You’ve probably heard the old-school take on Detroit. It usually goes something like this: big, clunky manufacturers that bleed cash and only pay dividends when they're not begging for a bailout. But honestly, looking at the actual numbers for general motors dividends per share lately tells a completely different story. It’s not the 1970s anymore.

If you’re checking your brokerage account today, January 17, 2026, you’re looking at a company that has fundamentally rewired how it treats its owners.

Last year was a massive turning point. In February 2025, Mary Barra and her team didn’t just nudge the payout; they hiked the quarterly dividend by 25%. We went from $0.12 to $0.15 per share. That might sound like pennies if you're only holding ten shares, but in the world of institutional capital, it was a loud, aggressive signal. It brought the annualized general motors dividends per share to a solid $0.60.

The Dividend is Only Half the Story

The yield looks small. Around 0.7% to 0.8%, depending on where the stock is trading this morning.

Some income investors see that and yawn. They compare it to Ford’s much higher yield and think GM is being stingy. They're wrong. What’s actually happening is a masterclass in what analysts call "Total Shareholder Yield."

GM isn't just sending you a check every three months. They are cannibalizing their own share count. Alongside that 2025 dividend hike, the board authorized a whopping $6 billion share repurchase program. They even did an accelerated $2 billion buyback right out of the gate.

Think about it this way. When a company buys back its own stock, your slice of the pie gets bigger without you spending a dime. By the end of 2024, GM had already dipped below 1 billion shares outstanding. That’s down from nearly 1.4 billion just a few years ago. Fewer shares mean the earnings—and eventually the dividends—are spread across a smaller group. It’s a stealthy way to build wealth.

Why the Payout is So Low (For Now)

Current general motors dividends per share represent a payout ratio of roughly 11% to 17%. That is incredibly low.

Usually, a low payout ratio means one of two things. Either the company is terrified of the future and hoarding cash, or they have way better things to do with that money than hand it to you. For GM, it’s the latter. They’re currently navigating a "mixed portfolio" world.

Mary Barra mentioned just a few days ago at the Detroit Auto Show kickoff that EVs are still the "end game," but the path is getting "slower and more complicated." They’re dumping billions into hybrids now because that’s what people are actually buying in 2026. They’re also fighting through the rollback of the $7,500 tax credit.

Real Numbers: The 2025-2026 Timeline

- February 2025: Dividend increased from $0.12 to $0.15 per quarter.

- July 2025: Buyback program resumed after a brief pause due to tariff noise.

- December 2025: Most recent ex-dividend date (Dec 5) with payment on Dec 18.

- March 2026: Next expected ex-dividend date is March 6, 2026, with a payment date around March 20.

