The headlines made it sound like a final, dramatic snub. "Gene Hackman Leaves Entire Fortune to Wife Betsy Arakawa." It paints a picture of a Hollywood legend, reclined in his Santa Fe compound, striking his three children from his will in a fit of cinematic pique. But honestly, the reality of the Hackman estate is way more complicated—and a lot more tragic—than a simple "disinherited" narrative.

It’s about a 34-year marriage, a devastating double tragedy in early 2025, and a legal "glitch" that might end up giving his children exactly what the tabloids claim he denied them.

The $80 Million Question

Gene Hackman wasn't just an actor; he was a machine. Between The French Connection, Unforgiven, and The Royal Tenenbaums, he amassed a fortune estimated at $80 million. When he retired in 2004, he didn't just leave Hollywood; he vanished into the New Mexico desert.

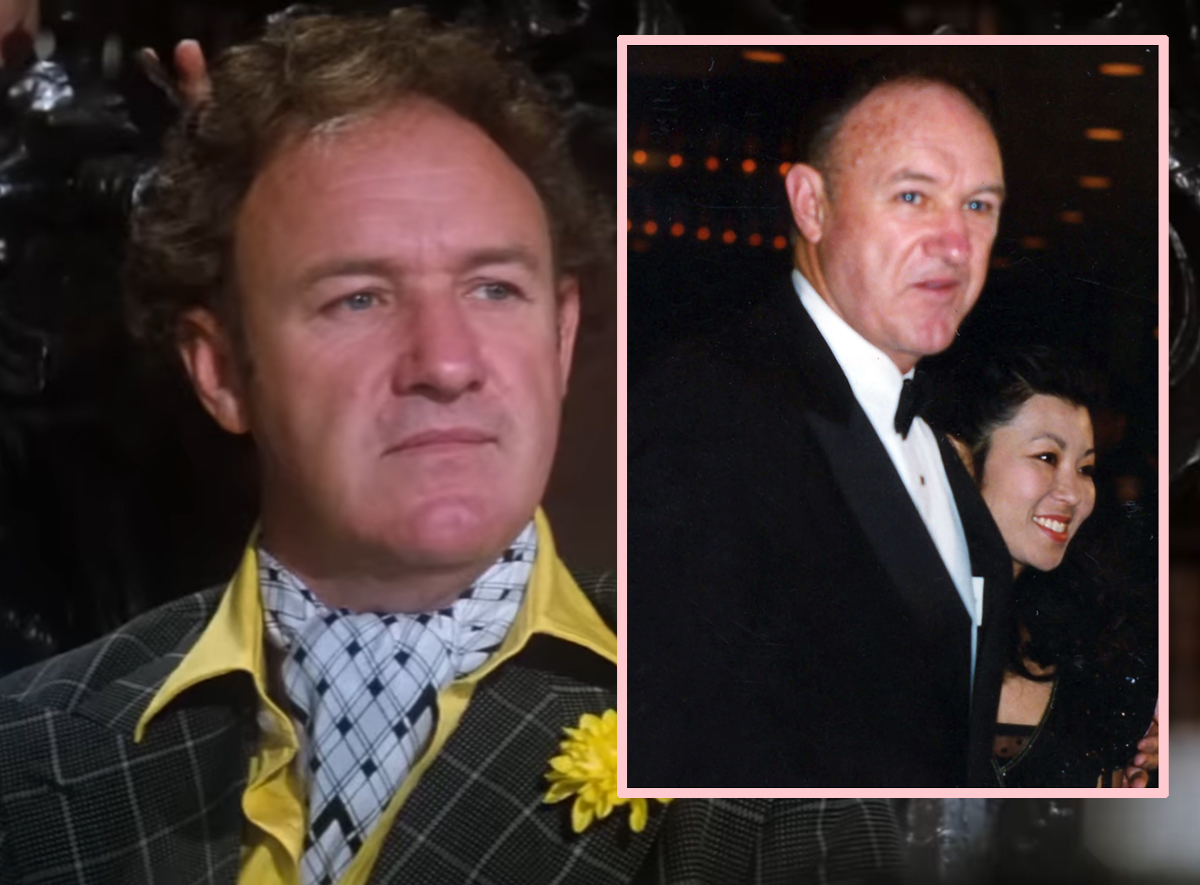

For decades, he lived a quiet, almost reclusive life with Betsy Arakawa. She was a classical pianist he met at a gym in the '80s—she actually refused to let him in because he forgot his membership card. He loved that. They married in 1991, and by all accounts, they were "joined at the hip."

So, when his will was revealed following his death at age 95, the fact that he left everything to Betsy wasn't a shock to those who knew them. He saw her as his partner, his protector, and the person who kept him alive long after his heart started failing. The "scandal" isn't that he left her his money; it's what happened when she died first.

The 90-Day Clause That Changed Everything

Here is where the "expert" estate planners start sweating. Gene and Betsy didn't just die of old age; they died within days of each other in February 2025.

