You’ve probably seen the headlines. GE isn't really "GE" anymore. After years of shedding weight, the industrial titan finally split into three separate entities, leaving the core GE Aerospace to carry the torch under the original ticker. Honestly, it's been a wild ride for anyone holding the stock through the spinoffs of GE HealthCare and GE Vernova.

Now that the dust has settled in early 2026, the question is whether the momentum can actually last. Most analysts aren't just optimistic; they're bordering on aggressive. We're looking at a general electric stock forecast that hinges almost entirely on one thing: engines. Specifically, the engines powering the planes you're probably flying on this year.

The 2026 Numbers: What the Street is Predicting

Let's get into the weeds. Right now, the consensus among 8 major Wall Street analysts is a "Strong Buy." That's not just marketing fluff. About 87.5% of them are pounding the table for this stock.

The price targets for 2026 are scattered, but the average is sitting around $341.25. Some outliers like Barclays have a more cautious $295.00 target, while the bulls are eyeing $378.00 or higher.

Why the confidence? It’s the cash. GE Aerospace is expected to pull in roughly $50.6 billion in revenue for 2026. If you compare that to where we were a couple of years ago, the growth trajectory is pretty staggering. Earnings per share (EPS) are projected to hit an average of $8.67 this year, representing a 14.7% jump from 2025.

Revenue Drivers You Can't Ignore

- The LEAP Engine: This is the bread and butter. Deliveries are expected to grow by 11%, with revenue from this segment climbing 10% year-over-year.

- Aftermarket Services: This is where the real profit hides. Total spare part sales are forecasted to rise by over 25%. Airlines are keeping older planes in the sky longer, and they need GE parts to do it.

- Pricing Power: GE recently hiked prices on its spare parts catalog, and guess what? The market swallowed it without a flinch.

Why Everyone is Obsessed with GE Vernova and Spinoffs

You can't talk about the general electric stock forecast without mentioning the kids. GE Vernova (GEV), which handles the power and renewable energy side, has been a rocket ship. It’s currently trading around $652, and some analysts—like those at GLJ Research—have set "silly" price targets as high as **$1,087**.

🔗 Read more: Is The Housing Market About To Crash? What Most People Get Wrong

If you’re still holding GE Aerospace, you’re basically betting on the "pure play" aerospace story. The company isn't distracted by wind turbines or MRI machines anymore. It’s lean.

But there’s a catch. The valuation is getting... uncomfortable.

GE Aerospace is trading at a P/E ratio of about 42x. For context, the rest of the Aerospace & Defense industry averages around 39x, and some peers are sitting way lower at 27x. You’re paying a premium for the GE brand and the fact that they basically have a duopoly with Raytheon (Pratt & Whitney) in the engine market.

The Risks Nobody Mentions at Cocktail Parties

It’s not all clear skies. While the 2026 outlook is sunny, the long-term forecast has some dark clouds.

Between 2030 and 2035, industry service volumes are expected to drop. We're looking at a potential 9% decline in compound annual growth. Why? Engines are becoming more efficient and durable. It’s the classic "lightbulb" problem—if you build a product that doesn't break, you stop selling replacement parts.

💡 You might also like: Neiman Marcus in Manhattan New York: What Really Happened to the Hudson Yards Giant

Also, supply chains are still a mess. Management recently shaved $100 million off their revenue estimates because of delays in LEAP engine deliveries. If Boeing or Airbus can't get their acts together, GE can't deliver the engines. It’s that simple.