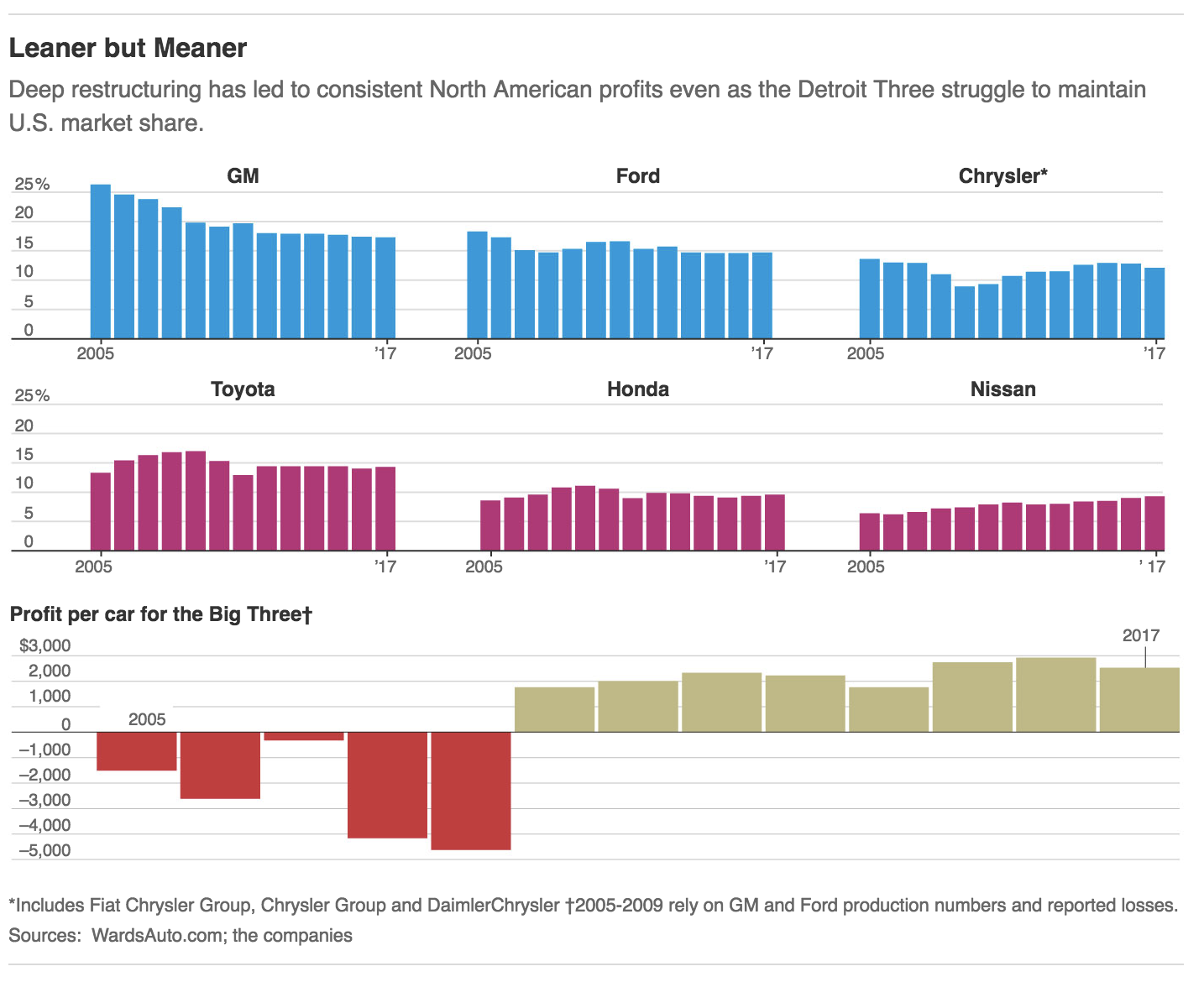

The consensus among the twelve or so analysts covering this closely—including the folks at UBS and Seeking Alpha—is that we’re headed toward $0.65 per share annually by the end of this year. Some bulls think they could even push to $0.70 if North American margins hold at that 8-10% sweet spot.

🔗 Read more: Did Warren Buffett Send Money To Ukraine: What Really Happened

The "Constructive Tension" of Capital

There’s this phrase Mary Barra uses: "constructive tension." She wants her engineers and CFOs to argue. It’s the same tension you see in the stock price.

On one hand, you have the massive cash flow from internal combustion trucks—the Sierras and Silverados that basically print money. On the other, you have the "money pit" of the transition. GM recorded a $6 billion charge just this month to unwind some EV investments that weren't panning out.

That $6 billion could have been used to triple the general motors dividends per share. It wasn't. And as an investor, you have to decide if you’re okay with that.

What You Should Actually Do

If you’re hunting for a 5% yield to live off of in retirement, GM probably isn't your first pick. Go look at REITs or utilities for that.

But if you’re looking for a "Total Yield" play, the math changes. When you combine the 0.8% dividend with the nearly 10% buyback yield, you're looking at a double-digit return to shareholders in terms of capital allocation.

Watch the upcoming Q1 2026 earnings report closely. If they announce another leg of the $6 billion buyback or even a small $0.01 bump to the quarterly dividend, it confirms they are ignoring the macro noise and sticking to the plan.

The Practical Strategy

Don't just look at the dividend check. Track the "Shares Outstanding" figure in the quarterly reports.

💡 You might also like: PutterPong: Why the Shark Tank Ping Pong Golf Hybrid Actually Works

If that number keeps dropping while the general motors dividends per share stays at $0.15 or moves to $0.16, the "floor" for the stock price keeps rising. Most people miss this because they only look at the yield column on Yahoo Finance.

Keep an eye on the March 6 ex-dividend date. If you want that next $0.15, you need to own the stock before then. Just remember that in today’s market, GM is playing a long game of shrinking the float, and the dividend is just the bait.

Check your current exposure to the automotive sector. If you're already heavy on Ford or Tesla, adding GM might feel redundant, but their capital allocation strategy is currently much more aggressive on buybacks than their peers. Verify your holding's ex-dividend eligibility by checking your brokerage's "Upcoming Actions" tab before the end of February.