Waiting for that direct deposit notification is basically a national pastime every February. You’ve probably already poked around a few online tools trying to get a solid estimate on tax refund amounts before you even have all your forms in hand. It's tempting. Who doesn't want to know if they're looking at a new couch or just a steak dinner? But here’s the thing: most of those "quick" calculators are about as accurate as a weather report three weeks out.

The IRS processed over 150 million individual tax returns last year. Most people got money back. In fact, the average refund usually hovers somewhere around $2,800 to $3,200 depending on the year and legislative tweaks. But your specific number isn't an average. It's a complex mathematical puzzle influenced by everything from your side hustle to that one week you forgot to adjust your withholdings after getting a raise.

Why Your Estimate on Tax Refund Usually Shifts

If you’re looking for a raw estimate on tax refund totals, you have to start with the baseline: your total tax liability versus what you actually paid. It sounds simple. It isn't. Most people think a refund is a gift from the government. It’s not. It’s an interest-free loan you gave to Uncle Sam because you overpaid throughout the year.

Tax brackets are progressive. This is where people get tripped up. If you jump from the 12% bracket to the 22% bracket, only the money inside that higher range is taxed at the higher rate. If you’re using a basic calculator and you get your "taxable income" wrong by even a few thousand dollars, your estimate is toast. Then there’s the standard deduction. For 2025 filings, it’s $14,600 for singles and $29,200 for married couples filing jointly. If you don't account for the slight inflation adjustments the IRS makes every year, your math will be off before you even start.

Let's talk about the "lifestyle creep" of taxes. Did you get married? Have a kid? Start selling vintage lamps on Etsy? Each of these moves changes your tax "profile." For example, the Earned Income Tax Credit (EITC) is a huge driver for larger refunds, but the phase-out hurdles are incredibly specific. If you earn one dollar over the limit, your "estimated" refund could plummet by hundreds in a heartbeat.

📖 Related: PDI Stock Price Today: What Most People Get Wrong About This 14% Yield

The Withholding Trap

Look at your pay stub. Seriously, go grab it. That line for Federal Income Tax is your "input." If that number hasn't changed but your life has, your refund estimate is going to be a surprise, and maybe not the good kind. The IRS updated Form W-4 a few years back to try and make withholdings more accurate, which actually sounds like a good thing, but it resulted in smaller refunds for a lot of people who were used to big windfalls. They weren't paying more in taxes; they were just getting more of their money in their weekly checks instead of one big lump sum.

The Big Players: Credits vs. Deductions

To get a real-world estimate on tax refund outcomes, you have to know the difference between a credit and a deduction. It's the difference between a discount and a coupon. A deduction lowers the amount of income you're taxed on. A credit is a dollar-for-dollar reduction in the tax you owe.

Credits are the holy grail. The Child Tax Credit (CTC) is the big one here. While there’s always talk in Congress about expanding it or making it fully refundable, you have to look at the law as it stands today. Currently, a portion of it is refundable via the Additional Child Tax Credit (ACTC). If you're estimating your refund and you count the full $2,000 per kid as cash back without checking if you actually owe enough tax to offset it, your estimate is going to be way too high.

Then there’s the "hidden" stuff:

👉 See also: Getting a Mortgage on a 300k Home Without Overpaying

- Energy Credits: Did you put in a heat pump? Solar panels? The Inflation Reduction Act created some beefy credits that people often forget when doing a rough estimate.

- Education Credits: The American Opportunity Tax Credit (AOTC) is worth up to $2,500. If you’re a student or paying for one, this is a massive variable.

- Premium Tax Credit: If you get your health insurance through the Marketplace and your income was higher than you predicted, you might actually owe some of that subsidy back. That turns an estimated refund into a bill real fast.