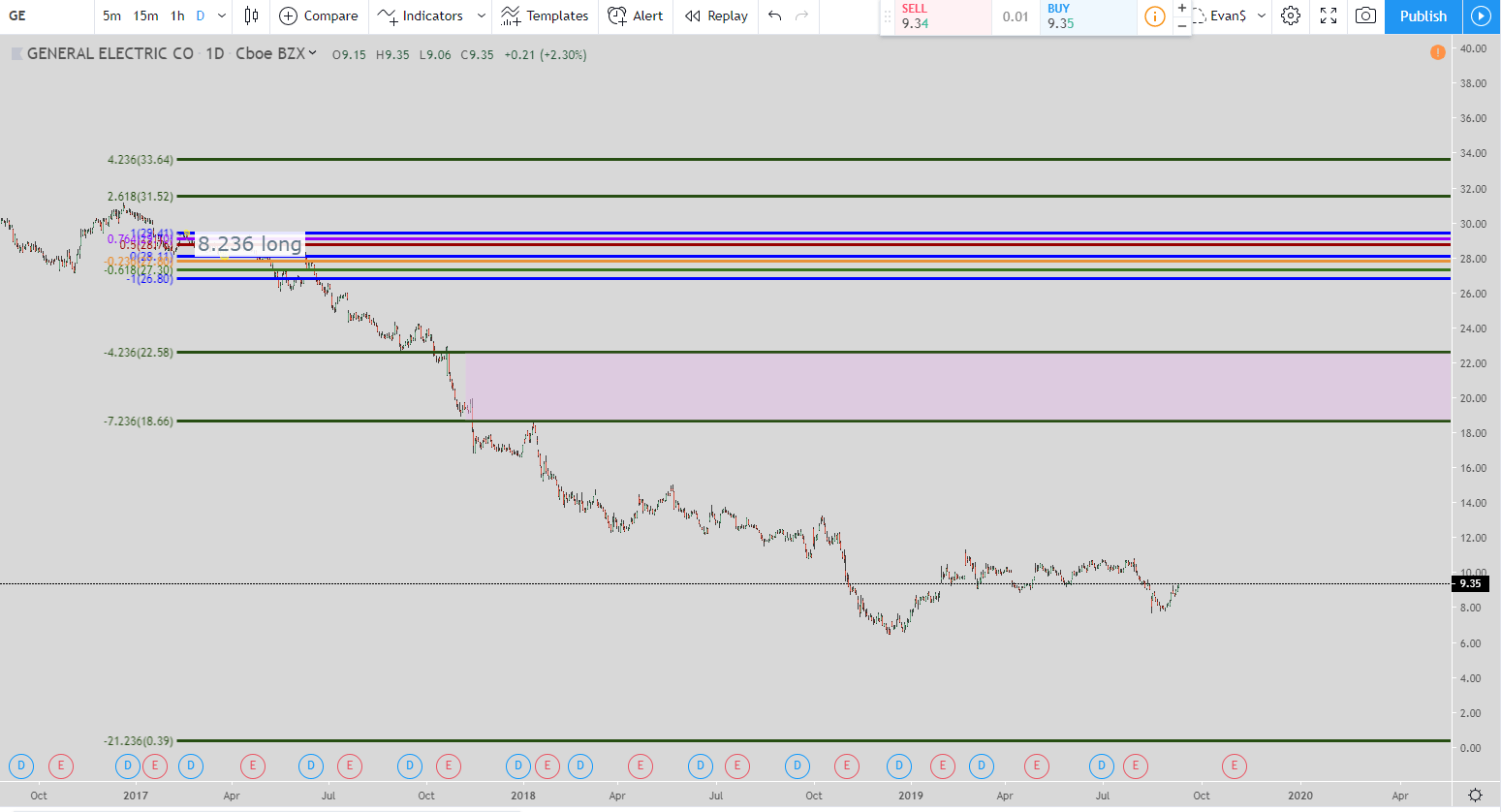

The Technical View: Bullish or Overheated?

Technical analysts see an "ascending channel." That's fancy talk for "the stock keeps going up in a predictable zigzag."

The 50-day moving average is sitting comfortably above the 200-day average. Usually, that’s a signal to buy the dip. If the upward trend stays intact, we could see the stock consolidate between $350 and $370 by the middle of 2026.

However, some models, like the Discounted Cash Flow (DCF) analysis used by Simply Wall St, suggest the stock is "overvalued" by as much as 60%. They argue that for the current price to make sense, GE needs to generate nearly $11 billion in free cash flow annually by 2030. That’s a tall order even for a company with this much history.

Actionable Insights for Your Portfolio

If you're looking at the general electric stock forecast and wondering what to do with your money, here’s the breakdown based on the current market data:

📖 Related: Rough Tax Return Calculator: How to Estimate Your Refund Without Losing Your Mind

1. Watch the Earnings Calls: Pay attention to "Shop Visits." If the number of engines coming in for repair stays high, the stock will likely outperform. This is the high-margin revenue that keeps the lights on.

2. Mind the Multiple: Don't get blinded by the 87% returns of the past year. If the P/E ratio starts creeping toward 50x, the "correction" risk becomes real.

3. The Spinoff Effect: If you missed the original GE split, don't try to "recreate" it by buying all three companies (GE, GEV, GHC). They are different beasts now. GE Aerospace is a growth and income play; GE Vernova is a high-volatility energy transition play.

4. Use Trailing Stops: Since the stock is near all-time highs, using a trailing stop-loss can help you lock in gains while still giving the stock room to hit those $370+ analyst targets.

To stay ahead of the next move, you should monitor the quarterly delivery numbers for the CFM LEAP engines and the GE9X. These are the primary indicators of whether GE will meet its 2026 revenue guidance of $50 billion+. Check the official GE Aerospace Investor Relations portal for the most recent 10-Q filings to verify these delivery rates against analyst expectations.