Honestly, if you're looking for the general electric stock price quote today, you've probably noticed something a bit weird. The "GE" you grew up with—the massive conglomerate that made everything from light bulbs to credit cards—doesn't really exist anymore. It’s leaner. It's faster. It's basically a high-tech flight company now.

As of the market close on Friday, January 16, 2026, GE Aerospace (GE) shares finished at $325.12. That was a solid 1.62% jump for the day. But that’s only half the story. If you’re tracking the "old" GE family, you also have to look at GE Vernova (GEV), which absolutely tore it up on Friday, closing at $681.51, up a massive 6.12%.

Since today is Sunday, January 18, the markets are closed, but the "quote" everyone is buzzing about reflects a company that has successfully reinvented itself.

The $325 Question: Is GE Aerospace Overvalued?

A lot of people look at a $300+ stock price and think they’ve missed the boat. You haven't. Or at least, the big Wall Street banks don't think so. Bank of America’s Ronald Epstein recently nudged his price target up to $365. He’s looking at the "shop visits"—that’s industry speak for jet engine maintenance—and seeing a goldmine.

Jet engines aren't like car engines. You don't just get an oil change at Jiffy Lube. These are billion-dollar assets that require highly specialized, high-margin servicing for decades. GE Aerospace basically owns the skies right now through its CFM International partnership.

What’s driving the price?

- The LEAP Engine Ramp: Boeing and Airbus are screaming for these engines.

- The Aftermarket Juice: Engines sold ten years ago are coming in for service now. That is pure profit.

- The Defense Bounce: GE isn't just commercial; its defense systems are getting a second look as global tensions keep budgets high.

GE Vernova: The Dark Horse is Now a Frontrunner

If you held GE stock before the April 2024 split, you're likely sitting on a pile of GEV shares too. Man, what a run. GEV handles the power grid and wind turbines. While wind has been a headache for years (supply chain issues, mostly), the "Electrification" side of the business is printing money.

Data centers. AI. We're building these massive server farms that eat electricity like crazy. GE Vernova is the company providing the hardware to keep the lights on in those data centers. That's why the stock is pushing $700 while everyone else is still arguing about interest rates.

The Dividend Double-Down

Back in December 2025, GE Vernova did something that caught everyone off guard. They doubled their dividend. Usually, "green energy" companies are cash-strapped. Seeing GEV toss cash back to shareholders was a huge signal that the turnaround is complete.