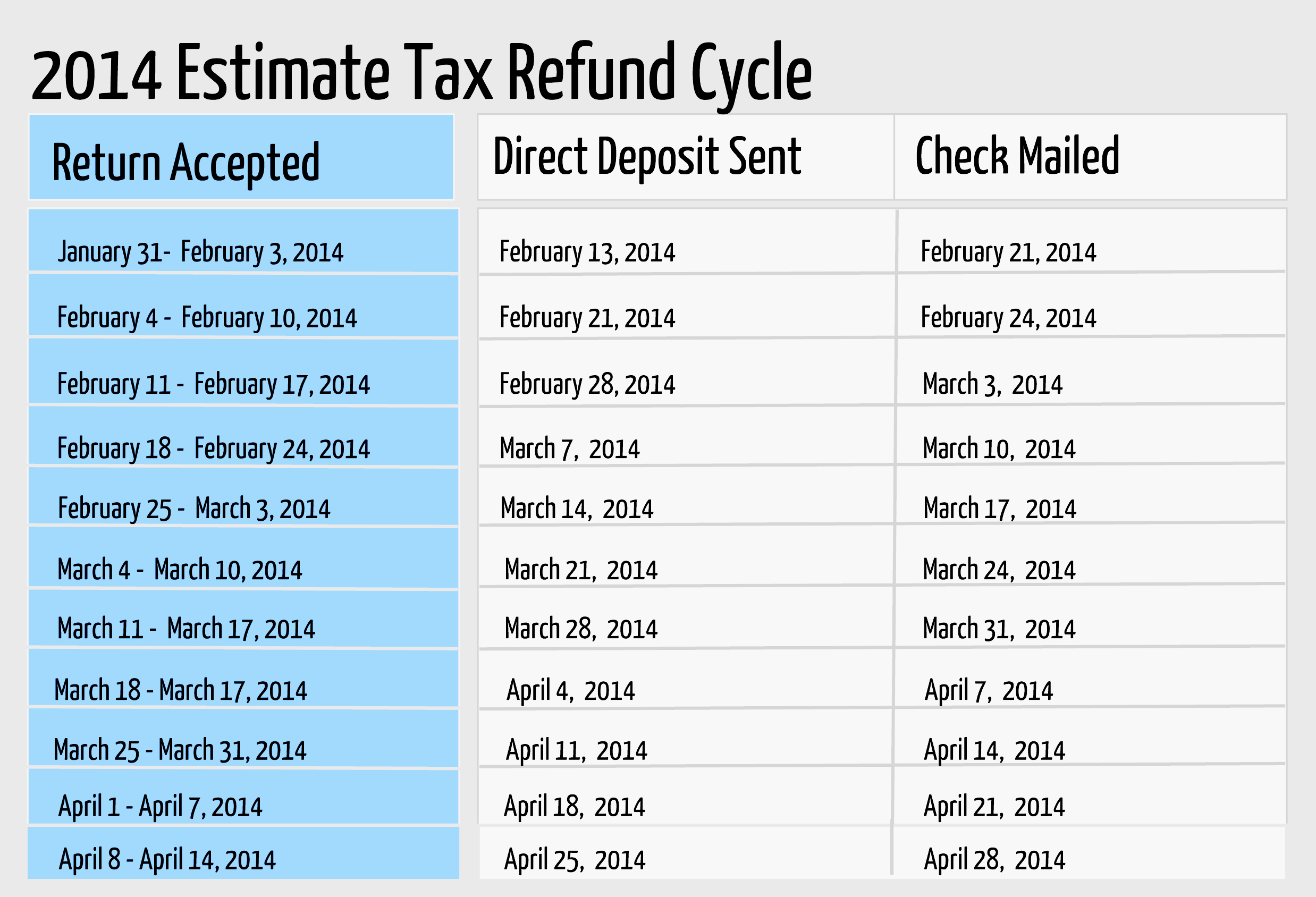

The Timing Factor and the PATH Act

You might have your math perfect. You might have the best estimate on tax refund ever calculated by a human. But you still might not see that money for a while. If you claim the EITC or the ACTC, the IRS is legally required by the PATH Act to hold your refund until mid-February. This is to prevent fraud. So, if you're counting on that money for a Valentine's Day trip, you might want a backup plan.

Accuracy matters more than speed. The IRS's "Where's My Refund?" tool is the gold standard once you've filed, but even that doesn't update in real-time. It’s a once-a-day refresh, usually overnight.

Real Examples of Estimate Errors

I knew a guy—let's call him Mark—who used a basic online tool. He entered his salary, his one kid, and his filing status. The tool told him he was getting $4,000 back. He went and put a down payment on a truck. When he actually sat down with a pro, he realized he’d forgotten about the $5,000 he made in capital gains from selling some crypto. He also didn't realize his "contractor" side gig meant he owed Self-Employment tax (which is roughly 15.3%). His $4,000 refund turned into a $200 bill.

Mark's mistake was thinking "income" only meant his W-2.

✨ Don't miss: Class A Berkshire Hathaway Stock Price: Why $740,000 Is Only Half the Story

If you have a 1099-NEC or 1099-K (which is now triggered at much lower levels for apps like Venmo and PayPal), your estimate on tax refund is basically a guess until you account for those taxes. Self-employment tax hits you for both the employer and employee portions of Social Security and Medicare. It’s a silent refund killer.

How to Get the Most Accurate Estimate Possible

Stop using the "3-minute calculators" that only ask for three pieces of info. They’re marketing tools for tax software, not financial instruments. To get close to the real number, you need:

- Your last pay stub of the year: This shows your total federal tax withheld ($).

- Every 1099 you expect: Even if it hasn't arrived, check your app history.

- Adjustments to income: This includes student loan interest, HSA contributions, or IRA contributions. These are "above-the-line" deductions that lower your Adjusted Gross Income (AGI).

The AGI is the most important number on your return. It determines your eligibility for almost every credit. If your AGI is $1 over a limit, you could lose thousands in credits.

Don't Forget State Taxes

Most "refund estimators" focus on federal. If you live in a state with income tax, that’s a whole different animal. Some states, like California or New York, have very different credit structures than the federal government. A federal refund doesn't guarantee a state refund, and vice-versa.

Actionable Steps for Your Tax Season

Getting a handle on your estimate on tax refund requires a bit of homework, but it prevents the "refund shock" that ruins many Februarys.

- Gather the "Paper Trail" Early: Don't wait for the mail. Log into your payroll provider (like ADP or Gusto) and your bank. Most 1090-INTs (interest) are available online by mid-January.

- Use the IRS Withholding Estimator: Honestly, it’s the best tool out there. It’s more granular than the commercial ones. It asks about your spouse’s job, your dividends, and your specific credits.

- Adjust for the Future: If your refund is massive (like over $5,000), you're overpaying. You're giving the government money that could be earning interest in your own savings account. Use the estimate to fill out a new W-4 for the current year.

- Factor in Filing Fees: If you're using a big-name tax software, they'll often subtract their $60–$150 fee directly from your refund. It’s a small dent, but it’s part of the math.

- Check for "Surprise" Income: Did you win money at a casino? Did you get a settlement? These are taxable. If you don't include them in your estimate, the IRS definitely will when they receive the matching copy of the form.

The reality of a tax refund is that it's a reflection of your financial life from the previous year. It’s not "free money," and it’s rarely a round number. By taking the time to look at your AGI and your total withholdings, you can move from a "guess" to a "forecast" that you can actually bank on.