That is called "structuring."

It is a federal crime. Even if the money is 100% legal and you paid every cent of taxes on it, the act of breaking up a large cash transaction to avoid a reporting threshold is a felony under the Bank Secrecy Act. It sounds crazy, but the Department of Justice prosecutes this. If you need $10,000, just take it out all at once. Fill out the form. It takes two minutes. No one cares unless you’re actually laundering money for a cartel. Trying to be "sneaky" by taking out fifty bills at a time is the fastest way to get your bank account flagged or closed.

Practical Uses for a $5,000 Cash Stack

Why would someone actually want this much cash? In 2026, it feels archaic, but there are plenty of legitimate reasons.

- Private Party Vehicle Purchases: Sellers love cash. It’s final. No bounced checks, no wire transfer delays.

- Emergency Preparedness: Keeping $5,000 in a fireproof safe at home is a classic "Plan B" for people who don't trust the grid.

- Contractor Discounts: Sometimes, a local tradesperson will give you a "cash price" because it saves them credit card processing fees (and, let's be real, some of them are dodging taxes, though that's on them, not you).

- Estate Sales and Auctions: When the hammer falls, cash talks.

If you are holding that many bills, you’re also holding a lot of risk. Cash isn't insured. If you lose that envelope or get pickpocketed, the FDIC isn't coming to save you. It’s gone.

📖 Related: Getting a Mortgage on a 300k Home Without Overpaying

How to Get This Much Cash Without the Headache

If you actually need to pull this off, don't just show up.

Call the bank 24 to 48 hours in advance. Talk to the branch manager. Tell them, "Hey, I need to withdraw $5,000 in hundreds on Friday for a private purchase." They will appreciate it. It allows them to ensure they have the "fit" currency available and might even save some "new" bills for you if you like that crisp feel.

Also, consider the security of the exit. Don't walk out of the bank with a bank bag that says "BANK" on it. Put the envelope in an inner jacket pocket or a mundane backpack. Thieves watch bank parking lots for people walking out with those specific white or clear envelopes.

Actionable Steps for Handling Large Cash Amounts

If you find yourself in possession of 50 100 dollar bills, or need to acquire them, follow these protocols to keep things smooth:

- Verify the Source: If receiving the cash from a private party, use a high-quality UV light or a professional-grade counterfeit detector (like the ones from Cassida) rather than just a detector pen.

- Document Everything: If the cash is for a business transaction, keep a signed bill of sale or receipt. If the bank asks where the money is going, tell the truth. Transparency is your best friend.

- Secure Storage: Do not keep this much cash in a drawer. Use a bolted-down safe with a high fire rating (at least 1 hour at 1700 degrees).

- Insurance Riders: Check your homeowners or renters insurance. Most policies only cover about $200 in lost cash. You can sometimes add a "rider" for more, but it’s usually not worth the premium unless you're a permanent "cash person."

- Avoid the "Old Bill" Trap: Try to get the "Series 2009" or newer bills with the blue security ribbon. Older "small head" hundreds or even the 1990s "large head" versions without the ribbon are harder to spend at retail stores because younger cashiers often think they’re fake.

Handling five thousand dollars in large bills is a responsibility. Treat it with the respect that a stack of Benjamins deserves, and you'll avoid the common pitfalls of the modern cash economy.