🔗 Read more: How Does APR Work: Why Your Bank Hopes You Won't Read This

Why the "Today" Quote is Different from Your Memory

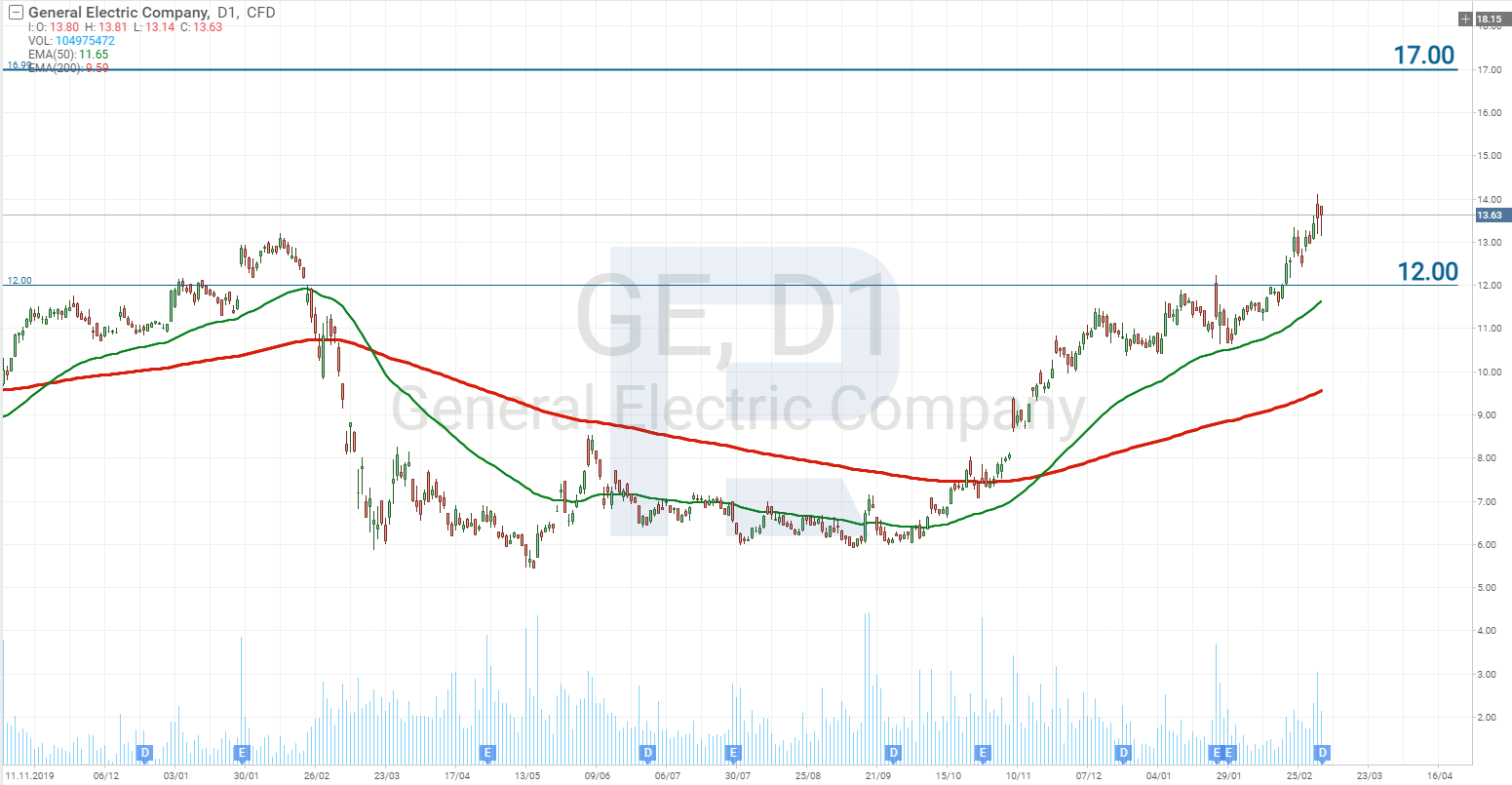

If you haven't checked the ticker in a few years, you might remember GE trading for $10 or $15. You aren't crazy. In 2021, the company did a 1-for-8 reverse stock split. They basically traded eight "cheap" shares for one "expensive" share to clean up the balance sheet.

Then came the big divorce in 2024.

- GE HealthCare (GEHC) went its own way first.

- GE Vernova (GEV) split off next.

- GE Aerospace kept the original GE ticker.

So, when you see a quote of $325.12 today, you're looking at a pure-play aviation company. You aren't buying a toaster company. You're buying a company that helps a plane take off every two seconds somewhere in the world.

Analyst Sentiment: The "Strong Buy" vs. The Skeptics

Most analysts are leaning bullish, with about 63% of major firms tagging GE with a "Buy" rating. But let's be real—there are risks.

"GE Aerospace faces a potential decline in industry service volumes in the early 2030s," some bears argue.

👉 See also: Why Triad Center Salt Lake City Still Anchors the West Side

Basically, the newer engines are too good. They don't need to be fixed as often. If GE can't find a way to monetize that efficiency, the growth might stall out in about five or six years. Also, any slowdown in global travel—think another pandemic or a massive global recession—hits GE harder than almost anyone else.

Institutional Movers

In the last quarter of 2025, we saw JPMorgan Chase & Co. add over 4 million shares to its position. On the flip side, some big funds like Capital International have been trimming their stakes. This is normal "profit-taking." When a stock doubles in a year, the big guys usually sell a little to lock in gains.

Making Sense of the Numbers

If you're looking to trade on Monday morning, keep an eye on the $320 support level. GE has shown a lot of "support" there lately. If it dips below that, it might be a buying opportunity, or a sign that the market is finally cooling off on the aerospace hype.

👉 See also: 450 EUR to USD Explained: What You Actually Get Today

Practical Next Steps for Investors:

- Check your cost basis: If you've held since the split, your "GE" price is actually a combination of GE, GEV, and GEHC. Use a calculator to see your true total return.

- Watch the Jan 22 Earnings: GE Aerospace is slated to report earnings on January 22, 2026. This is the big one. Expect volatility.

- Don't ignore the grid: If you want a play on AI that isn't a chip maker, look closer at GE Vernova (GEV). The power grid is the ultimate bottleneck for artificial intelligence.

- Set trailing stops: With the stock near all-time highs, a 5-10% trailing stop can protect your gains if the market decides to take a breather.

The general electric stock price quote today isn't just a number on a screen; it's the result of one of the most complex corporate breakups in American history. It seems to have worked. For now, the "Aviation-first" GE is flying much higher than the old conglomerate ever could.