✨ Don't miss: Enrique Iglesias Height: Why Most People Get His Size Totally Wrong

Betsy, 65, passed away from hantavirus pulmonary syndrome—a rare respiratory disease often linked to rodent exposure. Gene, suffering from advanced Alzheimer’s and heart disease, died about a week later. Investigators believe he was so far gone he didn't even realize his wife was dead in the house with him.

The legal snag is a nightmare:

- Gene’s Will: Specifically stated, "I give my entire estate to Betsy Arakawa Hackman." It was written in 2005.

- The Beneficiary Problem: Because Betsy died before Gene, she couldn't inherit the money. You can't leave a fortune to someone who isn't there to receive it.

- Betsy’s Will: She had a "90-day survivorship clause." It said if Gene didn't survive her by at least 90 days, her share would go to charity.

Since Gene only lived a week longer than her, Betsy’s portion of their community property is likely headed to various Santa Fe charities. But Gene’s personal $80 million? That’s where things get messy.

Why the Kids Might Get the Money Anyway

Hackman had three children from his first marriage to Faye Maltese: Christopher, Elizabeth, and Leslie. For years, the narrative was that they were estranged. Gene himself admitted he was a "late-blooming" father because he was too obsessed with his career.

However, "estranged" is a strong word. In his final years, his daughters were reportedly back in his life. Leslie even spoke to the press after his death, mentioning they were close.

🔗 Read more: Elisabeth Harnois: What Most People Get Wrong About Her Relationship Status

Since Gene's will named Betsy as the sole beneficiary and didn't clearly outline a "Plan B" (what lawyers call a contingent beneficiary) for his personal assets, the law of intestacy might kick in. Basically, if a will fails because the beneficiary is dead, the money often defaults to the "next of kin."

In this case? That’s the three children.

The "Unforgiven" Legal Battle

Despite the possible windfall, it’s not a smooth ride. Christopher Hackman has already hired a heavy-hitting California trust attorney. Why? Because while the will is public, Gene also had a Living Trust created in 2005.

Trusts are private. We don't know what's in it. It’s entirely possible the trust says, "If Betsy is gone, give the money to the Smithsonian" or "Give it to a German Shepherd rescue."

The children are likely preparing to challenge the 20-year-old documents. Their argument? Undue influence or perhaps just a lack of updated intent. It's kinda hard to argue Gene "hated" his kids enough to leave them nothing if the last time he signed a document was two decades ago. A lot of bridge-mending can happen in 20 years.

💡 You might also like: Don Toliver and Kali Uchis: What Really Happened Behind the Scenes

The Reality of the Santa Fe Compound

A huge chunk of that $80 million isn't just cash in a vault; it's the legendary 12-acre Santa Fe compound. This wasn't some flashy Malibu mansion. It was a 1950s building they painstakingly renovated into a blend of Spanish Baroque and Pueblo styles.

Gene did the painting. Betsy did the linens. They lived there with their German Shepherds and watched low-budget DVDs.

The house is currently valued at nearly $6 million. Under New Mexico's community property laws, half of that belonged to Betsy. Because of her 90-day clause, her half of the house might literally belong to a charity now, while the other half belongs to Gene's estate. Imagine trying to sell a house where a local non-profit owns the kitchen and the children own the bedroom.

What This Teaches Us About Estate Planning

You don't have to be a two-time Oscar winner to learn from the "Gene Hackman leaves entire fortune to wife Betsy Arakawa" saga. Honestly, it’s a masterclass in what happens when you "set it and forget it."

- Update Your Documents: A will from 2005 is a ticking time bomb. People die, relationships change, and tax laws evolve. If you haven't looked at your will since The Da Vinci Code was in theaters, you're doing it wrong.

- The "Simultaneous Death" Clause: Most people assume the younger spouse will outlive the older one. Betsy was 30 years younger than Gene. No one saw a hantavirus tragedy coming. Always name a "back-up" beneficiary.

- Trusts vs. Wills: Gene's use of a trust is the only reason this hasn't turned into a total public circus yet. Trusts keep the messy details out of the newspapers, even if the children eventually fight it in court.

The story of Gene Hackman's fortune isn't really a story about greed or family feuds. It's a story about a man who was so devoted to his wife that he couldn't imagine a world where she wasn't there to take care of things. He left her everything because, to him, she was everything.

The legal fallout is just the paperwork of a life lived very privately, and perhaps, a bit too quietly for the lawyers to keep up.

Actionable Insights for Your Own Estate

- Review your "Secondary Beneficiaries": Open your existing will today. If the first person named died tomorrow, where does the money go? If the answer is "I don't know," call a lawyer.

- Check for Survivorship Periods: Ensure your documents specify a timeframe (like 30, 60, or 90 days). This prevents "double probate" where money moves from one deceased person’s estate to another, racking up double the legal fees.

- Consider a Letter of Intent: Even if your legal documents are rigid, a non-binding letter explaining why you made certain choices can prevent family infighting and clarify your heart to those left behind.